April 2025

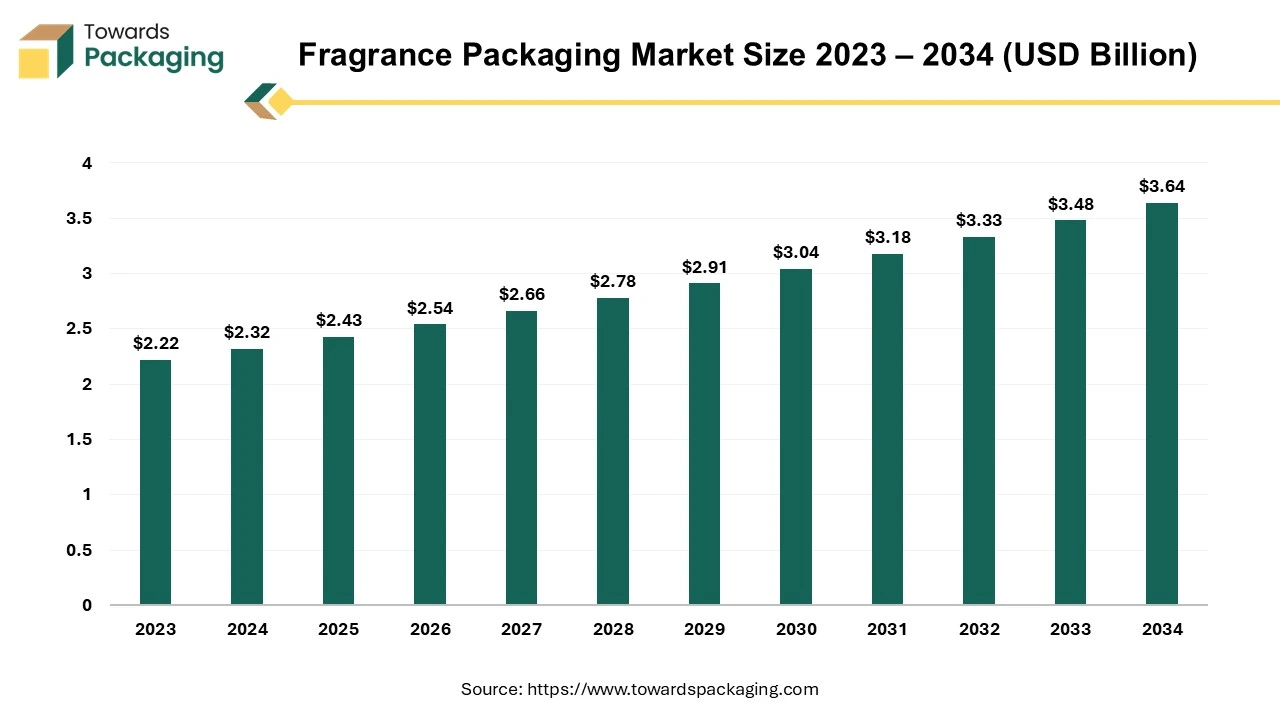

The fragrance packaging market is projected to reach USD 3.64 billion by 2034, expanding from USD 2.43 billion in 2025, at an annual growth rate of 4.6% during the forecast period from 2025 to 2034.

A fragrance is a chemical composition that produces a smell or odour but also has cultural, historical, social, economic, and emotional significance. Fragrance packaging is specialized in fragrance-related products such as perfumes, room fragrances, candle jars, colognes, and essential oils. Fragrances are a fascinating blend of science and art, where expert chemists transform into creators, and molecules weave the fabric of memories. Fragrances, created with great care, passion, and inventiveness, play a unique role in the daily lives of billions of people worldwide. People all over the globe enjoy these olfactory creations, which range from the refreshing scent of shampoo to the appeal of a trendy perfume, from the comforting aroma of a scented candle to the crisp fragrance of freshly cleaned linens. Fragrances are more than just scents; they are artistic expressions that speak to people personally.

Fragrances are essential in driving choice, and consumer brands use scent innovation to differentiate their products and create value. The fragrance market is expanding beyond traditional odours, with a greater emphasis on mood-boosting fragrances and perfumes that positively impact wellness. The fragrance industry's packaging has evolved, with intriguing trends emerging globally. The altering consumer landscape during the shutdown period yielded fascinating insights. Contrary to expectations, customers did not forsake perfumes but modified their usage patterns and expectations. A remarkable 56% of consumers across 11 nations showed a heightened appreciation for perfumes during lockdown, seeking refuge and comfort in the scents.

This developing dynamic emphasizes the enduring bond between people and fragrances as aromas continue to permeate the fabric of daily life, impacting emotions, preferences, and experiences. Fragrances, with their ability to trigger emotions and memories, continue to be a significant and treasured component of the sensory world.

For Instance,

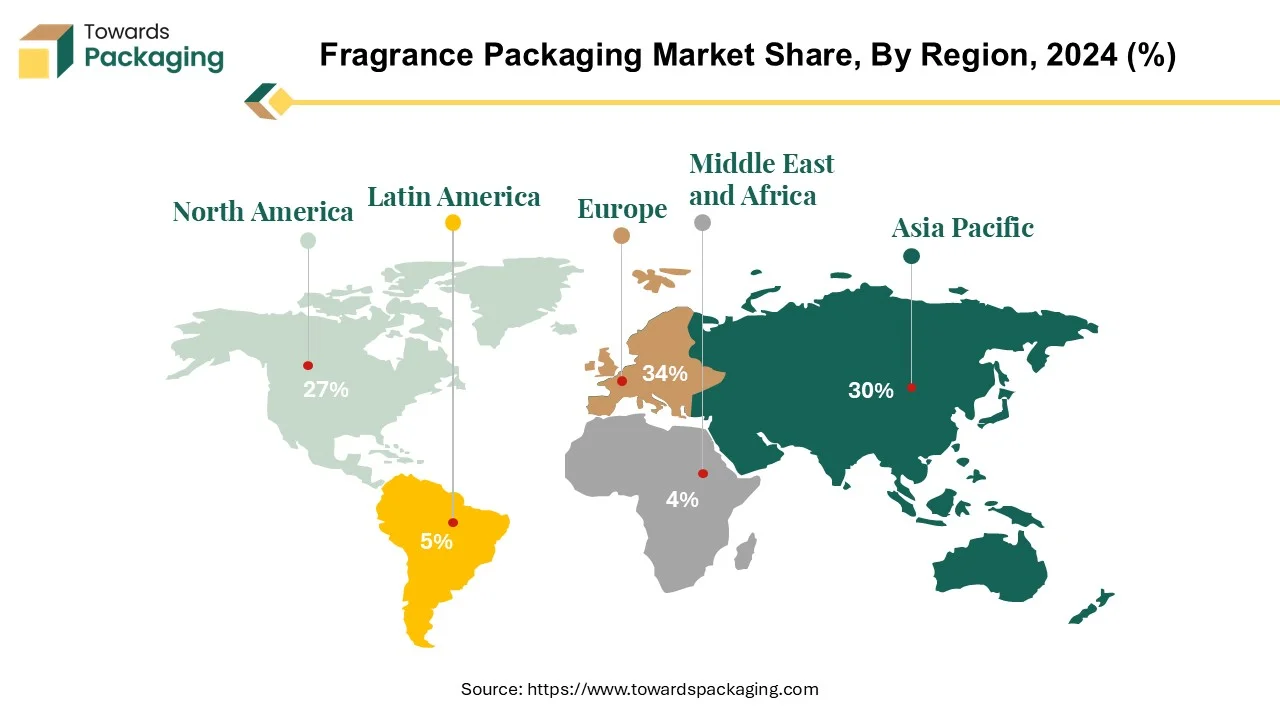

Europe stands out as a global leader in the fragrance packaging market. Numerous manufacturers specializing in perfumes and scents operate as critical players in the market in the European Union, providing complete solutions that cover the whole product lifecycle. These solutions cover packaging, labeling, production, and formulation. The cooperative endeavors of these producers culminate in the manufacturing of a wide range of products in the fragrance industry, encompassing essential oils and perfumes. The significance of perfumes as a commodity traded internationally is especially remarkable. Perfumes, with a total trade value of $19.5 billion, are the 219th most traded product overall. This demonstrates how popular these olfactory goods are throughout the globe. There has been a significant increase in perfume export, a notable 27.5% jump. The global solid market for fragrances and the growing understanding of their economic significance are reflected in the export value, which increased from $15.3 billion to $19.5 billion.

Perfumes comprise approximately 0.093% of global trade, yet several self-assured European Union nations are significant players in this growing market. France is the world's largest supplier of perfumes, with a staggering $6.23 billion in export value. Germany makes a substantial contribution with an export value of $1.71 billion, and Spain comes in second place with $2.17 billion. These nations are notable for being important participants, exhibiting their expertise in the fragrance sector and reaffirming their roles as vital contributors to the worldwide perfume trade.

For Instance,

| Perfumes Exporting Countries, 2022 | |||

| RANK | EXPORTER | EXPORTED PERFUMES | 2021-22 |

| 1 | France | $6,773,304,000 | 15.70% |

| 2 | Spain | $2,558,457,000 | 13.20% |

| 3 | Germany | $2,056,915,000 | 8.90% |

| 4 | United States | $1,593,832,000 | 11.10% |

| 5 | Italy | $1,566,837,000 | 12.70% |

| 6 | Singapore | $1,221,607,000 | 2.00% |

| 7 | Netherlands | $847,356,000 | 24.80% |

| 8 | United Kingdom | $736,060,000 | -0.90% |

| 9 | Czech Republic | $658,582,000 | 5.90% |

| 10 | Poland | $530,530,000 | -13.80% |

| 11 | Hong Kong | $437,451,000 | -0.50% |

| 12 | United Arab Emirates | $403,921,000 | -78.10% |

| 13 | Belgium | $390,397,000 | -1.60% |

| 14 | Panama | $339,946,000 | 20.70% |

| 15 | Switzerland | $257,014,000 | 17.80% |

| 16 | China | $245,666,000 | 38.70% |

| 17 | India | $196,954,000 | 46.70% |

In 2022, the international perfume market showed a high concentration level, with the top 17 countries comprising 99.98% of the total exported perfume value. This suggests that a small group of nations substantially influence the global fragrance trade. The data confirms the concentrated economic impact of these key players, emphasizing their crucial role in shaping market dynamics and highlighting their significance in the overall global perfume economy. This concentration indicates a dependency on a limited set of countries in driving trends and outcomes within the international perfume market.

Prominent firms in the fragrance packaging sector, including GROUPE POCHET, RC Group, Gpack, and Quadpack, are essential since they provide unique and superior packaging options. These solutions successfully capture the distinctive essence of a brand's hallmark aroma by utilizing various materials, such as glass, plastic, metal, and other cutting-edge materials. Interestingly, the sector has noticed a noticeable change towards sustainable and eco-friendly packaging options, indicating a more significant trend in reaction to increased environmental consciousness. To address the increased need for sustainable packaging choices, companies in the fragrance packaging market are investing more and more in research and development (R&D).

Asia Pacific's fragrance packaging market is expanding rapidly, making the region the second-largest global market. The premium fragrance market is seeing a solid uptick, indicating a promising development outlook, especially in the vibrant Asian market. Notably, the cosmetics industry in Asia-especially Japan has observed a discernible preference for white workers. Its minimalist efficiency defines this style; matte finishes are preferred over glossy ones, and frosted glass is chosen over transparent. With refillable alternatives, separable packaging components, and glue-free secondary packaging, the packaging for these high-end fragrances emphasizes sustainability. It keeps up with the growing trend of environmentally conscious activities.

The Asian market has driven the adoption of scent forms designed for convenience, making them an indispensable part of daily life in the region due to its preference for on-the-go beauty practices. Three major Asian markets China, India, and Indonesia significantly contribute to the booming fragrance packaging sector. One noteworthy trend in China is the increasing popularity of 5–10 ml of small fragrance bottles. These smaller sizes target customers searching for a portable scent alternative for their night out by positioning themselves as inexpensive impulse purchases. The sheer size of the Chinese market implies the profitable potential for businesses sensitive to this shift in customer behavior, even though the unit cost per transaction may be low.

For Instance,

Asia Pacific has a dynamic and influential role in setting global trends, as seen by the changing patterns of fragrance market usage. The Asian consumer market is broad and sophisticated, shown in the desire for portable forms, luxury scent preferences, and sustainable packaging methods. Manufacturers can gain as the fragrance packaging industry grows in the region by matching their products to these changing consumer tastes and way of life choices.

For Instance,

Glass has been widely used in the fragrance packaging market. Glass material used as primary packaging in the packaging market. Because they can be made in any form, size, or design, glass perfume bottles are becoming quite popular. This is because they are a great way to display and store perfumes. Glass's natural beauty and durability are often the driving forces behind glass choices. Glass is an inert material that ensures it won't react with the smell, one of the main benefits of utilizing it in fragrance bottles. Consumers can also visually determine how much perfume is left in the bottle because of the Glass's transparency, which gives the bottle's design a helpful component.

Glass fragrance bottles are available in various styles, with sculptural curves, finely molded corners, and shimmering aspects that draw in customers. Successful fragrance packaging designs aim to generate olfactory feelings through visual clues, deliberately connecting the design to the smell itself. Package designers work hard to create a scent experience that allows customers to virtually "smell" the fragrance just by glancing at the bottle. Designing glass perfume bottles with lightweight in mind has become crucial. This technique allows producers to reduce the quantity of materials needed for production while preserving the bottle's opulent appearance. One prominent supplier that sticks out for its dedication to sustainability is Bormioli Luigi. The company's Italian factories, regarded as some of the world's most sustainable industrial locations, make bottles for the cosmetics industry. Bormioli Luigi's production techniques place a high priority on conserving energy and water, as well as reducing waste.

Packaging providers are bringing glass advancements designed to satisfy fragrance brands' environmental aspirations to improve sustainability further. The glass composition, currently made in France and Spain, will soon be produced in South Korea in 2023. In the United States, later this year. Glass will continue to be chosen in the fragrance packaging market due to this increase, which aligns with a more significant industry trend towards ecologically friendly methods.

For Instance,

Bottle packaging has emerged as the leading force in the fragrance packaging market, pivotal in shaping the industry's dynamics. Perfumes, a prominent segment within this market, have witnessed a surge in demand, making the design and functionality of their packaging crucial in capturing consumer attention.

The perfume industry has undergone a notable transformation, shifting towards more innovative and visually appealing bottle packaging designs. These designs serve the practical purpose of containing and preserving the fragrance and act as a powerful marketing tool. The evolution of bottle packaging reflects a blend of traditional craftsmanship and contemporary aesthetics. Manufacturers increasingly explore unique shapes and sizes, providing consumers with various options beyond mere functionality. Eco-friendly considerations have also become integral to bottle packaging in response to the growing environmental consciousness among consumers. Sustainable materials and practices are being incorporated into the manufacturing process, aligning with the broader global trend towards eco-conscious consumption.

Customization is another key driver behind the prominence of bottle packaging in the fragrance market. Companies are investing in creating personalized experiences through unique logos, ingenious color combinations, and captivating slogans. This enhances brand identity and establishes a deeper connection with consumers.

The leading position of bottle packaging in the fragrance packaging market is a result of its multifaceted role–from preserving and presenting the fragrance to serving as a canvas for innovation, sustainability, and brand identity. The evolving landscape indicates that bottle packaging will continue to be a driving force in shaping the future of the fragrance industry.

For Instance,

Perfume dominates the fragrance packaging market, reflecting its growing ubiquity in people's daily lives. Redesigning the packaging is becoming more and more essential to remain competitive. As current packaging designs and conventional techniques coexist, it becomes increasingly important to draw in customers. Innovations in perfume packaging include:

The next step is customized perfume packaging with eye-catching phrases, imaginative color schemes, and distinctive logos as a successful marketing tactic.

A clear trend indicates consumers will probably choose perfume packaging with lots of symbolic imagery. It is expected that the combination of personalized perfume bottles with custom-made perfume boxes and caps would draw customers and set perfume companies apart in a competitive market.

Consumers' willingness to pay for perfume components varied greatly across product categories; for fragrances, it was significantly higher, ranging from 75% to 88%. The Christian Dior group is a significant force in this market's fragrance industries. The Perfumes business category is gaining considerable traction, encompassing well-known, well-established brands and emerging, promising ones. The company is dedicated to maintaining its core product lines, ensuring they are successful over the long run, and taking calculated risks when creating new goods.

For Instance,

The competitive landscape of the fragrance packaging market is characterized by established industry leaders such as Verescence France SASU, Saverglass sas, Gerresheimer AG, Albea S.A., EXAL Corporation, Quadpack Ltd., Piramal Glass Ltd., Coverpla S.A., Alcion Plasticos, CCL Container, Inc., General Converting, Inc., and Intrapac International Corporation. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences.

Verescence, a notable figure in glass packaging for beauty and fragrance, counts Verescence France SASU as a main business specialising in the production of glass perfume containers. Verescence France SASU, known for its expertise, offers a wide range of innovative and personalised packaging solutions to meet the specific needs of fragrance brands.

Saverglass continuously produces ground-breaking solutions that provide new opportunities for brand expression. Saverglass distinguishes itself via its competence in producing extra-white and antique glass, both unique to their services-furthermore, Saverglass pioneers ecologically aware methods with 100% recyclable organic decorating and cutting-edge 3D decorative processes.

Gerresheimer emerges as a leading provider of packaging solutions for the cosmetics industry, cooperating with several well-known brands. Gerresheimer is famous for its customized glass and plastic packaging solutions, and it specializes in providing quality alternatives for the fragrance, cosmetics, and personal care industries. With competence in glass and plastic design, the company offers a wide range of sophisticated decorative possibilities to produce a high-end appearance. Gerresheimer showcases some of its most recent launches at Luxe Pack Monaco, exhibiting its commitment to innovation.

By Material

By Packaging Type

By End Use

By Region

April 2025

April 2025

April 2025

April 2025