Biodegradable Paper and Plastic Packaging Market Consumer Behavior, Demand and Forecast

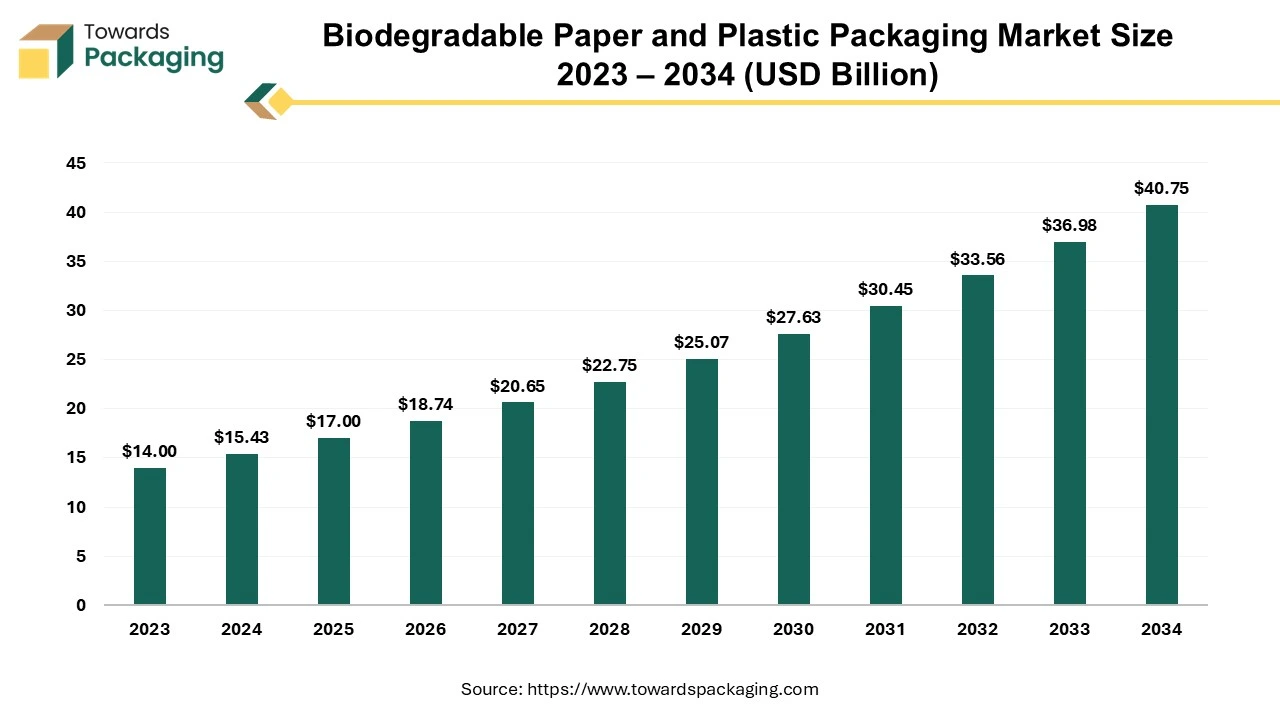

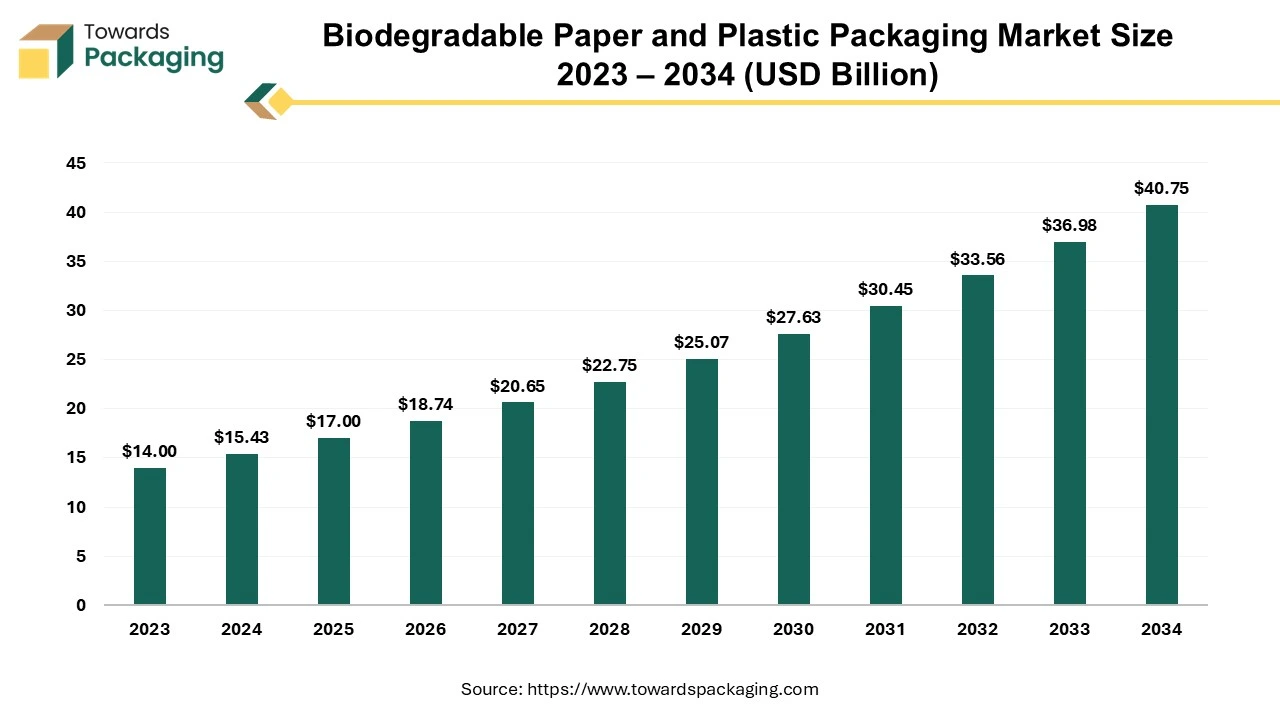

The biodegradable paper and plastic packaging market reached USD 17 billion in 2026 and is expected to hit USD 40.75 billion by 2035 at a CAGR of 10.20%, and our report covers full segment-wise data, regional insights across North America, Europe, Asia Pacific, Latin America, and MEA, key companies, competitive landscape, value chain structure, global trade flows, and detailed manufacturer–supplier mapping.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing fiber based packaging which is estimated to drive the global biodegradable paper and plastic packaging market over the forecast period.

Major Key Insights of the Biodegradable Paper and Plastic Packaging Market

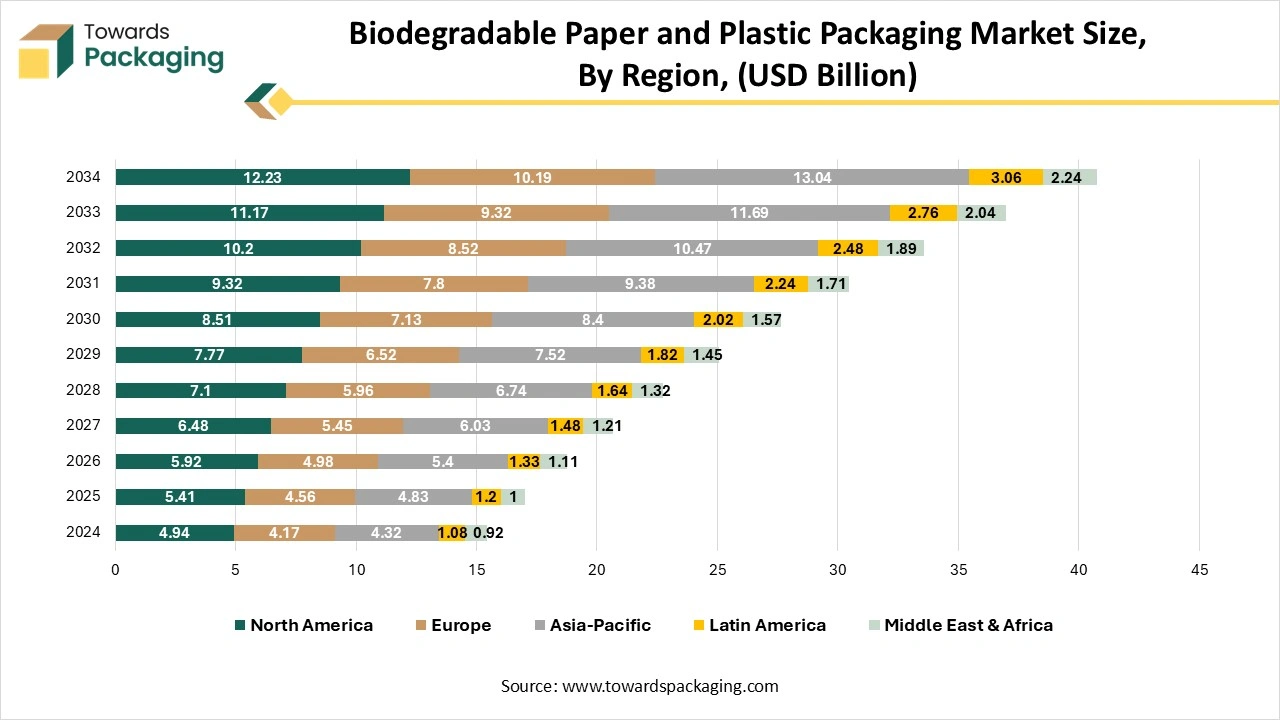

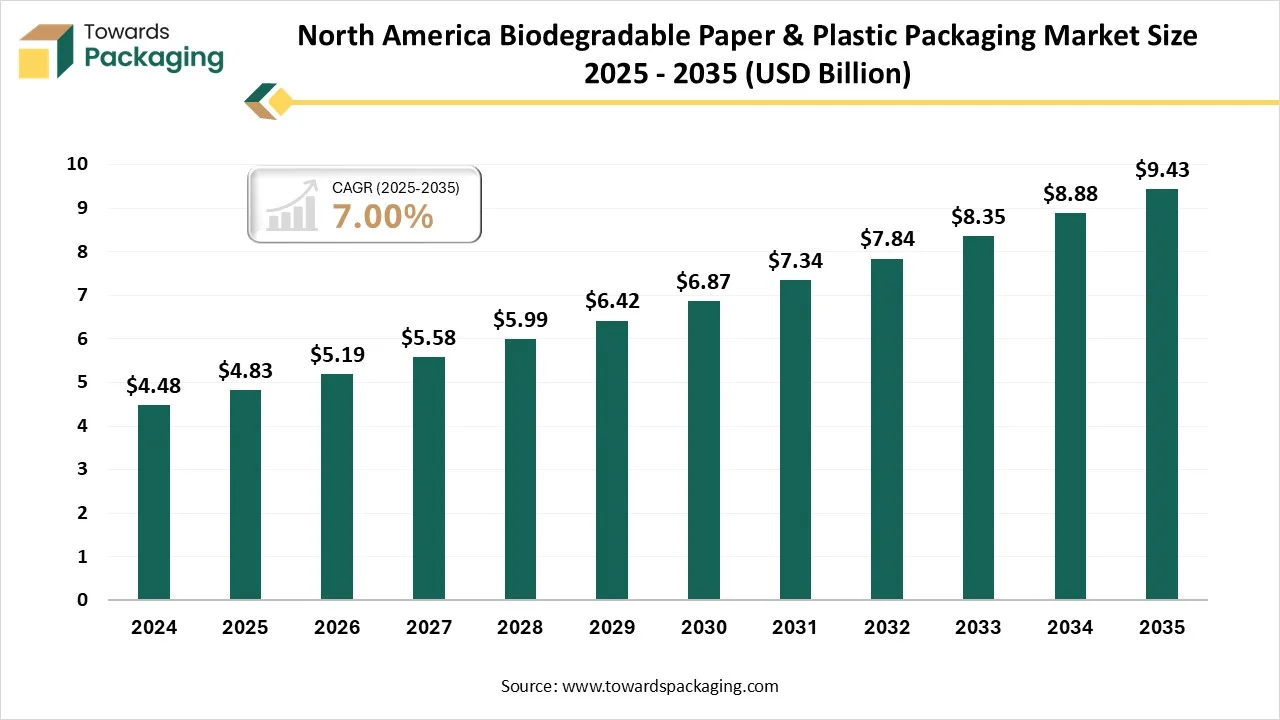

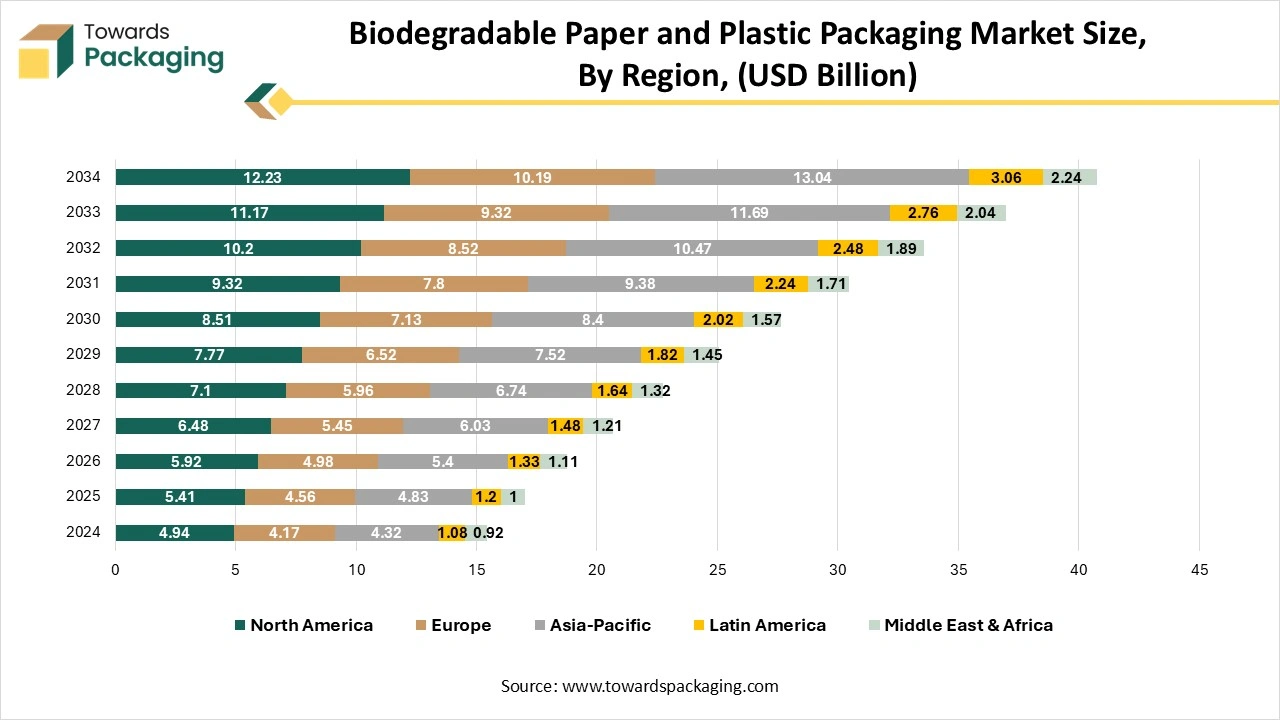

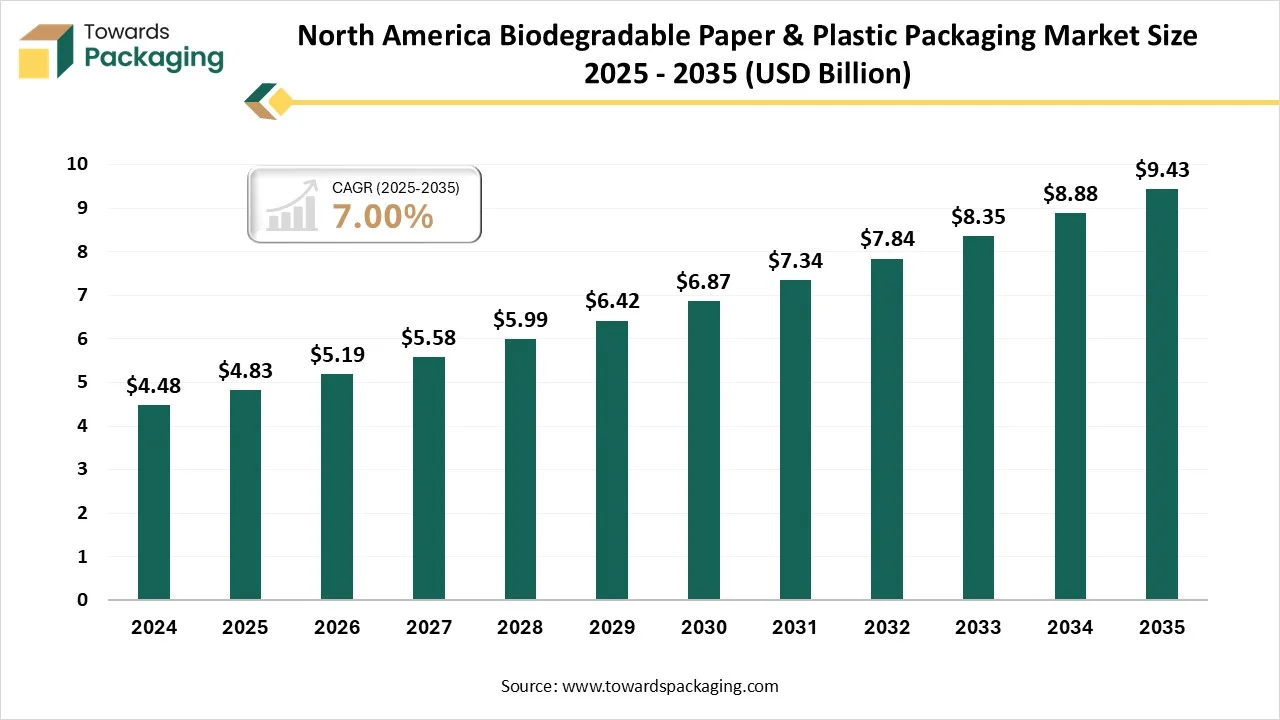

- North America held a significant share of the market in 2024.

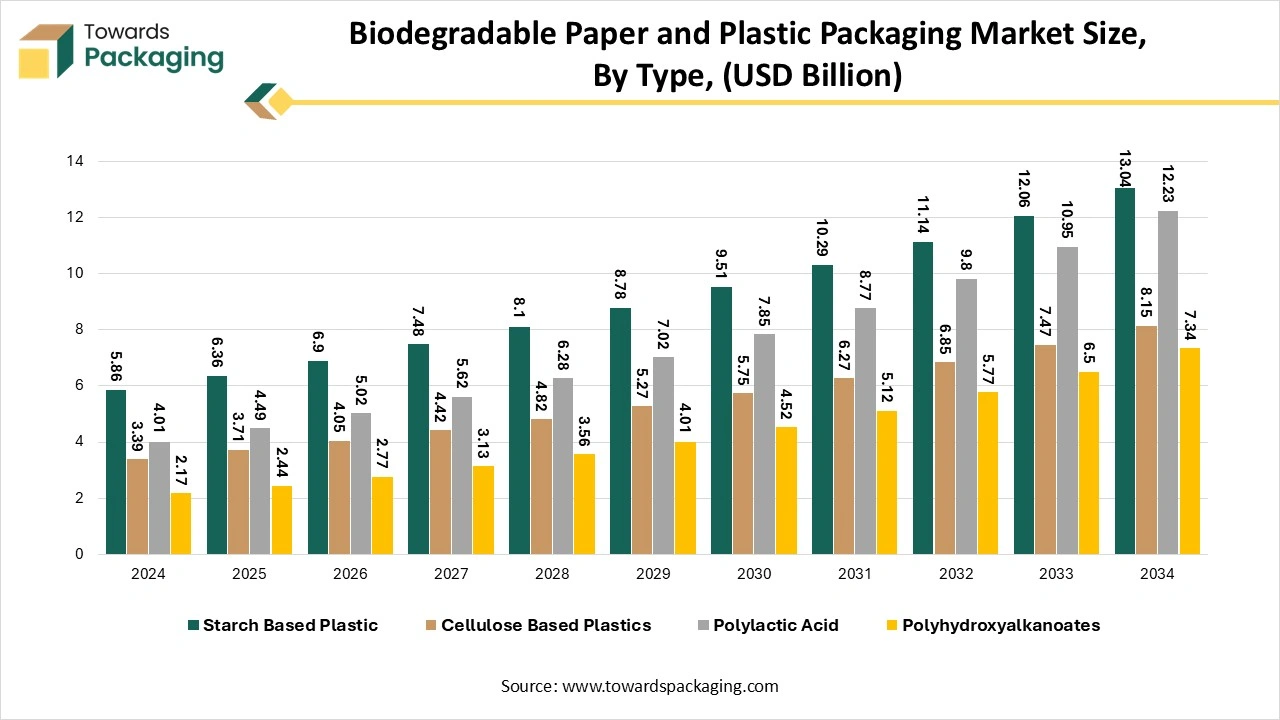

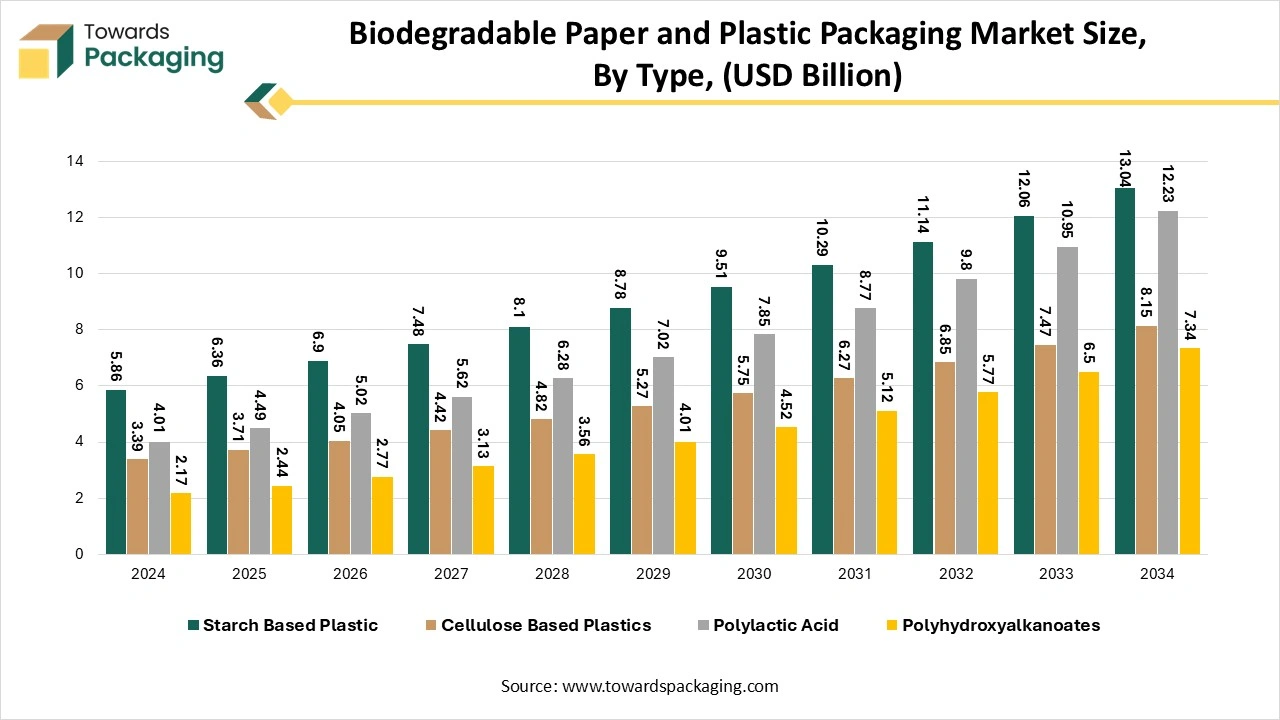

- By type, the starch based plastic segment dominated the market with the largest share in 2024.

- By material, the plastic segment registered its dominance over the global biodegradable paper and plastic packaging market in 2024.

- By end user, the food & beverages segment dominated the biodegradable paper and plastic packaging market in 2024.

Biodegradable Paper and Plastic Packaging Market: Eco-Friendly Packaging

Biodegradable paper and plastic packaging refers to packaging materials that are developed to decompose naturally in the environment through biological processes involving microorganisms, such as fungi and bacteria. These materials break down into natural elements like carbon dioxide, water, and biomass within a reasonable timeframe, leaving minimal or no toxic residue. Biodegradable paper packaging is manufactured from natural fibers such as bamboo, wood pulp, or recycled materials. Examples include cardboard boxes, paper bags, and molded pulp containers. Biodegradable paper easily decomposes when exposed to moisture, air, and microorganisms.

Biodegradable plastic packaging manufactured from natural, renewable sources like sugarcane, cornstarch, or other plant-based materials. The common biodegradable plastics consists of Polylactic Acid (PLA) which derived from cornstarch or sugarcane and Polyhydroxyalkanoates (PHAs) produced from microorganisms. The biodegradable paper and plastic packaging is designed to break down under specific conditions, such as in industrial composting facilities or home compost setups.

Market Trends

Technological Advances and Economies of Scale Driving Growth

Advances in biodegradable packaging technology have manufactured materials more cost-competitive with traditional plastics. Economies of scale achieved through increased production and the growing availability of raw materials have further cut-down costs.

Key Players Embrace Biodegradable Packaging to Achieve Sustainability Goals

Key Players are adopting biodegradable packaging to meet sustainability goals. For instance, Grupo Bimbo, food processing company aims for 100% of its packaging to be recyclable, biodegradable, and/or compostable by 2025.

Eco-Friendly Packaging Drives Companies to Adopt Biodegradable Solutions

Consumers are constantly seeking eco-friendly packaging options, prompting companies to adopt biodegradable materials to meet this demand.

How Can AI Improve the Biodegradable Paper and Plastic Packaging Industry?

The integration of Artificial Intelligence (AI) into the biodegradable paper and plastic packaging industry will notably improve its growth and efficiency. The integration of Artificial Intelligence (AI) assists in analyzing the properties of biodegradable materials to develop stronger, more efficient, and cost-effective packaging solutions. AI-driven systems can optimize manufacturing processes, reducing energy consumption and waste, leading to more sustainable production.

AI detect defects or inconsistencies in packaging materials during production, ensuring high-quality standards. AI-powered systems assist in predict equipment failures, reducing downtime and maintaining continuous production. AI can enable mass customization of biodegradable packaging, tailoring designs to specific consumer or business needs. AI integration identify emerging consumer preferences for eco-friendly packaging, allowing companies to innovate and stay competitive. AI help identify the most cost-effective and sustainable sources for raw materials, reducing production costs. Machine learning algorithms can optimize every aspect of the production cycle, from raw material usage to energy consumption.

2024 EBITDA Margins of Leading Biodegradable Paper & Plastic Packaging Suppliers

| Supplier |

EBITDA % (2024) |

Basis |

Evidence |

| Smurfit WestRock |

15.20% |

Combined adjusted EBITDA margin (full-year 2024) |

Company press release summarizing FY2024 combined results. |

| Mondi |

14.20% |

Underlying EBITDA / revenue (Group, FY2024) |

Underlying EBITDA €1,049m; revenue €7.4bn ⇒ ~14.2%. |

| Huhtamaki |

15.50% |

Adjusted EBITDA / net sales (derived: Adjusted EBIT €416.9m + D&A €221.3m; sales €4,126m) |

Annual Report 2024: Adjusted EBIT, net sales, and D&A totals. |

| DS Smith |

15.60% |

Adjusted EBITDA margin (derived) using net debt (£2,230m) and covenant ND/EBITDA (2.1×) ⇒ EBITDA ≈ £1,062m; revenue £6,822m |

FY2023/24 press release: revenue; net debt; ND/EBITDA ratio and definition. |

| Amcor |

13.30% |

EBITDA / net sales (FY2024) using EBITDA $1.819bn and sales $13.64bn |

EBITDA from Macrotrends; FY2024 sales from Amcor FY24 results. |

- Smurfit WestRock 15.2% - A top global producer of fiber-based (biodegradable) packaging across containerboard, corrugated, and consumer paperboard. The combined 2024 adjusted EBITDA margin stood at 15.2%, reflecting synergy capture, disciplined pricing, and cost management.

- Mondi 14.2% - An integrated leader in sustainable paper & flexible packaging, Mondi focuses on compostable and recyclable mono-material solutions. In 2024, underlying EBITDA was €1.049bn on €7.4bn revenue, giving a 14.2% margin, showing resilience in pulp and packaging demand.

- Huhtamaki 15.5% - Specializes in fiber foodservice products, molded fiber, and flexible packaging with recyclable and compostable innovations (e.g., plastic-free barrier boxes). FY2024 adjusted EBIT plus depreciation implies an adjusted EBITDA of ~€638m; with net sales of €4.126bn, margin was 15.5%.

- DS Smith 15.6% - A major corrugated/fiber packaging supplier known for biodegradable solutions. In FY2023/24, revenue was £6.822bn; based on net debt and ND/EBITDA disclosures, adjusted EBITDA is estimated at ~£1.062bn, equating to a 15.6% margin. Strong focus on innovation in recycled paper-based packaging.

- Amcor 13.3% - A global leader in flexible and rigid packaging with increasing investments in recyclable and bio-based product lines. FY2024 EBITDA was $1.819bn on net sales of $13.64bn, equating to a 13.3% margin. The company is actively pivoting towards sustainable packaging formats.

Driver

E-Commerce Growth Driving the Shift to Biodegradable Packaging

The e-commerce boom has increased demand for sustainable packaging materials, particularly for shipping products to eco-conscious consumers. The e-commerce boom need substantial amounts of packaging for shipping and delivery. Biodegradable materials offer an eco-friendly alternative to traditional plastics, aligning with the sustainability goals of e-commerce companies. Consumers increasingly demand sustainable packaging options for their online purchases, pressuring e-commerce platforms to adopt biodegradable materials. Companies providing eco-friendly packaging solutions gain a competitive advantage and foster customer loyalty.

Governments worldwide are implementing stricter regulations on plastic waste, particularly from e-commerce packaging. Biodegradable materials help companies comply with these laws while maintaining operations. Biodegradable packaging addresses growing concerns over the waste generated by e-commerce, particularly single-use plastics, by offering sustainable alternatives that decompose naturally.

- In August 2024, according to data published by the E-commerce Council, major e-commerce players, such as Amazon and Alibaba, are committing to sustainability by adopting biodegradable and recyclable packaging to reduce their environmental footprint. These initiatives align with broader Environmental, Social, and Governance (ESG) strategies and contribute to brand reputation. Amazon’s Climate Pledge: Includes initiatives to reduce plastic packaging and increase the use of biodegradable materials. In the US, Amazon controls 37.6% of the commerce market. As a result, Amazon now holds the most market share in the US, with Walmart coming in second with 6.4%.

Restraint

Limited Availability of Raw Materials & Lack of Proper Infrastructure

The key players operating in the market are facing issue due to limited availability of raw material & lack of proper infrastructure which may restrict the growth of the biodegradable paper and plastic packaging market. Biodegradable packaging materials often rely on agricultural feedstocks like corn, sugarcane, or cassava, which may be limited by competing demands for food production or biofuel. Biodegradable materials may not perform as well as traditional plastics in terms of strength, flexibility, or moisture resistance. Effective degradation of many biodegradable materials requires industrial composting facilities, which are not widely available in many regions. Mixing biodegradable plastics with conventional plastics can contaminate recycling streams, complicating waste management.

Opportunity

Government Policies and Technological Innovations Driving Growth in Biodegradable Packaging

Policies banning single-use plastics and promoting biodegradable alternatives create a favourable regulatory environment. Governments offer tax benefits, grants, and subsidies for adopting biodegradable packaging solutions. Research into additives that improve the degradation process under natural conditions provides notable growth potential. Innovations in bio-based coatings and barrier technologies can expand applications in high-performance packaging.

For instance, in August 2024, By creating PBAT-based biodegradable packaging, a group of scientists at the Defence Research and Development Organisation (DRDO) transformed the market with environmentally friendly substitutes that break down in three months without leaving any toxic trace behind. DRDO scientist Dr. K Veerabrahmam and his colleagues at the DRDO Advanced Systems Laboratory in Hyderabad created biodegradable packaging items by employing PBAT, a biodegradable polymer made from plant or petroleum-based oils. With the goal of being widely used both domestically and internationally, this cutting-edge technology has been freely distributed to more than 40 industries.

Segmental Insights

Starch-Based Plastics is the Leading Eco-Friendly Solution in Biodegradable Packaging

The starch based plastic segment held a dominant presence in the biodegradable paper and plastic packaging market in 2024. Starch-based plastics decompose naturally in the environment, reducing plastic pollution and landfill waste. The production process has a smaller carbon footprint compared to petroleum-based plastics. Starch is derived from abundant and renewable agricultural crops like corn, potatoes, and cassava, making it an eco-friendly alternative. Government policies restricting conventional plastics develop a favourable environment for starch-based alternatives. Starch-based plastics help companies meet sustainability regulations such as the EU's Packaging and Packaging Waste Directive.

Starch-based plastics are used in packaging, agriculture, medical devices, and consumer goods. Starch-based plastics can often be processed using conventional plastic manufacturing equipment, reducing barriers to adoption. Starch is inexpensive and widely available, making it a cost-effective raw material for bioplastics.

Plastic Segment: The Backbone of Biodegradable Packaging with Versatility and Cost-Efficiency

The plastic segment accounted for a significant share of the biodegradable paper and plastic packaging market in 2024. Plastic materials are in high demand globally due to their unique combination of properties, versatility, cost-effectiveness, and widespread applicability. Plastics can be tailored to meet the needs of diverse industries, including automotive, construction, packaging, healthcare, and electronics. Plastics can be molded into virtually any shape, size, or form, making them suitable for both simple and complex applications. Plastics are relatively inexpensive to produce compared to alternatives like metal, glass, or wood. High-volume production capabilities reduce per-unit costs, making plastics affordable for mass-market applications.

Plastics are significantly lighter than metals or glass, reducing transportation and shipping costs. Many plastics are resistant to wear, corrosion, and environmental factors, ensuring long-lasting performance. Plastics provide high strength relative to their weight, making them ideal for various structural and non-structural uses. Many plastics can be flexible or rigid, depending on the requirements of the application. Plastics are widely used as insulators in electrical and thermal applications.

Food & Beverages Sector: Leading the Shift to Sustainable Biodegradable Packaging in 2024

The food & beverages segment registered its dominance over the global market in 2024. Biodegradable packaging materials help reduce the environmental impact of single-use plastics, which can take hundreds of years to decompose in landfills or oceans. Biodegradable materials, such as those made from plant-based sources, have a smaller carbon footprint compared to traditional plastic packaging derived from fossil fuels. With increasing bans and restrictions on single-use plastics globally, biodegradable packaging allows food and beverage companies to comply with local regulations and avoid penalties. A growing segment of consumers is increasingly aware of environmental issues and prefers products packaged in biodegradable materials. This demand pushes companies in the food & beverages industry to adopt more sustainable packaging options.

Brands that utilize eco-friendly packaging gain positive recognition and strengthen customer loyalty. Consumers are more likely to support companies that demonstrate environmental responsibility. Many regions, especially in Europe and parts of North America, have implemented laws banning or limiting the use of single-use plastics. This makes biodegradable packaging a compliant and practical alternative for food and beverage packaging. Regulations such as the EU's Packaging and Packaging Waste Directive and the U.S. Environmental Protection Agency’s guidelines encourage the use of biodegradable and recyclable materials in food packaging.

North America Leads Biodegradable Packaging Adoption in Response to Plastic Bans and Sustainability Laws in 2024

North America region held a significant share of the biodegradable paper and plastic packaging market in 2024. Many states and cities in the U.S., as well as Canadian provinces, have introduced plastic bans or restrictions on single-use plastics, including plastic bags, straws, and utensils. These bans and policies by government drive the demand for biodegradable alternatives such as paper and plant-based plastics. For instance, California's Plastic Waste Reduction Law: Aiming to reduce plastic pollution, this law encourages the use of biodegradable and compostable packaging alternatives.

Canadian Ban on Single-Use Plastics: Canada announced the launch of the plans to ban certain single-use plastics, prompting companies to explore alternatives like biodegradable and compostable materials. These programs, especially prevalent in Canada, make producers responsible for the entire lifecycle of their packaging, including disposal. This encourages companies to adopt more sustainable and biodegradable materials. For example: British Columbia's EPR Program: This program mandates that companies ensure their packaging is recyclable or compostable, pushing for biodegradable options.

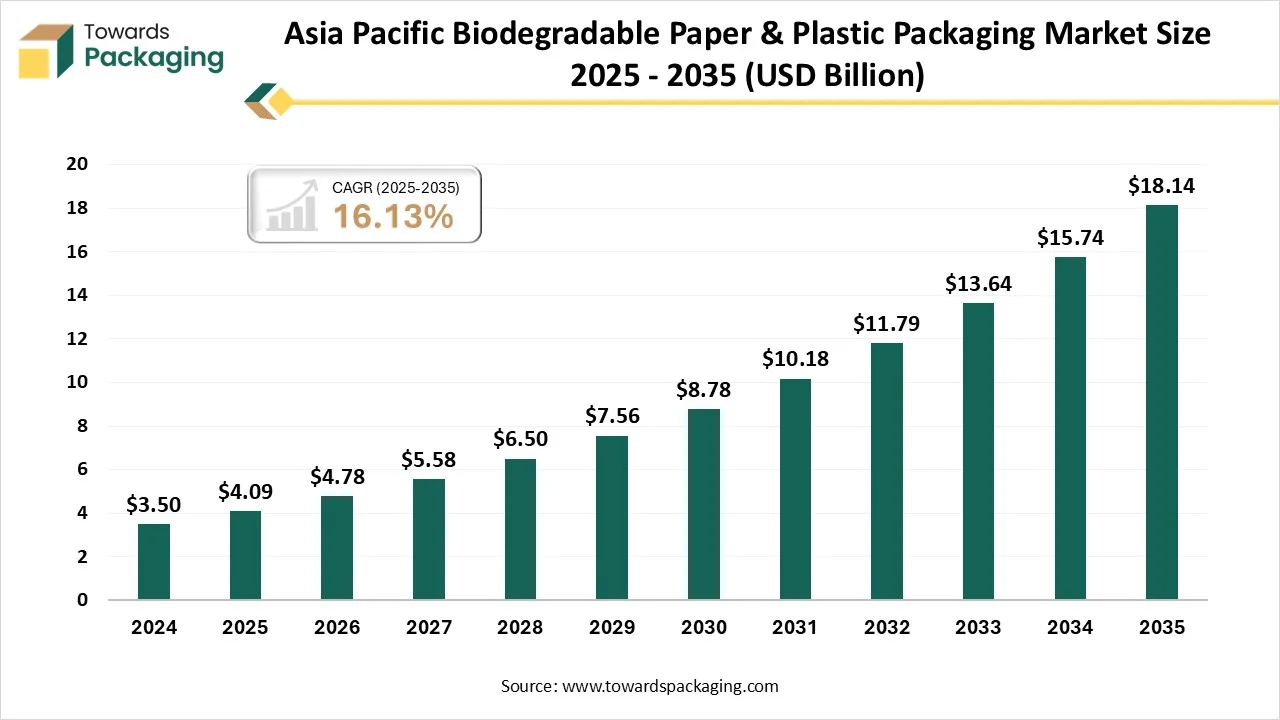

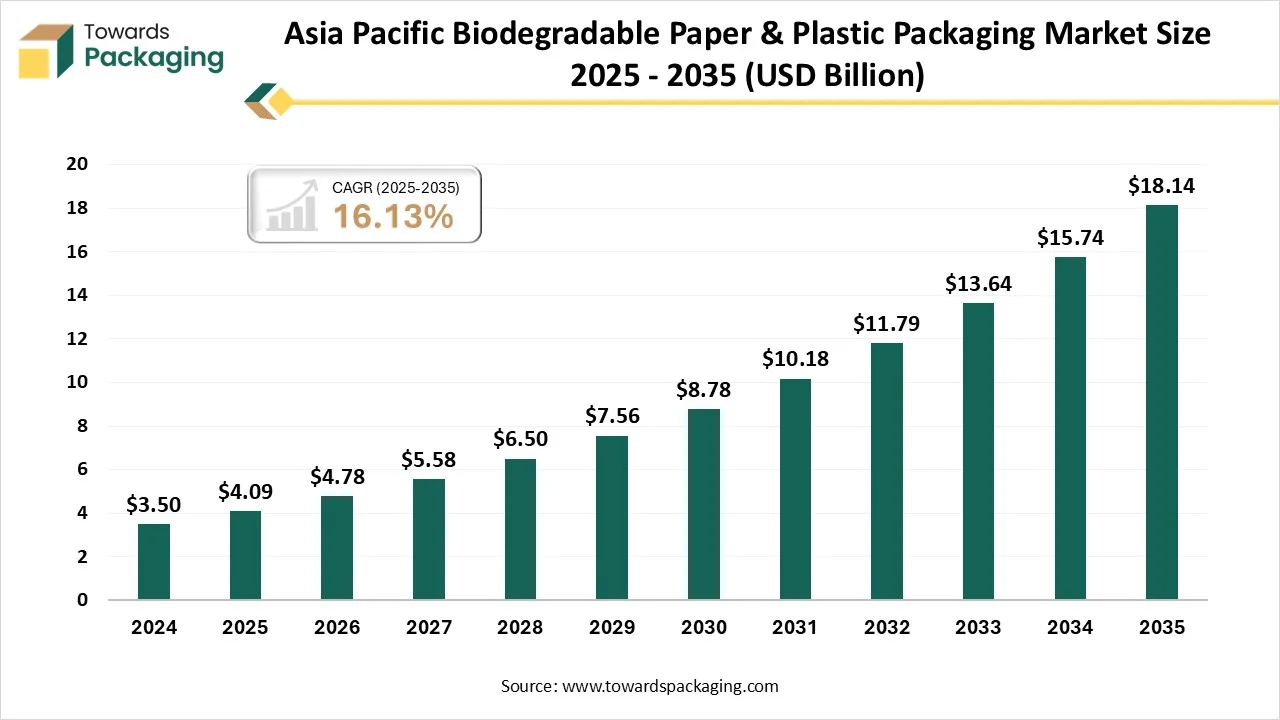

Asia-Pacific to Drive Fastest Growth in Biodegradable Packaging Market, Fuelled by E-commerce Demand and Environmental Regulations

Asia Pacific region is anticipated to grow at the fastest rate in the biodegradable paper and plastic packaging market during the forecast period. E-commerce relies heavily on packaging for shipping and protecting goods, leading to a surge in demand for packaging materials. Several Asia-Pacific countries are implementing stricter regulations to reduce plastic waste, encouraging the use of biodegradable packaging.

Consumers in the Asia-Pacific region are becoming more environmentally conscious, often favoring brands that use sustainable packaging. Major e-commerce players in the region, such as Alibaba, Shopee, and Flipkart, are committing to sustainability. Their shift to biodegradable packaging sets a trend that smaller companies are likely to follow, creating a ripple effect across the industry.

Biodegradable Paper and Plastic Packaging Market Key Players

Latest Announcements by Biodegradable Paper and Plastic Packaging Industry Leaders

- In September 2024, Pakka company's India Business Head, Jagdeep Hira, stated that the Pakka company have been working toward company’s vision to make the earth cleaner for more than four decades. Pakka company’s expanded the product line last year after partnering with a brand to introduce compostable flexible packaging, so it was only a logical next step. The food business has a large demand for flexible packaging. The Pakka company is making sure that the company provide a range of biodegradable packaging options to both consumers and companies with new products. This will not only help with flexible packaging, but it will also help cut down on packaging waste.

New Advancements in Biodegradable Paper and Plastic Packaging Industry

- In November 2024, ABB Group, packaging solutions providing company, has been initiated a series of industry papers that showcase innovation in pulp and paper as part of its global Real Progress sustainability program for the process industries. Every study in the three-part series will specifically address the ways in which the industry is changing to prepare for a more sustainable future. With technology leadership in electrification and automation, the papers highlight the influence of customers in the value chain and how they are facilitating a more sustainable and resource-efficient future, acknowledging the tremendous progress that has already been done.

- In January 2024, SEE (Sealed Air Corporation) has created the first biobased, global packaging solutions provider, industrial compostable tray for protein packaging that has been successfully tested to satisfy the requirements of current food processing equipment as part of its ongoing efforts to create packaging materials that satisfy its clients' sustainability goals. The USDA-certified biobased, food-contact grade resin used to make SEE's new CRYOVAC brand biodegradable overwrap tray has a 54% biobased content and is chemically generated from sustainable wood cellulose. The tray was developed as an alternative to those constructed of expanded polystyrene (EPS), which are typically used to package fresh chicken and red meat for customer purchase but are neither recyclable nor biodegradable. It will decompose into organic material without leaving any harmful residue behind.

- In March 2024, Donovan Bros. Ltd. unveiled their newest line of biodegradable and environmentally friendly food packaging options. Donovan Bros Ltd, a Kent-based company, is making great progress in lowering the food industry's carbon footprint by providing creative and environmentally friendly packaging options without sacrificing usefulness or quality. For a long time, the food business has used materials like plastic and Styrofoam for packaging, which greatly increases waste and pollution in the world. According to the Environmental Protection Agency (EPA), around 82.2 million tons of municipal solid trash were made up of containers and packaging in 2018 alone.

Biodegradable Paper and Plastic Packaging Market Segments

By Type

- Starch Based Plastic

- Cellulose Based Plastics

- Polylactic Acid

- Polyhydroxyalkanoates

By Material

By End User

- Food and Beverage

- Catering Service Wares

- Personal and Home Care

- Healthcare

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait