April 2025

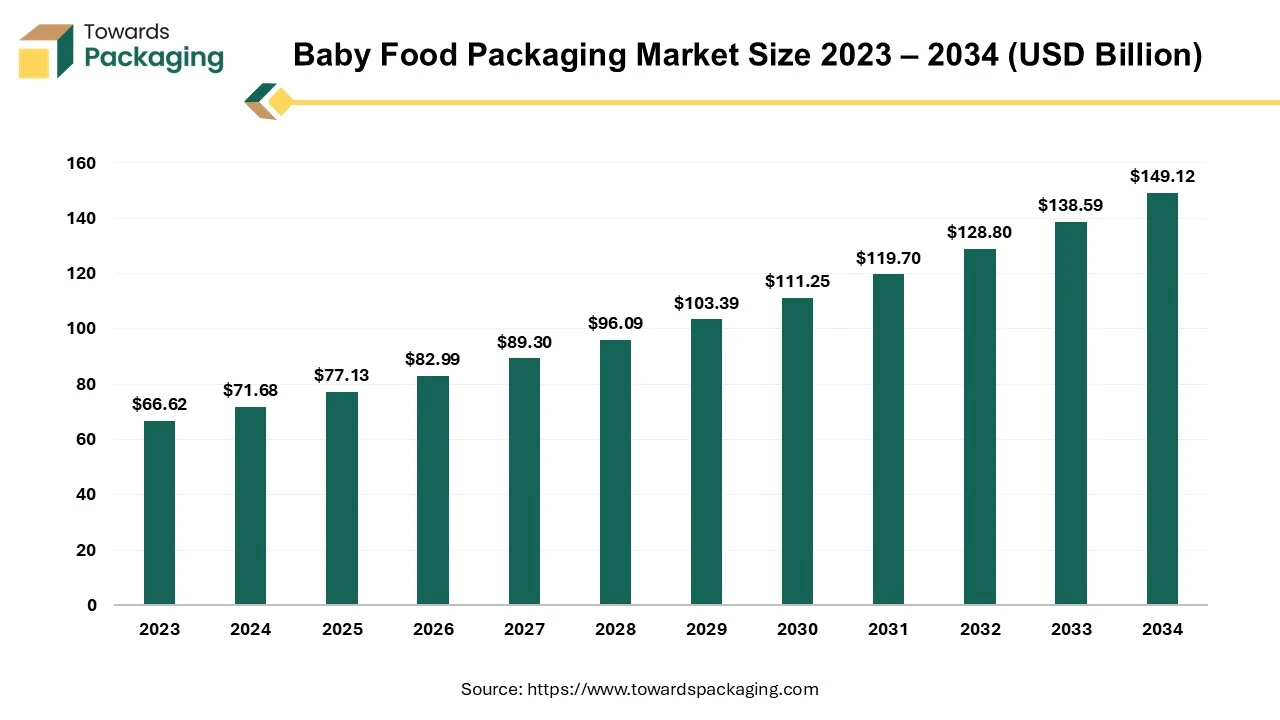

The baby food packaging market size is forecasted to expand from USD 77.13 billion in 2025 to USD 149.12 billion by 2034, growing at a CAGR of 7.6% from 2025 to 2034.

Baby food packaging market is a part of the packaging industry segment that focuses on creating, manufacturing, and distributing packaging solutions specifically for food products intended for infants and toddlers. The company's mission is to ensure the safety, nutritional integrity, and convenience of its goods for parents and carers.

Infant food manufacturers are witnessing a significant shift in packaging tactics, driven by the rise of millennial parents as the most influential consumer demographic. Traditional eye-catching labels and unique imagery methods, such as the iconic Gerber baby, are no longer sufficient. The landscape of infant food packaging is transforming, necessitated by the evolving concerns, preferences, and lifestyles of millennial parents, who now hold the reins of the market. Millennial parents, known for demanding brand transparency, are attracted to visually appealing products with imaginative designs for their infants. Numerous well-known baby food businesses have switched to flexible stand-up pouches with spouts, moving away from the traditional tiny paper label on a tiny jar. The drawbacks of these conventional methods include limited space for information, less visual appeal, and less convenience for on-the-go feeding. These creative packaging ideas are aesthetically pleasing and a vital component of the marketing plan as they package and safeguard baby food.

The safety and quality of baby food are greatly dependent on the packaging. Nutritional integrity is preserved by contamination prevention provided by childproof and sanitary packaging. Parental decision-making is facilitated by clear labelling, and portion-sized packaging makes feeding on-the-go more feasible while putting the health and convenience of young consumers first.

Baby food packaging that adapts to consumers' changing requirements and lifestyles is preferred, as evidenced by the trend towards flexible stand-up pouches. More excellent design and communication versatility are possible with these pouches, which provide a more contemporary and dynamic alternative. The functionality of these pouches corresponds with the tastes of millennial parents, who value ease of use and are drawn to packaging that not only holds but also successfully preserves infant food items. Packaging for baby food has evolved in response to shifting consumer demands and the demographic situation. Brands carefully choose container styles, such as flexible stand-up pouches, to satisfy the needs of millennial parents while ensuring the correct containment and preservation of their baby food items.

For Instance,

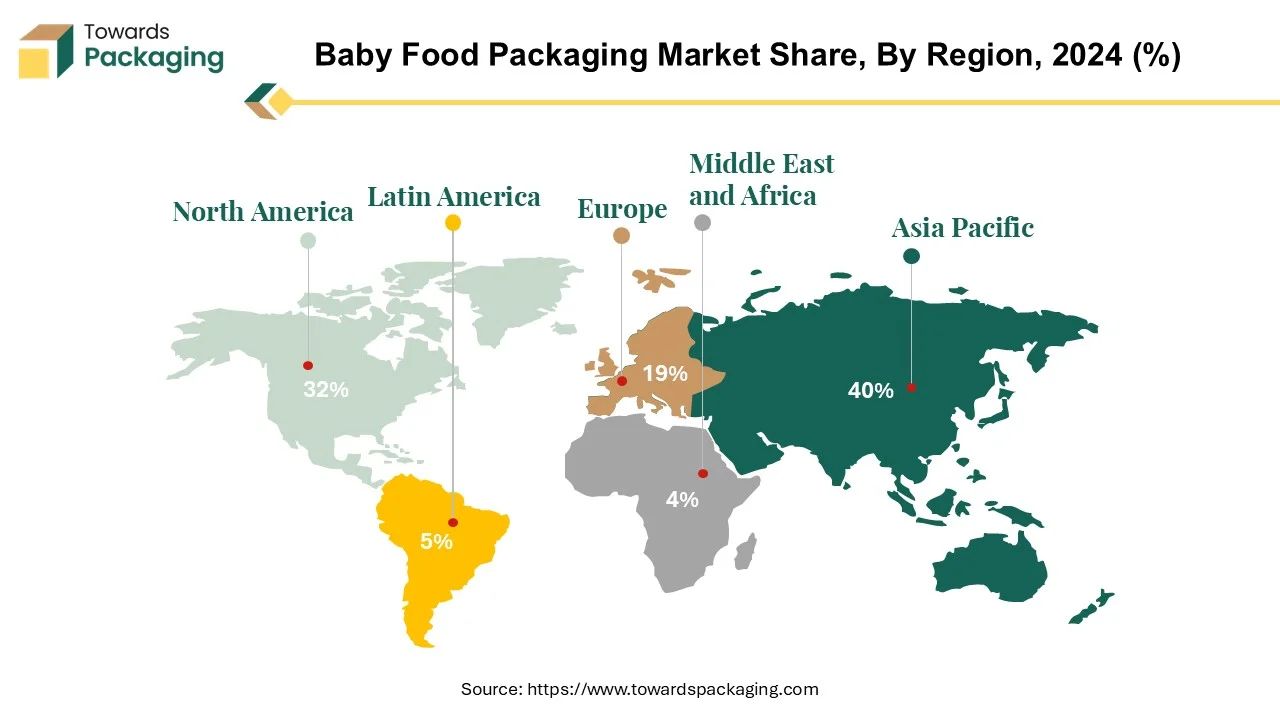

With the significant 40.2% market share in the infant food sector, the Asia-Pacific area is the centre of the worldwide baby food packaging business. The region's high birth rates and growing purchasing power, taken together, fuel the need for items based on milk formula and baby food, contributing to its dominance. China is the market leader, with the distinction of being the biggest customer in the Asia-Pacific area. Moreover, the promising economies of Indonesia and India are expected to play a pivotal role in driving the growth of the region's infant food market, offering a bright outlook for the future. Milk formula, holding the largest market share, is the preferred choice among customers, indicating a stable and reliable market demand.

The prepared baby food product industry follows closely, making a substantial contribution to the varied infant nutrition landscape of the Asia-Pacific region. The notable concentration of sales in infant food made from milk formula highlights the popularity of this category of items in the area. Supermarkets, a crucial distribution channel for the infant food sector, account for a significant portion of its total distribution. This underlines the vital role of conveniently accessible retail locations in reaching a broad customer base, ensuring the products' wide availability. In the infant food packaging industry, positioning claims emphasize three essential features: convenience packing, organic content, and no additives or preservatives. Convenience packaging stands out among these in growth, with an astounding 72% increase. Notable growth rates of 25% and 7%, respectively, are seen in the demand for organic infant food and items free of additives and preservatives. These trends show a strong demand for products that fit convenient and health-conscious lifestyles, aligning with consumers' growing preferences in the Asia-Pacific area.

| Fertility Rates in India | ||

| Year | Fertility Rate | Growth Rate |

| 2023 | 2.139 | -0.93% |

| 2022 | 2.159 | -0.92% |

| 2021 | 2.179 | -0.95% |

| 2020 | 2.2 | -0.90% |

India's fertility rate is steadily declining, estimated at 2.139 births per woman in 2023, a 0.93% drop from 2022. Factors like increased education access, contraception, urbanization, and female workforce participation contribute to this trend. If the fertility rate falls below replacement levels, it could lead to an aging population and a shrinking workforce, impacting demographics and the economy.

Asia-Pacific's infant food packaging market is essentially defined by its strong growth, high birth rates, rising purchasing power, and wide range of product preferences. The market is changing and dynamic, as seen by the prevalence of milk formula, the role retailers play in distribution, and the increase in demand for handy and health-conscious packaging.

For Instance,

The North American market has emerged as the fastest-growing hub with 32.1% of market share in the vast landscape of baby food packaging. A detailed survey of over 1,000 parents in the United States was done to determine their preferences for infant food packaging. This extensive investigation dug into consumer perceptions about the convenience, value, design, safety, and overall attractiveness of several infant food brands, evaluating the visual and structural components of their packaging. The spike in organic baby food sales, which has seen a [insert percentage] increase spurred by parents' increased health concerns, has taken the stage in the US. Customers' rising concern about food safety is a crucial factor affecting this development, encouraging them to spend more money on organic infant food. This shift is primarily motivated by a desire to protect newborns from pesticides and other additives, consistent with the broader cultural trend towards health-conscious consumerism.

The widely held assumption among health professionals that infants and children benefit more from organic food than adults reinforce the health-conscious approach. This derives from the belief that children, who are more susceptible to contaminants in their meals, stand to benefit significantly from the purity and nutritious content of organic food. Studies have shown that organic food can provide [insert specific health benefits] for infants. Birth rates are expected to rise as economic conditions improve and Americans gain confidence in their prospects. This is predicted to lead to a corresponding increase in the value of infant food sales. Economic prosperity and increased confidence combine to create an optimistic prognosis for the North American baby food market, setting it for long-term expansion.

The North American baby food packaging business is rapidly expanding, driven by rigorous monitoring of parental preferences and a significant trend towards organic baby food. The convergence of health-conscious choices, worries about food safety, and the anticipated improvement in economic conditions shape the landscape, pointing to a promising path for the market's expansion in the region.

For Instance,

The baby food packaging sector has emerged as a leader, with plastic containers emerging as the most popular material. Plastic containers have various advantages over glass counterparts. They are noticeably lighter, allowing for better handling, transit, and storage, which is especially useful for bulk shipping products. Furthermore, plastic containers are more durable and less likely to break than glass, making them a better choice for storing and handling infant food supplies. While plastic containers in the infant food packaging sector are frequently recyclable, contributing to sustainability initiatives, examining the potential downsides of using plastic containers is critical. For instance, certain types of plastic can leach harmful chemicals into the food, especially when heated. These chemicals can interfere with the baby's hormonal system and lead to health issues in the long run. The possibility that traces levels of potentially dangerous substances, such as phthalates and BPA (bisphenol A), may seep into infant food from plastic is a cause for concern. To resolve this matter, it is recommended that consumers use infant foods that bear the labels "BPA-free" or "phthalate-free."

The possibility of these chemicals leaking into the food can be increased by heat exposure, such as microwaves, or damage to plastic containers. Although BPA is prohibited in some infant goods by the U.S. Food and Drug Administration, BPA is said to be safe to use in other kinds of food packaging. However, the American Academy of Paediatrics advises parents to proceed cautiously, given that young children and newborns are especially susceptible to chemical exposure. To make educated decisions, customers should avoid plastics labeled with specific recycling codes such as 3 (phthalates), 6 (styrene), and 7 (bisphenols, including BPA).

Additionally, looking for products in packaging labelled "biobased" or "greenware" is suggested, as these containers are constructed from plant-based materials. Notably, baby food bags are frequently lined with polypropylene, as indicated by recycling code 5, providing a BPA-free plastic option. Overall, recognizing plastic containers' benefits and potential drawbacks in the baby food packaging market allows consumers to make informed and health-conscious decisions for their infants.

For Instance,

Powder baby food items dominate the baby food packaging market and have established themselves as a significant sector. Consumers worldwide favor powdered or dried infant food products for their unrivalled convenience, prolonged shelf life, and nutritional benefits. These devices are popular because of their ease of use and versatility for carers. The assortment of packaging materials used for powdered baby food items highlights their crucial role in maintaining the food's quality and freshness. Packaging serves a purpose beyond merely housing the product; it acts as a protective barrier, ensuring the nutritional value of the infant food remains intact from packaging to consumption.

Products are meticulously packaged with materials like paper and cardboard, which are used for items such as cereals, baby formulas, and snacks. The choice of packaging material plays a pivotal role in safeguarding and preserving powdered baby food. Manufacturers opt for these materials for their functionality and environmental benefits, aligning with the baby food industry's growing focus on sustainable and ethical packaging practices.

For Instance,

Powder baby food products are gaining popularity in the baby food packaging industry due to consumer preferences for convenience, longer shelf life, and nutritional content, anchored in worldwide consumer trends. The preservation of the quality of different infant food products is greatly aided by the packing materials, such as cardboard and paper, emphasizing the significance of well-thought-out and practical packaging solutions throughout the packaging-to-consuming process.

Pouches have risen to prominence in the infant food packaging market, offering distinct advantages that meet both parents' and customers' needs and expectations. In contrast to conventional packaging, pouches provide ample' retail space' for various elements such as artwork, logos, ingredient details, nutritional information, serving suggestions, and product formulation details. This abundance of information empowers parents to make well-informed choices about the baby food products they select for their infants. Parents surveyed have shown a strong preference for stand-up pouches with spouts, recognizing them as more convenient for storing baby food and significantly safer than rigid glass jars, which pose a risk of breaking and shattering if dropped.

The stand-up pouch with a spout was recognized as safer and more practical, even by parents initially content with glass jars. Concerning grocery stores, an overwhelming majority of respondents, accounting for 73.61%, believe that stand-up pouches with spouts would garner greater visibility on the shelves compared to glass jars. In the baby food packaging sector, pouches exhibit adaptability and can be customized to fulfil diverse purposes. They can be produced in multiple sizes, shapes, and structures to meet product requirements and maintain brand recognition. This versatility also mirrors the ability to fit into modern parents' diverse preferences and active lifestyles.

For Instance,

Several baby food businesses have already adopted spouted pouches for their products, drawn by their safety features, ease of use for busy parents, and the ability to print in vibrant colors, sizes, and shapes that appeal to young children. Pouches offer greater space efficiency than bulky, rigid containers due to their portability, making them a perfect fit for diaper bags and household pantries. Furthermore, pouches are cost-effective for manufacturers, contributing to their widespread acceptance in the evolving infant food packaging market.

The competitive landscape of the baby food packaging market is characterized by established industry leaders such as Ardagh Group, Amcor PLC, Mondi Group, Winpak Ltd, Sonoco Products Company, Bemis Company, Inc., Rexam PLC, RPC Group, Bericap India Pvt Ltd. And Hindustan National Glass & Industries Ltd. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences.

The packaging specialists at Amcor use a wide range of pioneering techniques to enhance packaging sustainability. Amcor’s products guide the process of confirming and promoting the recyclability of packaging; R&D teams may draw in 84% of consumers and increase their market share. Winpak is dedicated to investing in sturdy and safe packaging materials to meet the needs of our youngest customers, infants and toddlers. Winpak has been developing liquid packaging solutions with various filling technologies and flexible and rigid packaging materials for over 30 years. The company's products include functional and aesthetically pleasing pouches and cups. Sonoco Products Company provides largest player in infant puree packaging with quality and convenience.

An experiment showed that microwaving baby food in plastic containers can release over two billion tiny plastic particles (nanoplastics) and four million slightly larger particles (microplastics) per square centimeter of the container.

The health effects of consuming large amounts of these tiny plastic particles are still unknown, according to researchers.

They then analyzed the liquids and found microplastics and nanoplastics. The number of particles released varied depending on the container type and the liquid.

The researchers concluded that toddlers eating microwaved dairy products and infants drinking microwaved liquids are consuming the highest amounts of plastic particles.

By Material

By Product Type

By Packaging

By Region

April 2025

April 2025

April 2025

April 2025