April 2025

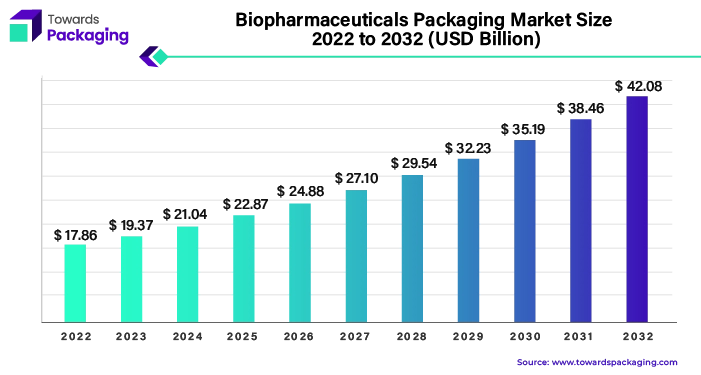

The biopharmaceuticals packaging market is set to grow from USD 23.01 billion in 2025 to USD 49.98 billion by 2034, at a 9% CAGR. This growth is driven by the rise in pharmaceutical outsourcing and a growing focus on sustainable, recyclable packaging.

The biopharmaceuticals packaging market deals with the process of enclosing medications and other pharmaceutical products in packaging materials that guarantee their information dissemination, identification, and protection. These materials include cardboard, paper, aluminum, glass, and plastics. These materials are carefully selected based on their ability to protect against regulatory requirements and external factors and compatibility with the pharmaceutical product.

Biologics are becoming more prevalent to meet unmet medical demands, such as rare and chronic diseases. Biologics requires controlled strict and highly sensitive environments throughout supply, manufacturing, and development.

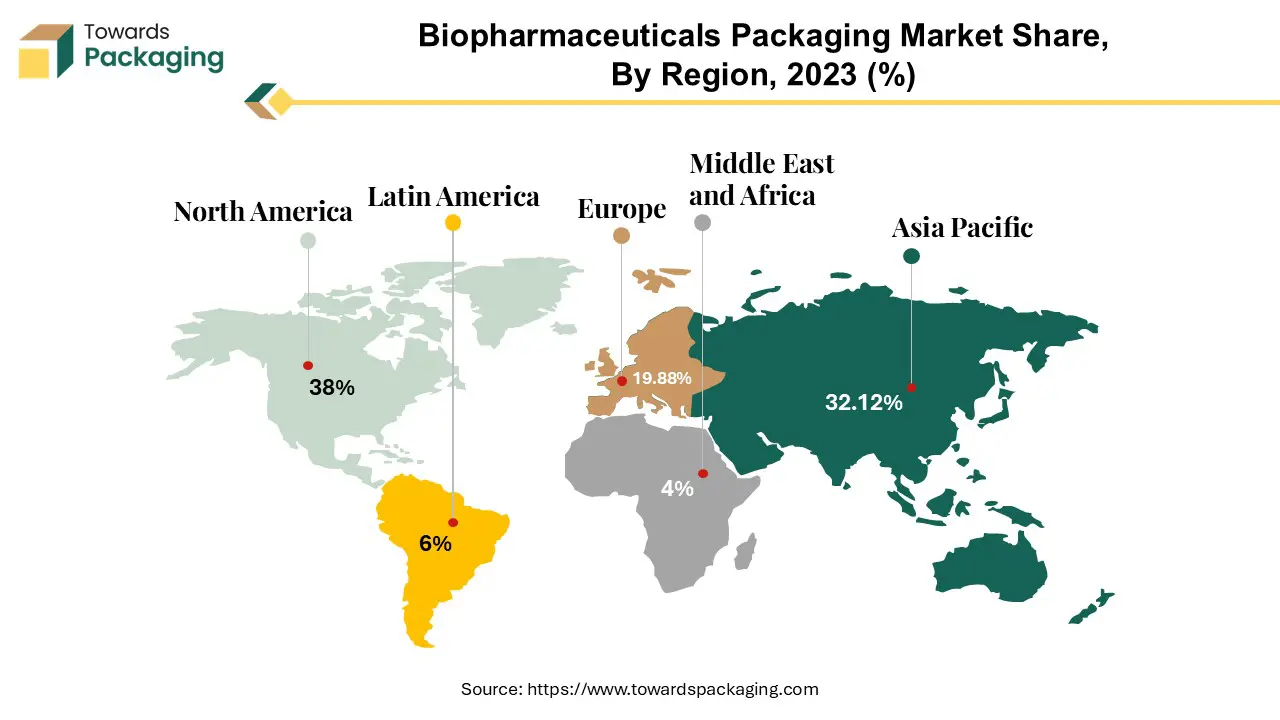

The North American biopharmaceuticals packaging market is influenced by a number of key factors that shape its dynamics and growth trajectory. The region benefits from a vibrant pharmaceutical industry, which is driven by a strong demand for innovative biopharmaceutical goods fueled by advances in biotechnology and healthcare research. This demand necessitates specialised packaging solutions designed to maintain the integrity and efficacy of biopharmaceuticals. The biopharmaceutical sector in the United States provides significant value to the Gross Domestic Product (GDP), with a substantial "multiplier" effect on employment and revenue. The United States continues to hold a strong position in global pharmaceutical research, with 44% of R&D companies situated there as of 2022. Over half of all R&D pharmaceuticals in the world are being developed in the United States.

The sector has a large network of production facilities throughout the country, with 1,580 firms scattered throughout 48 states and Puerto Rico. Approximately 20% of these new facilities produce active pharmaceutical ingredients (APIs). Biopharmaceutical manufacturers have worked hard over the years to build strong global supply chains that ensure patients around the world have continuous access to medicines, which required significant investments in time, resources, and coordination with regulatory bodies such as the United States Food and Drug Administration.

The North American biopharmaceuticals packaging market has made sustainability a primary focus due to the rise in environmental concerns and corporate sustainability initiatives. Packaging manufacturers are constantly developing eco-friendly materials, recyclable packaging options, and sustainable procedures with the goal to reduce the environmental impact while meeting regulatory and consumer requirements.

North America's biopharmaceuticals packaging industry is dynamic and competitive, with a focus on innovation, regulatory compliance, technical developments, and an increasing emphasis on sustainability.

For Instance,

The Asia-Pacific region emerges as the fastest expanding segment of the biopharmaceutical packaging industry. As biopharmaceutical manufacturing expands in Asia, major companies have increased exposure to supply chain potential risks along Asian trade channels. The company goods shipment management is vital to economic success, especially for companies that handle high-volume products. The demand for these services is increasing significantly. Patients are able to purchase the most accurate and effective biopharmaceuticals because to increasing revenues, smart packaging techniques and an improving reimbursement situation.

Regulatory agencies are streamlining approval processes to speed up the market release of innovative biopharmaceuticals and biosimilars. As Asia's healthcare systems develop, the demand for innovative biopharmaceutical drugs surges. Many of these drugs are extremely temperature sensitive, emphasising the crucial need of dependable cold chain services for the effective distribution of biopharmaceutical packaging throughout the region.

For Instance,

South Korea is rapidly establishing itself as a major industry base. Samsung Biologics, located in the country, was recently named the world's largest contract maker of biopharmaceuticals after completing a $759 million plant south of Seoul. Concurrently, Japanese enterprises are aggressively pushing into the cell therapy domain, indicating that cell biopharma output is expected to accelerate in the future. China is being known as a growing hub for the production of biopharmaceuticals. While still small by international standards, many manufacturers are setting up operations domestically to be able to take advantage of enormous prospects in the home market. Several consider China as a location for biologics and biosimilars contract production, and about 85% of domestic manufacturers expect to sell biologics to Western markets in the next five years.

India is currently among the world's top suppliers of affordable medications and immunisations. With the most biosimilars authorised for the home market, the Indian biopharma sector leads the world in biosimilars. Biosimilars, which are expected to increase at a CAGR of 24%, would likely constitute a $36 billion global market by 2025.The market for biopharmaceutical packaging has been growing rapidly, which is closely correlated with the increase in biopharmaceutical output.

The biopharmaceutical sector places a high value on using materials and production processes that meet restricted requirements. Companies Prioritise developing custom solutions and broadening product line to offer alternatives made of high-performance plastics. These plastics are especially suitable to the pharmaceutical industry due to their durability, sterilizability, and good machinability, which allows for the production of complicated geometries and meeting rigorous criteria while staying cost-effective.

The pharmaceutical sector plays an important role in generating pharmaceuticals that have a significant impact on improving and saving lives every day. The industry is currently looking into ways to benefit people while simultaneously having a good influence on the environment. Many biomanufacturers are actively looking for solutions to cut greenhouse gas emissions and minimise their environmental impact. Modern pharmaceutical manufacturing presents a considerable environmental issue.

Every year, an estimated 5.5 million tonnes of plastic are disposed of around the globe, primarily by incineration or landfills. The biopharmaceutical industry, which is primarily reliant on single-use plastics, contributes to this problem. In comparison to stainless steel equivalents, facilities that use single-use plastics can significantly reduce water consumption, electricity consumption, and, as a result, CO2 emissions. Despite efforts to address the issue, the biopharmaceutical industry still discards 94,000-200,000 metric tonnes of plastic per year. While this number is significant, it accounts for less than 1% of the 350 million metric tonnes of plastic disposed of worldwide each year, making it difficult to attract recyclers willing to invest in advanced recycling methods on such a small scale.

Paper-based packaging has various advantages in pharmaceutical packaging, including the ability to provide a printed surface for labelling and branding, and it also facilitate straightforward transmission of critical information to consumers and healthcare professionals. Paper-based packaging is also preferred for its environmental sustainability, as it is biodegradable, recyclable, and renewable. This makes it an eco-friendly choice for pharmaceutical businesses aiming to reduce their environmental impact and meet sustainability goals.

For Instance,

Vials constitute vital parts of the biopharmaceutical packaging market because they are the main containers used for injectable pharmaceuticals, vaccines, and biologics as well as for storing and dispensing liquid medications. Vials, which are usually constructed of glass or plastic, offer sterile, protected environments for pharmaceutical goods, guaranteeing their integrity and stability during storage and transit.

Vials are available in a variety of sizes and forms in the biopharmaceutical industry to meet a range of volume and dosage needs. To keep them sterile and stop leaks, they have tight closures like screw caps or rubber stoppers. Vials may also have characteristics like break lines for simple opening and graduations for precise dosing.

Vials are essential for maintaining the efficacy and safety of biopharmaceutical drugs because they shield them from contaminants and external influences. As a result, in order to satisfy the highest standards for pharmaceutical packaging, they are subject to stringent quality control procedures and regulatory regulations.

For Instance,

Vaccine application in the biopharmaceutical packaging industry is vital for ensuring the safe and effective distribution of vaccinations to individuals globally. Biopharmaceutical packaging plays an important role in maintaining the integrity and efficacy of vaccines throughout their lifecycle, from production to delivery. The availability of high-quality, low-cost, and user-friendly vaccines has grown increasingly crucial in recent years, particularly in poor countries. This is especially relevant in light of the present COVID-19 pandemic crisis, in which the globe requires adequate vaccinations that can be produced in huge quantities in a short period.

Biopharmaceutical packaging acts as a barrier against environmental influences such as light, moisture, and temperature variations, all of which can reduce vaccination potency. Vaccines are more stable during storage and transit when packaged in specialised materials including vials, syringes, and ampoules. The biopharmaceutical sector is under great pressure to minimise vaccine time-to-market in the future. Vaccine manufacture requires substantial research and testing, as well as numerous hurdles along the manufacturing process. It is necessary to safeguard the active chemicals, which are frequently quite sensitive, against shocks, extremes in temperature, and unwanted interactions with the primary pharmaceutical packaging. Small batch sizes are another factor that obstructs the proper scaling of production in support of the urgent need for new vaccinations.

With estimates of approximately 15.5 million and 14.5 million kilogrammes of vaccines produced year, respectively, the EU is the world's largest vaccine manufacturer, closely followed by India. China ranks in third position with an output of between 8 million and 12 million kilogrammes. Vaccine development is a potential area of growth for biopharmaceuticals. If molecular biology techniques are applied during the creation of a vaccine, then that vaccine may be considered biopharmaceutical. Vaccine use in the biopharmaceutical packaging market is critical for ensuring vaccine quality, efficacy, and safety, hence contributing to global public health initiatives to prevent and control infectious diseases.

The competitive landscape of the biopharmaceutical packaging market is dominated by established industry giants such as Cipla, Gerresheimer, Multipharma, Bormioli Pharma, Febelco Group, and Merck KGaA collaborate with LOG Pharma Packaging, W.L Gore & Associates, Inc., West Pharmaceutical Services, Inc., Pacific Vial Manufacturing, and Piramal Glass Private Limited, Stevanato Group, Shandong Pharmaceutical Glass Co, and Chongqing Zhengchuan Pharmaceutical Packaging Co. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Cipla is a prominent global pharmaceutical business dedicated to offering inexpensive and accessible healthcare solutions. Cipla's focus in the biopharmaceutical packaging business is likely to be on innovation and cost effectiveness. They may spend in R&D to develop unique packaging methods that address the special needs of biopharmaceutical goods while remaining affordable to patients and healthcare providers.

Gerresheimer is an established supplier of high-quality glass and plastic packaging products for the pharmaceutical and healthcare industries. In the biopharmaceutical packaging industry, Gerresheimer is likely to focus on supplying premium packaging solutions that match the high quality and regulatory requirements of biopharmaceutical goods.

Multipharma is a pharmaceutical firm that offers a diverse variety of healthcare goods and services. In the biopharmaceutical packaging market, Multipharma may take a varied strategy, providing packaging solutions targeted to different segments and applications within the industry.

Bormioli Pharma is a prominent developer of glass and plastic packaging solutions tailored to the pharmaceutical and biopharmaceutical sectors. Bormioli Pharma's priorities in the biopharmaceutical packaging market are anticipated to be product innovation, sustainability, and customer centricity.

By Material

By Packaging Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025