May 2025

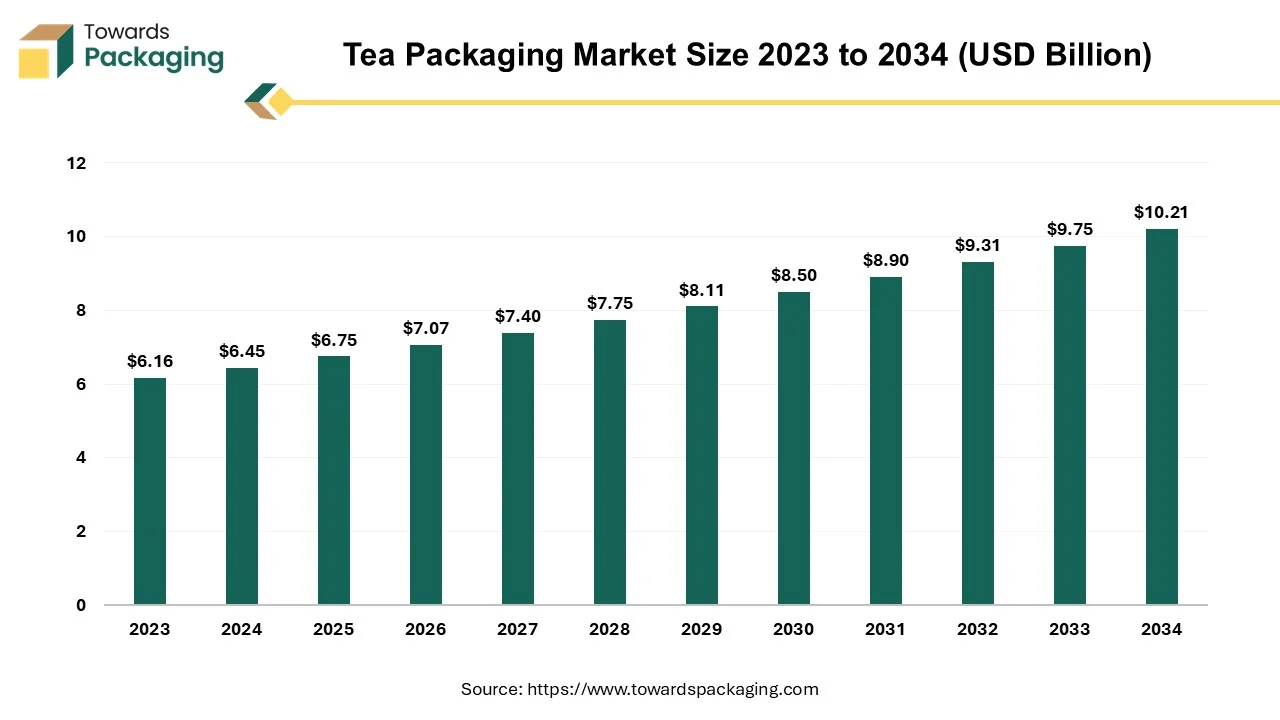

The tea packaging market is forecast to grow from USD 6.75 billion in 2025 to USD 10.21 billion by 2034, driven by a CAGR of 4.7% from 2025 to 2034.

Tea is the plant's leaves, leaf buds, and internodes that have been dried and prepared for drink use. This drying process can be done immediately with heat or after fermentation.

Tea is the world's second most consumed beverage, with a vast global following of tea drinkers. The global tea market, worth a whopping US$ 21 billion, is still proliferating, with per capita tea consumption increasing by 2.5% over the last decade, notably in tea-producing regions. Given these developments, the significance of strategic tea packaging decisions for businesses operating in this fast-paced industry cannot be emphasized. Traditionally, tea packaging has depended on traditional materials such as boxes and tins. However, the scene is fast changing, owing to the rise of online sales platforms and subscription models, which have fundamentally altered how tea products are advertised and distributed. In response to these shifting dynamics, great tea companies increasingly adopt flexible packaging solutions to comply with changing consumer preferences and market trends.

Flexible packaging has numerous benefits, including increased security, branding options, and improved retail capabilities. Furthermore, it offers significant cost savings in shipping and user convenience through resealable features and increases product shelf life, making it an excellent alternative for forward-thinking tea producers.

Tea production substantially contributes to the global packaging business, with critical producers including China, India, Sri Lanka, and Kenya. China's tea production in 2022 was roughly 3.18 million metric tonnes, a modest rise over the previous year's output of around 3.12 million. China, India, Sri Lanka, and Kenya are the world's major tea exporters. The expansion in tea production in these nations meets the global demand for tea. It drives the packaging market as the demand for efficient and sustainable packaging solutions rises to accommodate the growing volume of tea exported.

Tea brands' marketing strategies rely heavily on their packaging. Whether catering to the mainstream market or specializing in artisanal teas, packaging options are critical for businesses to position their brand, communicate their values, and connect with their intended audience. Customer preferences for tea packaging are changing, with an increased emphasis on sustainability and environmental responsibility. Recognizing this transition, industry leaders like Swiss Pack have significantly invested in research and development to provide environmentally friendly tea packaging solutions. These innovations include 100% recyclable pouches for tea bags or loose tea and the use of ethically produced paper in creating kraft packaging, which responds to the tea market's growing desire for eco-friendly packaging solutions.

For Instance,

The Asia Pacific region leads the global tea packaging market because of several characteristics, such as solid health positioning, a strong cultural affinity for tea, competitive price, and local production capabilities. Strong tea cultures, vast production facilities, and substantial populations are advantages for leading regional tea markets, including China, India, Japan, and Indonesia. In addition, there's a discernible upsurge in customer demand in the tea market for creative flavors, various origins, and sustainability.

China's global tea exports are growing at a CAGR of 0.57%, a noteworthy growth trajectory. But by 2022, China's CAGR had risen to a remarkable 9.18%, indicating a notable acceleration of export development in recent years.

Black tea remains dominant in the market due to its vast availability and low cost despite severe competition from green tea and fruit/herbal tea variations. In emerging markets such as India, black and green tea has emerged as the fastest-growing category in recent years, introduction of new variations and increased knowledge of its health advantages.

For Instance,

India ranks among the world's top five tea exporters, accounting for around 10% of global exports. From April to October 2022-23 (provisional), India's tea exports totalled US$ 474.22 million. Indian Assam, Nilgiri, and Darjeeling teas are regarded as some of the finest in the world. The majority of tea exported from India is black tea, which accounts for around 96% of total exports. Exported through India include black tea, green tea, regular tea, masala tea, herbal tea, and lemon tea. Black, regular, and green tea account for around 80%, 16%, and 3.5% of India's total tea exports, respectively.

Tea companies actively aim to attract customers by using elegant packaging and obtaining loose tea leaves grown nearby. For example, TWG Tea in Singapore debuted a limited-edition Darjeeling Nouveau, known as the "king of black teas." Packed in gold to exude grandeur and superior quality, the loose black tea leaves are sourced from the Himalayas. To advertise their high-end products and increase sales, tea companies use e-commerce platforms. Cooperations like the one between JD and the China Tea Marketing Association seek to advance the digitalization of the tea sector by enticing consumers to upgrade to higher-quality teas through improved e-commerce activities over five years.

The industry's dedication to adjusting to shifting customer tastes and utilizing digital platforms for market expansion and brand promotion is emphasized by this strategic approach.

For Instance,

Europe, which comes in right behind Asia Pacific, is the second-largest market for tea packaging. Interest in premium specialty teas has significantly increased throughout Europe and other developed countries with developed markets. Green and fruit teas are becoming more popular because of their purported health benefits and changing customer preferences. Customers are increasingly looking for distinctive and high-quality tea kinds to improve their tea-drinking experience, which is particularly noticeable in Europe. With an incredible 1,300 cups of tea consumed on average per person each year, Turkey is the country that consumes the most tea worldwide. Tea is a significant part of Turkish society and daily life, as this outstanding tea culture highlights.

Turkey's tea industry generated US$3.5 billion in revenue in 2024, demonstrating the beverage's enormous economic significance. The European tea packaging market is changing due to consumers' interest in specialty teas and unusual flavors. In response to consumer demand, brands provide a wide assortment of premium teas in creative and eye-catching packaging designs. To satisfy the changing needs of contemporary consumers, packaging options that put sustainability, convenience, and product freshness first are included.

Tea packaging companies can benefit greatly from the growing popularity of tea in Turkey. Innovative packaging ideas are needed to meet the ever-increasing demand for tea in Turkey and improve the attractiveness and accessibility of tea products. Consumer preferences are evolving towards higher-quality specialty teas, which is driving a transition in the tea packaging market in Europe. Turkey is the country that consumes the most tea worldwide, so the European tea packaging market has a tonne of room to grow and innovate. In this dynamic and quickly changing market landscape, brands that can effectively adapt to changing consumer demands and preferences will stand to benefit.

For Instance,

Tea bags have emerged as the dominating material in the tea packaging market, owing to their widespread acceptance among customers. The primary goal of tea packaging is to protect the tea's remarkable quality from the moment it leaves the factory until it reaches the cup. Surprisingly, 51% of tea drinkers only use tea bags, with an additional 20% preferring this packing method. The meticulous design of the tea bag, where every detail matters, is where the journey of tea packing starts. The tea bag in the shape of a pyramid is distinctive in its practical design and visual appeal. It enhances the flavor profile by giving the tea leaves enough room to unfold and fully infuse. The transparent design of pyramid tea bags enhances the visual tea-drinking experience by letting customers see the extra ingredients.

A ground-breaking invention in the tea bag packaging sector has wholly transformed the packaging process. A state-of-the-art robotic feed system that automates tea bag handling and ensures accurate placement along a controlled input line must be developed to achieve this. These technological developments raise the bar for the industry by significantly improving packaging process accuracy and efficiency. Despite the ubiquitous packaging, British people have a stronger attachment to tea bags than Americans. Tea bags account for an astounding 96% of all tea consumed in Britain, demonstrating the popularity and broad acceptance of this type of packaging.

The specifications for tea bags and loose-leaf tea packaging are the same; they emphasize portability, maintaining nutritional value, and shielding the product from moisture and light. Tea packaging innovations are essential to satisfying customer expectations and improving the tea-drinking experience as tea consumption continues to evolve.

For Instance,

Black tea is the most popular product category within the tea packaging market due to its extensive appeal and strong market presence; up until 2030, the output of black tea is expected to rise by 2.1% annually on average, indicating a continued need for this popular beverage. Global consumption of black tea has increased by 3.5% in the last ten years, primarily due to solid growth in tea-producing countries that have more than offset the decline in import demand in traditional tea-importing regions. Harvard University research has shown substantial health advantages linked to black tea drinking. People who drank at least one cup of black tea daily showed an astounding 44% lower chance of having a heart attack. This research shows the increasing awareness of black tea as a beverage that promotes health, which is driving up consumption, which is expected to rise by 2% over the next ten years.

China, one of the top five producers of black tea, is expected to see significant development, with an annual consumption growth rate of 4.9%. Increased knowledge of black tea's health advantages and the appeal of other types, like pu'er tea and dark tea, are credited with this growth.

For Instance,

Black tea is frequently packaged using compression, albeit this technique is not as popular. Black tea packaging usually reflects the qualities of the tea itself; robust teas are matched with equally potent colors. For example, rooibos tea, which has a reddish-brown color, can be packaged in warm earth tones, whereas black tea is typically packaged in black packaging. Precise and convenient folding boxes are well-liked, tried-and-true black tea packaging. These boxes retain the tea bags precisely and function as a resealable dispenser to keep the tea's aroma fresh for longer. Folding boxes continue to be a traditional option for packaging black tea because of their adaptability and practicality, which satisfies the demands of both producers and customers.

For Instance,

The competitive landscape of the tea packaging market is characterized by established industry leaders such as Swiss Pack, DS Smith Plc, Tetra Pak, Huhtamaki, Blue Ridge Tea and Herb Company, Cascades Inc., Aero-pack Industries, Teepack, Novoflex, Heyne & Penke Verpackungen, Scholle IPN and Coveris These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences.

Swiss Pack's expertise in tea packaging is reflected in its varied selection of packaging solutions, which include pouches, bags, and sachets designed to keep tea fresh, flavourful, and aromatic. Swiss Pack provides customizable packaging solutions for loose-leaf tea, tea bags, and specialized mixes.

Huhtamaki, a global packaging solution manufacturer, has a substantial presence in the tea packaging market. Huhtamaki, with its expertise in sustainable packaging and inventive solutions, provides a variety of packaging alternatives customized to the unique demands of tea producers and consumers globally.

For Instance,

Tetra Pak's tea packaging offerings come in various formats, such as cartons, pouches, and bottles, and are suitable for both hot and cold tea products. These packaging methods provide multiple advantages, including increased shelf life, protection from light and air, and easy storage and transportation.

By Material

By Product Type

By Region

May 2025

May 2025

May 2025

May 2025