March 2025

.webp)

Principal Consultant

Reviewed By

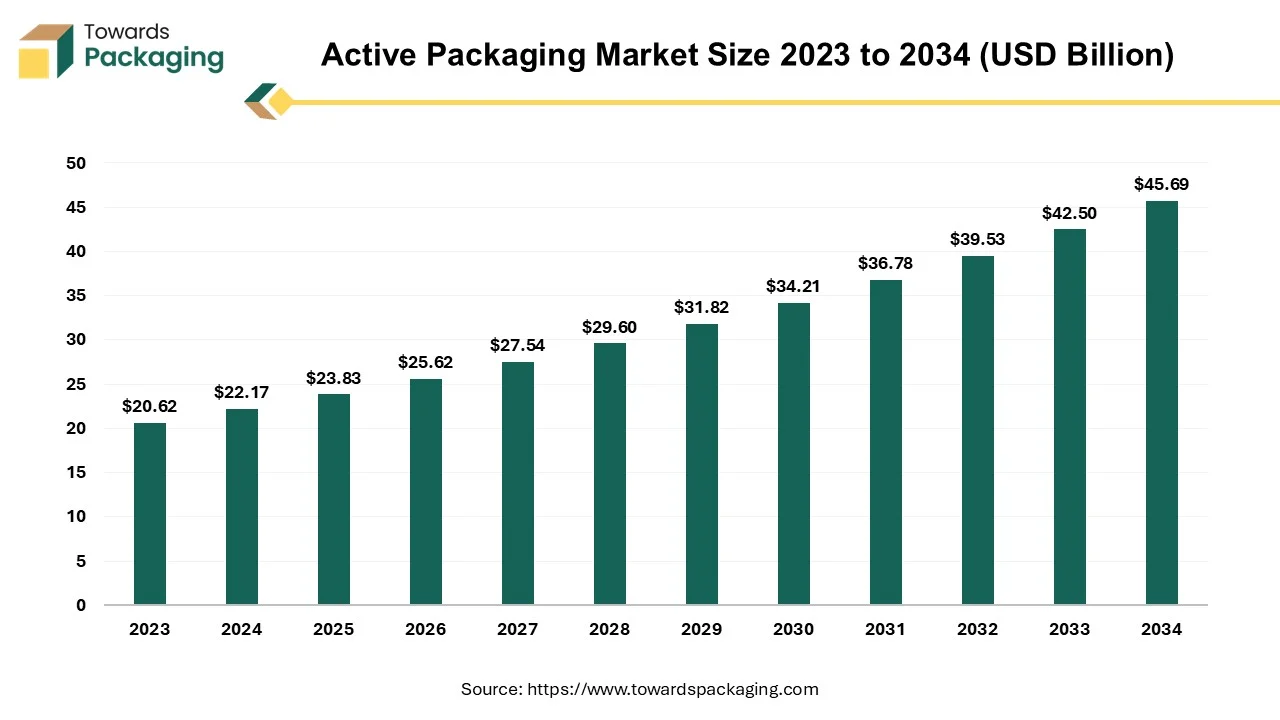

The active packaging market is projected to reach USD 45.69 billion by 2034 growing from USD 22.17 billion in 2024, expanding at a rapid CAGR of 7.5% between 2025 and 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing active packaging which is estimated to drive the global active packaging market over the forecast period.

The advanced type of packaging engineered to interact with the product which contains to extend shelf-life, maintain quality, and enhance safety is known as active packaging. The active packaging only serves as a passive barrier, active packaging actively responds to environmental changes and improves the condition of the packaged product. The key functions of active packaging are extending shelf life, maintaining freshness, enhancing safety, and improves product quality.

The innovation of modified atmosphere packaging (MAP) has adjusted composition of gases inside packaging to extend shelf life, accounts for over 50% of total demand in the active packaging sector. Food deteriorates in quality and spoils naturally as result of oxidation, which happens when it is exposed to air. This especially problematic for goods that contain a lot of oils and fats because they are more prone to oxidation.

Increasing environmental awareness is prompting companies to innovate eco-friendly and biodegradable active packaging materials, aligning with global sustainability goals and reducing reliance on plastics. For instance, in September 2024, according to power adhesives company, its biodegradable hot melt adhesive is a “world first” and is intended for use by contract packers, point of sale (POS) converters, cartons, and corrugated packaging.

According to certification, the adhesive is guaranteed to decompose entirely in the presence of oxygen, producing only harmless byproducts and no microplastics. According to Power Adhesives, Tecbond 2014B is made up of 44% bio-based components and is approved by AST D6400 and EN13432, two European Union standards that outline the specifications for products that are biodegradable and compostable.

The artificial integration can significantly improve the active packaging market by optimizing production, enhancing quality control, and enabling smart packaging solutions. The artificial intelligence integration driven sensors can monitor temperature, humidity gas levels, and products freshness in real-time. Machine learning algorithms analyze this data to provide insights on product safety and shelf life.

For instance, AI –powered labels that change color when food spoils or temperature-sensitive packaging that alerts consumers to improper storage. The artificial intelligence powered computer vision can inspect packaging for defects, ensuring consistent quality and reducing product recalls.

When combined with AI models, smart packaging can allow patients and caregivers greater visibility and control over the appropriate dosage and impact of medications given to patients. Pharmacies can better manage their supply chain by tracking packages from manufacturing to final consumption, and consumers can now confirm product authenticity due to connected packaging, which also helps avoid the consumption of counterfeit medications.

As the online food and pharmaceutical sales rise, packaging that maintains product quality during shipping is in higher demand. Online retail involves longer supply chains and increased handling, requiring packaging that ensures product freshness, stability, and protection from external conditions like temperature fluctuations, moisture, and oxygen exposure. The rise of grocery and meal kit delivery services demands packaging that maintains food quality, prevents spoilage, extends shelf-life, especially for perishable goods. Active packaging solutions like antimicrobial films and oxygen scavengers help to maintain freshness during transit. Hence, the expansion of the e-commerce platform has estimated to drive the growth of the active packaging market in the near future.

For instance, according to the data published by the National Ecommerce Association, in 2025, online commerce will account for 21% retail sales, the largest percentage to date. By 2027, it is anticipated that 22.6% of all retail transactions will take place online. Since 2021, the percentage of retail purchases made online has increased by an average of 0.32% per year.

The key players operating in the market are facing issue due to regulatory challenges, limited consumer awareness, and compliance issues, which has estimated to restrict the growth of the active packaging market. Strict food safety and environmental regulations vary across regions, making compliance complex and costly. Approval processes for new packaging materials can be time-consuming. Many consumers and businesses are unaware of the benefits of active packaging or hesitate to pay a premium for it. Advanced materials, smart sensors, and specialized coatings increase production costs, making active packaging more expensive than traditional options.

Integration of technologies like QR codes, RFID, and time-temperature indicators can help track product conditions and enhance supply chain transparency. Smart packaging solutions that offer real-time freshness indicators appeal to both consumers and businesses. Governments and regulatory agencies are pushing for safer, more sustainable packaging solutions, creating opportunities for eco-friendly active packaging innovations.

Countries in Asia-Pacific, Latin America, and Africa are experiencing growing urbanization and packaged food consumption, creating a lucrative market for active packaging. Hence, adoption of active packaging in emerging markets has estimated to create lucrative opportunity for the growth of the active packaging market in the near future.

The oxygen scavenger segment held a dominant presence in the active packaging market in 2024. Oxygen exposure accelerates food spoilage, oxidation, and microbial growth. Oxygen scavengers helps extend shelf life, making them essential for packaged food, beverages, and pharmaceuticals. Oxygen scavengers are utilized in packaged meat, baked goods, dairy, snacks, and ready-to-eat meals to maintain freshness and prevent discoloration.

They are also used in beer, wine, and other beverages to prevent oxidation and flavor degradation. Many drugs and biologics degrade in the presence of oxygen. Oxygen scavengers ensure the stability of oxygen-sensitive medications, increasing their shelf life. New developments such as self-activating and biodegradable oxygen scavengers, are making them more efficient and sustainable.

The food and beverage segment registered its dominance over the global market in 2024. Active packaging solutions like oxygen scavengers, moisture absorbers, and ethylene absorbers helps to reduce spoilage, keeping food fresh for longer. Anti-microbial packaging prevents bacterial and fungal growth preserving taste, texture, and nutritional value. Shields food from moisture, oxygen, UV light, and temperature fluctuations, which can degrade quality. Smart packaging solutions, such as freshness sensors and time-temperature indicators, provide real-rime information on food quality.

Numerous companies have specialized in active packaging solutions for the food and beverage industry, offering technologies that enhances product freshness, extend shelf-life, and ensure safety. Amcor Group GmbH offers innovative active and intelligent packaging technologies for various industries, including beverages and food. Bemis company has specialized in flexible packaging solutions, offering active packaging options. Clariant international company is a specialised in chemicals company that provides additives and functional materials for active packaging applications in the food industry.

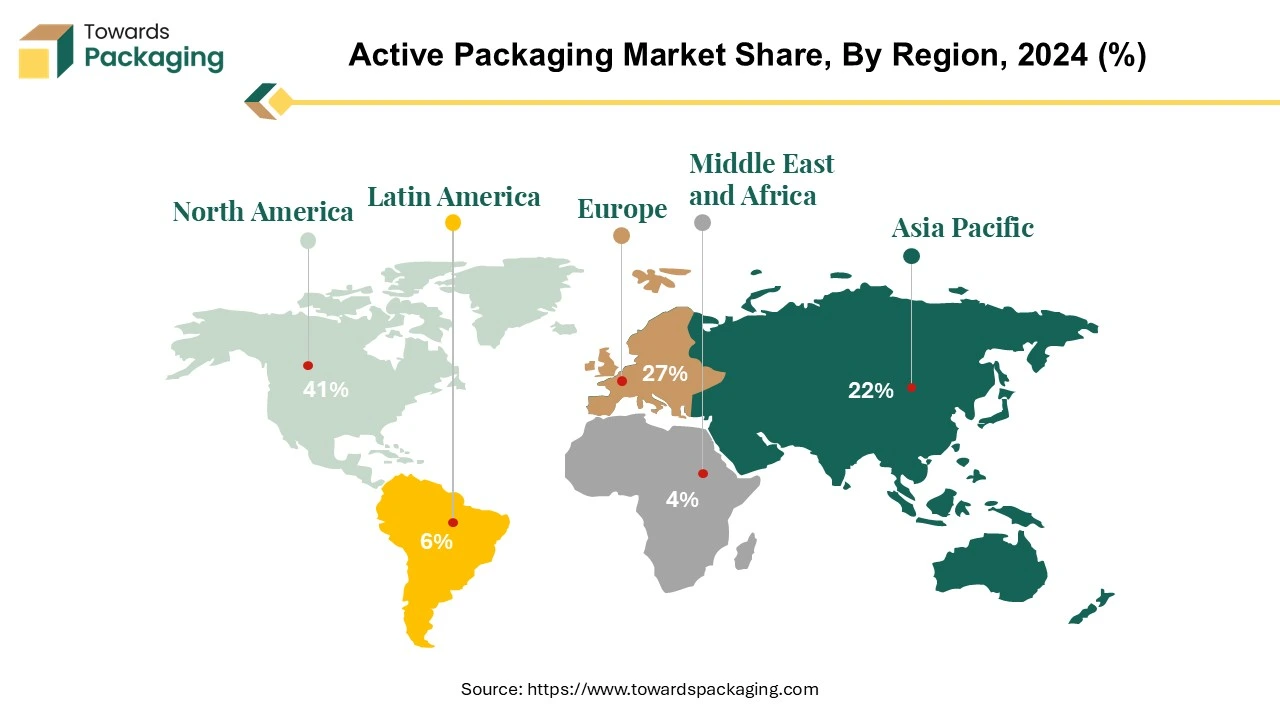

North America region held a significant share of the active packaging market in 2024. North America region has highest consumption of ready-to-eat meals, frozen foods, and snacks, driving the need for packaging that extends shelf life and maintains freshness. Companies in North America are developing intelligent packaging solutions with QR codes. Freshness sensors, and nanotechnology-based materials. Key Players in North America region, such as Amcor, Avery Dennison, Sealed Air, and Berry Global company, are investing in active packaging solutions.

U.S. market players play major role in active packaging industry. The more than half population of the U.S. earns more than average and due to this there is rising demand for fresh, minimally processed foods. As the U.S. market is mature and is home for various pharmaceutical industries the demand for the active packaging is high.

Asia Pacific region is anticipated to grow at the fastest rate in the active packaging market during the forecast period. Increasing urban populations and busy lifestyles drive demand for convenience foods, ready-to-eat meals, and packaged snacks, boosting the demand for advanced packaging solutions in Asia Pacific region. Rising income levels in countries like China, Southeast Asia and India are leading to higher consumption of premium, packaged and fresh food products, which require active packaging for quality preservation.

Asia Pacific is major hub for processed food, dairy, seafood, and meat industries, all of which require active packaging to extend shelf life and maintain freshness. India’s online food delivery platform Zomato, Swiggy, Swish has raised the demand for the active packaging in India. Asia-Pacific is a fast growing pharmaceutical market, increasing the demand for moisture-resistant, oxygen-absorbing, and temperature-sensitive packaging. Countries like China, Japan, India and South Korea have implemented strict food safety laws, pushing companies to adopt high-quality, functional packaging solutions.

China’s pharmaceutical sector is rapidly expanding, with increasing demand for moisture-resistant and oxygen-barrier packaging to protect drugs and medical supplies. The Chinese government promotes packaging innovation as part of its “Made in China 2025” strategy, boosting investment in smart and active packaging technologies. Chinese consumers are more health-conscious, demanding organic, fresh, and chemical-free foods, which require advanced active packaging solutions. Growth in premium and imported food products in China region has increased the demand for high-quality protective packaging.

Europe region is observed to grow at a considerable growth rate in the upcoming period. The European Food Safety Authority (EFSA) and EU regulations enforce strict guidelines on food quality, fostering the adoption of advanced active packaging solutions. Compliance with Regulation (EC) NO 1935/2004 ensures that packaging materials do not compromise food safety, increasing demand for oxygen scavengers, antimicrobial films, and moisture absorbers. The EU’s Circular Economy Action Plan and bans on single-use plastics push companies towards biodegradable and recyclable active packaging.

Europe leads in nanotechnology, intelligent sensors, and RFID-based active packaging for real-time food quality monitoring. Countries like Germany, the U.K. and France invest heavily in fresh indicators, smart labels, and temperature-sensitive packaging. The expansion of Amazon Fresh, Ocado, Carrefour, and local grocery delivery services increased the demand for protective, freshness-preserving packaging for online food distribution.

By Type

By Application

By Region

March 2025

March 2025

March 2025

March 2025