April 2025

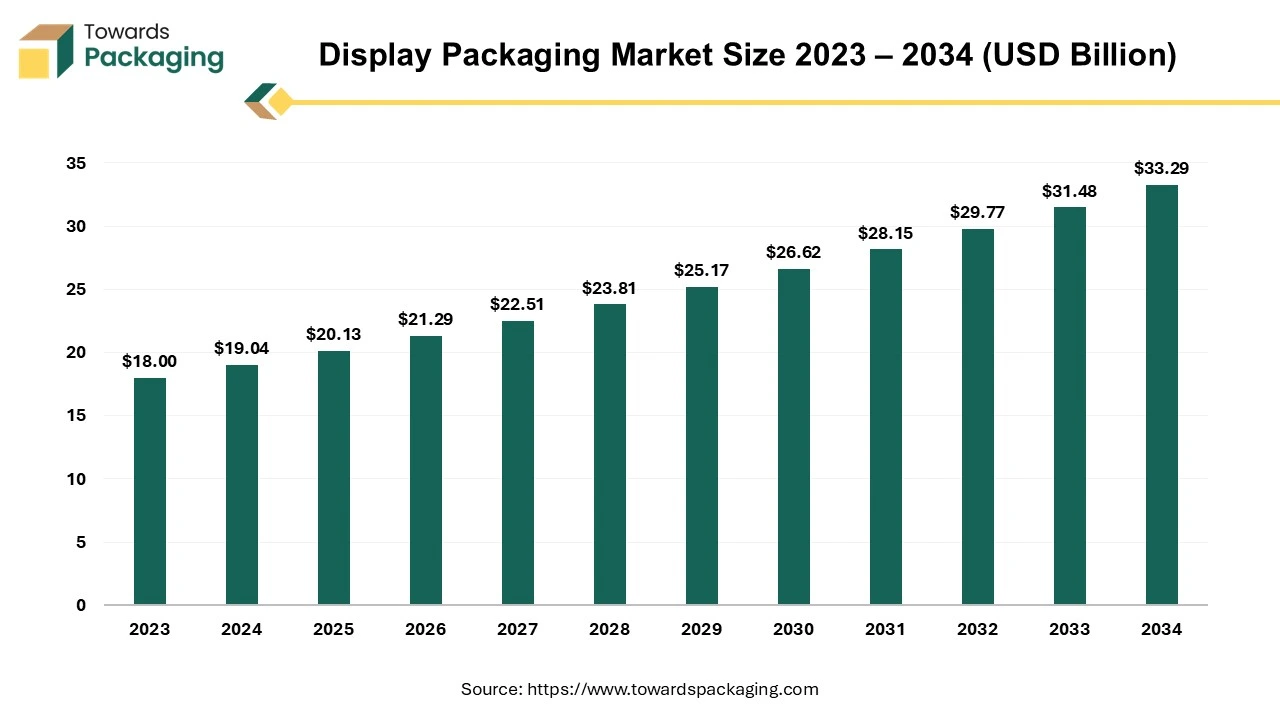

The global display packaging market size reached US$ 19.04 billion in 2024 and is projected to hit around US$ 33.29 billion by 2034, expanding at a CAGR of 5.75% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing display packaging which is estimated to drive the global display packaging market over the forecast period.

A type of packaging especially designed for retail environment to showcase products in a visually appealing manner is known as display packaging. It is utilized to highlight a product's design or features and is placed directly on display shelves or counters, making it easy for customers to see and access. Unlike traditional packaging, which aims primarily on protecting the product, display packaging is intended to serve both as protective and promotional packaging. Display packaging has ability to develop a more engaging shopping experience, making it easier for customers to interact with the product before making decision of a purchase.

The main purpose of display packaging is to attract attention. It is often designed with bright colors, bold graphics, or unique shapes that help the product stand out on retail shelves or in a store environment. The packaging may include product information, branding, and marketing messages to influence purchasing decisions. The global packaging market size is estimated to grow from USD 1.27 trillion in 2025 to USD 1.49 trillion by 2030, Asia currently accounts for the majority of global packaging sales, North America represents the globe's second-largest packaging market.

Sustainability continues to be one of the dominant trends in the display packaging market. Consumers and retailers are increasingly prioritizing eco-friendly materials, and governments are implementing stricter regulations on packaging waste. As a result, manufacturers are turning to:

This trend is particularly evident in industries like food and beverage, personal care, and cosmetics, where consumers are becoming more conscious of the environmental impact of packaging.

The integration of technology into display packaging is turning into more prevalent, especially in industries like fashion, luxury goods and electronics. Some of the technological innovations include:

Advancements in digital printing and automation are revolutionizing the production of display packaging. Digital printing allows for:

Automation also assists streamline packaging processes, upgrade efficiency, and minimize labor costs, making it easier to meet the rising demand for personalized packaging solutions.

There has been a growing demand for high-quality, visually striking display packaging in the premium and luxury goods sectors. High-end brands use display packaging not only as a protective means but also as a critical part of their branding and customer experience. Key trends include:

The integration of artificial intelligence will help in revolutionizing the display packaging industry by optimizing design, production, marketing, and customer experience. AI can help in developing innovative and optimized packaging designs by analyzing consumer preferences, market trends, and brand requirements.

AI-driven design tools can create multiple design variations based on specified criteria (e.g., brand identity, material constraints, functional requirements). These tools can use algorithms to generate optimized packaging shapes, structures, and aesthetics that maximize space utilization and appeal to consumers.

AI can analyze vast amounts of data from customer feedback, social media, and online behaviour to recognize design trends and consumer preferences, assisting brands design packaging that resonates with target audiences. AI can analyze customer data to create packaging designs tailored to specific target audiences. This can include customizing packaging features, such as messages, designs, or promotional offers based on the consumer's preferences or purchasing behaviour.

As branding becomes more crucial to a product's success, display packaging is increasingly used as a marketing tool to strengthen brand identity. Due to rise in disposable income, the consumers are preferring the products that are packaged attractively. Packaging design not only protects the product but also serves as a medium for storytelling, creating emotional connections, and conveying key messages to consumers. Packaging allows manufacturers/ brands to communicate their values, quality, and unique selling propositions (USPs) directly to consumers, reinforcing their image. High-end brands utilize sophisticated display packaging to develop a luxury experience, increasing demand for premium packaging solutions.

Consumers are increasingly drawn to visually appealing packaging, especially in retail environments where products compete for attention on crowded shelves. Display packaging plays a crucial role in enhancing the visual appeal of a product, which can influence purchasing decisions. The need for packaging that is both functional and aesthetically pleasing has increased, particularly in sectors like cosmetics, food and beverages, electronics, and luxury goods.

As brands strive to stand out in highly competitive markets, unique, eye-catching display packaging becomes a powerful tool for differentiation. Attractive packaging has ability to encourage impulse buying, a key driver of sales, particularly in categories like beverages, snacks, and small consumer goods.

Tetra Pak's value chain sustainability initiatives were showcased at a two-story giant booth made from recycled Tetra Pak carton packaging, which also features furniture manufactured from the latter. Tetra Pak's packaging portfolio, which features premium paper board that is recyclable, was also displayed so that clients could see the newest developments in environmentally friendly packaging. In order to demonstrate how companies can utilize technology to change garbage from a cost center into a revenue producer by utilizing data from waste material, a smart bin collection system for carton packaging was also be accessible at the booth.

The key players operating in the market are facing issue in manufacturing display packaging due volatility in raw material price and supply chain disruption, which has observed to restrict the growth of the display packaging market over the forecast period. The prices of critical raw materials, such as rare earth metals utilized in display manufacturing, can be volatile. Fluctuating material costs can lead to price instability, affecting the overall affordability of display packaging solutions.

The advanced technologies required for display packaging, such as 3D packaging, OLED, and microLED, involve significant investment in materials, equipment, and R&D. These high costs can limit market expansion, especially in price-sensitive regions. In mature markets, particularly in North America and Europe, the saturation of end-product displays like computers, smartphones and televisions, can limit the expansion of potential for display packaging, as demand for new packaging solutions diminishes.

Consumers increasingly value convenience in their shopping experience, and this extends to product packaging. Display packaging that offers portability, ease of use, and functionality is in high demand. Packaging that can be resealed, such as pouches for snacks or beverages, appeals to consumers who value convenience and product freshness. Small, lightweight, and portable packaging solutions cater to consumers looking for products they can easily carry and store. Packaging that is easy to open, especially for products aimed at elderly or disabled consumers, is becoming a key factor in design.

Technological advancements, such as smart packaging, digital printing, and automation, have significantly enhanced the functionality and appeal of display packaging. These innovations enable brands to offer more customized and personalized packaging, which appeals to consumers who seek unique and tailored experiences.

The plastic segment held a dominant presence in the display packaging market in 2024. Plastic material are low in cost compared to other materials like glass, wood or metals. This makes them an attractive option for manufacturers aiming to reduce overall production costs, especially in high-volume manufacturing environments. Plastics are lighter than alternatives such as wood, glass or metal, making them ideal for packaging displays, especially in portable devices like tablets, smartphones, and laptops. This minimizing shipping costs and enhances the portability of the final product. Plastics, especially high-performance polymers, offer good protection against physical damage, such as impact and scratches, which helps preserve the integrity of delicate display panels during transportation and handling. They also provide a barrier against moisture and dust, which is important for display longevity.

Many plastic materials, such as PET (Polyethylene Terephthalate), are recyclable, and the increasing availability of recycling programs helps in minimizing environmental impact. While still a point of concern, the recyclability of plastics is improving with advancements in sustainable plastic materials and recycling technologies. Plastic packaging can be easily customized with colors, textures, and branding, which is beneficial for consumer electronics companies that want to differentiate their products in the market. Printing on plastic is also easier and cheaper compared to some other materials.

The counter display segment accounted for a significant share of the display packaging market in 2024. The counter display draws attention of the customers on the products really very quickly. Counter displays are strategically placed where customers can easily see them, often near checkout counters or high-traffic areas. This prime positioning increases the chances of the product being noticed and purchased, especially if it's an impulse buy.

With eye-catching designs and branding elements, counter displays help reinforce brand identity and increase consumer awareness. When customers interact with the display, they get a direct, visual connection to the brand, which can strengthen brand recall. Counter displays are effective for promoting special offers, discounts, or limited-time promotions. These can encourage customers to do quicker purchasing decisions when they see the value or urgency associated with the deal.

The food & beverage segment registered its dominance over the global display packaging market in 2024. As the F&B sector expands, there is a continual introduction of new products, including premium, organic, or specialty items. Display packaging provides an effective way to present these products in a visually appealing manner that attracts attention. Whether it's a new flavor of a popular snack or a health-focused beverage, custom display packaging helps these new items stand out in crowded retail spaces. Display packaging plays a critical role in showcasing ready-to-eat products in an easy-to-access, attractive format. The key players operating in the food and beverages market are focused on launching the suitable display packaging for food, which has observed to drive the growth of the segment over the forecast period.

Asia Pacific region dominated the global display packaging market in 2024. The Asia Pacific region there is a strong cultural emphasis on gifting, especially in countries like China, Japan, and India. This has resulted in a higher demand for aesthetically designed and premium packaging for food and beverages, especially around holidays or special events. Display packaging that highlights the luxury or special nature of a product is often seen as an important factor in influencing purchasing decisions. For example, festive packaging for food items like sweets, snacks, and beverages during the Diwali in India or Lunar New Year in China fuel the demand for attractive display packaging.

The Asia Pacific region supports the growth of the display packaging market through a combination of changing consumer preferences, rapid economic expansion, expansion of cosmetics industry, technological advancements, and a strong retail and e-commerce environment. With a rising focus on premiumization, sustainability, and innovative design, the demand for display packaging continues to rise in Asia Pacific region, making it a key growth driver for the global display packaging market

North America region is anticipated to grow at the fastest rate in the display packaging market during the forecast period. The well-established food and beverage (F&B) market in North America plays a crucial role in supporting the growth of the display packaging industry. With a mature consumer base, advanced retail infrastructure, and a focus on product innovation, North America creates strong demand for packaging solutions that enhance visibility, convenience, and brand differentiation.

North American consumers are increasingly looking for premium products, specialty items (e.g., gluten-free, organic, plant-based), and luxury foods and beverages. The key players operating in the food and beverages market of North America are focused on introduction of new packaging for their products, which is estimated to drive the growth of the display packaging market in North America over the forecast period.

By Material

By Type

End-user

By Region

April 2025

April 2025

April 2025

April 2025