April 2025

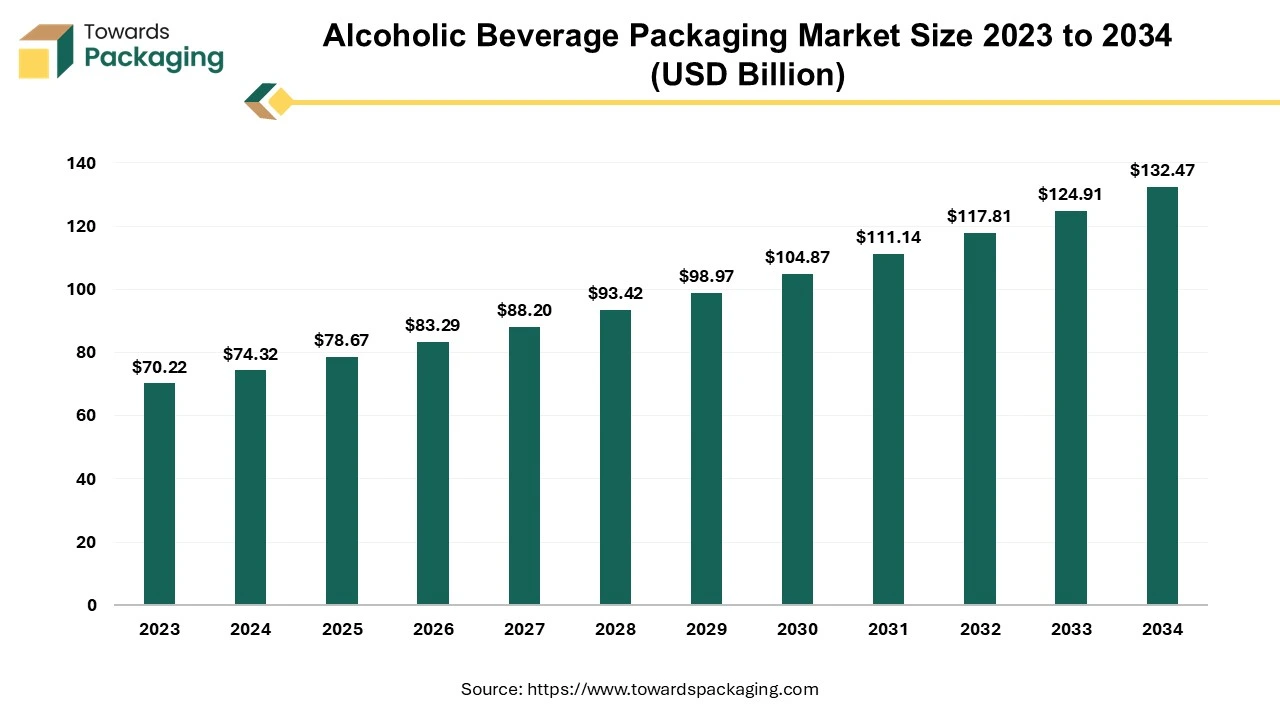

The alcoholic beverage packaging market is projected to reach USD 132.47 billion by 2034, growing from USD 78.67 billion in 2025, at a CAGR of 5.8% during the forecast period from 2025 to 2034.

Alcohol, a fascinating molecule with a long history of ancient civilizations, has seen extraordinary transformations over the centuries. Alcoholic beverage transportation and storage vessels have changed substantially, from rudimentary hollowed-out gourds and clay flasks to more sophisticated glass bottles. Cans, bag-in-boxes and pouches have recently been added to the list of containers, reflecting advances in packaging technology and different consumer preferences. Alcoholic beverage production, marketing and consumption are all dynamic industries that adapt to shifting consumer needs and embrace cutting-edge technology. The growth of the alcohol industry is seen in the wide range of available packaging alternatives, as well as in the production processes and marketing strategies used. The alcohol market is shaped by the dynamic interplay between tradition and innovation as producers aim to satisfy a sophisticated and modern consumer base.

Globally, per-capita alcohol consumption rose from 5.9 liters in 1990 to 6.5 liters in 2017. Additionally, it is anticipated that for the next 13 years, alcohol consumption per person will increase by 17%, reaching 7.6 liters in 2030. The increased consumption of alcoholic beverages is the primary driver of the packaging market's growth.

The alcohol companies are exploring novel packaging options in response to consumer demand shifting towards convenience, sustainability and distinctive experiences. This covers the composition of the materials layout and performance of the containers. The future of industries will be significantly influenced by technology, and the alcohol industry is navigating a world where old-world craftsmanship and new-world packaging techniques coexist. Beyond the processes of fermentation and distillation, the history of alcohol also involves adaptation to shifting social and cultural norms. The history of alcohol packaging, from prehistoric ships to cutting-edge packaging innovations, demonstrates the adaptability and tenacity of a sector that has endured.

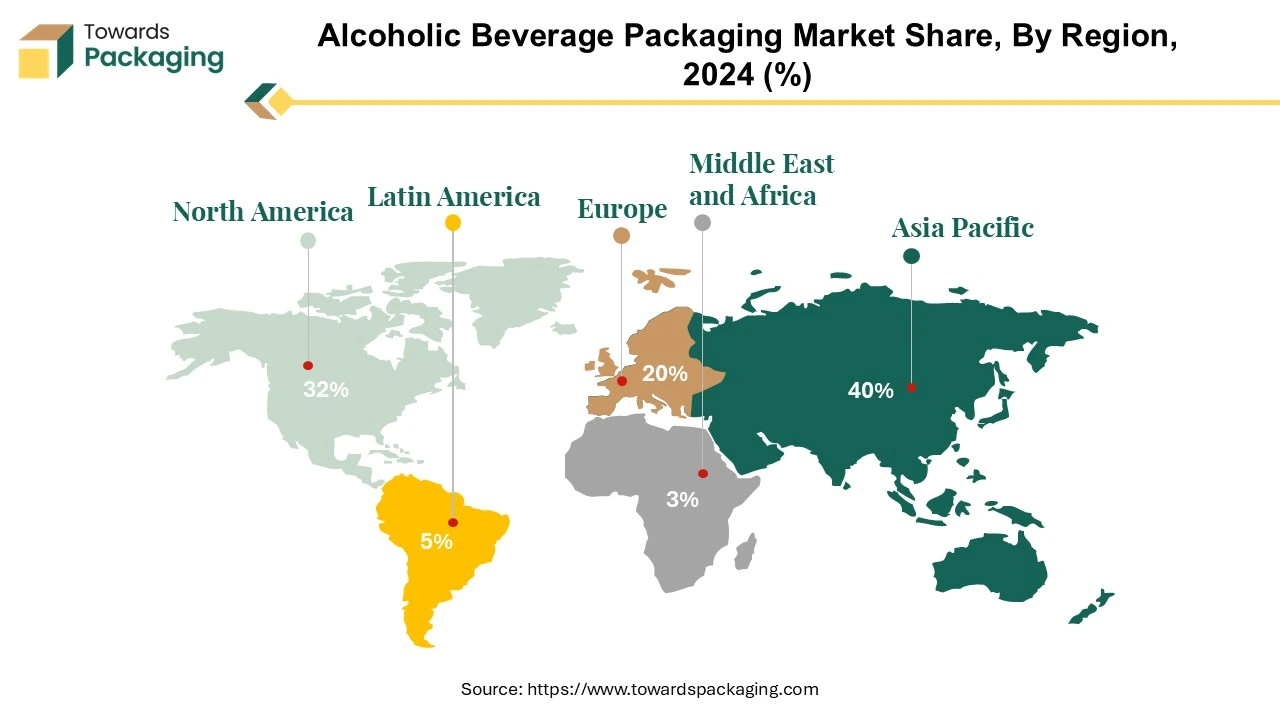

The packaging market in the Asia-Pacific beverage industry offers numerous prospects for local and international businesses. The area has gained prominence for beverage corporations because of growing economies, rising disposable income, and changing consumer behaviours that mirror worldwide trends. With its rich cultural heritage of festivities and social gatherings, India is one of the world's most alluring Alco-Bev (Alcoholic-Beverage) markets. However, these dynamics have been severely upset by the pandemic, which has had beneficial and harmful effects on people's lifestyles.

It is projected that 39% of Indians will be of legal drinking age, up from the current 33%. It is anticipated that the Alco-Bev market in India will reach ₹2.6 lakh crore by FY22, making it the third-largest market in the world after China and Russia. With 20.9% of new product releases including natural or organic components, clean labelling is becoming more and more popular as customer preferences change. Trust is built on clean labelling, which is especially important in the Asia Pacific market since people's trust in big businesses may erode.

Vietnam, a country with a long history of favouring beer, demonstrates an increasing concern for locally sourced ingredients, indicating a desire to support local businesses. For Indonesian customers, environmental sustainability and items that suit their nutritional needs and preferences are very important. Notably, functional ingredients, eco-friendly packaging and Halal-certified goods have been Indonesia's top three beverage claims during the last year. The dynamic nature of the beverage market in Asia-Pacific highlights the significance of comprehending and adjusting to shifting consumer preferences, placing equal emphasis on product quality and packaging. Considerations for clean labels, local sourcing and sustainable packaging will probably be crucial to a company's success as it navigates this fast-paced industry.

North American alcoholic packaging market, maintaining the region's position as the second leader in the sector. The alcoholic beverage industry drives the growth of glass packaging in North America. Many alcoholic beverage companies in the area now prefer to use glass because of its classic appeal and capacity to exude high quality. The growing popularity of premium spirits, craft breweries and distilleries in North America has dramatically raised demand for glass packaging. Glass containers are an excellent fit for craft beers, artisanal spirits and premium wines since they not only maintain the beverage's integrity but also provide an artistic canvas for label designs and branding. Glass packaging is typically associated with a more upscale and sophisticated drinking experience among North American consumers, especially those who are drawn to the craft and premium segments.

Glass packaging is highly versatile, offering various shapes, sizes and closing options. This flexibility helps firms stand out on store shelves and improve their market presence. Furthermore, glass's capacity to be recycled fits perfectly with consumers' increasing need for environmentally friendly and sustainable packaging options. This sustainability feature makes glass packaging even more appealing in North America, where environmental concerns heavily influence consumers' decisions.

North America, which holds the second position in the alcoholic packaging market, has embraced glass packaging, which reflects industry trends and highlights the material's lasting popularity in the region. Glasses natural attributes and the alcohol beverage industry's pursuit of luxurious packaging make it a key component in creating the visual identity.

Glass is a valuable way to showcase a distinctive product, especially as the market grows for craft and premium spirits and low or no-alcohol options. Glass packaging is strongly associated with premium alcohol goods; according to 79% of consumers, glass represents superior quality spirits. Elegant glass packaging speaks volumes about the calibre of the product and the brand's meticulous attention to detail. Tailored forms can generate brand recognition and emotional allegiance, promoting customer loyalty and repeat business. Embossing and surface textures give the design a tactile quality while smoothly blending branding components.

Decorative elements like premium materials, hot stamping and complex label designs can further enhance products' premiumization. Approximately 46% of bottles of premium spirits have unique textures, embossments, or forms. Glass bottles raise a brand's perceived value and emotionally connect with consumers-especially regarding accountability. Glass is infinitely recyclable and reused, which aligns with the principles of a global customer base that prioritizes responsibly created and sourced.

74% of consumers say they would be more likely to try a new spirit product if it came in a single-serve package, demonstrating the growing popularity of this trend. This is a reflection of how customers' tastes are changing and how they are looking for premium quality and sustainable beverage options. Glass bottles are positioned as strategic components in spirit products' branding and market success due to the combination of artistry, premiumization, premiumization in addition to serving as containers.

The market for alcohol bottles has grown significantly, and glass bottles now account for most of the volume of alcoholic beverages sold. Glass bottles are now the go-to alternative for businesses that transport their goods to customers because they are an affordable solution. About 70% of the bottles used for natural mineral water are made of plastic, but this tendency may change as demand for environmentally friendly packaging increases. With 53% of millennials saying they prefer single-serve cocktails packaged in cans or bottles, they are the generation pushing significant changes in the alcohol packaging environment. Specifically, aluminium bottles offer distinctive chances for businesses to stand out. For customers constantly on the go, their resealable feature improves mobility and provides a safe choice. With choices like direct printing, pressure-sensitive labels and shrink sleeves, aluminium cans and bottles offer plenty of room for branding. This lets designers create eye-catching designs and messaging that appeal to consumers.

The packaging sector has had difficulties, though as the price of materials—including glass bottles—has significantly increased. Glass bottle prices increased by 8%, carton prices by 37% and labels and closures by 5% and 15% in just one year (FY22). The economic challenges in the packaging industry are highlighted by this cost increase, which forces beverage businesses to make intelligent packaging decisions. Amid these dynamics, customer demand drives the industry to adopt more environmentally friendly packaging options. The increasing inclination of millennials towards environmentally responsible solutions is pushing beverage businesses to investigate more environmentally conscious alternatives. Packaging decisions will be critical in meeting customer expectations and the alcohol beverage industry's financial concerns as the market develops.

In the UK, a growing number of alcoholic beverage companies are switching from glass to paper bottles. A notable retailer recently introduced wine packaged in bottles made from 94% recycled paperboard, featuring a food-grade pouch inside. This move follows Absolut Vodka's launch of single-mold paper bottles in June 2023.

The shift is driven by sustainability, cost savings, and recent disruptions in glass supply. A recent survey shows that 65% of UK consumers consider sustainability a crucial factor. One paperboard bottle manufacturer claims their bottles have a carbon footprint about six times lower than traditional glass bottles.

While glass is biodegradable, its production requires large amounts of sand, leading to environmental issues like soil erosion and coastal damage. This growing environmental concern is fueling the trend towards paper bottles in the alcoholic beverage industry.

The competitive landscape of the alcoholic beverage packaging market is characterized by established industry leaders such as Amcor plc., Diageo PLC, ProAmpac., Tetra Pak Group, BALL CORPORATION, Ardagh Group S.A., Berry Global Inc., Sonoco Products Company, Crown and Brick Packaging. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences. Additionally, the sector sees dynamic collaborations, acquisitions, and strategic partnerships as companies strive to capture market share in this highly competitive and evolving industry.

By Material

By Type

By Region

April 2025

April 2025

April 2025

April 2025