April 2025

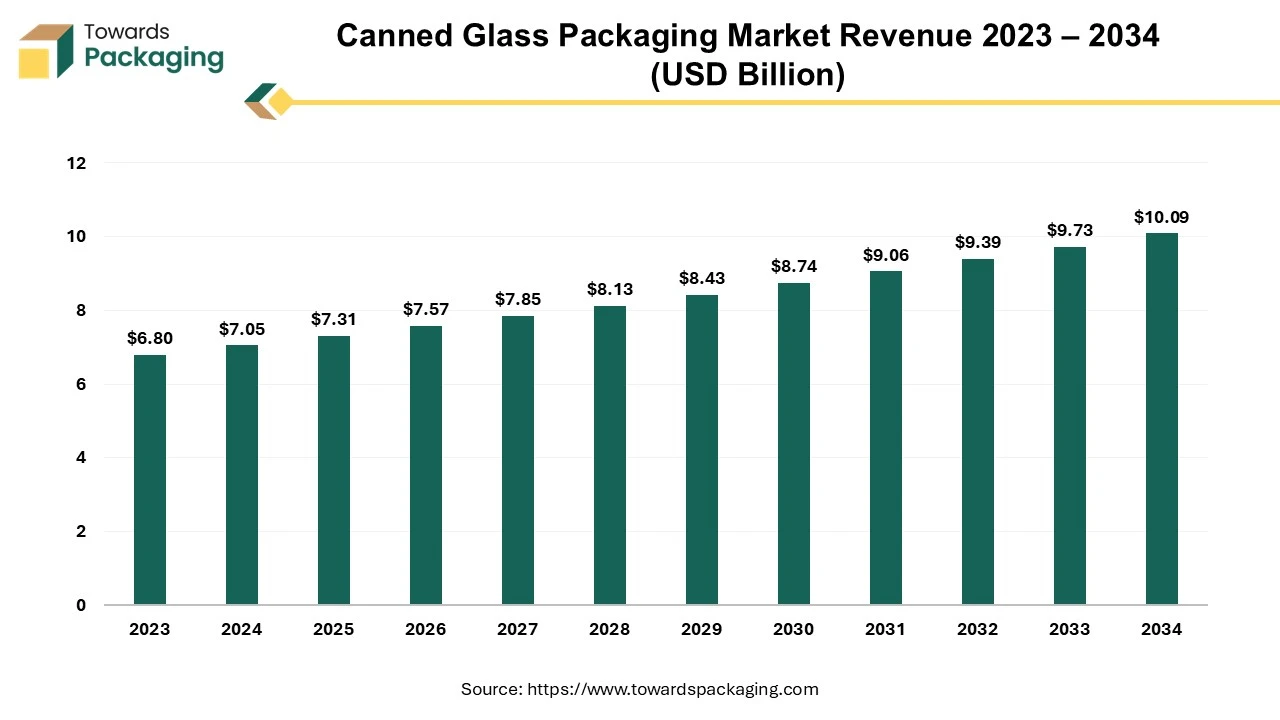

The canned glass packaging market is projected to reach USD 10.09 billion by 2034, growing from USD 7.31 billion in 2025, at a CAGR of 3.65% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The market is proliferating due to the increasing demand for packed pickles, milk, jam, and various such food and beverages industry, and pharmaceutical industries which demand safe and contamination-free packaging of drugs and vaccines. This eco-friendly and safe packaging demand in several industries significantly drives the canned glass packaging market.

The canned glass packaging market is an important industry in the packaging sector. This deals with sustainable packaging and transporting glass cans to several areas. This market is generally driven by the rising trend of eco-friendly packaging and premium-looking bottle demand among consumers which should also be convenient. The canned glass packaging industry manufactures different types of bottles with various shapes, sizes, colours, locking systems, and many others. This industry manufactures different quality canned glass with a variety of designs which makes it different from one brand to another. These bottles are of different types according to their weight as well. As there is a huge demand for lightweight canned glass the growth factor of this industry is exponential.

One of the main developments in the canned glass packaging market is the growing consumption of ready-made food globally. Canned glass foods are available with a longer shelf life that attracts consumers to use them for convenience storage. Ready-to-eat food culture is getting popular now with more people going to work together. These are some of the most popularly purchased products from stores globally, with a noteworthy upsurge in demand in developing markets such as India, Japan, China, and many others.

This rise in consumption is pushed by a rising number of people with growing disposable earnings and a social modification in the direction of using canned glass food often. These launches of stored food frequently favour canned glass packaging for its finest look and capability to reserve taste and worth, thus driving the demand in the industry.

Another development aspect is the fondness for canned glass packaging of food over any other packaging materials because of their eco-friendly nature and recyclability possibilities. As ecological apprehensions become more projecting, consumers and manufacturers both are inclined towards eco-friendly packaging solutions. Canned glass packaging can be reutilized in various ways for endless time without compromising on quality or cleanliness which make them an ideal choice for ecologically sensible brands and consumers. Furthermore, canned glass packaging delivers high-quality barrier assets, shielding the food quality from outer impurities and conserving its taste which makes it easy to maintain brand status and customer fulfilment.

One of the important opportunities in the canned glass packaging market is the rising consumer fondness for off-seasoned food. As customers become more perceptive and exploratory in their food packaging options, there is a growing demand for exclusive and superior-quality food which are not available for the entire year or which cannot be grown everywhere. This factor is pushing the development of agriculture and transportation businesses, which frequently prefer canned glass packaging for the safety of the food and the capability to maintain the integrity of the food.

This offers a chance for packaging industries to grow advanced and appealing glass packaging with patterns that supply the ready-to-eat food sector. Moreover, the growing fame of partial-version issues and seasonal food delivers additional opportunities for modified and limited packaging solutions. Another chance lies in the rising importance of sustainability and environment-friendly packaging options. Customers are more ecologically conscious and are looking for products that line up with their ethics. Canned glass packaging is highly reusable and recyclable, and is well-placed to take advantage of this tendency.

Asia Pacific witnessed the highest revenue share for the year 2023 this growth is because of the growing demand for seafood consumption it is the sustainable solution for seafood packaging in the market. This development is mainly driven by the growing urbanization, changing consumer preferences, and disposable incomes in countries such as Japan, China, South Korea, Thailand, and India.

The growing popularity of seafood consumption and its packaging among the young population and the rising adoption of good quality seafood and its storage are contributing to the request for canned glass packaging in these countries. Moreover, favourable government guidelines and funds in the food & beverage industry provide additional support to market development. The Asia Pacific market delivers noteworthy opportunities for pharmaceutical product packaging producers to tap into the increasing customer base and grow advanced packaging solutions personalized to the preferences of the region.

Some of the major market players contributing to the growth of the canned glass packaging market are Toyo Seikan Co. Ltd., Honshu Seikan Co. Ltd., Japan Seiko Glass, Ishizuka Glass Co., Ltd., Takara Yoki Co., Ltd., Nihon Yamamura Glass Co. Ltd., Takeda Pharmaceutical Company Limited, and many others. These are well-known for producing canned glass-based packaging solutions for the food and pharmaceutical industry in Japan.

North America is estimated to grow at the fastest rate over the forecast period. The canned glass packaging market shows changing development designs across diverse regions, driven by several aspects such as disposable earning economic conditions, cultural preferences, and ready-to-eat food consumption trends. In countries such as the U.S. and Canada, the market is considered by a strong occurrence of seasonal food demand and a superior quality of seafood consumption.

These countries have numerous major market players such as Arkansas Glass Container Corporation, O-I Glass, Roetell, Silver Spur Corporation, Glassnow, Silver Spur Corporation, Ardagh Group, Stoelzle, and many others which contribute significantly to the growth of this market. The demand for canned glass packaging in North America is determined by the rising pharmaceutical drugs demand, which highlights quality, genuineness, and exclusive packaging. Moreover, the trend in the direction of premium packaging and the growing popularity of off-season food further push the market to grow in this region.

By type, the 100 g segment led the canned glass packaging market in 2023. 100 g canned glass is widely used in the food and pharmacy sector as these are convenient to use. As these are considered to be appropriate for the consumers.

By application, the canned food segment led the beer glass packaging market in 2023. These are highly preferred by working women which eventually enhances the demand in the canned glass packaging market. Canned glass helps to maintain the quality of ready-to-eat food which is preferred by brands as well as consumers.

By Type

By Application

By Region Covered

April 2025

April 2025

April 2025

April 2025