April 2025

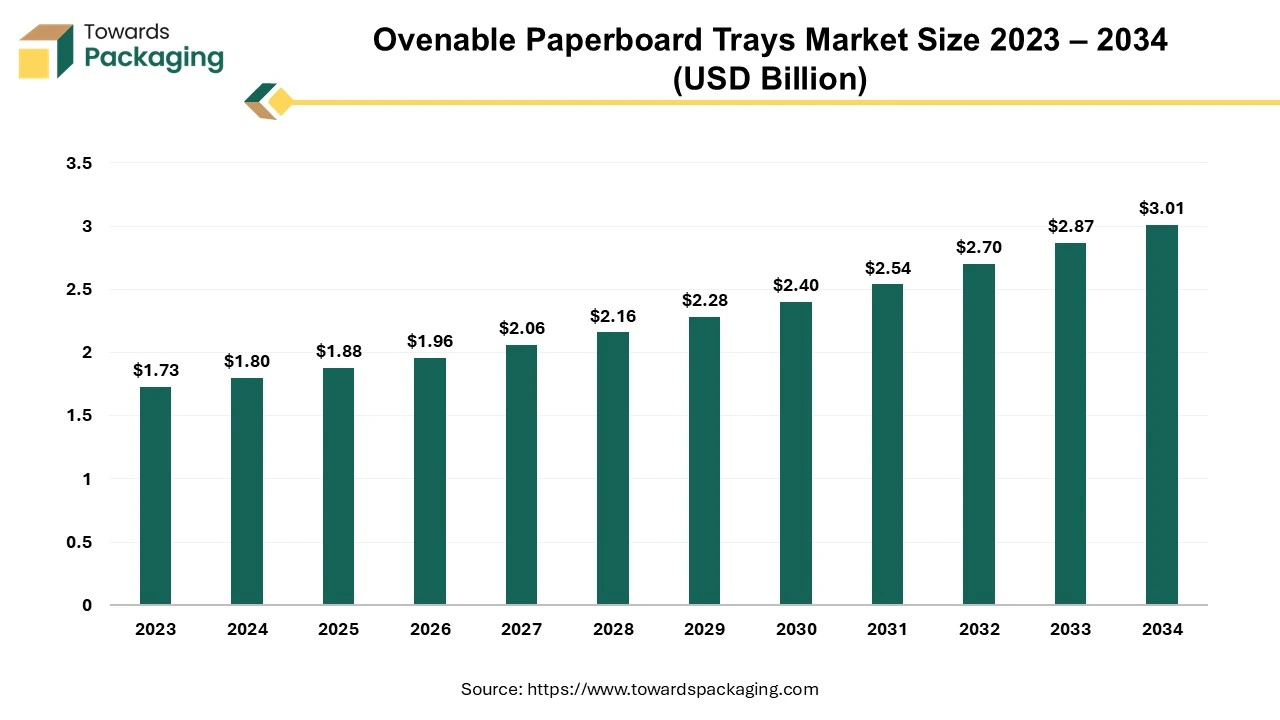

The global ovenable paperboard trays market is projected to grow from $1.80 billion in 2024 to $3.01 billion by 2034, expanding at a CAGR of 5.32% between 2025 and 2034. This surge is driven by the rising demand for sustainable, heat-resistant packaging solutions.

Unlock Infinite Advantages: Subscribe to Annual Membership

The ovenable paperboard trays market is anticipated to grow at a substantial rate during the forecast period. Like the aluminum trays, these paperboard trays are easy to seal and can be used in ovens, freezers as well as microwaves. There is a waterproof covering on the renewable material. The environmental impact of this eco-friendly packaging is minimal. The paperboard trays can be printed with the business's own design and comes in a variety of colors.

These trays provide an environmentally acceptable substitute for plastic or metal packaging and are frequently used for baking, reheating, and preparing convenience foods. Their versatility coupled with their ability to be recycled or composted, makes them a perfect choice for both consumers and food service providers seeking sustainable options.

The rising demand for the sustainable and eco-friendly packaging coupled with the increasing environmental awareness among the consumers is expected to augment the growth of the ovenable paperboard trays market during the forecast period. Furthermore, the growing preference for the ready-to-eat and convenience foods coupled with the growth of the food service industry and home delivery services are also anticipated to augment the growth of the market. Additionally, the stringent regulations and policies promoting sustainable packaging alternatives as well as the rapid urbanization and changing lifestyles in the emerging economies along with the focus on reducing the plastic usage is also projected to contribute to the growth of the market in the near future.

The growth of the online food delivery platforms owing to the increasing adoption of the cashless payment systems and high-speed internet access is anticipated to support the growth of the ovenable paperboard trays market during the estimated timeframe. Changing work patterns such as longer hours and remote working have also contributed to the surge in the food delivery, as consumers seek convenient and time-saving meal options. Thus, online food delivery platforms like Uber Eats, DoorDash and Zomato are continuously launching new services as well as expanding in various regions.

Customers are increasingly ordering prepared meals for convenience. This shift has generated a pressing demand for packaging options that keep food fresh throughout transit and can be reheated. As food delivery becomes more prevalent in modern living, specifically in cities, restaurants and meal kit providers are looking for ecological and functional packaging choices. Ovenable trays not only meet consumer convenience demands, but also reflect a rising preference for sustainable options. Their ability to go effortlessly from freezer to oven or microwave makes them ideal for delivering ready-to-cook and heat-and-eat meals.

The availability of the other substitute materials like aluminum and silicone is expected to hamper the growth of the ovenable paperboard trays market within the estimated timeframe. Aluminum oven trays have been popular in most of the kitchens owing to its flexibility and efficiency. The fact that aluminum trays are lightweight is one of its main benefits. Especially when contrasted with the heavier materials, they are manageable. Aluminum trays are quite strong and resilient, even though they are lightweight. Another well-known characteristic of aluminum is its superior heat conduction capabilities. This minimizes the possibility of hot areas that leads to uneven cooking and guarantees that food bakes evenly. It also performs better in applications, like managing greasy and liquid-based dishes or holding onto moisture when baking.

Glass trays are another popular choice for the oven due to its high heat tolerance, consistent cooking capabilities and non-reactivity. They are intended to deal with high temperatures, making them excellent for baking, roasting as well as reheating a wide range of foods. Glass conducts heat evenly across its surface, reducing hot spots and guaranteeing that food cooks consistently. Additionally, glass is non-reactive, meaning it will not leach chemicals or flavors into the dish, even when used with acidic foods. Similarly, silicone trays also attract the environmentally conscious consumers who prefer long-lasting options over the disposable packaging. The main benefit of utilizing silicone for baking is that it is non-stick; it mostly eliminates the requirement of oiling or greasing trays. These alternatives benefit from the established market positions as well as consumer familiarity, making it challenging for the ovenable paperboard trays to capture the market share.

The growing demand for sustainable packaging is expected to create substantial growth opportunity for the ovenable paperboard trays market in the near future. One of the trends in packaging that has grown the fastest is sustainable packaging. Sustainable packaging materials as well as alternatives are expected by both customers and regulators. Approximately 60% of shoppers expect packaging that is recyclable or biodegradable in the near future, according to the most recent Mondi Company survey. In the coming years, many of organizations are promising to work towards recycled packaging only. For instance:

Mindful Chef received packaging from Smurfit Westrock that is entirely recyclable, minimizing waste and guaranteeing total traceability all the way throughout the process. The durability of the packaging was extensively tested in a number of ways to guarantee that their fresh fruit and ingredients arrived in the best possible shape. To minimize the carbon imprint, the Smurfit Westrock crew resized the crates to fit as many as possible onto each truck.

This trend is owing to the increased concern about plastic pollution, climate change and the need for sustainable resource management. Paperboard trays that are created from renewable resources are commonly recyclable or compostable and an ideal solution to these concerns, providing an environmentally friendly packaging option. In addition to decreasing environmental impact, ovenable paperboard trays help to promote a circular economy, adding to their value as a sustainable option. As awareness grows, the need for green packaging products is projected to surge.

In the industry, artificial intelligence (AI) is without a doubt one of the most important technological concept. Although AI has become extremely overhyped due to years of ambitious claims, we are passed this stage, and packaging firms are starting to recognize the real advantages of AI and its potential within Industry 4.0. Organizations will increasingly be able to lease rather than make an AI platform owing to the cloud-based AI technologies that are provided as a service. AI systems need an enormous amount of the data and processing capacity, which not every organization has. The cloud has opened up access to AI for new users and democratized its use. AI is made both scalable and reasonably priced by utilizing a pay-as-you-go strategy to provide on-demand accessibility to algorithms and application programming interfaces (APIs).

Furthermore, advanced AI algorithms are anticipated to assist in the development of innovative tray designs through analyzing consumer preferences, performance requirements as well as environmental factors, leading to better-functioning and more sustainable products. As sustainability becomes a focal point, AI will help in the development of new materials and coatings to go along with the environmental regulations.

Additionally, gen AI can help organizations in many more ways than traditional AI, mostly due to its capacity to create new content and manage the disorganized data, as well as its user-friendly interface, which facilitates broader adoption. Gen AI may be utilized for all of the industry's essential tasks, from streamlining the R&D process to optimizing back-office operations. The integration of AI is expected to support innovation, operational efficiency and market growth, positioning it as a transformative factor in the global ovenable paperboard trays industry.

The coated paperboard segment held largest share of 62.18% in the year 2024. Coated paperboard is coated with unique layers that improve heat resistance and grease-proofing, which makes it an excellent choice for a variety of applications.

For instance, the clay-coated SBS (solid bleached sulfate) paperboard provides an excellent print surface for the high-end graphics as well as the branding needs. This feature is important in the retail sector, where visually appealing packaging is likely to influence the purchasing decisions. Additionally, clay-coated SBS is 100% compostable and that positions it as a sustainable choice for the eco-conscious consumers. Similarly, PET-coated SBS paperboard provides exceptional functionality for the heat-intensive applications. This segment also gained substantial popularity in the food service industries that needs the packaging that maintains food quality as well as withstands high-temperature environments.

The food service industry segment held largest share of 44.16% in the year 2024. The manufacturing of the organic and locally produced products is becoming increasingly important to restaurant patrons. There are numerous examples that demonstrate how client interests have changed. For example, the rise in Google search volume for the phrase "veganism" from 2015 to 2023 indicates that this trend has not slowed down in almost all large markets.

Additionally, many of diners are growing more aware of how their diet affects their own health. It's already more common than not to find vegan, GMO, gluten-, and dairy-free alternatives on menus. This change in preferences, along with the introduction of food delivery applications, food influencers on social media, and self-order kiosks, has left the industry at a turning point. Additionally, the rise of the tourism, globalization and social dining culture are further expected to support the segmental growth of the market in the near future.

North America held substantial market share of 28.90% in the year 2024. This is owing to the fast-paced lifestyle of the consumers and rapid growth of the platforms like Uber Eats, DoorDash and Grubhub across the region. For instance, with a target of eliminating all single-use plastic items on Department-managed lands by 2032, Secretary's Order 3407 (SO 3407) was issued on June 8, 2022, with the intention of reducing the purchase, distribution, and sale of single-use plastic products and packaging.

Additionally, the policies aimed at reducing single-use plastics and promoting sustainable alternatives as well as the growing environmental awareness among consumers is also expected to contribute to the regional growth of the market. Furthermore, the advanced food processing as well as packaging industries are also expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at the fastest CAGR of 7.23% during the forecast period. This is due to the growing urban population in countries like India, China and Southeast Asian nations. Also, the growing middle class with higher disposable incomes as well as the rapid expansion of QSR chains such as McDonald’s, KFC, and local equivalents along with the growing food processing industry is likely to contribute to the regional growth of the market. According to the India Brand Equity Foundation data, the food processing market in India is expected to grow from US$ 866 billion in 2022 to US$ 1,274 billion in 2027 owing to the country's growing population and shifting dietary preferences. Furthermore, the growth of the e-commerce platforms coupled with the subscription-based meal kit services are also expected to contribute to the regional growth of the market.

By Type

By End-User

By Region

April 2025

February 2025

February 2025

February 2025