April 2025

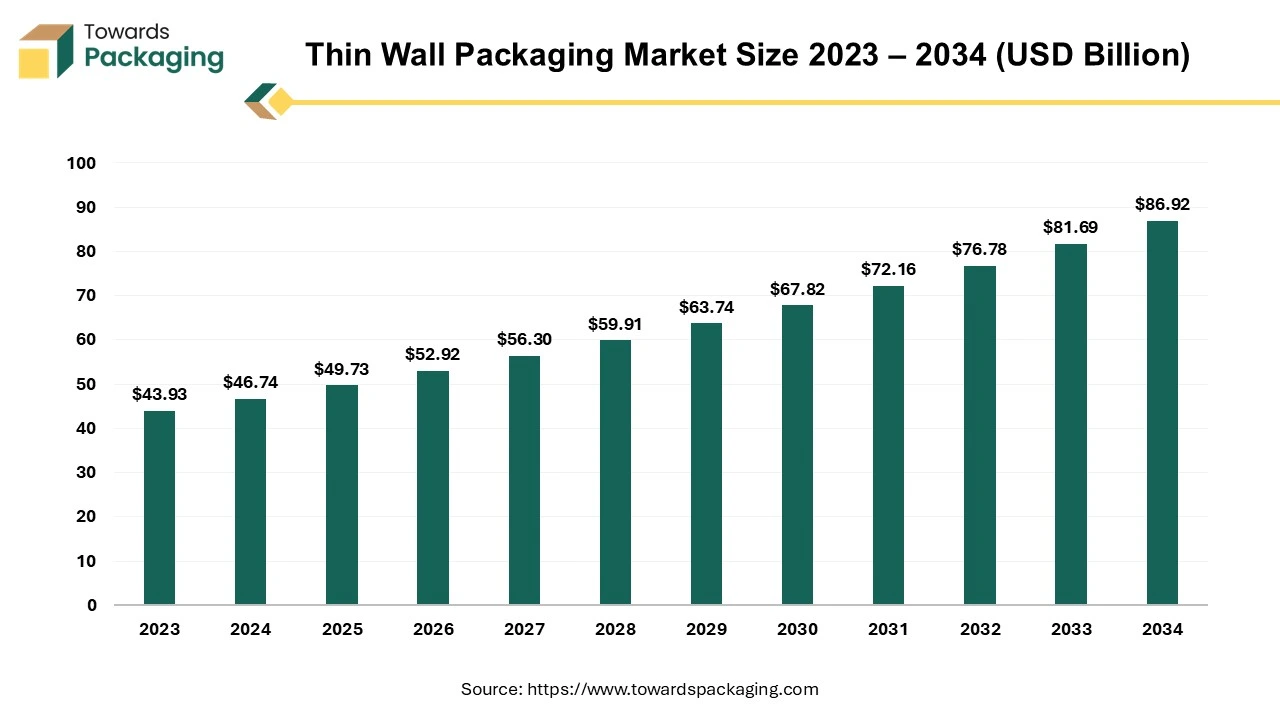

The thin wall packaging market is projected to reach USD 86.92 billion by 2034, growing from USD 49.73 billion in 2025, at a CAGR of 6.4% during the forecast period from 2025 to 2034.

Thin Wall Packaging Market" refers to the industry involved in the production, distribution, and sale of packaging materials that are characterized by their thin and lightweight design. Thin wall packaging typically involves the use of materials such as plastics, including polyethylene terephthalate (PET), polypropylene (PP), and other lightweight materials.

Thin wall packaging plays a pivotal role in advancing sustainability objectives by reducing plastic usage and optimizing the overall weight of packages. This lightweight design translates into lower energy requirements for transportation. It's noteworthy that plastic packaging generally holds distinct advantages over alternatives such as paper, glass, or aluminium, and thin wall packaging takes these advantages to the next level. Anticipated growth in the demand for thin wall packaging is poised to outpace the broader packaging market.

A substantial portion of global polypropylene consumption, exceeding 40%, is attributed to packaging applications. The use of polypropylene in rigid packaging is witnessing an annual growth rate exceeding 8%, with approximately 3% of this growth attributed to the substitution of other plastics. This success positions polypropylene as one of the most thriving polymers in the packaging market. Packaging's substantial share in global polypropylene consumption underscores the industry's significance, especially as the adoption of thin wall packaging continues to gain momentum.

The demand for thin wall packaging is escalating due to its pivotal role in enhancing sustainability and operational efficiency. With a lightweight design, thin wall packaging reduces plastic consumption, lowering transportation energy costs. Notably surpassing alternatives like paper and aluminium, thin wall packaging capitalizes on the inherent advantages of plastic. This trend, driven by the imperative for eco-friendly solutions, is expected to outpace the broader packaging market. The thriving demand aligns with the global push for sustainable practices and positions thin wall packaging as a critical driver in evolving efficient and environmentally conscious packaging solutions.

| Trends | |

| Advancements in Material Technology | Ongoing innovations in material science influence thin wall packaging trends. Developing high-performance, lightweight materials and improved barrier properties enhance product protection, extend shelf life, and meet evolving consumer expectations. |

| E-commerce Packaging Optimization | As e-commerce gains prominence, thin wall packaging is adapting to meet the specific demands of online retail. The focus is on creating packaging solutions that balance protection, aesthetics, and cost-effectiveness while minimizing environmental impact during shipping. |

| Customization and Branding | As e-commerce gains prominence, thin wall packaging is adapting to meet the specific demands of online retail. The focus is on creating packaging solutions that balance protection, aesthetics, and cost-effectiveness while minimizing environmental impact during shipping. |

| Sustainable Packaging Mandate | The push for sustainability continues to drive thin wall packaging trends, with businesses increasingly adopting eco-friendly solutions. Consumers and regulatory pressures are prompting the industry to reduce material usage and enhance recyclability, positioning thin wall packaging as a frontrunner in meeting these demands. |

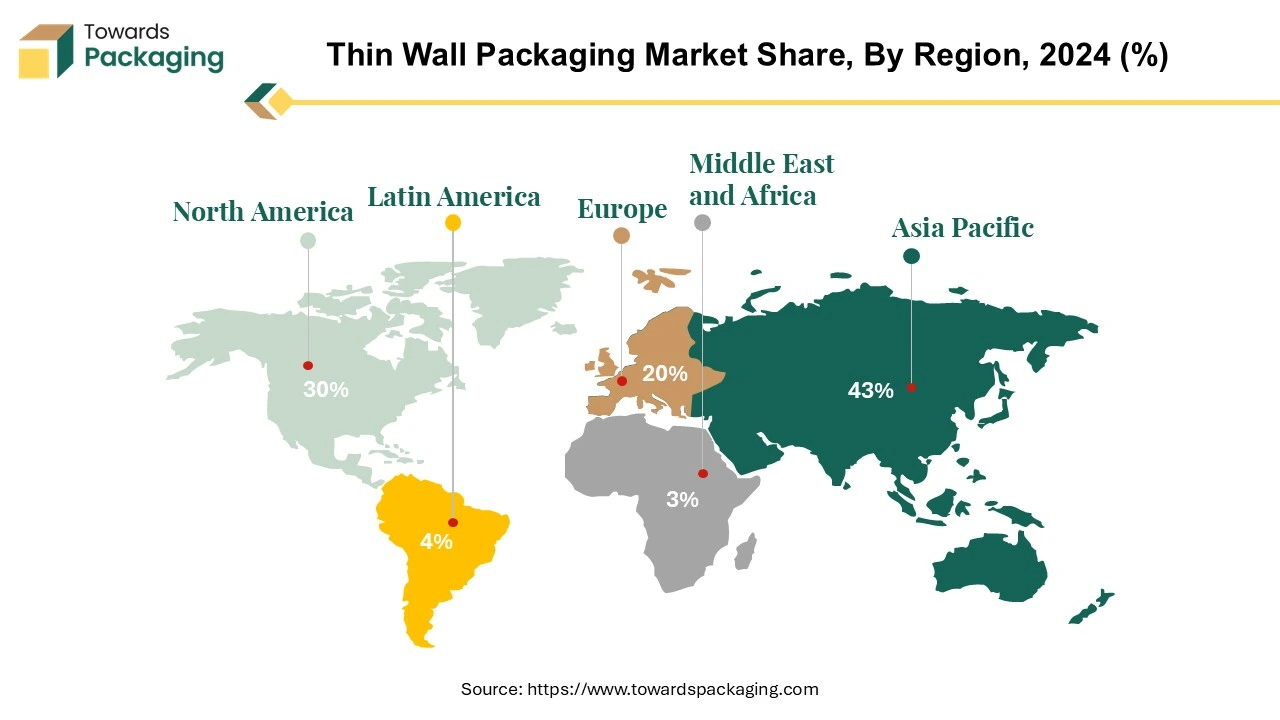

The Asia-Pacific (APAC) region played a pivotal role in the global plastics landscape, contributing over half of the world's plastic production at 51% of the total 390.7 million metric tons. As a major hub for plastic manufacturing, the APAC region stands poised to lead the transition towards a circular economy for plastic packaging. China, the largest global consumer of plastics, and India represent key markets for plastic packaging within the APAC region, experiencing heightened demand as consumers shift towards packaged goods.

China, responsible for 31% of the world's plastic production, spearheads the region's dominance in plastics manufacturing. Other Asian nations, including Japan, contribute significantly, making up 3% of global plastic production, with the rest of Asia accounting for 16%. The APAC single-use plastic packaging market is anticipated to grow at a CAGR of 5.66% until 2030, emphasizing the region's continued influence in the global plastic packaging landscape.

China's commitment to environmental sustainability is evident in its five-year action plan unveiled in 2021, aimed at reducing plastic pollution. Initiatives include bans on non-biodegradable plastic bags in supermarkets, shopping malls, major cities, and food delivery services. This underscores the region's proactive approach to addressing environmental concerns associated with plastic use.

The APAC region, driven by factors such as a high demand for lightweight and durable packaging like thin wall packaging, has witnessed significant business growth. Factors like isolation, an expanding affluent middle class, and increased trade activities contribute to the expansion of the thin wall packaging industry. The market's growth is further propelled by consumer preferences for ready-to-make products. Overall, the APAC region's dominance in plastic production and its commitment to sustainable practices position it as a key player in shaping the future of the thin wall packaging market.

With its substantial plastic generation, North America is a significant player in the thin wall packaging market. The United States alone, as per the American Chemistry Council, produced 36.7 million tonnes of plastics in 2022, making up 12.2 per cent of Municipal Solid Waste (MSW) generation. This significant production volume accentuates North America's pivotal role in the global plastic industry.

The key lies in devising end-of-life solutions for these plastics, with a strong focus on fostering a circular economy. The goal is to repurpose spent plastics into new materials, avoiding disposal. This circular strategy is in line with sustainable practices and is aimed at minimizing environmental impact. It's worth noting that around 60% of North American plastic production, which stays within the region and isn't exported, is used to manufacture durable goods.

This emphasis on converting spent plastics into new materials addresses environmental concerns and aligns with the broader global trend toward sustainability. North America's commitment to circular economy principles positions it as a key player in shaping the future of the thin wall packaging market. As industries and consumers increasingly prioritize environmentally friendly solutions, the region's focus on finding sustainable end-of-life solutions for plastics reinforces its standing as a significant contributor to North America's growth and evolution of the thin wall packaging industry.

Polypropylene (PP) containers stand out as a leading material in the thin wall packaging market, particularly in scenarios where cleanliness and sustainability are paramount. These containers replace single-use packaging made from alternative materials, offering a solution that is not only eco-friendly but also addresses concerns related to hygiene. The Thin Wall Injection Molding (TWIM) process for PP containers enhances their versatility, making them suitable for freezer and microwave use. As a result, they emerge as efficient, reusable options for food storage, ensuring the prolonged freshness and healthiness of stored items.

Despite the prevalent use of plastic in packaging across Europe, accounting for approximately 40% of total demand, the disposability of packaging materials raises environmental concerns. The lack of design guidelines or legal requirements often results in creating single-use products, contributing to increased consumption and a need for improved end-of-life recyclability. Recognizing these challenges, the goal is to promote the adoption of PP containers. This eco-friendly material is lightweight, affordable, and versatile for daily food storage, delivery, and various occasions.

It's crucial to highlight the potential environmental impact of disposable packaging, mainly when not correctly disposed of. With a significant portion of plastics ending up as marine litter due to their disposable nature, there is a growing need to encourage sustainable practices and proper waste management. Additionally, since most plastics have limited recyclability, identifying viable end uses for recycled materials becomes essential to establish a closed-loop system and mitigate the environmental footprint associated with plastic packaging.

Boxes have emerged as the leading product in the thin wall packaging sector due to their versatility, practicality, and widespread applicability. These thin wall boxes, often made from materials like polypropylene (PP) through processes such as Thin Wall Injection Molding (TWIM), offer a lightweight yet robust solution for packaging various goods. The design of thin wall boxes caters to diverse industries, including food packaging, consumer goods, and electronics.

Their popularity is attributed to several factors, including cost-effectiveness, ease of manufacturing, and the ability to accommodate intricate designs. Thin wall boxes efficiently balance the need for durable packaging with reduced material usage, aligning with sustainability goals. They provide excellent protection for products while optimizing space and reducing transportation costs.

Furthermore, thin wall boxes are favoured for their eco-friendly attributes, contributing to the shift towards sustainable packaging solutions. As consumers and industries increasingly prioritize environmental considerations, thin wall boxes stand out as a leading product, meeting the demands of functionality and environmental responsibility in the dynamic landscape of modern packaging.

Thin wall plastic packaging has become integral in various industries, notably the food and beverage sector, showcasing its versatility and widespread application. In the food and beverage industry, thin wall packaging is extensively employed for dairy containers, including yoghurt cups and yellow fats, frozen foods, fruits, vegetables, bakery items, ready meals, juices, soups, and meats. Its usage extends beyond traditional applications, finding new roles as a replacement for glass and cans in commodities such as meat and preserves. This not only reduces weight but also opens up innovative design possibilities.

Two main components stand out within the thin wall packaging market: open-top containers and lids. These components serve diverse purposes in both food and non-food applications. Open-top plastic containers, a prevalent choice in this market, are commonly utilized for packaging frozen food or fresh food items and in industries like paint, adhesives, cosmetics, and pharmaceuticals. The adaptability of thin wall packaging in the food and beverage industry addresses the specific needs of various products. It contributes to overall sustainability efforts through reduced material usage and weight optimization. The ongoing innovations and applications of thin wall packaging underscore its significance in enhancing efficiency, reducing environmental impact, and meeting the evolving demands of the food and beverage market.

Several key players characterize the competitive landscape of the thin wall packaging market. Major companies in this market include Berry Global, Amcor, Sem Plastik, Double H Plastics, Greiner Packaging, Tek Pak, RPC Group, Reynolds Group, Sanpac and Plastipak Industries Inc. These companies focus on strategies such as mergers and acquisitions, product innovations, and expanding their regional presence to gain a competitive edge. The market is also influenced by changes in regulatory requirements and consumer preferences shifts, driving the need for innovative and sustainable thin wall packaging refrigerant solutions.

By Material

By Product Type

By Region

April 2025

April 2025

April 2025

April 2025