April 2025

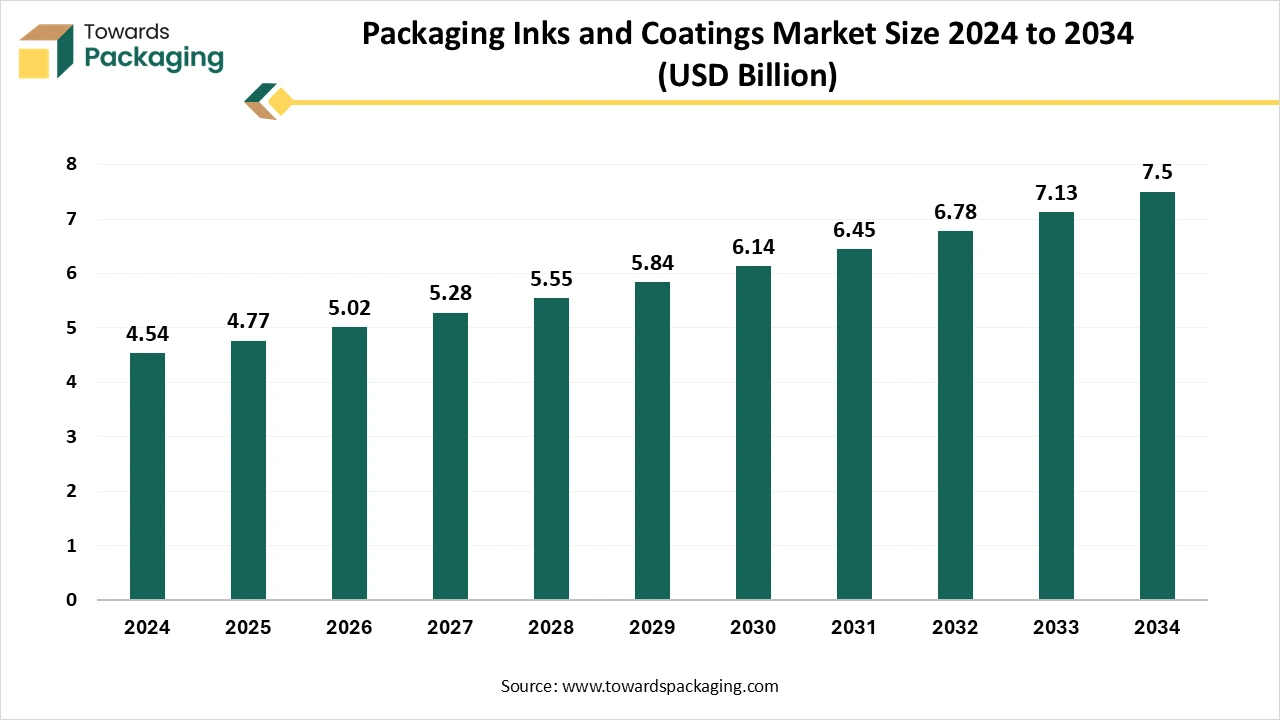

The global packaging inks and coatings market is projected to reach USD 7.5 billion by 2034, growing from USD 4.77 billion in 2025, at a CAGR of 5.15% during the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing packaging inks and coatings which is estimated to drive the global packaging inks and coatings market over the forecast period.

The packaging inks and coatings is known as the materials used in the printing and protection of packaging products. They are critical for branding, labeling, and safeguarding the product inside. Packaging inks are the inks used to print on packaging materials like cardboard, plastic, metal, and paper. They are specially formulated to provide vibrant colors and clarity, while also being resistant to fading, smudging, and environmental factors. Packaging inks can be water-based, solvent-based, or UV-cured, depending on the specific requirements of the packaging and the type of material.

Coatings are applied to packaging surfaces for various reasons, such as improving durability, appearance, and performance. They can provide gloss or matte finishes, protect against moisture, grease, or UV damage, and enhance tactile qualities. Coatings can also help with food safety (in the case of food packaging) and increase shelf life. Common types include varnishes, laminates, and specialty coatings that offer functional properties like anti-scratch or anti-microbial effects.

| Metric | Details |

| Market Size in 2024 | USD 4.54 Billion |

| Projected Market Size in 2034 | USD 7.5 Billion |

| CAGR (2025 - 2034) | 5.15% |

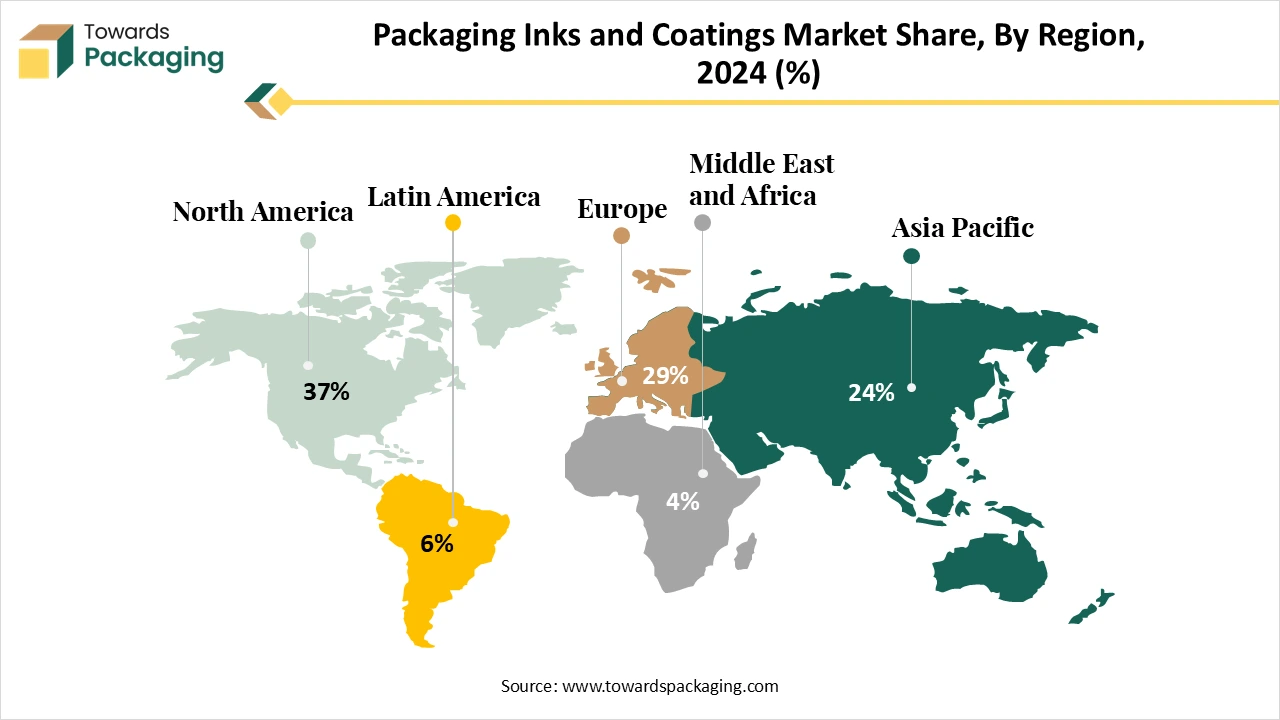

| Leading Region | North America |

| Market Segmentation | By Type, By Application and By Region |

| Top Key Players | Sun Chemical Corporation, Flint Group, Toyo Ink Group, Siegwerk Druckfarben AG & Co. KGaA, DIC Corporation |

Increasing emphasis on eco-friendly and biodegradable packaging materials. Companies are developing protective coatings for paper and cardboard packaging that replace non-recyclable, petrochemical-based solutions. For instance, Earthodic, a green start-up, has raised $6 million to advance its development of a fully recyclable protective coating for paper and cardboard packaging.

The incorporation of smart technologies, such as anti-counterfeiting features and temperature-sensitive coatings, is gaining prominence. These technologies enhance product security, traceability, and user experience, catering to the demand for interactive and innovative packaging.

Digital printing technologies are being increasingly utilized, enabling customization, shorter lead times, and reduced waste. This trend allows for more flexibility in design and customization, catering to the demand for personalized and on-demand packaging solutions.

There is a growth in demand for bio-based printing inks derived from renewable sources. These inks align with global sustainability goals and regulatory standards, offering lower environmental impact and reduced volatile organic compound emissions.

The industry is witnessing consolidation, with companies like DS Smith experiencing a decline in profits due to weaker packaging demand and paper pricing. This trend reflects the cyclical nature of the industry and the need for companies to adapt to changing market conditions.

AI can analyze vast amounts of data from different sources (like raw materials, environmental conditions, etc.) to help optimize ink and coating formulations. This can lead to better-quality products, reduced waste, and faster production times. AI-driven predictive models can also foresee potential issues in formulations before they occur, improving consistency and reliability. AI-enabled predictive maintenance tools can monitor machinery performance in real-time and predict when maintenance is needed, reducing downtime and increasing the efficiency of production lines. Additionally, AI can automate process controls, ensuring that coatings and inks are applied uniformly, reducing variability in the final product.

AI can facilitate the development of customized inks and coatings to meet specific customer needs, whether it's for eco-friendly materials, enhanced durability, or special finishes. AI can also support digital printing technologies that allow packaging companies to produce on-demand and highly personalized packaging with minimal lead time. AI can assist in researching and developing bio-based inks and coatings, offering insights into alternative materials or energy-efficient processes. By simulating different production scenarios, AI helps manufacturers reduce energy consumption, waste, and the use of harmful chemicals, thus supporting the push for sustainable solutions.

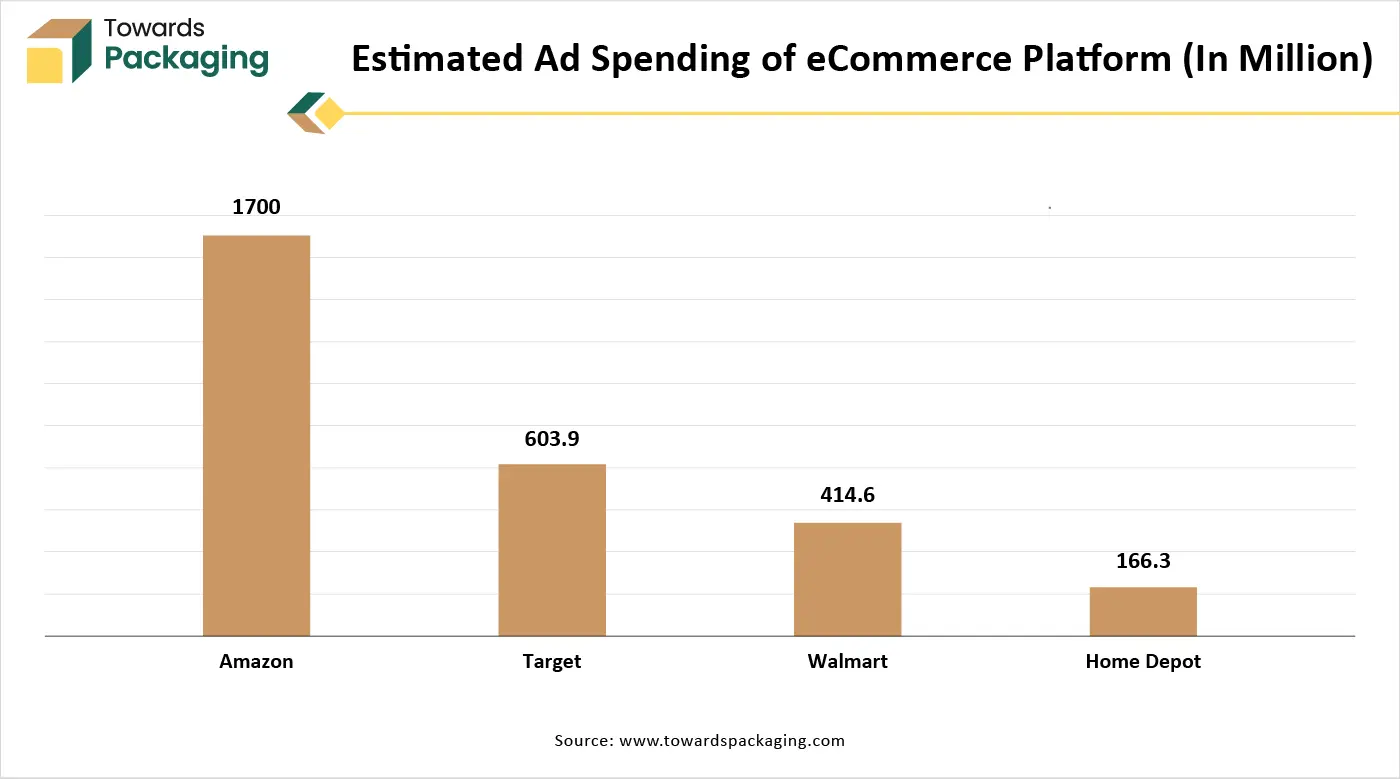

The rapid growth of e-commerce has significantly boosted the demand for packaging materials. Packaging inks and coatings are crucial in ensuring that products are not only well-protected during transit but also visually appealing to consumers. Custom packaging designs and protective coatings are increasingly important in the e-commerce sector, driving growth in the packaging inks and coatings industry.

In January 2025, according to the data published by the eCommerce Professionals Association (ePA), there are 28 million commerce websites globally as of 2025, a 2.9% rise from the year before. This indicates that during 2024 and 2025, about 2,162 Commerce websites were launched every day. Fifty percent of all commerce sites worldwide are located in the United States. Shopify and Wix power the bulk of online stores, accounting for 29% and 20% of total stores, respectively.

The key players operating in the market are facing issue due to regulatory challenges and competition from alternatives as well as price pressure, which has restricted the growth of the packaging inks and coatings market. Governments worldwide are imposing stringent rules on volatile organic compounds (VOCs) in solvent-based inks and coatings, increasing compliance costs. Packaging for food and beverages requires compliance with regulations like FDA (U.S.) and EFSA (Europe), limiting certain chemical formulations.

High competition among manufacturers leads to pricing pressures, reducing profit margins. Emerging private-label brands from retailers push for lower-cost solutions. The U.S. and Canada enforce low-VOC limits and FDA restrictions on food packaging inks, limiting certain formulations. Major brands (e.g., Coca-Cola, Nestlé) push for recyclable and compostable packaging, increasing demand for water-based and UV-curable coatings.

Faster curing, energy efficiency, and eco-friendliness boost adoption in high-speed printing. Nanotechnology-Based Coatings improves durability, anti-counterfeiting, and antibacterial properties for food & pharma packaging. Metallic & special effect ink growing in premium branding & luxury packaging for cosmetics, alcohol, and high-end products. Increasing launch of the advanced printing technologies has created lucrative opportunity for the growth of the packaging inks and coatings market in the near future.

The flexible plastic segment held a dominant presence in the packaging inks and coatings market in 2024. Flexible plastics can be engineered to provide moisture, oxygen, and UV resistance, which helps protect packaged products and enhances the lifespan of inks and coatings. Many flexible plastics, such as polyethylene (PE) and polypropylene (PP), can be treated to improve ink adhesion, allowing for high-quality printing and coatings that resist smudging or fading. Packaging inks and coatings need to withstand oils, solvents, and chemicals present in food, cosmetics, and pharmaceuticals. Flexible plastics can be formulated to resist these substances. Flexible plastic films are lightweight and use less material compared to rigid packaging, reducing costs in manufacturing, transportation, and storage.

The paper segment is expected to grow at the fastest rate in the packaging inks and coatings market during the forecast period of 2024 to 2034. Many governments are implementing restrictions on single-use plastics, encouraging businesses to adopt paper-based packaging. Recyclability regulations favour paper over plastic, making it the preferred choice for food, beverage, and e-commerce packaging. Paper is widely available and relatively low-cost compared to high-performance plastic films. Paper-based materials, like cartons, paper wraps, and coated paperboard, are increasingly used in fast food, frozen food, and takeaway packaging. Water-based and UV-curable inks are making paper packaging more resistant to moisture and grease.

The advertising segment registered its dominance over the global market in 2024. Packaging serves as a silent salesperson, making high-quality printing and coatings essential for attracting consumers. Vibrant colors, unique textures, and special effects (e.g., metallic, gloss, or matte coatings) help brands stand out on retail shelves. Brands are investing in personalized packaging using variable data printing (VDP) and custom inks to target specific demographics and seasonal promotions. Digital printing technologies enable cost-effective short-run packaging campaigns with customized messaging.

Consumers are drawn to environmentally friendly packaging, leading to increased use of water-based, soy-based, and biodegradable inks. Brands highlight their eco-conscious efforts directly on packaging through sustainable printing and coatings. As companies expand globally, multilingual packaging and region-specific designs require advanced printing and coating solutions. Luxury brands and premium products rely on high-end printing techniques to maintain exclusivity.

North America region held the largest share of the packaging inks and coatings market in 2024. North America is home to major food, beverage, pharmaceutical, and personal care brands, all of which require high-quality packaging with advanced inks and coatings. The rise of e-commerce (Amazon, Walmart, Shopify) has boosted demand for corrugated packaging, flexible pouches, and premium printed labels. Companies in North America invest heavily in research and development (R&D) to create smart packaging with thermochromic, QR-enabled, and interactive ink technologies. Custom packaging solutions for personalized branding drive demand for high-performance inks and coatings.

The presence of leading packaging companies like Amcor, WestRock, and International Paper ensures a steady demand for packaging inks and coatings. North America’s developed logistics and supply chain allow for quick adaptation to new trends and innovations.

Asia Pacific region is anticipated to grow at the fastest rate in the packaging inks and coatings market during the forecast period. The region has the largest consumer base, with countries like China, India, and Japan driving demand for packaged goods. This leads to an increased need for packaging inks and coatings for a wide range of products. A booming middle class in India, China, and Southeast Asia is propelling demand for packaged foods, beverages, consumer goods, and personal care products, all of which require high-quality packaging.

Rapid urbanization and industrialization have led to a surge in demand for consumer goods, which is driving packaging needs. As manufacturing hubs for many global brands, countries like China and India produce a significant portion of the world's packaged goods, contributing to a substantial portion of the packaging inks market.

With increasing awareness around environmental issues, there is a growing demand for sustainable packaging. Asia Pacific is rapidly adopting bio-based, recyclable, and eco-friendly inks in response to both consumer demand and government regulations. Countries like Japan and South Korea are investing in advanced coating technologies to ensure environmentally friendly solutions.

China’s massive population and its status as a global manufacturing hub make it the leading market for packaging inks and coatings in Asia. The growing demand for packaged food, beverages, consumer goods, and pharmaceuticals fuels this market. India’s expanding middle class, combined with increasing urbanization, creates strong demand for packaged goods in food, beverages, and personal care sectors, requiring high-quality inks and coatings. Japan leads in packaging technology and is known for its precision packaging, which is critical for industries like electronics, food, and beverages. This results in a high demand for specialty inks (e.g., UV-curable, anti-counterfeit) and innovative coatings.

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025