April 2025

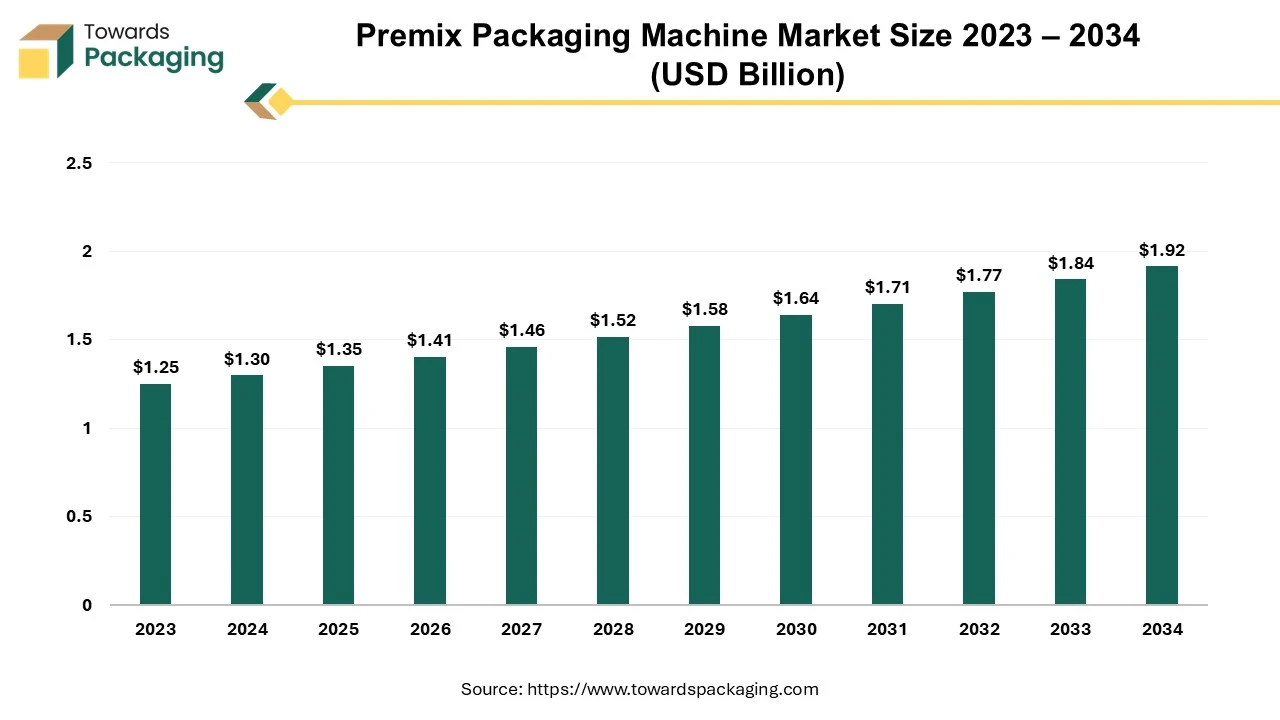

The global premix packaging machine market was valued at USD 1.3 billion in 2024 and is projected to grow to USD 1.915 billion by 2034, expanding at a CAGR of 3.95% over the next decade. Driven by increasing demand for automated and efficient packaging solutions, this market presents lucrative opportunities for businesses investing in advanced packaging technologies.

Unlock Infinite Advantages: Subscribe to Annual Membership

Premix packaging is known as the process of combining and packaging a mixture of ingredients or components that are pre-measured and prepared for a specific purpose. This kind of packaging is commonly used in various industries, such as pharmaceuticals, food, agriculture, and construction. Premix packaging often includes blends of spices, baking ingredients (like pancake or cake mixes), or drink powders that consumers can easily use by adding a few additional ingredients (e.g., water, milk).

A premix packaging machine is a specialized piece of equipment designed to automate the process of mixing, filling, and sealing pre-measured mixtures of various ingredients into appropriate packaging. These machines are widely used in industries such as food and beverages, pharmaceuticals, chemicals, agriculture, and construction.

Below is a detailed overview of the key components, functionalities, and types of premix packaging machines. There are different types of premix packaging machines which have been mentioned here as follows: Vertical Form-Fill-Seal (VFFS) Machines, Multi-Lane Sachet Packaging Machines, Horizontal Form-Fill-Seal (HFFS) Machines, Auger Filling Machines and Rotary Packaging Machines among others.

Due to Rapid Modernization there’s is significant shift towards integrating automation, robotics, and smart technologies into packaging processes. This integration enhances efficiency, precision, and customization capabilities, allowing manufacturers to meet diverse market demands effectively.

With growing environmental concerns, both consumers and manufacturers are prioritizing sustainable packaging solutions. The industry is responding by developing machines capable of handling biodegradable or compostable materials, aligning with global sustainability goals.

There's an increasing demand for packaging solutions that offer flexibility in portion control, packaging formats, and printing options. Additionally, the incorporation of advanced sensors and data analytics enables real-time monitoring and predictive maintenance, optimizing operational efficiency.

AI can predict when a machine is likely to fail or require maintenance, reducing downtime and ensuring continuous operation. AI algorithms can optimize packaging processes by adjusting machine settings in real-time for maximum efficiency and minimal waste. AI-powered vision systems can detect defects or inconsistencies in packaging, ensuring high quality and reducing the need for manual inspection. AI provides detailed insights into machine performance, helping manufacturers make informed decisions about upgrades and process improvements.

AI can analyze customer feedback and behavior to improve packaging designs and meet consumer preferences. AI can identify potential safety hazards in the packaging process and alert operators, reducing workplace accidents. AI ensures compliance with industry standards and regulations by continuously monitoring processes and reporting deviations.

AI ensures consistent packaging quality by monitoring and adjusting parameters like fill levels, sealing, and labeling. AI systems can learn and adapt to different packaging requirements, allowing machines to handle a variety of products and packaging styles with minimal reconfiguration. AI enables machines to cater to customized packaging demands, improving customer satisfaction and opening new market opportunities. AI can analyze market trends and customer data to forecast demand, helping manufacturers plan production and inventory more accurately. AI optimizes inventory levels by predicting usage patterns and minimizing storage costs. Automation through AI reduces the need for manual intervention, lowering labor costs.

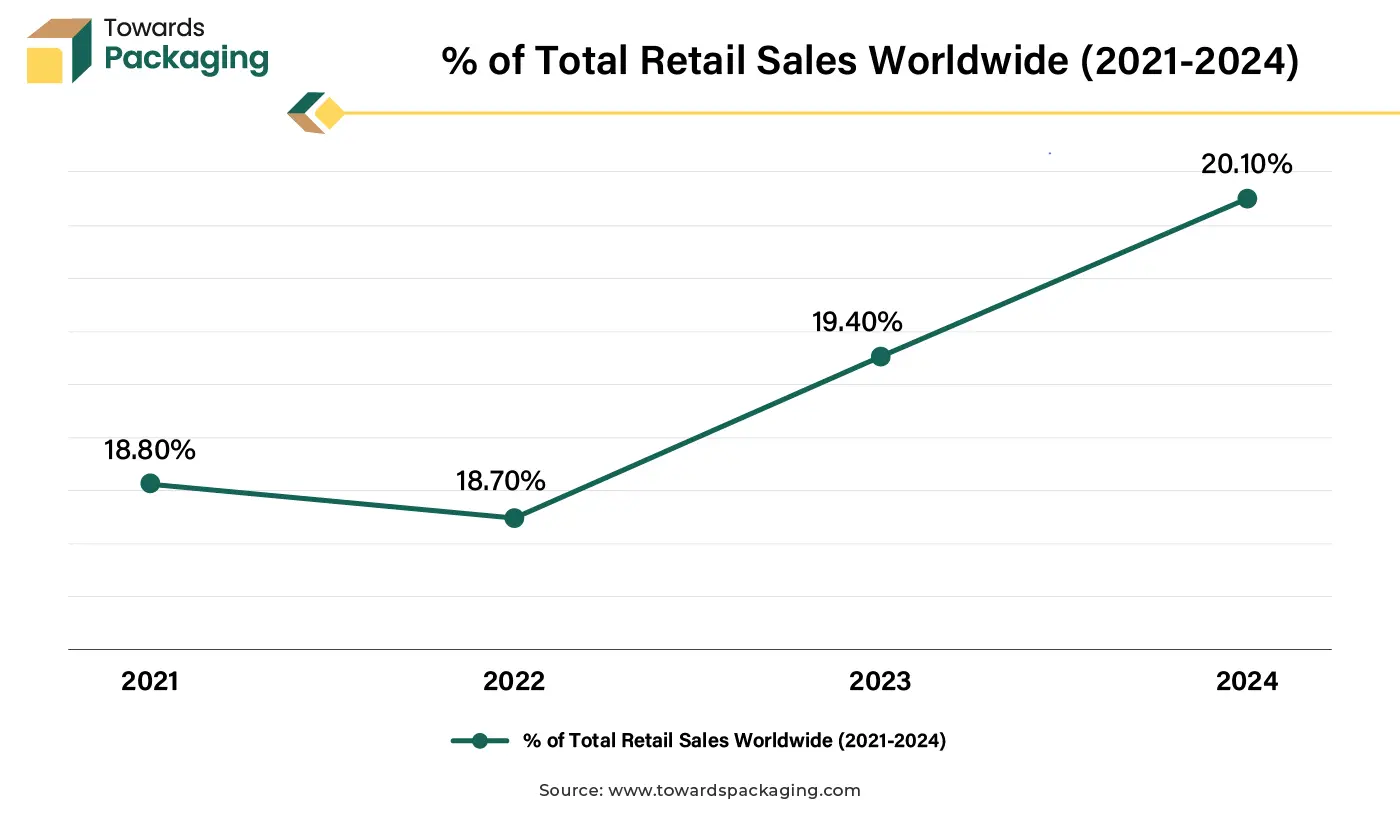

The growth of e-commerce and direct-to-consumer sales channels increases the demand for efficient packaging solutions to handle smaller, customized orders. Growing consumer preference for ready-to-eat and convenience foods has risen the demand for efficient packaging solutions, boosting the need for premix packaging machines, which has driven the growth of the premix packaging machine market in the near future.

E-commerce platforms often deal with a wide variety of packaged products, including food and beverage, pharmaceuticals, and personal care items. The surge in online shopping leads to higher demand for these packaged goods, necessitating more efficient and automated packaging solutions like premix packaging machines. As e-commerce businesses grow, they need scalable packaging solutions. Premix packaging machines can be easily scaled to meet increasing production demands, supporting the growth trajectory of e-commerce companies.

The key players operating in the market are facing issue due to technology complexity and economic fluctuations, which has estimated to restrict the growth of the premix packaging machine market in the near future. Advanced premix packaging machines require specialized knowledge for operation and maintenance. A lack of skilled labor can hinder the adoption of these machines. Rapid technological advancements can make existing machines obsolete, requiring continuous investment in upgrading and innovation.

Regular maintenance and operational costs, including energy consumption and spare parts, can be high, affecting the overall profitability. Economic downturns or instability can lead to reduced investment in new machinery, affecting the industry's growth.

The growing awareness of health and wellness is increasing the demand for premixes in sectors like nutraceuticals, dietary supplements, and functional foods. This creates a need for specialized packaging machines that can handle a variety of premix formulations. Industries like food and pharmaceuticals have stringent quality and safety standards. Packaging machines that ensure product integrity, hygiene, and compliance with regulations are in high demand, encouraging the development of specialized machinery. As the demand for premix products grows, manufacturers require more efficient and higher-capacity packaging machines to meet production targets. This drives investment in advanced premix packaging machinery.

The liquid fillers segment held a dominant presence in the premix packaging machine market in 2024. Liquid fillers ensure precise measurement of liquid ingredients, which is crucial for maintaining the consistency and quality of premixes. These machines can fill containers quickly and efficiently, increasing production speed and reducing labor costs. Liquid fillers can handle a wide range of liquid viscosities, making them suitable for various types of premix products, from thin liquids to thicker syrups.

Automated filling processes reduce the risk of contamination, ensuring a more hygienic packaging process, which is especially important in food and pharmaceutical industries. Liquid filling machines can be adjusted to handle different container sizes and production volumes, making them adaptable to both small-scale and large-scale operations.

The automatic machines segment accounted for a significant share of the premix packaging machine market in 2024. The automatic premix packaging machines can operate continuously at high speeds, greatly increasing production output compared to manual labor. This is essential for industries needing large quantities of premixed products in a short amount of time. Automatic machines ensure consistent filling and packaging, which is critical for maintaining product quality. The precision of these machines assists to minimize errors, such as overfilling or underfilling, ensuring that each package contains the correct amount of product. The use automatic machine lower labor costs over time by minimizing manual labour. They also minimize waste by optimizing the use of raw materials.

Automatic machines are designed to minimize human contact with the product, helping to maintain cleanliness and reduce contamination risks. This is especially important in food, pharmaceuticals, or chemicals. Many automatic machines can be customized for specific products, such as powdered or granular substances, and can handle different package types (e.g., sachets, pouches, or bags), making them versatile for various industries.

The food and beverages segment registered its dominance over the global premix packaging machine market in 2024. As consumers demand more convenient, ready-to-use products, there is a greater need for premixed items such as powdered beverages, soups, sauces, and instant food products. Premix packaging machines can efficiently package these items, thus meeting the industry's growing demand for speed, consistency, and precision in packaging. Food and beverage companies are constantly innovating new products, especially in the healthy, organic, or ready-to-eat categories. Premix packaging machines can adapt to these innovations, ensuring that new food products are packaged efficiently, safely, and in a way that preserves their quality.

As food and beverage products diversify, companies need packaging that can accommodate various product types, sizes, and packaging materials. Modern premix packaging machines are flexible and customizable, which makes them ideal for the diverse needs of the expanding food and beverage industry.

North America held the dominating share of the premix packaging machine market and is observed to sustain the position during the forecast period. North American consumers are increasingly seeking convenience in their diets, leading to a rise in demand for ready-to-eat meals, powdered beverages, and pre-mixed ingredients. This trend drives the need for advanced packaging solutions to efficiently package such products.

As consumers in North America become more environmentally conscious, there is a growing demand for eco-friendly packaging solutions. The premix packaging machine industry is evolving to meet these demands, creating machines that use sustainable materials and reduce waste, thus attracting companies that want to align with sustainability goals.

North America, particularly the U.S. and Canada, is home to some of the most advanced technological developments in automation and packaging. The growth of online grocery shopping and direct-to-consumer food and beverage deliveries has increased the need for effective packaging solutions in North America region. Consumers in North America are seeking more customized food and beverage options, including specialized premixes. North American food and beverage companies are investing in automated packaging solutions to enhance efficiency and reduce labor costs.

Several key companies like KHS, Praxair (now part of Linde), Bosch Packaging Technology (now Syntegon Technology), ProMach, Tetra Pak, and FLEXICON Corporation among others in the North American region play a major role in making the premix packaging machine industry dominant.

Asia Pacific region is observed to be the fastest growing in the forecast period. The demand for premixed food and beverages, including ready-to-eat meals, powdered beverages, and dairy products, is rising in the Asia Pacific. This drives the need for advanced packaging solutions to ensure product quality and shelf life.

Asia Pacific region is a major exporter of packaging machinery. With trade agreements and global shipping infrastructure, countries in Asia Pacific can easily access international markets, boosting the industry's growth. Many Asia Pacific countries are investing heavily in automation and innovative packaging technologies, improving the efficiency and capabilities of premix packaging machines. Countries like Japan and South Korea are known for their technological leadership. Countries like China, Japan, India, and South Korea have established themselves as global manufacturing hubs. This enables a steady supply of high-quality, cost-effective packaging machines.

By Product

By Machine Type

By End Use

By Region

April 2025

April 2025

April 2025

April 2025