March 2025

The chlorine-free shrink bags market is experiencing rapid growth, with projections indicating a revenue surge into the hundreds of millions between 2025 and 2034.

The chlorine-free shrink bags market is likely to grow at a substantial CAGR during the forecast period. Chlorine-free shrink bags are a green packaging material that does not have chlorine-based compounds, which makes them a safer alternative to typical PVC shrink films. These bags are frequently made-up of polyolefin materials and provide outstanding transparency, durability, and shrink qualities while lowering the risk of toxic emissions during production and disposal. 25% more bags may fit in a box that lowers the need for corrugated materials, shipping expenses as well as warehouse space. These bags provide a broader sealing window and better seal quality, sealing reliably and cleanly at lower temperatures. They are commonly utilized in food packaging, pharmaceuticals, consumer goods, and other applications, delivering a long-term alternative that fulfills regulatory requirements and rising customer demand for environmentally responsible packaging.

The rising environmental regulations and sustainability initiatives along with the growing consumer awareness and demand for sustainable packaging is expected to augment the growth of the chlorine-free shrink bags market during the forecast period. Furthermore, advancements in the material science such as the development of the high-performance polyolefin alternatives that gives superior strength, clarity and shrink properties are also anticipated to augment the growth of the market. Additionally, the expanding food and beverage industry as well as the growth of the e-commerce and retail packaging coupled with the rise of the circular economy initiatives and recyclability requirements is also projected to contribute to the growth of the market in the near future.

The rapid growth of the e-commerce and retail sectors due to the increasing internet penetration, smartphone adoption as well as the changing consumer shopping behaviors is anticipated to support the growth of the chlorine-free shrink bags market during the estimated timeframe. With the increasing popularity of e-commerce grocery platforms, meat delivery services and the subscription-based meal kits, packaging is important in preserving the freshness, preventing contamination as well as extending shelf life. Nearly all American households i.e., 98.5% buy meat, according to the 17th annual Power of Meat survey by FMI and Meat Institute. This trend is supported due to the rise in sales volume (an increase of 3.9% across all meat as opposed to pre-pandemic levels). This increase can be attributed to a number of COVID-19-related grocery buying patterns, such as a rise in home cooking and record-high shopping online. Today, almost half of the meat customers (46%) routinely shop online and more meat consumers (61%), compared to just 39% in 2019, purchased online than ever before.

Unlock Infinite Advantages: Subscribe to Annual Membership

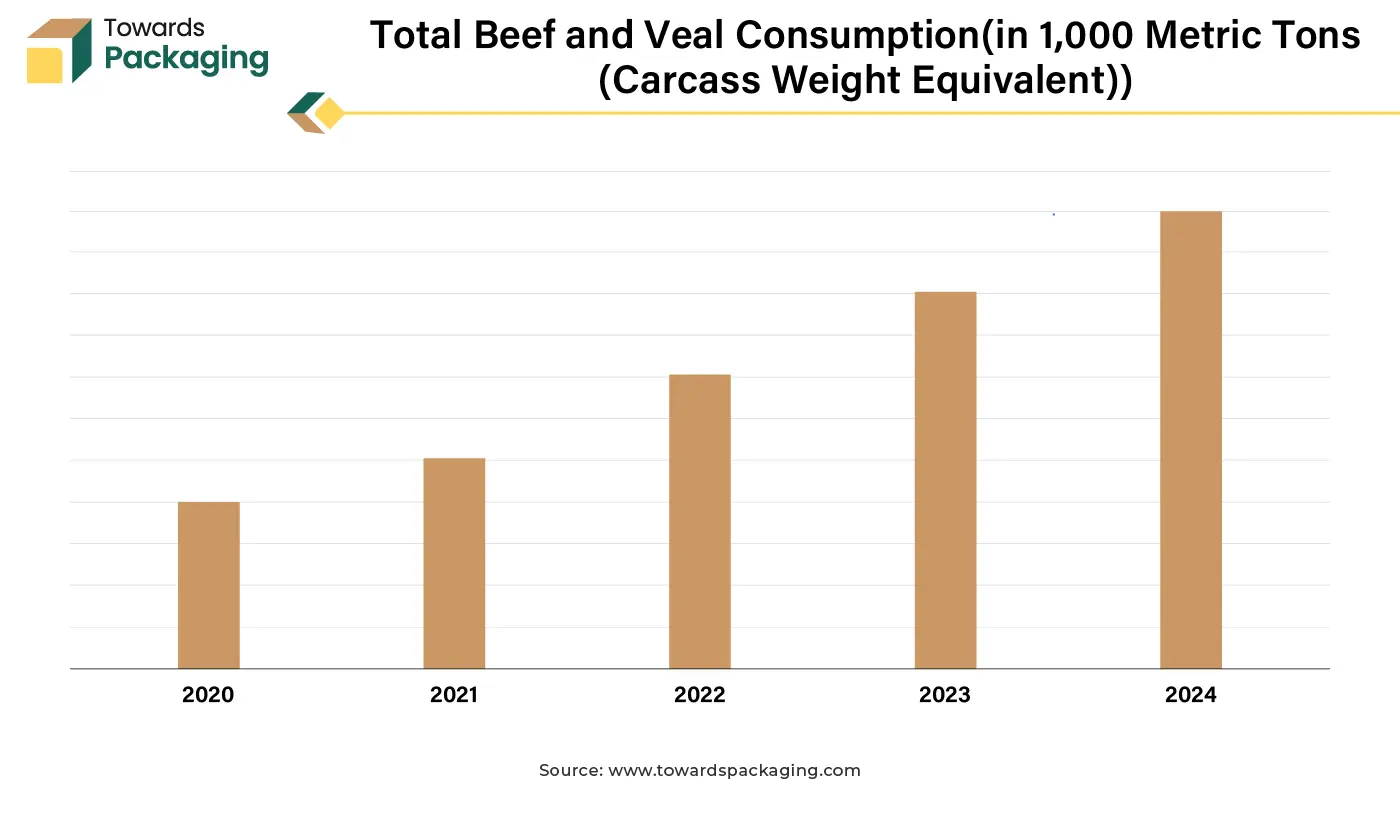

Furthermore, the increasing global consumption of the meat is also expected to support the demand for chlorine-free shrink bags. According to the United States Department of Agriculture, the consumption of beef and veal reached nearly 60,000 metric tons in 2024 from 56,000 metric tons in 2020. Meat is considered as high-quality protein source that is essential for muscle growth, cognitive function and overall health. Moreover, globalization has expanded the variety of meat products available to consumers, with international cuisines and dietary trends such as high-protein, keto and paleo diets, driving further demand. Chlorine-free shrink bags provide leak-proof, vacuum-sealed packaging, guaranteeing safe storage and transportation. As global meat consumption rises, the demand for durable and visually appealing packaging will continue to grow, and this makes the chlorine-free shrink bags an essential choice for the modern meat industry.

The performance limitations compared to the PVC-based shrink films is expected to hamper the growth of the chlorine-free shrink bags market within the estimated timeframe. As chlorine-free alternatives such as polyolefin shrink bags, are gaining popularity due to their environmental benefits and regulatory compliance, they frequently fall short in certain functional areas, which makes it difficult for some industries to shift smoothly. PVC shrink films have been recognized for having high shrink ratios and this means they provide a tighter and uniform fit around the items when subjected to heat. This feature is important for companies that need accurate product wrapping like the food and retail packaging. In contrast, some chlorine-free shrink films may have reduced shrinkage and elasticity properties leading to a poorer packing and irregular wrapping.

Another important problem is clarity and gloss, as PVC films typically have high transparency and a glossy finish, which improves product visibility as well as shelf attraction. This is specifically important in industries like food and consumer goods, where customers choose products with simple appealing packaging. Even though polyolefin and other chlorine-free polymers are becoming clearer, their optical performance might not match that of PVC-based substitutes.

Additionally, sealing strength and longevity may be an issue. PVC shrink films are known for their dependable seals that guarantee tamper evidence along with the product safety. Some chlorine-free shrink bags could require higher sealing temperatures or just specialized sealing equipment, increasing production complexity as well as costs for manufacturers. These gaps in the performance present substantial hurdles for the companies that rely on highly efficient shrink packaging. This is likely to slower the transition towards chlorine-free alternatives even with the rising environmental concerns.

The growing demand from emerging markets such as Asia-Pacific, Latin America and Middle East regions are expected to support the growth of the chlorine-free shrink bags market in the years to come. Consumers in these regions have become more environmentally conscious, businesses and regulatory bodies are actively pushing for eco-friendly alternatives to traditional packaging. This shift presents an ideal opportunity for chlorine-free shrink bags, which provide environmental benefits while retaining the durability as well as efficiency required for packaging applications.

Countries in Asia-Pacific, such as China and India, are seeing growth in the food, retail and e-commerce sectors, generating the need for clear protective shrink packaging. As per the recent survey, customers in the Asia-Pacific region are acting on their environmentally concerned beliefs. When they shop, more than half i.e., 55% of the consumers actively choose sustainable options. When it comes to buying sustainable items, younger generations Gen Z that is 56 percent and Millennials (59 percent) are leading the way, surpassing Gen X and Baby Boomers.

Also, retailers, ranging from well-known global corporations to digitally native new companies, are rushing to understand the implications of consumers' increased knowledge of sustainability for their brands and companies.

Similarly, Latin America has seen a surge in the food consumption where the meat and dairy industries are growing rapidly. The adoption of the chlorine-free shrink bags in these regions is expected to rise as companies search for options with new sustainability standards. Through increasing their presence in these high-growth markets, chlorine-free shrink bag manufacturers may reach new client segments, develop strategic relationships as well as build strong supply chains, guaranteeing long-term success in the global sustainable packaging industry.

Artificial Intelligence (AI) is likely to support the growth of the chlorine-free shrink bags market in the years to come. AI automation and predictive analytics are optimizing manufacturing, material selection and quality control that is leading to cost reductions as well as higher production efficiency. In food packaging, AI based computer vision and machine learning algorithms are improving defect detection and guaranteeing consistent product quality, reducing material waste and improving the sustainability efforts. Additionally, AI is supporting smart packaging options such as real-time monitoring of product freshness and tamper-proof security features, increasing the consumer trust in packaged goods.

AI is also expected to speed up the research and development in biodegradable and recyclable shrink films, assisting industries in creating innovative chlorine-free alternatives with improved barrier qualities as well as sealing performance. Furthermore, AI based customer insights and data analytics make it possible for the organizations to personalize their packaging strategy according to the shifting consumer demand for eco-friendly transparent packaging. AI has the potential to completely change the chlorine-free shrink bag market in the years to come by increasing its efficiency, cost-effectiveness, and environmental responsibility due to regulatory challenges, sustainability objectives and increased digitization.

The polyolefins segment held considerable share in the year 2024. Polyolefin shrink films are mostly made-up of polyethylene (PE) and polypropylene (PP). They are frequently utilized because of their high clarity, exceptional strength and good shrink performance. The demand for the polyolefins across various industries is further increased by the fact that they are an environmentally friendly and legally compliant substitute for shrink films made-up of PVC because they do not contain chlorine. One of the primary drivers of polyolefin dominance in 2023 was the growing demand for sustainable packaging alternatives across a variety of industries. Polyolefin shrink bags are becoming increasingly popular among food packaging makers due to its non-toxic nature, strong barrier qualities, and ability to keep food freshness while maintaining safety. Due to its chlorine-free nature, polyolefin shrink film has become popular for food packaging and is safe for customers to consume.

The food & beverage segment held substantial share in the year 2024. This is owing to the increasing global demand for packaged foods coupled with the rising preference for sustainable packaging. Meat, poultry, seafood, dairy and bakery products require high-barrier, contamination-resistant and visually appealing packaging and this makes shrink bags an ideal choice for food manufacturers and retailers. A major driving force behind this growth was the increasing consumption of fresh and frozen meat products, predominantly across North America, Europe and Asia-Pacific. With global meat consumption projected to rise, food processors and distributors sought high-clarity shrink bags that provide extended shelf life as well as superior oxygen barrier properties. Additionally, the rapid expansion of the online grocery and meat delivery services is also expected to contribute to the segmental growth of the market during the forecast period.

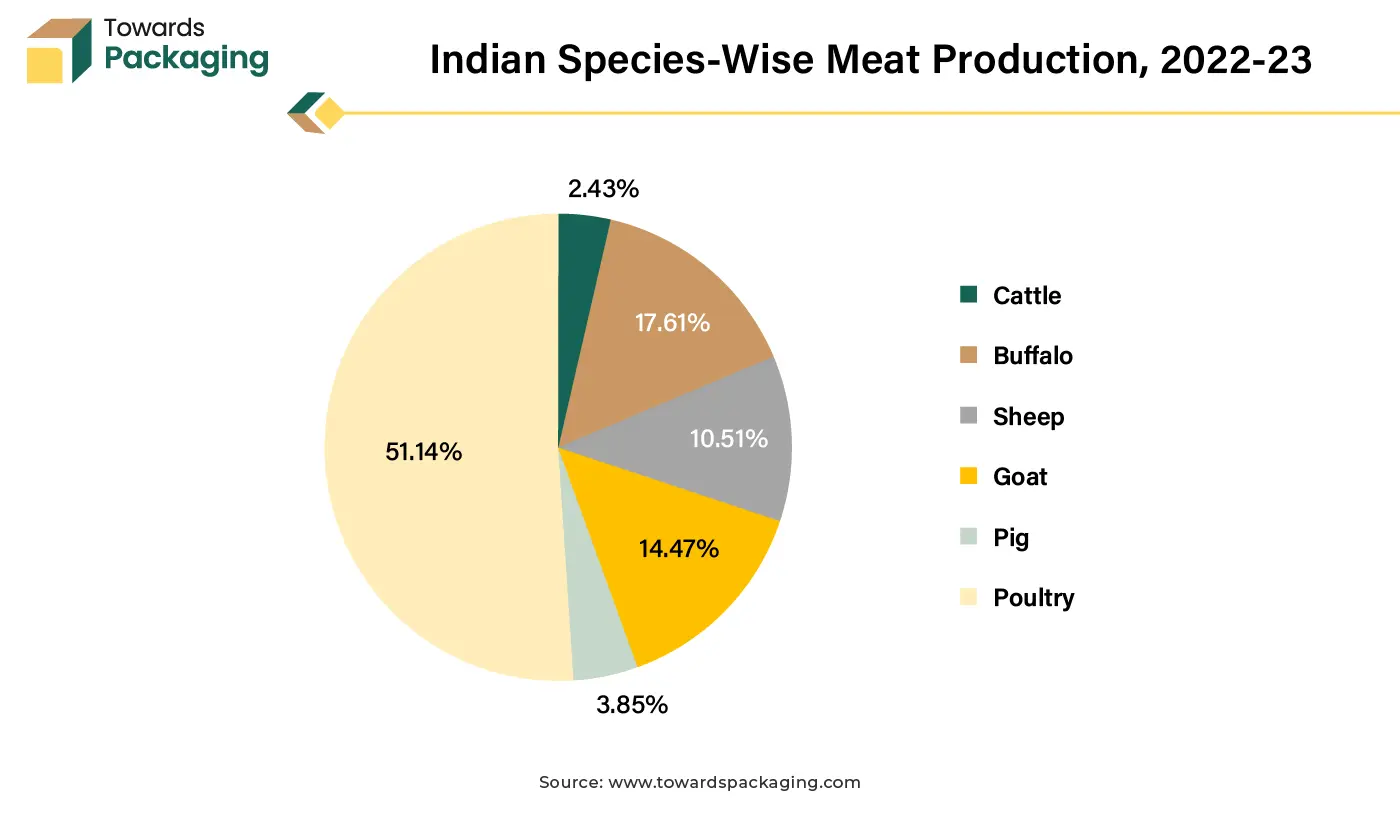

Asia Pacific is likely to grow at a fastest CAGR during the forecast period. This is due to the rising disposable incomes as well as the increasing urban populations in China, India, and Southeast Asian countries. Additionally, the growing production as well as consumption of meat is also expected to contribute to the regional growth of the market. According to the data by the Department of Animal Husbandry, Dairying and Fisheries (DAHD), 9.77 million tonnes of meat were produced in India overall in 2022–2023. In comparison to the previous year (2021–2022), the production of meat has increased by 5.13%. About 51.14% of all meat production comes from poultry, which produces 4.995 million tonnes of meat annually. Poultry meat output has grown by 4.52% in comparison to the previous year. Furthermore, the proliferation of modern supermarkets, convenience stores as well as hypermarkets (e.g., 7-Eleven, Tesco, Walmart China) is likely to contribute to the regional growth of the market.

North America held considerable market share in the year 2024. This is due to the stringent environmental regulations along with the high demand for sustainable packaging option across the region. Additionally, the expanding meat & poultry industry as well as the rise of the e-commerce grocery platforms like Amazon Fresh, Walmart+, and Instacart, alongside meal kit delivery services (HelloFresh, Blue Apron, Freshly) is also further expected to contribute to the regional growth of the market. Also, the consumer awareness of food safety & hygiene are further expected to support the regional growth of the market.

By Material

By End-Use Industry

By Region

March 2025

February 2025

February 2025

February 2025