April 2025

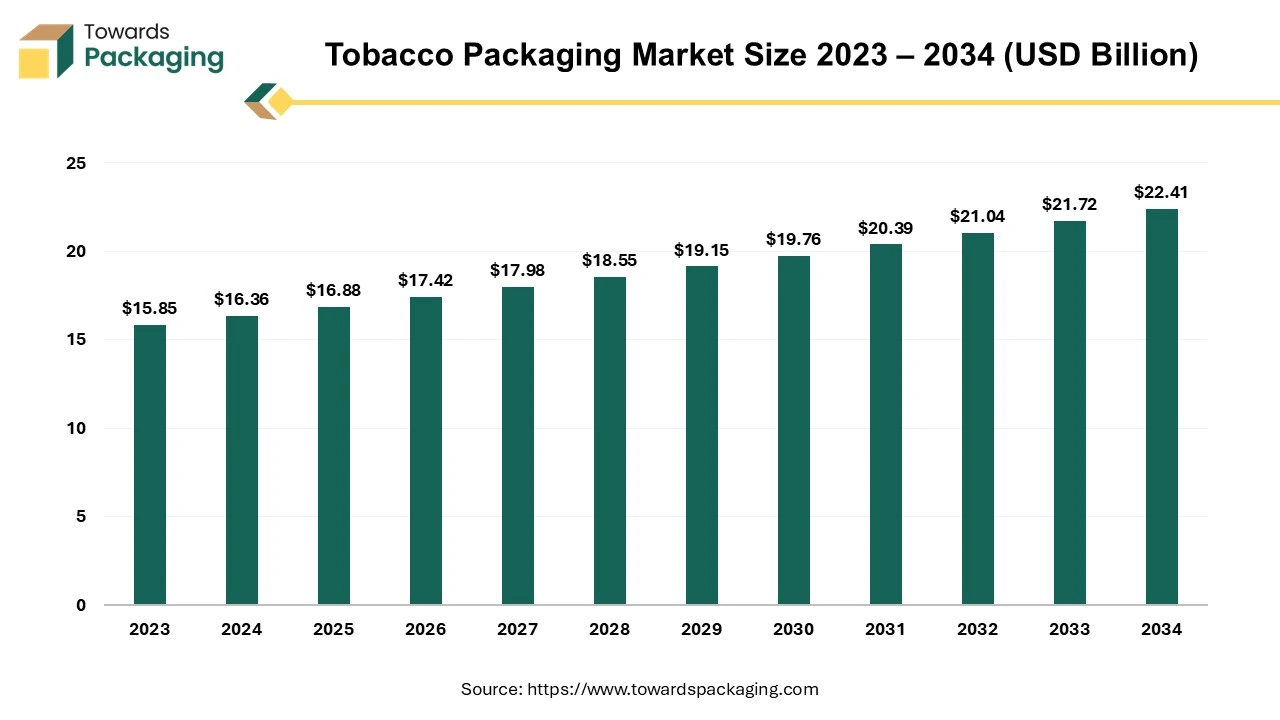

The global tobacco packaging market size reached US$ 16.36 billion in 2024 and is projected to hit around US$ 22.41 billion by 2034, expanding at a CAGR of 11.05% during the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing tobacco packaging which is estimated to drive the global tobacco packaging market over the forecast period.

Tobacco packaging plays a significant role in both marketing and public health. Historically, tobacco companies utilized attractive colors, designs, and branding to make their products appealing. However, as the health risks of smoking became more widely recognized, governments worldwide began regulating packaging to reduce its appeal, especially to young people. The tobacco packaging is crucial for tobacco marketing, as advertising restrictions increase worldwide.

Governments worldwide are implementing stricter regulations to curb tobacco use. Measures such as plain packaging laws, which standardize pack appearance and remove branding elements, are becoming more common. For instance, new laws have been introduced requiring vapes to use plain packaging similar to tobacco products, aiming to reduce their appeal, especially among younger populations.

The market is witnessing a surge in alternative nicotine products like nicotine pouches. Brands such as Zyn have gained popularity due to their discreet use and absence of smoke or vapor, appealing to a broad demographic seeking alternatives to traditional tobacco products.

With growing environmental awareness, tobacco companies are adopting eco-friendly packaging solutions. This includes using biodegradable materials and reducing plastic components to minimize environmental impact. These trends indicate a dynamic tobacco packaging market adapting to regulatory pressures, consumer health consciousness, and sustainability demands.

With e-cigarettes and other new tobacco products becoming more and more popular, there is a growing need for child-resistant packaging to prevent accidental consumption and poisoning of tobacco products.

Although paper and plastic are still the most common materials, businesses are looking into recyclable and biodegradable alternatives as part of a push for sustainable and eco-friendly materials.

Artificial Intelligence (AI) is transforming the tobacco packaging industry by enhancing manufacturing efficiency, regulatory compliance, anti-counterfeiting measures, supply chain transparency, and sustainability efforts. AI-powered computer vision systems can detect packaging defects (misaligned prints, incorrect labels, torn seals) with high accuracy. The artificial intelligence integration ensures consistent branding and regulatory compliance, reducing product recalls.

AI-integrated robots and cobots (collaborative robots) enhance precision in cutting, folding, and sealing cigarette packs. AI-driven IoT sensors monitor packaging machines, predicting failures before breakdowns occur. AI tools customize warning labels based on region-specific legal requirements. Automates compliance with EU TPD (Tobacco Products Directive), FDA regulations, and WHO guidelines. AI-powered track-and-trace technology prevents illicit trade and tax evasion. AI-enhanced holograms, security inks, and invisible watermarks improve brand protection. AI-enhanced holograms, security inks, and invisible watermarks improve brand protection. Machine learning can analyze patterns in counterfeit product distribution and identify high-risk areas.

Smokeless tobacco products like chewing tobacco, snus, and nicotine pouches are growing in popularity, requiring custom packaging solutions. Heated tobacco products (HTPs) like IQOS and Glo demand premium, eco-friendly, and innovative packaging designs. Hence, the expansion of smokeless tobacco & heated tobacco products (HTPs) has estimated to drive the growth of the tobacco packaging market over the forecast period.

According to a KT&G spokesperson, "Pod products will be released irregularly, but devices are typically updated every one to two years." The three gadgets that KT&G presently sells in the Korean market are the "Lil Solid 3.0," "Lil Able 2.0," and "Lil Hybrid 3.0." The most recent product launch was in September 2024, when the upgraded version of "Lil Solid 2.0" called "Lil Solid 3.0" was introduced.

The key players operating in the market are facing issue due to stringent government regulations, shift to alternatives packaging options and decline in smoking habits has estimated to restrict the growth of the tobacco packaging market in the near future. Many countries, including Australia, Canada, UK, India, and France, have enforced plain packaging rules restricting branding and reducing packaging appeal. Logos, colors, and design elements are prohibited, negatively impacting premium tobacco packaging sales.

WHO’s Framework Convention on Tobacco Control (FCTC) promotes tobacco control policies worldwide. Public awareness campaigns encourage smoking cessation, reducing demand for tobacco products. Consumers are shifting toward e-cigarettes, vaping products, and nicotine pouches, which use different packaging formats. Reduction in the demand for traditional cigarette and cigar packaging.

QR codes, augmented reality (AR), and RFID tracking allow brands to engage consumers with authentication, promotions, and storytelling. Smart packaging solutions help in counterfeit prevention and consumer interaction. Increasing launch of the smart & interactive packaging has estimated to create lucrative opportunity for the growth of the tobacco packaging market in the near future.

Growth in recyclable and biodegradable packaging solutions due to sustainability initiatives. Coated paperboard with moisture-resistant properties replaces traditional plastic-based packaging.

The paper & paperboard segment held a dominant presence in the tobacco packaging market in 2024. The paper & paperboard segment is the dominant material in the tobacco packaging market due to its cost-effectiveness, sustainability, branding flexibility, regulatory compliance, and protective qualities. Paperboard is biodegradable, recyclable, and sourced from renewable resources. Paperboard-based tobacco packaging is lightweight, reducing shipping costs and carbon emissions. Cigarette packaging requires billions of units annually, making paperboard the most scalable and economically viable material. Paperboard allows high-resolution printing, embossing, foil stamping, and gloss/matte finishing.

The secondary segment accounted for a significant share of the market in 2024. Secondary packaging allows advanced printing techniques, such as embossing, metallic foiling, matte/gloss coatings, and textured finishes. Secondary packaging allows advanced printing techniques, such as embossing, metallic foiling, matte/gloss coatings, and textured finishes. Secondary packaging offers structural integrity, making it ideal for long-distance shipping and retail displays. Online tobacco sales require sturdy secondary packaging to ensure safe delivery and brand appeal.

The boxes segment registered its dominance over the global tobacco packaging market in 2024. Boxes allow premium printing techniques like embossing, foil stamping, matte/gloss coatings, and textured finishes. High-end tobacco products use rigid boxes with premium finishes to enhance perceived value. Boxes provide ample space for large text and graphic warnings without affecting product integrity. Boxes allow easy integration of authentication features to combat counterfeiting. As the boxes packaging prevents crushing, moisture damage, and freshness loss and hence more in high in demand.

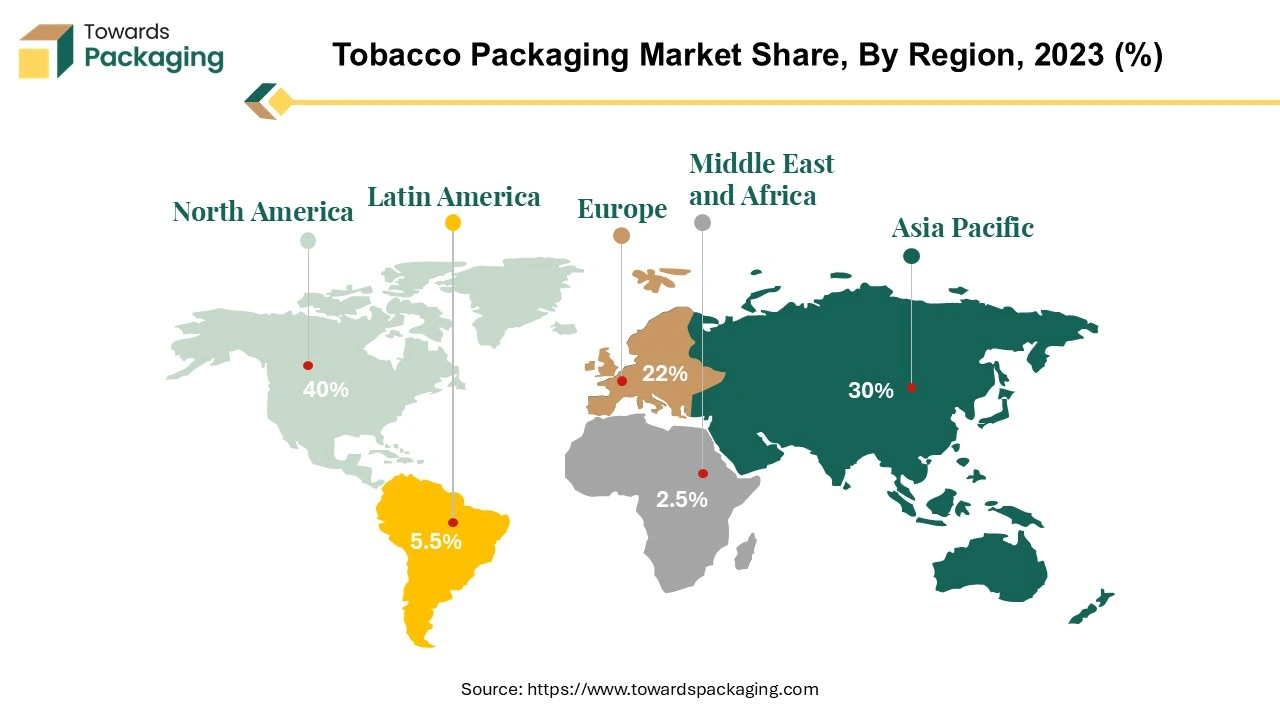

Asia Pacific region dominated the global tobacco packaging market in 2024. China, India, Indonesia, and Japan account for over 60% of global tobacco consumption, driving demand for cigarette and cigar packaging. India and Bangladesh have a large market for chewing tobacco, snuff, and bidis, requiring specialized packaging solutions. China, India, and Indonesia are among the world’s largest tobacco producers, requiring high volumes of cigarette cartons, soft packs, and rigid boxes.

China, Japan, and South Korea have a growing market for premium cigars, hand-rolled cigarettes, and limited-edition tobacco products, requiring rigid boxes, gold foils, and embossed designs. Major tobacco companies such as China National Tobacco Corporation, ITC Limited (India), and Japan Tobacco International (JTI) drive demand for customized and high-volume packaging solutions.

China Tobacco Packaging Market Trends

China alone consumes over 40% of the world's cigarettes, making it the largest driver of tobacco packaging demand. China has a well-developed supply chain for paperboard, aluminum foil, and flexible packaging materials, reducing production costs. China exports tobacco products to several countries, driving demand for export-grade cigarette cartons and duty-free packaging. Luxury packaging solutions for premium Chinese cigarette brands (e.g., Chunghwa, Panda) are highly sought after in global markets. China’s cigar market is growing, leading to increased demand for wooden boxes, rigid gift boxes, and high-end tobacco pouch packaging.

North America region is anticipated to grow at the fastest rate in the tobacco packaging market during the forecast period. The U.S. and Canada have a growing consumer base for vaping products, nicotine pouches, and heated tobacco. These products require specialized packaging solutions, including tamper-proof, child-resistant, and moisture-protective materials. Brands like ZYN, On!, and Velo have expanded their market share, driving demand for compact, resealable tins and biodegradable pouches.

The U.S. is a leading market for premium cigars, boosting demand for rigid boxes, wooden cases, and metallic embossed packaging. Altria, Philip Morris International, British American Tobacco (BAT), and Japan Tobacco International (JTI) are investing in advanced tobacco packaging solutions in North America. The presence of these key players ensures continuous innovation in materials, design, and compliance strategies.

U.S. Tobacco Packaging Market Trends

The U.S. tobacco packaging market is estimated to grow at rapid rate due to the technology advancement in the tobacco packaging. Philip Morris’ IQOS and BAT’s Glo are expanding in the U.S., requiring premium and eco-friendly packaging formats. The premium cigar market in the U.S. is growing, leading to an increase in rigid boxes, wooden cases, and metallic-embossed cartons. U.S. regulations discourage single-use plastics, prompting a shift to eco-friendly tobacco packaging solutions. U.S. international airports are major hubs for duty-free tobacco sales, increasing demand for premium multipack and gift-set packaging

Europe region is seen to grow at a notable rate in the foreseeable future. Europe is the largest market for heated tobacco products (HTPs) outside Japan, with brands like IQOS (Philip Morris) and Glo (BAT) expanding. Many European countries (e.g., France, UK, Ireland, Norway) enforce plain packaging rules, reducing branding but increasing demand for compliant yet innovative packaging formats. The EU Tobacco Products Directive (TPD) mandates track-and-trace systems, tax stamps, and authentication features on all tobacco packaging. Luxury cigar sales are rising across Spain, Germany, and the UK, increasing demand for wooden boxes, embossed rigid cartons, and high-end foil packaging.

According to Katarzyna Wasilewska, research and development manager at Masterpress, the Siegwerk Druckfarben AG & Co. KGaA company committed to promoting innovation in the shrink sleeve and self-adhesive label industry and are in a strong position to assist in expediting the commercialization of new, sustainable, recyclable products and materials on the market. The UV-printed PE labels' remarkable recyclability was validated by conducting experiments. Siegwerk's UV Deinking Primer significantly reduced the contamination of plastic recycling materials caused by discolouration when compared to other labels that lacked deinking technology.

By Material

By Packaging

By Product

By Region

April 2025

April 2025

April 2025

April 2025