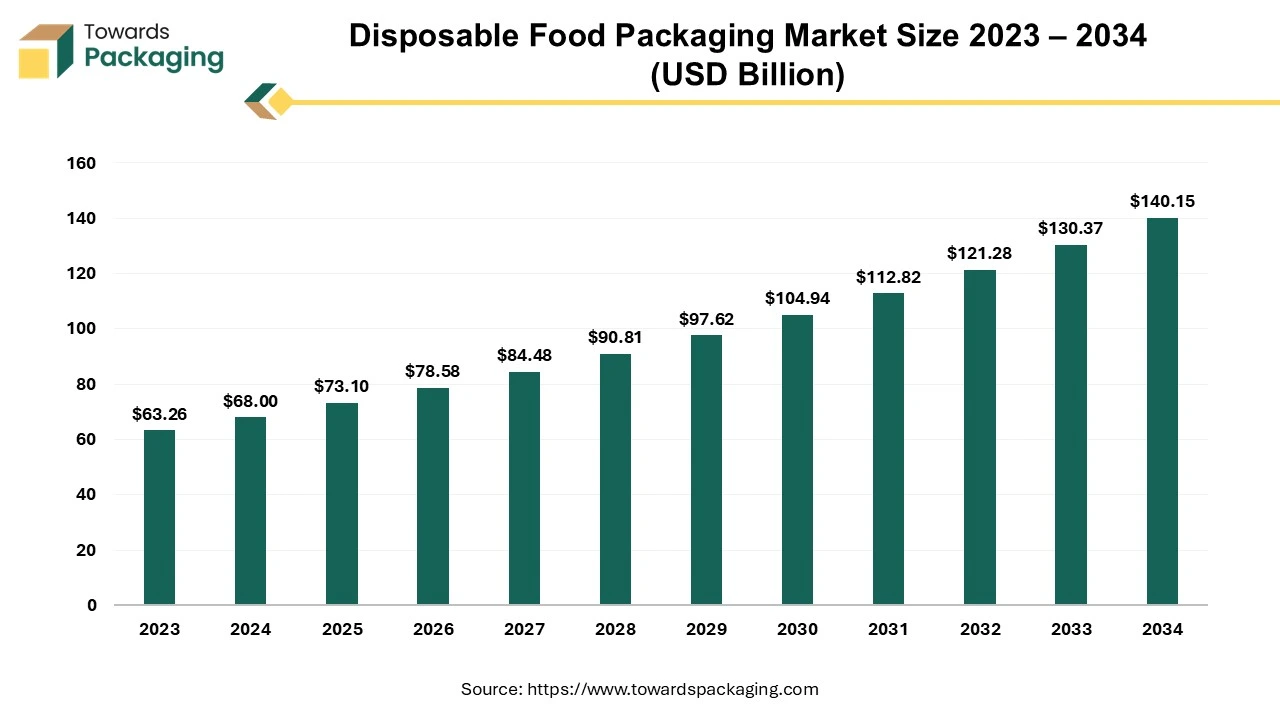

The disposable food packaging market is projected to grow from USD 78.58 billion in 2026 to USD 150.66 billion by 2035, registering a 7.5% CAGR during 2026–2035. Our coverage includes detailed market sizing, product segments (plastic, paper & paperboard, aluminum, biodegradable), application segments (food service, food delivery, retail, QSR chains), and full regional breakdown for North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. We also analyze leading companies, competitive strategies, value chain mapping from raw materials to distribution, global trade flows, and comprehensive manufacturer and supplier profiling.

The market is growing because disposable food containers and plates are convenient solutions, especially for disposable cutlery. The growth of biodegradable food packaging includes concerns about plastic waste collection.

The disposable food packaging market is growing rapidly because food packaging plays an important role in maintaining food quality and safety by acting as a barrier against external contamination such as bacteria, dust, oil, and light. Packaging also helps preserve food, provide information, and facilitate transportation. Biodegradable food packaging materials made from renewable biological materials have emerged as another way to solve the problems associated with plastic packaging. It helps to save time and provide fast and easy service.

Made of paper and biodegradable plastic, these packaging are durable, lightweight, and take up little space in storage. Containers are often used in the food and beverage industry to store and transport various products. Recent developments in biodegradable materials for food packaging applications. Biodegradable polymers provide an alternative to plastic by breaking down into water, carbon dioxide, and biomass. The growth of biodegradable food packaging includes concerns about the collection of plastic waste, the growth of the consumer environment, strict government regulations on packaging, and advances in biopolymer production and technology.

The European Union is acting to combat plastic pollution. Plastic waste paper, plates, straws, balloons, and cotton swabs must not be placed on the market in EU member states. The same measures also apply to cups, food and beverage containers made of expanded polystyrene, and all products made of oxo-degradable plastic.

Artificial intelligence is used to create safe and environmentally friendly packaging. AI-powered technology can determine the best packaging and design options for a particular product. AI can also choose the best packaging methods, such as maximizing material recycling or optimizing packaging lines. The term “plastic production automation” refers to the use of machines and systems to produce plastic products. AI can also be used to determine the best packaging methods, such as ways to recycle materials or optimize packaging lines.

The increasing demand for biodegradable food packaging has driven the growth of the disposable food packaging market. Biopolymer-based packaging offers sustainability, carbon neutrality, and improved waste management, reducing dependence on fossil fuels while meeting consumer growth and regulatory requirements for environmentally friendly solutions.

Advanced research in developing biopolymers through innovations such as polymer blending, nanomaterial integration, and incorporating antibiotics and antioxidants to improve performance, shelf life, and product quality. With strong testing standards, biodegradation processes, and life cycle assessments, the eco-friendly experience is aligned with global sustainability goals.

Biopolymer packaging, combined with technological advances and consumer preference for eco-friendly products, will play a transformative role in transforming the packaging industry's evolution toward sustainability.

The increasing popularity of biobased and nano-enhanced packaging due to its environmental and functional advantages presents transformative opportunities for the disposable food packaging market. This innovative development uses biodegradable materials such as biopolymers, PLA, polybutylene succinate, and nanotechnology advances to improve food quality and safety while addressing sustainability issues. Applications include nanosensors for food quality monitoring, nanostructured components, and smart packaging solutions to enhance new product designs. Emerging materials like magnetic nanoparticles and graphene nanosheets are helping extend shelf life and improve storage, especially for perishable items like fruits and vegetables. Bio-based nano packaging combines antibacterial technology with innovative measures to meet waste management goals and increase business efficiency by meeting customer demand for eco-friendly food products and smart packaging solutions.

The disposable food packaging market faces serious challenges due to rising costs in every aspect, including raw materials, manufacturing, transportation, and storage. These rising costs impact profitability and increase the need for cost-cutting strategies, such as using lighter materials and simplifying product packaging to achieve economies of scale. Additionally, rising labor costs and the need for efficient production processes further limit growth, as companies must balance efficiency with cost control. These pressures highlight the difficulty of maintaining competitiveness in an economy increasingly driven by financial and transport competition.

Plastics segment dominated the market with the largest share in 2024. The product composite includes cups, plates, bowls, cutlery, sandwich containers, food containers, and trays. PLA or polylactic acid is generally used to make these disposable food containers.

Bagasse is anticipated to register the fastest CAGR over the forecast period. Bagasse cutlery is 100% compostable and can be separated from household waste. Unlike food containers, bagasse containers are sturdy enough to hold all types of food, including hot, oily, wet, or greasy food. They are a good alternative to plastic, especially in the food packaging industry. The main advantage is that these products easily decompose and have multiple later applications.

The trays & containers segment dominated the overall market with a market share as this packaging has advantages such as cost-effectiveness and hygiene, time-saving, convenience, and good value. Disposable food containers play an important role in maintaining hygiene standards.

The cups & lids segment is a significant product category in the food industry due to the biodegradability of an important product. Therefore, even if paper cups are thrown away after use, they will eventually decompose due to the effect of bacteria. Disposable containers for many types of food and beverages are available in a variety of materials, types, and sizes.

Direct distributors dominated the overall disposable food packaging market with a share as their marketing channels enable brands to build relationships with the end users of their products. The direct delivery model allows businesses to work with customers to deliver the best customer service.

The group purchasing organizations (GPO) distribution channel segment is expected to grow robust with a CAGR during the forecast period. Group purchasing organizations (GPOs) are at the forefront of the supply chain. They are willing to buy goods and services at a low price. It is a group purchasing organization that uses its purchasing power to generate savings for its paying members by using its purchasing power for goods and services.

The food application segment dominated the market. It accounted for the largest market share as protective packaging such as egg cartons, wrappers, disposable plastic, lids, cups, plates, bottles, and food bowls. Polystyrene, in its expanded form, is used in non-food packaging and cushioning materials and can be recycled or reused.

The beverages is the fastest growing segment in the forecast period as there is no need for cleaning or maintenance, thus saving time and labor. This is especially useful in busy locations where cup checks are unavailable, such as large events, meetings, and conventions. Heavy-duty packaging allows beverage companies to reduce their carbon footprint by using fewer resources and producing less waste.

Foodservice dominated the overall market with a market share as the use of disposable packaging increases in the food industry, and government authorities are stepping in to regulate the production of some unhealthy products. Compostable materials such as plant-based molded fibers and bioplastics such as PLA are at the forefront of eco-friendly options for food packaging and have become popular choices.

The institutional segment is the fastest growing during the forecast period in the disposable food packaging market. The packaging is lightweight and affordable, providing better hygiene, convenience, and reduced food costs. Therefore, these waste disposal solutions are widely used in restaurants, hotels, schools, offices, hospitals, and homes.

Asia Pacific accounted for the largest market share for disposable food packaging market in 2024 due to recycling being this region's primary technology for plastic waste. Rigid plastics, especially PET bottles, are often recycled to create new pellets. Unlike most developed countries, some Asia-Pacific countries recycle plastic bags and other packaging easily through manual verification. China will be the largest plastic producer, contributing significantly to global plastic production.

Other Asian countries are major plastic producers, with Japan accounting for a notable share of global plastic production. Governments and companies worldwide have pledged to reduce plastic waste and packaging in recent years by emphasizing the transition to a circular economy and setting specific targets. China announced a five-year plan to reduce air pollution, which includes banning the use of non-biodegradable plastic bags in stores and shops, major cities, and road services, which drive the growth of the disposable food packaging market.

For instance,

An increase in government funding under programs like Atmanirbhar Abhiyan, Make in India, MSMEs. Promote a sustainable food packaging culture in India, enabling entrepreneurs to create eco-friendly solutions and promote environmental sustainability.

North America's market share is approximately 1 trillion pieces of single-use plastic and packaging used by restaurants and food manufacturers in the United States. The recycling industry that occurs in food service has the potential to change current food service and replace it with something better. With advances in public health and hygiene, such as urban waste collection, the emergence of sanitation facilities, and the rise of bacteriological diseases, cities in the region have successfully managed municipal solid waste for much of the twentieth century.

As part of the initiative, government agencies may also use sustainable purchasing processes requiring recycled materials where appropriate. Federal ministries and agencies are working to reduce single-use plastics in government projects, reduce pollution and chemicals in the plastic manufacturing process, and help fund historic investments to improve waste disposal and clean up existing pollution, which causes growth in the disposable food packaging market.

By Material

By Product

By Application

By End Use

By Distribution Channel

By Region

December 2025

December 2025

December 2025

December 2025