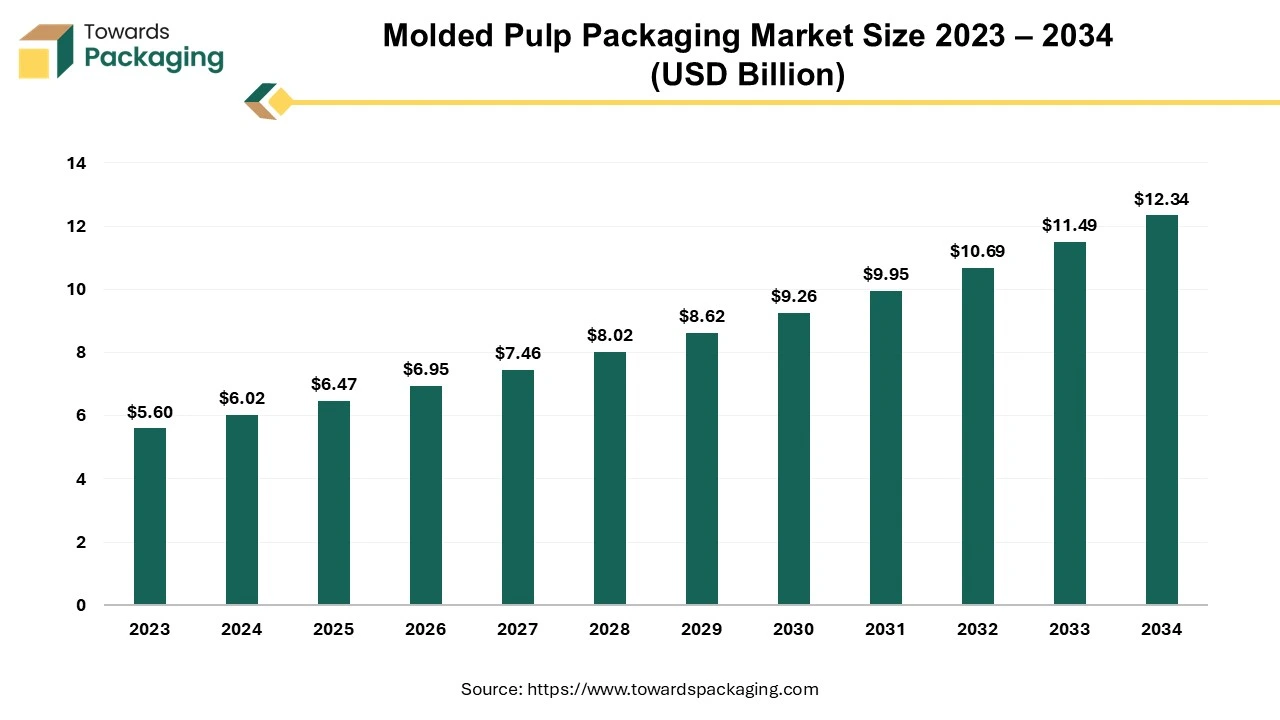

The molded pulp packaging market is valued at USD 6.47 billion in 2025 and is projected to reach USD 12.34 billion by 2034, growing at a CAGR of 7.45% during the forecast period. The market analysis covers detailed market sizing, growth trends, segment-wise demand, pricing benchmarks, and regional performance across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

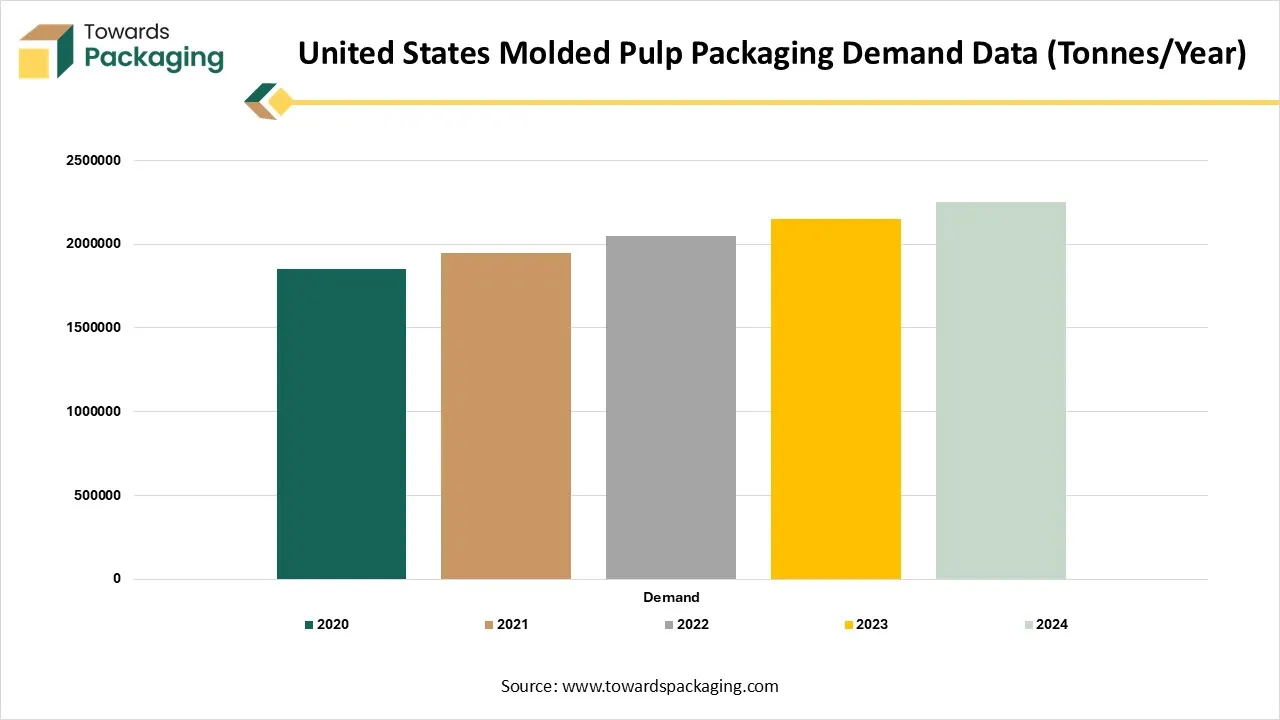

The report includes U.S. demand growth from 1.85 million tonnes in 2020 to 2.25 million tonnes in 2024, Europe’s demand expansion to 2.6 million tonnes in 2024, and average selling prices ranging from USD 1,100 to USD 3,600 per tonne depending on product type. It provides competitive analysis, company market shares, value chain structure, raw material sourcing, manufacturing economics, trade flows, and supplier–manufacturer dynamics, offering a complete strategic view of the molded pulp packaging industry.

The market for molded pulp packaging centers on efficiently producing and distributing packaging made from fibrous materials such as recycled paper, natural fibers (sugarcane bagasse, bamboo, wheat straw), and cardboard. Along with this, reducing carbon footprint and landfill waste by being biodegradable and shaped into various shapes and sizes are the market's primary objectives.

Plastic pollution, being a serious threat to the environment, is the largest contributor to the waste generation crisis, and the use of molded pulp packaging will enhance the market. The primary function of molded pulp packaging is to provide excellent bracing to the product by blocking the shock vibrations. It also resists intense turbulence by cushioning products, given the reason it is used in a wide range of applicants such as food and beverage, pharmaceutical and industrial, and consumer goods sectors.

| Year | Demand |

| 2020 | 1850000 |

| 2021 | 1950000 |

| 2022 | 2050000 |

| 2023 | 2150000 |

| 2024 | 2250000 |

The molded pulp packaging provides freshness by preventing moisture and air from contaminating the product, and the lightweight factor of the packaging makes transit easy and convenient. Apart from this, the use of sustainable materials for packaging increases the demand of the market due to consumer preferences. Recycled paper, being a reusable and biodegradable material, supports the circular economy sustainability and endless loop of circularity.

Customization of labels with good graphic designs can attract consumers with aesthetic preferences. Pulp is designed to nest for reduced shipping and storage costs. Thermoformed fiber thin-walled packaging helps prevent electric applications from getting damaged due to its electrically neutral feature. Additionally, the pulping process is chemical, and the final packaging is made of 100% recyclable material, making it safe and contributing to the growth of the molded pulp packaging market.

Apart from this, packaging like transfer molded thin-walled and thick-walled packaging are specifically used in the homecare sector due to their robust packaging. Pulp trays are durable and sturdy, made from recycled paper pulp, which is also a cost-effective option.

| Product Category | Price |

| Standard molded pulp | 1100 - 1600 |

| Thermoformed molded fiber | 1800 - 2600 |

| Specialty & coated pulp | 2200 - 3400 |

The use of technology boosts the demand for pulp material packaging. Integrating new features like those built into product security under harsh logistics conditions. New innovative technologies such as RFID tags, NFC, Hybrid IoT Solutions, and Multi-LPWAN are widely adopted in transportation and logistics. They are used with inventory tracking software to track products and shipping manifests accurately. Integrating these tags also helps reduce losses due to theft and misplacement.

Robust technological advancements are being made in materials based on ecological trends, which bend towards sustainable packaging. New developments in material science and the growing popularity of materials like polylactic acid, polyhydroxyalkanoates, and cellulose-based films are bio-based packaging products that decompose naturally, leading to an overall reduction in carbon print and landfill waste.

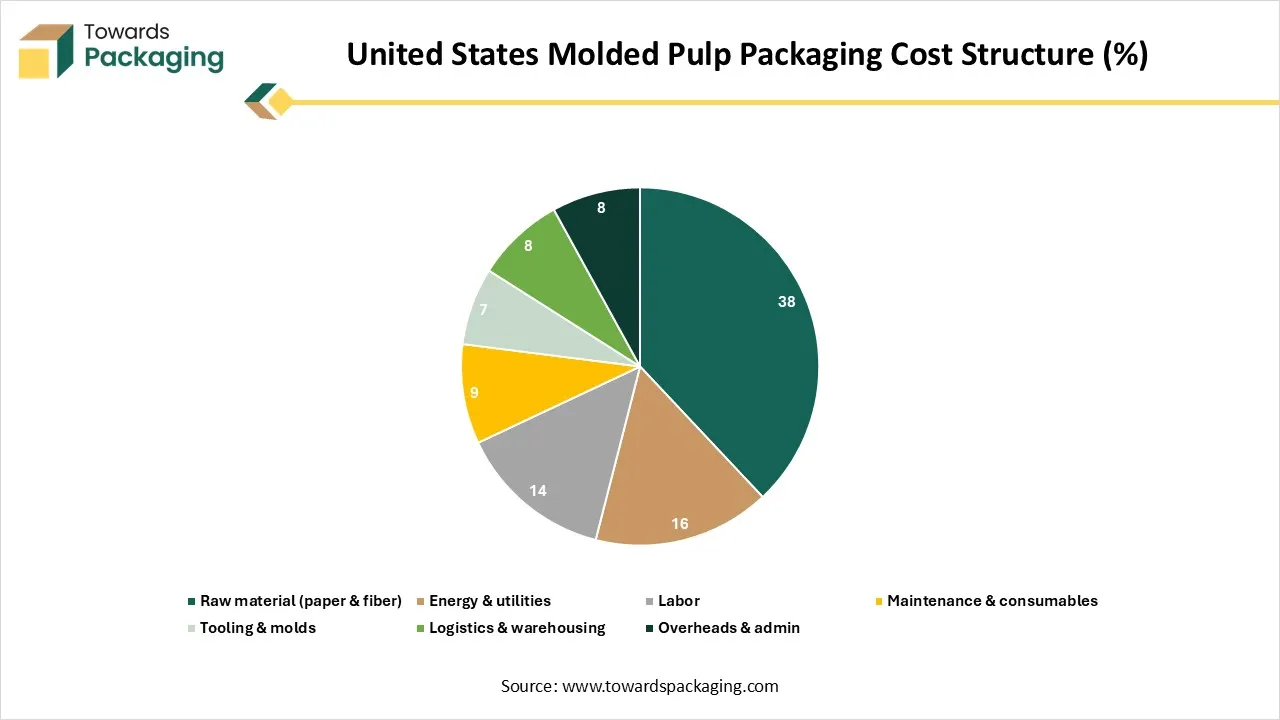

| Cost Component | Share |

| Raw material (paper & fiber) | 38 |

| Energy & utilities | 16 |

| Labor | 14 |

| Maintenance & consumables | 9 |

| Tooling & molds | 7 |

| Logistics & warehousing | 8 |

| Overheads & admin | 8 |

Reusability Factor to Become the Driver for the Market

The focus of the molded pulp packaging market is to provide fitted packaging solutions that also boost the market and eliminate waste generation by increasing the use of reusable material and decreasing the dependence on single-use material. The minimization of carbon footprint reduces environmental harm and easy-to-open containers increase the demand of the market. The major benefit of molded pulp packaging is that it offers a snug fit to most products, boosting cost-effectiveness due to damage prevention during transport. This kind of packaging also prevents moisture penetration.

Moisture Sensitivity to Hinder the Growth

The challenge for molded pulp packaging is moisture sensitivity, which can lead to a weak structure and damage the product's integrity. As pulp is lightweight and is made from recycled paper, it has lower load-bearing quality. It can face competition from bulky or plastic containers that have high load-bearing capacity. Since most of the molded pulp packaging is used for consumer and home care products, it can absorb odors, reducing the quality of products and thereby contaminating them. Furthermore, high production costs can also be a hindrance to the molded pulp packaging market.

Rising Trends of Recyclable Packaging: Market’s Opportunity

The molded pulp packaging market offers opportunities to provide recyclable and reusable materials made from biodegradable materials like recycled paper and natural fibers, which are sustainable options. Customization according to the manufacturer's preferences can create an opportunity for the market to provide them with higher packaging material, thus increasing the market growth.

Growth in e-commerce, as well as the healthcare, pharmaceuticals, cosmetics and personal care, and food and beverage industries, is expected to drive growth in the market in the coming years. These sectors offer groundbreaking new opportunities for growth in the molded pulp packaging market.

By source, the wood pulp segment dominates the pulp packaging market due to its versatile and cost-effective nature. The material is customizable into different shapes and sizes. Wood pulp is also environmentally sustainable, which contributes to its popularity. The non-wood pulp segment is the fastest growing due to rising concerns around the preservation of trees and awareness around damage and environmental loss caused by deforestation.

By molded type, the transfer molded segment dominates the pulp packaging market due to its air permeability features that extend the quality of packed food products. The thermoformed segment is the fastest-growing segment in the market. Environmental concerns around single use plastic is pushing consumers and in turn manufacturers towards more ecofriendly packaging solutions.

By product, the trays segment dominated the molded pulp packaging market. The packaging also provides a protective shield from contamination, external forces, and damage, and it also avoids degradation during transportation. The utilization of trays for a wide range of applications contributes to the market growth. Along with the customization of specific requirements, the improvisation of properties like strength and durability fuels the market growth.

By end-user industry, the food and beverages segment dominates the molded pulp packaging market. The segment dominates due to increasing consumer awareness regarding hygiene and visual appeal. The packaging prevents product contamination, increases the supply chain market due to e-commerce, and reduces packaging waste by following government guidelines.

Food safety awareness and sustainability standards increase the demand for molded pulp packaging in the food sector due to its versatile and lightweight properties. The use of biodegradable materials like cardboard, bagasse, plant-based plastics, paper, and compostable food wraps is being considered the go-to packaging option due to consumers' awareness of the environmental impact. The trends are adopted according to the consumer demand.

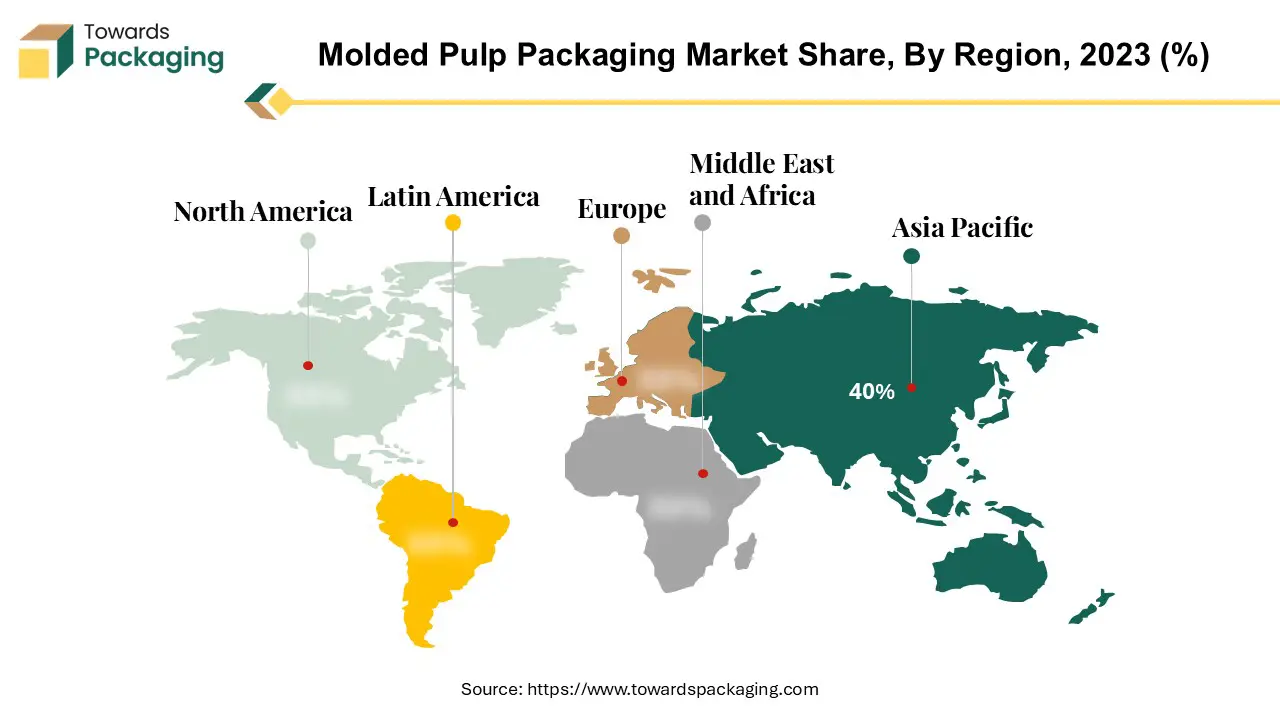

Asia-Pacific is the dominating region in the market due to its versatile use and demand for molded pulp packaging material. Indian convenience stores have thermoformed containers, heat-sealed, and cold-sealed containers due to consumer demand, given the reason that they are portable and easy to open and store. The growing number of urban inhabitants, a rising middle class, and cost-effective price increase the market demand. A growing health consciousness and demand for environment-friendly products among consumers has increased the market growth rate.

According to IBEF, foreign direct investments and innovations inflows in the paper and pulp industry totaled US$ 1.71 billion from April 2000 to March 2024, highlighting investor confidence in India's packaging landscape. The thriving growth in paper technology has also increased the regional market growth. Apart from this, the boom in e-commerce and demand for packaging in food and beverages and the medical sector also increases the market growth.

China Market Trends

China molded pulp packaging market is driven by rising technology advancement and emphasis on developing sustainable packaging. China's push toward sustainable and eco-friendly packaging to reduce plastic waste has encouraged the adoption of biodegradable materials like molded pulp. Initiatives such as the "plastic ban" and "green packaging" regulations (e.g., for e-commerce and food delivery) support the use of recyclable and compostable packaging. With rapid expansion in these sectors, there's increased demand for protective, cost-effective, and sustainable packaging like molded pulp.

Rising awareness among Chinese consumers about environmental issues is increasing the preference for eco-friendly products and packaging. Molded pulp packaging is widely used for industrial parts, electronics, and agricultural produce, all of which are growing sectors in China. As global markets demand more sustainable packaging, Chinese manufacturers are ramping up molded pulp production to meet international needs.

How does Latin America Influence the Molded Pulp Packaging Market?

Latin America also plays a remarkable, growing role in the molded pulp packaging market. This growth is driven by rising environmental awareness, sustainable packaging adoption, and a burgeoning e-commerce sector in the region. The region is experiencing growth in both market size and CAGR, with Argentina, Brazil, and Mexico as key players. Moreover, the expansion of e-commerce and the necessity for sustainable packaging options for online deliveries are heightening the growth of the molded pulp packaging market. Along with this, increasing consumer demand for eco-friendly products, government regulations promoting sustainability, and the shift towards sustainable packaging solutions too.

Europe is seen to grow at a notable rate in the foreseeable future. The European Union has strict regulations on single-use plastics and packaging waste, such as the EU Packaging and Packaging Waste Directive (PPWD) and the Single-Use Plastics Directive, which drive demand for biodegradable alternatives like molded pulp. The EU’s Circular Economy Action Plan promotes sustainable materials and recycling, encouraging the use of molded pulp packaging made from recycled paper or agricultural residues.

European consumers are among the most eco-conscious globally, leading to increased preference for sustainable packaging and pressure on companies to adopt greener alternatives. Europe has well-established recycling systems, making it easier and more economically viable to produce molded pulp from recycled paper and cardboard. Many European companies are committing to ESG (Environmental, Social, and Governance) goals, which include switching to sustainable packaging like molded pulp.

Europe Molded Pulp Packaging Average Selling Price (USD/Tonne)

| Product Category | Price |

| Standard molded pulp | 1200 - 1700 |

| Thermoformed molded fiber | 2000 - 2900 |

| Specialty & barrier-coated pulp | 2400 - 3600 |

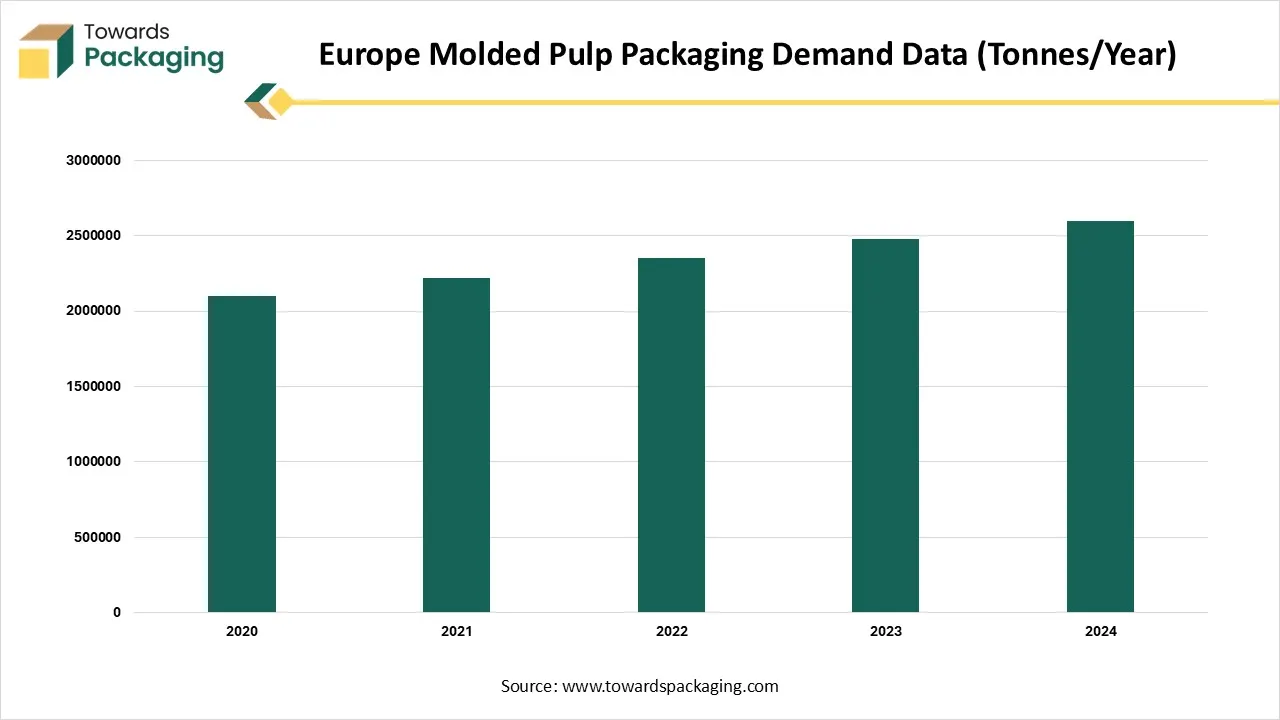

Europe Molded Pulp Packaging Demand Data (Tonnes/Year)

| Year | Demand |

| 2020 | 2100000 |

| 2021 | 2220000 |

| 2022 | 2350000 |

| 2023 | 2480000 |

| 2024 | 2600000 |

North America is the fastest-growing region in the market due to its focus on innovation and advancement in molded pulp packaging, given that materials like recycled paper and natural fibers are used in the manufacturing process. The strict regulations reflect restrictions on plastic usage, which harms the environment, and its carbon footprint ensures an increase in sustainable packaging.

According to the American Forest and Paper Association, the United States has a recycling rate of 66% for paper products, hence increasing the utilization of molded pulp packaging. Consumer preference for eco-friendly packaging also plays a big role in increasing market demand.

The U.S. Molded Pulp Packaging Market Trends

The U.S. plays a dominant role in the North American molded pulp packaging market. This is due to the U.S holding a significant share of the molded pulp packaging market. This is further attributed to the growing need for sustainable packaging as environmental concerns and government regulations are pushing companies to adopt sustainable packaging solutions. The prominent presence and higher demand for Quick Service Restaurants, Full-Service Restaurants, and other food service outlets contribute significantly to the demand for molded pulp packaging. Technological advancements in the region not only encourage innovations in molded pulp packaging manufacturing but also improve product quality and efficiency.

By Source

By Molded Type

By Product

By End-use

By Region

December 2025

December 2025

December 2025

December 2025