April 2025

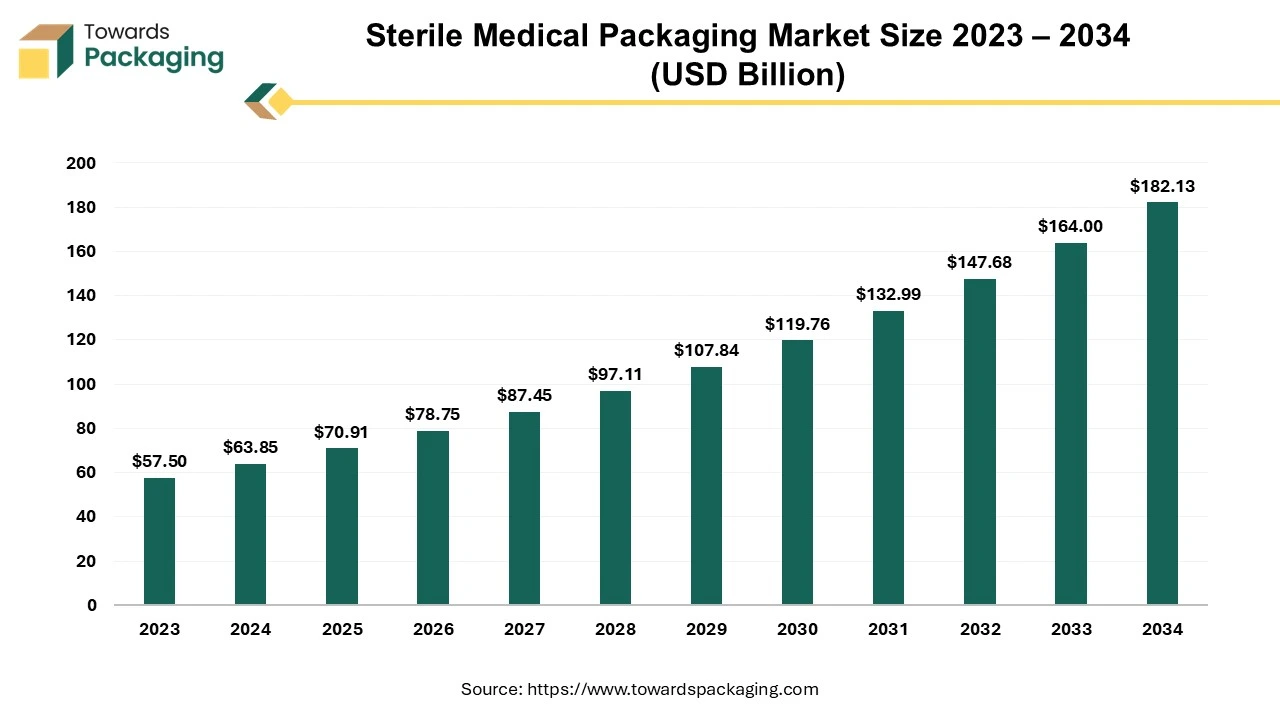

The sterile medical packaging market is anticipated to grow from USD 70.91 billion in 2025 to USD 182.13 billion by 2034, with a compound annual growth rate (CAGR) of 11.05% during the forecast period from 2025 to 2034.

The market is observed to grow due to the rising demand for the pharmaceutical industry. With the advancement in science and technology, the pharmaceutical industry is growing exponentially. Rapid growth in diseases of all age groups has influenced the increase in the production of medicine which has raised the sterile medical packaging market.

Sterilization is a significant step accomplished in the healthcare sector. Hence, the procedure of sterile medical packaging products or sterile block arrangements has achieved an important position in this market. This sterile medical packaging is a non-recyclable packaging that works as a barricade against contagious spread. The majority of such packaging, such as pouches, containers, and wraps are planned to protect medical supplies from the outside environment and unintentional spread of contamination.

Additionally, these sterile medical barrier arrangements preserve supply sterility from the fact of sterilization and packaging till the time of usage. They deliver valuable goods such as durability, tear resistance, a superior bacterial barrier, and breathability to preserve the pharmaceuticals and medical products sterile in their lifespan. These belongings would increase the request for these types of packaging in several applications extending from in-vitro diagnostic equipment to surgical & medical products.

AI has brought significant changes in the sterile medical packaging market by adding several advantages to reshape the major factors of this important sector. AI-incorporated systems can precisely check sterile medical barrier packaging for faults and guarantee strict quality regulators. By introducing computer visualization and machine learning algorithms, producers can recognize even small inadequacies, decreasing the risk of negotiated sterility. This results in a supply of safer products and enhanced customer belief. Automation determined by AI tools can rationalize packaging processes, significant for increasing effectiveness.

Analytical maintenance set-up can predict equipment failures, reduce downtime and enhance production time. The consequences of speeding up turnaround times decreased costs and enhanced overall efficiency. AI allows modified packaging results tailored to specific needs. By identifying data on customer preferences and market demands, producers can generate packaging patterns with artificial intelligence that satisfy target patients. This level of personalization can improve brand trustworthiness and influence customer engagement and practice.

The growing population combined with an upsurge in the prevalence of diseases and the incorporation of new guidelines by governments to regulate the widespread of contagious diseases are the prime aspects influencing the development of the healthcare sector. The development of the sterile medical packaging market in the healthcare sector is qualified due to its superior bacterial barricade and sturdy properties. This packaging keeps the medical and pharmaceutical devices sterile till the package is unlocked to utilise.

The growing demand for pharmaceutical injectables and the requirement for oncology and other high-strength medicines are influencing the development of the market. Moreover, using appropriate sterile medical packaging equipment is very significant as it permits the removal of packaged materials without contamination and harm. Henceforth, the growing demand for packaging resolutions in the healthcare sector will influence sterile medical packaging market development during the predicted period.

This market growth is hindered due to the high cost and environmental impact. Sterile medical packaging systems are intended to guarantee the sterility of packed products till their point of utilisation. Hereafter, strict regulatory values are made and applied to their production.

The growing cases of infectious diseases such as cold, coronavirus, tuberculosis, flu, and SARS have increased demand for single-use medical products or devices. The acceptance of single-use packaging is gradually more widespread in the healthcare sector as it can decrease the risk of contamination and infection. These products include needles, syringes, face masks, bandages, applicators, gloves, suction catheters, surgical sponges, and testing kits. As these products are used only a single time, they protect from the widespread of microbes or contamination from one patient to another patients.

The packaging utilized for such products requires to be very effective in continuing their sterility. These devices are measured to be suitable packaging solutions for such products. They keep single-use medical products away from chemicals and moisture. These packaging solutions are accessible in different shapes and sizes as per the requirement of the application area. Hence, the growing demand for single-use medical devices will boost the market.

The plastic segment is leading in sterile medical packaging as these are lightweight, cost-effective, and easy to mould. This market is segmented into metal, plastics, paper, glass, & paperboard, and others. Plastic is a widely used and fast-increasing raw material which is utilized in the manufacture of sterile medical packaging industry. They are majorly chosen in medical packaging and comprise polypropylene (PP), polyvinyl chloride (PVC), high-impact polystyrene (HIPS), polycarbonate (PC), high-density polyethylene (HDPE), and polyethylene terephthalate (PET).

These plastic packaging are a suitable choice for sterile medical packaging products as they deliver easy moldability, protective properties, and cost-effectiveness. They shield the packed devices, medical instruments, and drugs from contamination and damage. Plastics are used in manufacturing thermoformed blister trays and packs, closures, vials, bottles, overwraps, pouches and bags.

Based on product the thermoform trays are the most extensively used sterile medical packaging market. These are primarily produced utilising rigid material and have several compartments to support the medical products. These thermoform trays are widely used to pack sutures, sensitive surgical items, testing kits, and implants. The rising demand for single-use medical products and the growing importance of contamination control in healthcare are prime drivers boosting the acceptance of thermoform trays in the sterile medical packaging sector.

Based on sterilization procedure, the market is categorized into chemical sterilization, high temperature/pressure sterilization, and radiation sterilization. The chemical sterilization segment is further classified into hydrogen peroxide, ethylene oxide (ETO), and others. Likewise, the radiation sterilization segment is sub-categorized into e-beam, gamma radiation and others. Moreover, the high temperature/pressure sterilization process is divided into the dry heat and steam autoclave. Chemical sterilization packaging is the fastest-growing procedure accepted in the sector, in which ethylene oxide is the most influential chemical utilized for sterilization. It has an alkyl property that disturbs the reproductive methods and cellular metabolism of microbes.

Additionally, it is suitable for many materials, comprising glass and plastics, that are reduced by heat or radiation sterilization. Chemical sterilization is an extensively used technique in the healthcare sector, and its demand is anticipated to increase because of the growing consciousness about contamination control and the rising requirement for sterile medical packaging solutions. Overall, the chemical sterilization process is anticipated to play an important role in the progress of the sterile medical packaging market, influenced by its efficiency in contradicting microbes and its extensive range of submissions in the healthcare sector.

The speedily growing infectious and non-infectious diseases have resulted in an upsurge in the number of patients. This has led to a growing demand for medicine and blood tests. These aspects are anticipated to raise the demand for these packaging in pharmaceutical & biological usage and thus influence the market development. The pharmaceutical & biologics segment is a noteworthy and increasing part of the sterile medical packaging market.

This sector is anticipated to lead the market because of the rising demand for safe and effective treatments. The requirement for sterile medical packaging in the In-vitro Diagnostics sector is influenced by the growing need for precise and consistent diagnostic tests, along with the rising consciousness of the importance of contamination control in healthcare sector.

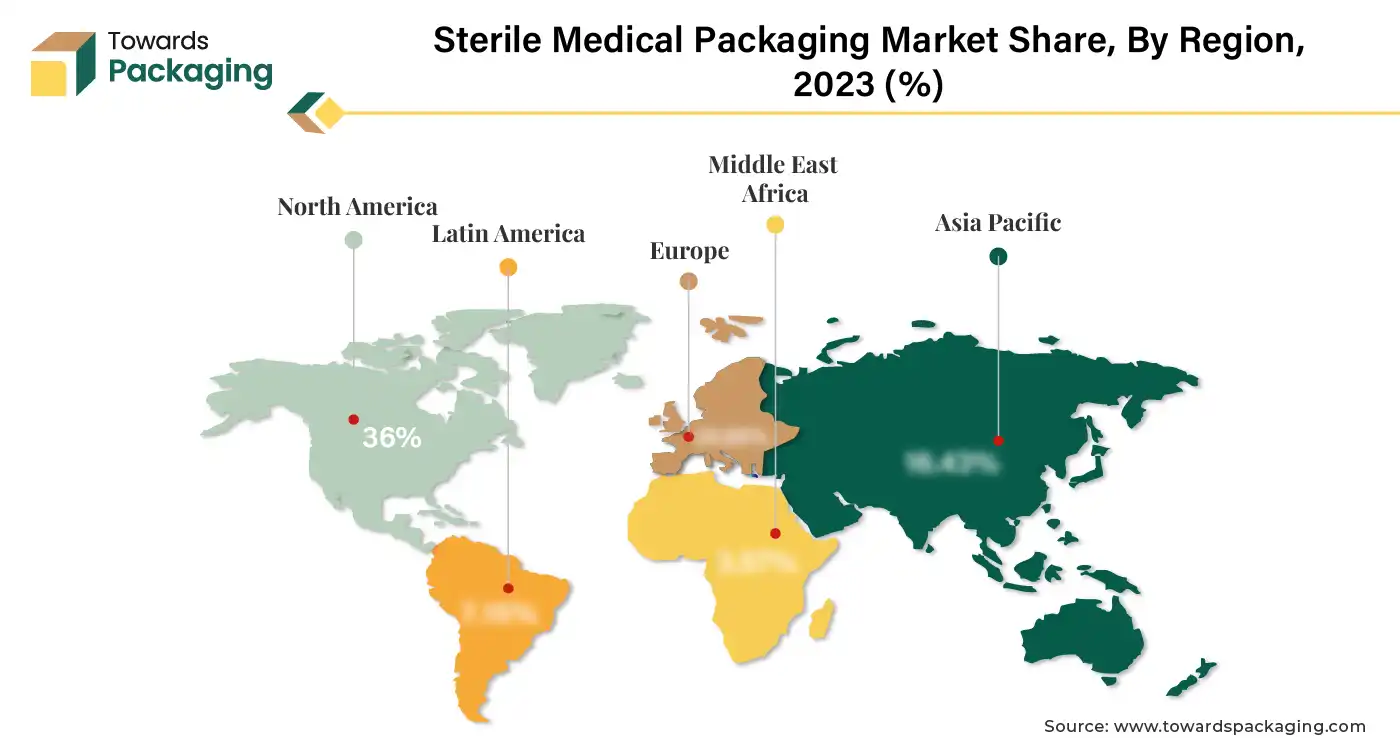

North America witnessed the largest market share for the year 2024 this growth is due to the growing brand production there is a high demand for enhanced and sterilized production of excellent packaging. The government is continuously working towards the enhancement of the packaging of medical products which can be stored for a longer duration without any risk of contamination.

The growing healthcare infrastructure also contributes significantly towards the growth of the packaging industry. With the growing number of infrastructure the demand for equipment also growing which results in the rising demand for packaging production and hence enhances the growth of the market. The government plays a significant role in providing funds for research and studies which help pharmaceuticals to produce new medicines and products with growing requirements.

In countries such as the U.S. and Canada, there is a huge rise in the establishment of brands that manufacture sterile medical packaging using advanced technology. Major market players such as Amcor, Technipaq, SteriPack, Berry Global, Oliver, Nelipak Healthcare Packaging, Almac, West Pharmaceutical Services, and other companies play a significant role in the development of the market. As with growing brands, there is a growth in the quality of the packaging products.

Asia Pacific is estimated to grow at the fastest rate over the forecast period. The market is growing significantly due to the rising demand for pharmaceutical products across all countries such as India, Japan, South Korea, China, and Thailand. Continuous initiatives by the government have also resulted in the growth of the production of pharmaceutical products which needed sterile packaging for safe storage and transportation of products.

Advancements in the technology of packaging to keep products safe from contamination such as moisture, air, water, light, or any external agent. In November 2023, Coveris, announced the launch of a new recyclable, flexible thermoforming film solution named Formpeel P.

Single-use packaging is highly preferred in this region to avoid any infection and advanced technology is incorporated to manufacture such products. This market is highly influenced by eco-friendly packaging due to the stringent guidelines of the packaging industry. Several market players such as SteriPack Contract Manufacturing, Nelipak Healthcare Packaging, West Pharmaceutical Services, Placon Corporation, ProAmpac, Technipaq, Inc., DuPont, and many others have continuously brought innovation to this market which resulted in the growth of the market.

By Material Type

By Product Type

By Sterilization Method

By Application

By Region Covered

April 2025

April 2025

April 2025

April 2025