February 2025

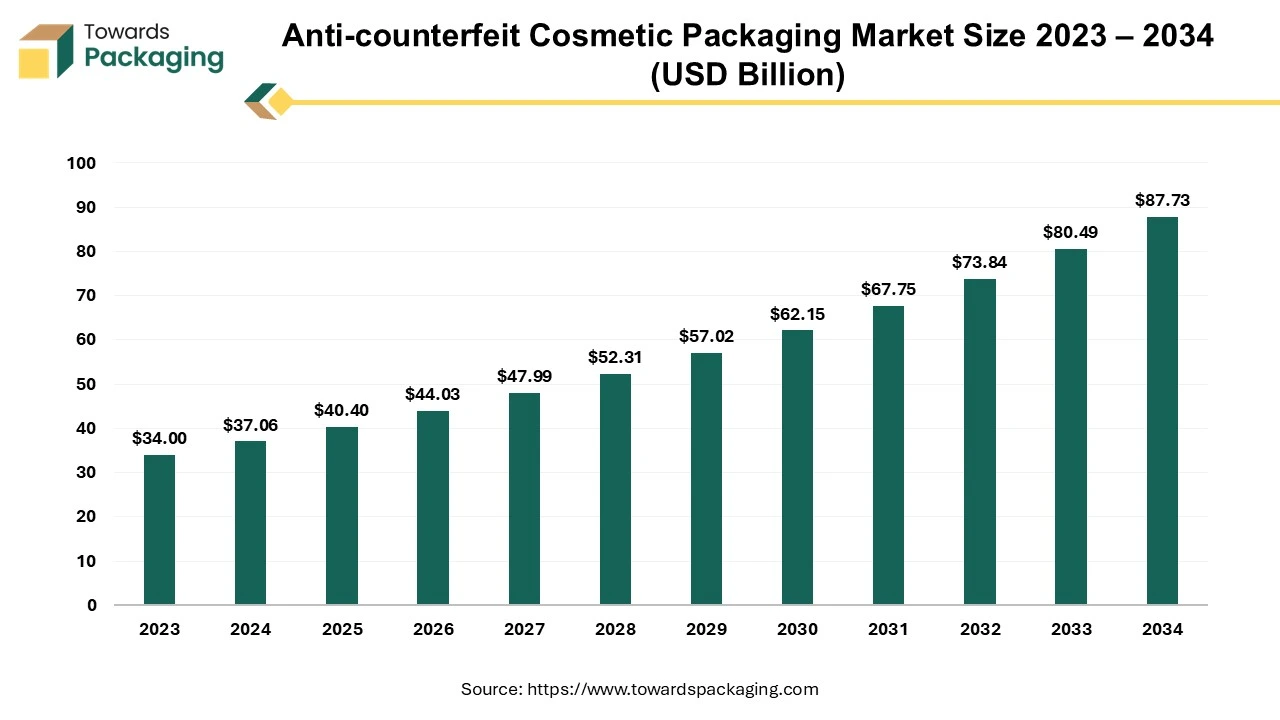

The global anti-counterfeit cosmetic packaging market size was evaluated at US$ 37.06 billion in 2024 and is expected to attain around US$ 87.73 billion by 2034, growing at a CAGR of 9% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Anti-counterfeit cosmetic packaging refers to packaging solutions designed to prevent the production and sale of fake beauty products. These solutions use advanced technologies and security features to help brands and consumers verify authenticity, protect brand reputation, and ensure product safety. Many leading cosmetic companies incorporate security holograms into their packaging. These holograms are challenging to replicate and provide a visual indication of authenticity. For instance, heat-shrink labels with integrated holograms have been utilized in the personal care industry to combat counterfeiting.

Some brands have adopted digital solutions, such as QR codes or NFC tags, allowing consumers to verify product authenticity using smartphones. For instance, NanoMatriX offers secure and smart packaging solutions with full-service anti-counterfeiting measures for the cosmetics industry. To ensure product integrity, companies use tamper-evident packaging that clearly indicates if a product has been interfered with. This includes specialized seals or packaging designs that reveal any unauthorized access. Advanced tamper-evident features make it evident if someone has attempted to tamper with the product, ensuring consumers receive genuine and untouched items.

Brands are increasingly integrating digital solutions such as QR codes and RFID technology into their packaging. These features allow consumers to verify product authenticity through smartphones, enhancing traceability and consumer trust.

There's a growing implementation of tamper-evident seals and closures in cosmetic packaging. These features provide visible indications of tampering, assuring consumers of product integrity and safety.

The use of holograms and other optical features is on the rise. These elements not only enhance the aesthetic appeal of packaging but also serve as security features that are difficult to replicate, aiding in counterfeit prevention.

The increasing demand for premium and luxury cosmetic products is driving the need for advanced anti-counterfeit packaging solutions. High-end brands are investing in sophisticated packaging to protect their products and maintain brand reputation.

There's a rising trend towards using sustainable materials in anti-counterfeit packaging. Brands are exploring eco-friendly options that do not compromise on security features, aligning with global sustainability goals.

AI can analyze patterns in QR codes or NFC tags to detect fakes by verifying authenticity in real time. AI can work with blockchain to create tamper-proof authentication systems that track every product's journey. Mobile apps with AI can scan product packaging and compare it to an authentic database to spot subtle differences in fonts, colors, or holograms. AI can detect microscopic variations in holograms, textures, or security labels, making counterfeiting harder.

AI can analyze shipping data and detect anomalies (e.g., unexpected distribution locations) that might indicate counterfeit activity. Smart packaging embedded with IoT sensors can report real-time location data and detect unauthorized diversions. Consumers can use AI-driven apps to scan and verify products before purchase. AI can analyze consumer complaints or return patterns to detect counterfeit hotspots and identify fraud trends.

AI can scan online marketplaces for suspect listings using image recognition and text analysis. AI can forecast counterfeiting risks by analyzing global counterfeit trends and emerging threats. AI can improve tamper-evident seals by analyzing user interactions and detecting packaging breaches. AI can help design unique, hard-to-replicate security patterns that change over time.

Scantrust provides an Internet of Things platform for identifying products online. They offer traceability for various industries, including luxury goods and food products, by using QR codes with an additional layer of protection against copying. Consumers can scan these codes with a smartphone to authenticate and track products, enhancing supply chain transparency and product authenticity.

Greyscale AI offers advanced imaging solutions that utilize AI and machine learning to inspect seals of pouches, bags, and rigid containers. Their technology measures and detects seal defects and strength, inspects traceability, and performs cloud analytics, ensuring product integrity and authenticity.

The rise of online shopping has made counterfeit cosmetics more accessible. Brands are strengthening packaging security to prevent fake products from infiltrating online marketplaces. Online marketplaces and social media platforms have become hotspots for counterfeit cosmetics, as fraudsters exploit the lack of physical verification. Fake products not only damage brand reputation but also pose health risks, increasing demand for anti-counterfeit packaging solutions like holograms, QR codes, and blockchain tracking.

Digital-savvy consumers are more aware of counterfeit issues and expect transparency and authenticity from brands. Smart packaging technologies such as RFID tags, NFC chips, and scannable QR codes help buyers verify product authenticity instantly. Governments and regulatory bodies are enforcing stricter anti-counterfeiting laws, especially in the cosmetics and skincare industry. Brands are investing in tamper-proof seals, serialized packaging, and blockchain-enabled traceability to comply with regulations and protect their market share. With eco-conscious consumers demanding sustainability, brands are integrating biodegradable anti-counterfeit solutions alongside smart tracking technologies. The surge in online and social media shopping is pushing brands to adopt innovative, tech-driven anti-counterfeit packaging solutions to ensure product authenticity, comply with regulations, and maintain consumer trust.

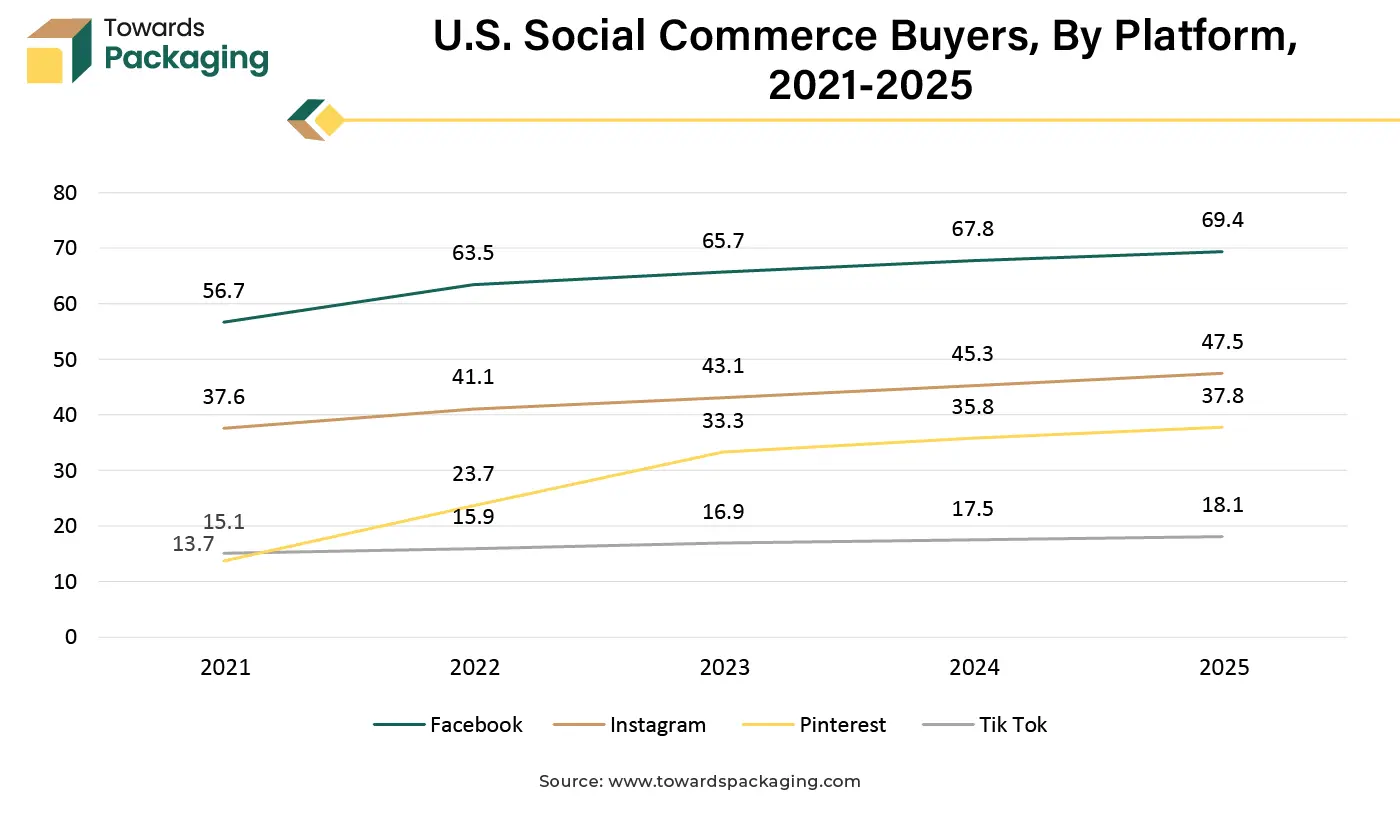

For instance, in December 2024, according to the data published by the B2B eCommerce Association, by 2025, Facebook is predicted to have 69.4 million American shoppers, making it the most widely used social media platform for social commerce. Twenty percent of the nation's population shops on social media. 47.5 million shoppers prefer Instagram, and TikTok is not far behind with an estimated 37.8 million users.With 18.1 million users anticipated to shop on the site this year, Pinterest is also becoming a dark horse in the social commerce race.

The key players operating in the market are facing issue due to lack of industry standardization and environmental concerns, which has estimated restrict the growth of the anti-counterfeit cosmetic packaging market in the near future. Advanced anti-counterfeit packaging technologies like RFID tags, holograms, and blockchain authentication can be expensive for manufacturers, especially smaller brands. The cosmetics industry relies on a global supply chain, making it difficult to track and authenticate every product effectively. Many consumers are unaware of anti-counterfeit features or how to verify product authenticity, reducing the effectiveness of these measures. The absence of universal anti-counterfeit packaging standards creates inconsistencies in implementation.

Governments worldwide are enforcing stricter anti-counterfeit packaging laws (e.g., serialization, track-and-trace systems). Compliance with regulations creates demand for advanced packaging solutions. For instance, in February 2025, according to data published by the International Trademark Association, Regulation (EU) 2025/40 on packaging and packaging waste (the Packaging and Packaging Waste Regulation (PPWR)) was released by the EU on January 22, 2025.

This comprehensive law will take the place of Directive 94/62/C on packaging and packaging waste once it is fully implemented. The PPWR creates regulations that address the full packaging life cycle.

By coordinating national policies, it helps the internal market run smoothly while preventing and reducing the harmful effects of packaging and packaging waste on the environment and public health. Along with provisions to decrease excessive packaging, including e-commerce packaging, improve recyclability, increase recycled content, phase out hazardous and harmful substances like perfluoroalkyl substances (PFAS), and encourage re-use, the PPWR also includes waste reduction measures and targets.

RFID segment held a dominant presence in the anti-counterfeit cosmetic packaging market in 2024. The global cosmetics industry faces a growing threat from counterfeit products, which can harm brand reputation and pose health risks to consumers. RFID helps verify product authenticity. RFID enables real-time tracking of cosmetic products from production to retail, ensuring supply chain integrity and preventing fake products from entering the market.

By embedding RFID tags, brands provide customers with a way to verify product authenticity using mobile apps or in-store scanners, boosting consumer confidence. RFID allows brands to integrate smart packaging features, such as interactive content and personalized experiences, enhancing customer loyalty and engagement. RFID helps manufacturers and retailers monitor inventory, detect fraud, and prevent unauthorized reselling of cosmetic products.

Bastille Parfums fragrance company has collaborated with Avery Dennison Smartrac to embed RFID tags into the outer packaging of its scent, Paradis Nuit. The integration allows Bastille Parfums to track each product's bottling date and location, offering consumers detailed information about fragrance composition, ingredient sourcing, and sustainability impact through an immersive mobile experience.

The bottles segment accounted for a significant share of the anti-counterfeit cosmetic packaging market in 2024. Bottled products, especially in pharmaceuticals, beverages, and personal care, are prime targets for counterfeiters. This drives demand for advanced anti-counterfeit solutions. Stringent regulations in industries like pharmaceuticals and food & beverage require secure packaging to ensure authenticity, making bottles a major focus for anti-counterfeit measures.

Bottles can easily incorporate security elements such as tamper-evident seals, RFID tags, holograms, and QR codes, enhancing product traceability and authentication. Bottles are widely used for medicines, alcoholic beverages, cosmetics, and high-value liquids, where counterfeiting can lead to health risks and economic losses. Brands and consumers prefer anti-counterfeit packaging in bottles because it reassures them about product authenticity and safety. The rise of smart packaging, including NFC-enabled caps and blockchain tracking, has further strengthened the dominance of bottles in the anti-counterfeit market.

The plastic segment led the global anti-counterfeit cosmetic packaging market. Plastic is widely used for anti-counterfeit cosmetic packaging because it offers a combination of security, customization, and cost-effectiveness. Plastic allows for advanced anti-counterfeit technologies like holograms, tamper-evident seals, RFID tags, and micro-printing, which are harder to replicate. Plastic is resilient to damage and can be designed with tamper-proof closures, ensuring product integrity. Manufacturers can create complex shapes, textures, and embossing that are difficult for counterfeiters to copy. Plastic can embed NFC chips or QR codes, enabling authentication through mobile apps. Some plastics provide added protection against UV rays and environmental factors that could degrade the product.

The skincare segment registered its dominance over the global anti-counterfeit cosmetic packaging market in 2024. Skincare products, especially luxury and dermatologist-recommended brands, are highly targeted by counterfeiters. This drives demand for advanced authentication solutions. Counterfeit skincare products can contain harmful ingredients, leading to skin damage or health issues. This makes tamper-evident and authentication technologies a priority for brands and regulatory bodies. Leading skincare brands invest heavily in track-and-trace technologies (RFID, QR codes, blockchain) and holographic labels to maintain brand integrity and protect consumer trust.

Online sales have made it easier for counterfeiters to distribute fake skincare products. This has led to increased adoption of digital anti-counterfeiting measures, such as smart packaging and blockchain-based authentication. Many skincare products fall under the luxury and premium category, making counterfeits more profitable for scammers. This drives brands to implement sophisticated anti-counterfeit packaging solutions to protect revenue.

With growing awareness of counterfeit risks, consumers are demanding verifiable, secure, and transparent packaging (such as NFC-enabled authentication via mobile apps). Governments and regulatory bodies (e.g., United States Food and Drug Administration, European Union Cosmetics Regulation) are increasingly mandating serialization, tamper-proof packaging, and authentication features to combat counterfeiting in skincare.

North America region dominated the global anti-counterfeit cosmetic packaging market in 2024. The U.S. and Canada have large luxury and premium cosmetic markets, making them prime targets for counterfeiters. Consumers in North America are highly aware of product authenticity and safety concerns, leading to demand for secure packaging solutions. The FDA (U.S. Food and Drug Administration) and Health Canada enforce strict regulations on cosmetic labeling, serialization, and product safety. Initiatives like the Drug Supply Chain Security Act (DSCSA) and emerging anti-counterfeit packaging mandates push companies to adopt advanced security measures. The region has one of the world's largest e-commerce beauty markets, increasing exposure to fake cosmetics sold online. To counter this, brands are using QR codes, blockchain, and AI-powered anti-counterfeiting solutions.

North America is a leader in smart packaging, including RFID tags, blockchain authentication, NFC-enabled packaging, and tamper-evident seals. Major companies invest heavily in track-and-trace systems to prevent counterfeit infiltration in supply chains. Major cosmetic brands (Estée Lauder, L’Oréal, P&G, Coty) and anti-counterfeit packaging companies are headquartered or have strong operations in North America. This encourages fast adoption of new security technologies and packaging innovations.

Estée Lauder Companies Inc. (U.S.) uses RFID-enabled packaging, holograms, and blockchain authentication for luxury brands like MAC, Clinique, and Estée Lauder. Estée Lauder Companies Inc., cosmetics company partnered with Avery Dennison and other tech firms to implement smart labeling solutions. L’Oréal USA (French brand with strong North American presence) invests in track-and-trace solutions and digital authentication to secure brands like Lancôme, Kiehl’s, and Urban Decay. L’Oréal USA developed Provenance blockchain technology to ensure product authenticity. Coty Inc. (U.S.) implements QR codes and near-field communication (NFC) tags for brands like CoverGirl, Kylie Cosmetics, and Rimmel London. Coty Inc. focuses on secure supply chain tracking to combat fake beauty products.

Asia Pacific region is anticipated to grow at the fastest rate in the anti-counterfeit cosmetic packaging market during the forecast period. Asia-Pacific, particularly China, India, and Southeast Asia, is a major hub for counterfeit cosmetics due to large-scale manufacturing and grey markets. The rise of e-commerce platforms has increased the risk of counterfeit beauty products, driving demand for anti-counterfeit packaging solutions. The rapidly growing middle class in countries like China, India, and South Korea has led to a booming demand for luxury and premium cosmetics. To protect brand reputation, global and local cosmetic brands invest in advanced packaging technologies like RFID tags, holograms, and QR codes.

Strict government regulations in countries like China (e.g., the China National Medical Products Administration rules) push brands to adopt secure packaging. Leading cosmetic brands implement track-and-trace solutions to comply with regulations and reduce counterfeiting risks. Asia-Pacific has a strong packaging industry, with innovation in smart packaging, blockchain-based authentication, and tamper-evident seals. Countries like Japan and South Korea lead in cutting-edge packaging solutions, driving the region’s dominance. Companies like Amcor, Avery Dennison, and Uflex are expanding their presence in Asia-Pacific. Trends like NFC-enabled packaging, blockchain tracking, and DNA-based authentication are gaining momentum.

Amcor Plc company specializes in tamper-evident labels, holographic security seals, and track-and-trace solutions. Amcor Plc provides RFID-enabled smart packaging for premium cosmetic brands. Avery Dennison Corporation company offers smart labels, QR codes, and blockchain-based authentication solutions. Uflex Limited (India) produces holographic security films and UV-printed labels that make duplication difficult. Innovating with tamper-evident flexible packaging for beauty and personal care. Systech (A Markem-Imaje Company) (China, India) specializes in cloud-based authentication and serialization technologies for cosmetic supply chains. Systech (A Markem-Imaje Company) helps brands implement real-time counterfeit detection. Huhtamäki Oyj, packaging company based in India, China, Southeast Asia focuses on high-security printing, invisible ink, and customized packaging to prevent duplication.

By Technology

By Packaging Format

By Material

By Application

By Region

February 2025

February 2025

February 2025

February 2025