April 2025

.webp)

Principal Consultant

Reviewed By

The tertiary packaging market is poised for significant growth from 2025 to 2034, driven by the rapid expansion of global trade, the booming e-commerce sector, and the increasing need for robust protective logistics.

Tertiary packaging is one of the three kinds of packaging that are used to safeguard goods for shipping or storing. It is meant to safeguard not only the product but also its transit and other packaging. Tertiary packaging is usually removed by retailers before the products are ready to be displayed for sale.

The tertiary packaging could be the cardboard boxes, containers, crates, drums, trays, wooden pallets and shrink wrap and this packaging are made up of paper and paperboard, plastic, metal, wood and other packaging materials. Which are widely used in contact packaging, pharmaceutical packages, warehouse and logistics and others.

Implementing the usage of eco-friendly and sustainable materials in the production of the packaging to make it possible for the customers to recycle it. Through the creative use of materials, such as bioplastics which are based on plants as a raw material instead of petroleum, the substitutes of films, cardboard and plastic bottles are being applied. Testing the materials, the packaging, unit loads or the products itself with transport simulation testing equipment leads companies to a new packaging design that reduces the costs and waste is both an environmental and a commercial success be it keeping the brand benefits and customer appeal. This enables companies to cut down on transport expenses by reducing the size of the packaging making it smaller, the space of the transport is used to its maximum capacity.

The use of stretch film should be reduced by testing the unit load to find out which packaging would be the best one. This will hence be the factor to decrease costs by reducing the time the wrapping machine is working, cutting the packaging waste and lowering the CO2 emission by the decrease of the load weight that has to be transported. In the distribution cycle, goods are subjected to various forces that can possibly compromise their safety and integrity. Such are the reasons for this problem. These can be, for instance, the result of acceleration, braking, handling or storing. These could be dangerous for the goods and the manner of loading and securing of these loads.

Transport simulation testing technologies become the main instruments of the threat predicting. Companies are also trying to find out the packaging strength for the bulky products and creating new packaging for the products. The demand for tertiary packaging is going to be growing indefinitely in the future.

Asia Pacific is the biggest of the three regions of the tertiary packaging market. The Asia region is the home of a huge consumer base, marked by a fast-evolving economy, a big middle class and a young population. The current is the growing demand in Asia pacific countries due to the global revolution, urbanization and industrialization. In the Asia pacific region, the induction of new industries and the complexity of the supply chain are increasing. These complicated supply chains are the cause of the logistics efficiency and security coming from the tertiary packaging. The constant growth of the industrial sector and the consumer product markets is the reason behind the fastest gains to India and China. China, which overtook the US as the world’s largest corrugated box market, is now the biggest in the world. The corrugated box as a tertiary packaging is intended to secure the products inside during the storage and transportation in warehouses and safe delivery to the destination.

China, India and Southeast Asia are the biggest countries that are the main suppliers of the goods via the shipments. Containers are now moving in and out of China at the highest rates because shippers are on a desperate search for capacity, but the port congestion in Europe and the US is still slowing down the return of containers to Asia and therefore the recovery of global ocean supply chains is being hindered. China is not the only among top exporting countries who have experienced turbo box turnarounds last year.

Vietnam, Singapore, Thailand and Indonesia have the median times in which containers remained in depots, which were average. Port container shipments in China have been carried out to 295. The container ranking is 87 million standard containers, which increased by 4. 7% is the percentage of the increasing ecommerce sector in the Asia Pacific that is the major factor for the growing packaging demand of tertiary industries. The factors which are causing the tertiary packaging market growth in the Asia pacific region are the numbers.

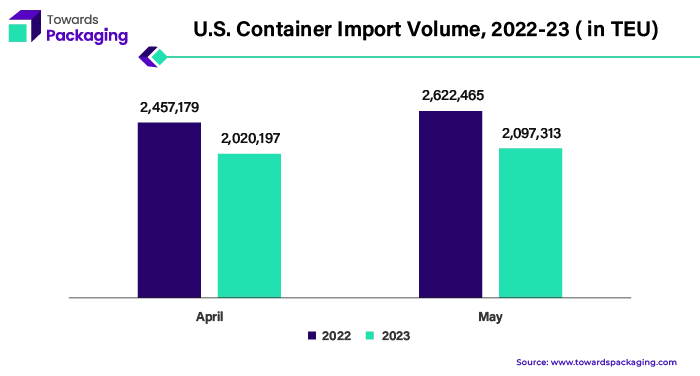

North America is the fastest growing region in the third sector of the packaging market. The rapid growth of palatalization and containerization in the shipment North America results in overseas container shipping market control. This is mainly because of the high demand and better transportation services that are available in this region. In North America, the United States is the biggest consumer of container shipping, and then comes Canada.

U.S import the containers from many different countries which due to increasing demand of tertiary packaging’s. The main reason is that the e-commerce giants such as Walmart, Alibaba, Amazon, etc. are attempting to replenish the supply after more than a year of supply chain disruptions due to the pandemic. The sea freight shipping rates surge has caused a spurt in shipbuilding.

The aggregate packaging from third party packagers, from the leaders in tertiary packaging. The robust manufacturing of the North America raises the demand for the tertiary packaging. The manufacturers of the packaging are switching to the sustainable ways for producing the eco-friendly packaging options. There is the huge growth of the tertiary packaging market in the coming years.

Paper and paperboard are the best materials that are used for the tertiary packaging. Different types of packaging are used for the tertiary packaging which is widely used for the product. Paper and paperboard materials are sustainable, recyclable, biodegradable and reusable. The paper-based packaging is the strength and durability that justify the global commerce through the safe and efficient transportation of goods and its versatility and visual appeal are the businesses' way to market their products. The fact that 81% of all paper-based packaging in the US is recycled and more than 96% of corrugated (cardboard) boxes are also recycled shows that the US is ahead of the world in this aspect.

There are numerous instances where paper and paperboard packaging is used as tertiary packaging like supermarkets, traditional markets and retail stores, mail order, fast food, dispensing machines, pharmacies, and in hospital, catering and leisure situations.

The market is witnessing the highest growth rate on the paper and paperboard material in the packaging because of its cheapness and sustainability and the plastic and other harmful materials used as a replacement are being eliminated.

For Instance,

Corrugated boxes are mostly used as tertiary packaging material, mostly of which are recycled for different purposes and have a major chunk of recycled fibres. Corrugated cardboard boxes are the fundamental support of the American supply chain. 38 billion packages are sent safely in corrugated boxes annually. Packaging made of corrugated is usually lightweight and therefore it can cut down the shipping costs. Manufacturers are shifting to the use of corrugated boxes because the raw materials and labor used to make corrugated boxes are cheap and lightweight and their containers can be filled and moved easily which in turn lowers the cost of labor.

The increase of e-commerce sectors is resulting in the rise of the corrugated boxes usage, which are less harmful to the environment and can be easily transported during transit. Corrugated cardboard boxes are made of materials that are renewable. Being made from trees, an inexhaustible resource, this kind of packaging is so easy to recycle. Through the recycling process, corrugated cardboard packaging is transformed into paper products and sometimes even new boxes again. The future preferences of manufactures for the tertiary packaging which will be the reason for the demand of the tertiary packaging market to grow.

The contract packaging segment is observed to grow at a significant rate. Contract packaging, which is done through the contract packing companies or the co-packers, is a method of outsourcing the packaging needs, thus the business can save resources and time that would otherwise be spent on the activity. Most of the Company's suppliers of contract packing widely use corrugated boxes for shipments and transportation to the company.

The leading brand owners like Mars, Unilever, and Kraft are the innovators of this transformation in the industry by asking the ECPA members to extend their opportunity beyond the contract packaging to also involving materials procurement, logistics, and even the basic raw materials handling. A great number of the co-packers who were surveyed provide the full-service formulation which in general increase the value of their services and make them the comprehensive solution providers.

A lot of the industries are outsourcing the packaging from the contract packers to the food and beverage, pharmaceuticals, industrial, chemical and others. The types of packaging materials used are different depending on the products. Boxes handled all kinds of products but there are few products which need oil such as oil that is used for plastic or other materials for protecting and preserving the product. The future market will be enormously developed because of the increasing need for the contact packer in the tertiary packaging.

The competitive landscape of the tertiary packaging market is dominated by established industry giants such as DS Smith, Becton, Owens Illinois, Inc., WestRock Company, Comar, Amcor plc, SGD Pharma, Schott AG, Gerresheimer AG, AptarGroup, and Dickison. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

DS Smith is a front-runner in the sustainable packaging market and is probably doing a strategic development of the eco-friendly tertiary packaging options made of recycled or recyclable paper and cardboard.

Becton's tertiary packaging strategy would probably be the one that would emphasize the sterility and temperature control in order to make sure the safe transport of the fragile medical pharmaceutical.

O-I is centered on the creation of light but sturdy palletizing solutions that are going to help in the transportation efficiency without, at the same time, destroying the product safety.

By Material

By Product Type

By End User

By Region

April 2025

March 2025

March 2025

March 2025