April 2025

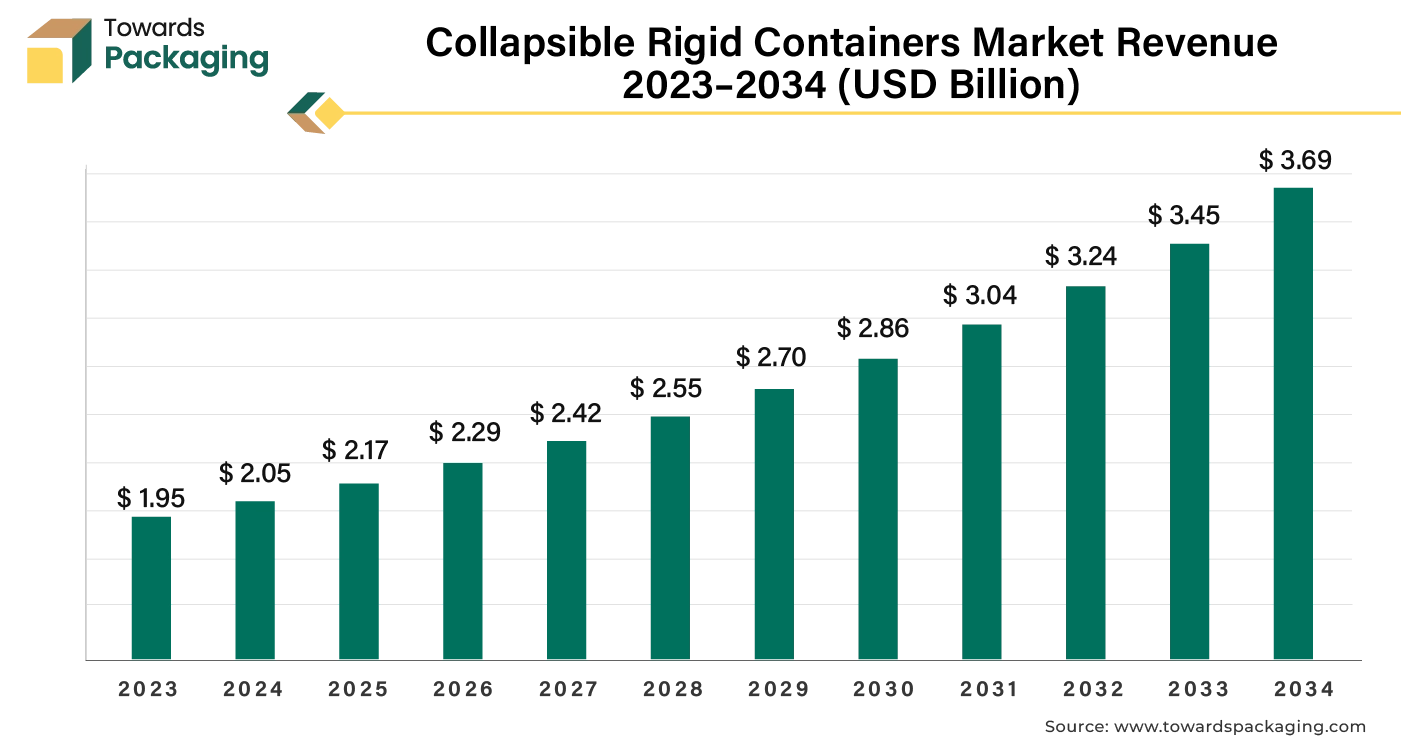

The collapsible rigid containers market is predicted to expand from USD 2.17 billion in 2025 to USD 3.69 billion by 2034, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

Rising regulations and industry standards around packaging safety and quality encourage the adoption of robust, complaint packaging solutions which is estimated to drive the global collapsible rigid containers market over the forecast period.

Packaging that combines the strength of rigid boxes with the flexibility of collapsible design is known as collapsible rigid boxing. Collapsible rigid containers are made of sturdy materials like cardboard or plastic, these boxes are able to hold their shape and offer strong protection for the contents inside. However, because they are made to be folded or collapsed when not in use, they take up less space in storage and during transportation. In summary, collapsible rigid boxes combine the strength and protection of rigid packaging with the practical benefits of lower storage and shipping costs because of their ability to collapse flat.

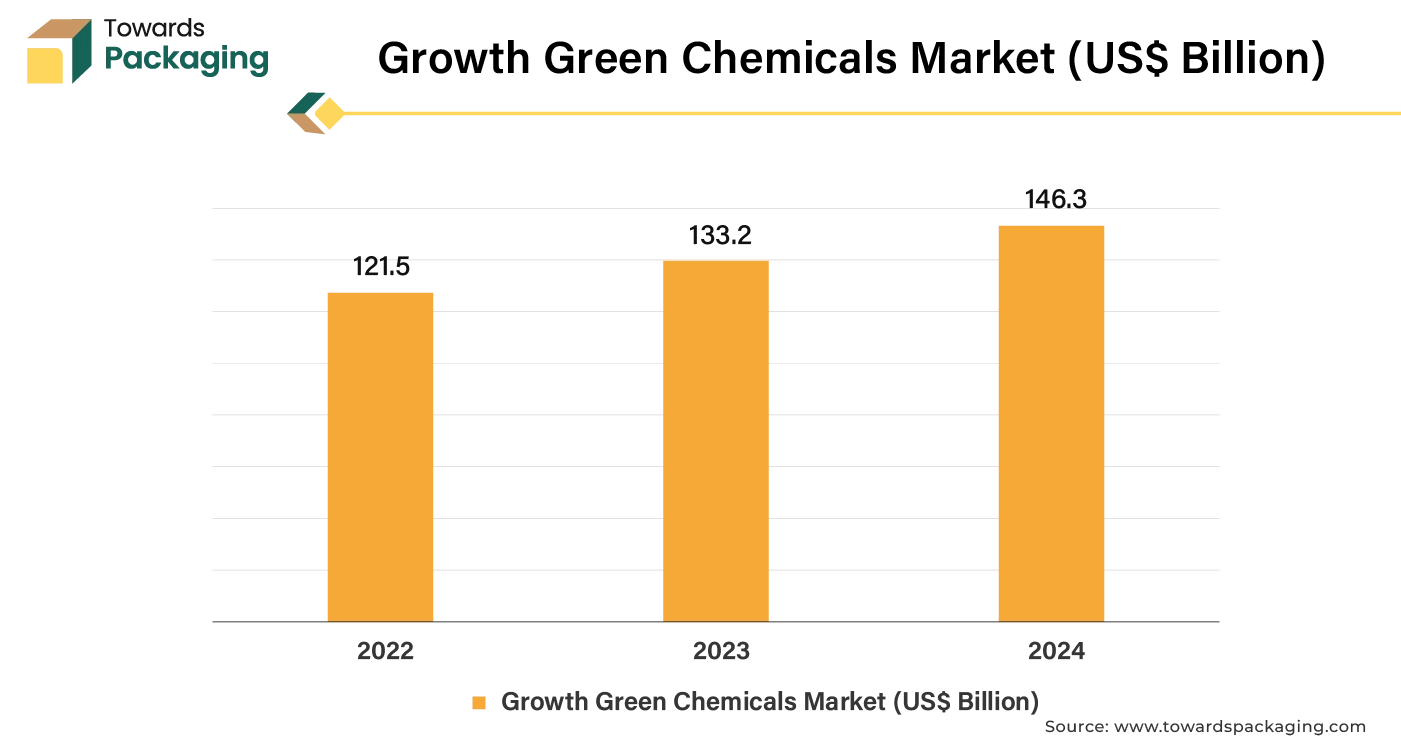

The collapsible rigid containers offer premium presentation as well as space-saving convenience. They readily unfold into robust boxes after folding flat for compact storage and transportation. They minimize environmental effect while providing a beautiful look and feel, making them ideal for high-end products, presents, and clothing. All things considered, collapsible rigid boxes provide a flexible, eco-friendly packaging option that blends style and utility. Their compact size, simplicity in assembly, and elegant presentation make them a well-liked option for companies trying to maximize their packaging while preserving a superior brand image. The global packaging industry size is growing at a 3.16% CAGR.

AI can evaluate an immense amount of data to support the creation of more robust and effective containers. The ideal compromise between strength, weight, and cost can be found by simulating various materials and designs using algorithms. AI-driven analytics, based on usage trends and wear-and-tear data, may forecast when containers are likely to fail or need maintenance. This prolongs the life of the containers and cuts down on downtime. By anticipating demand, maximizing inventory levels, and enhancing logistics, artificial intelligence (AI) can improve supply chain management. Better resource allocation and lower operating expenses may result from this.

In comparison to human inspections, AI-powered image recognition and sensors may automate the inspection process, guaranteeing that containers satisfy quality standards and rapidly and accurately identifying problems. AI can make container solutions more customized and flexible. By examining consumer demands and usage trends, artificial intelligence (AI) can facilitate more customized and adaptable container solutions, resulting in more specialized goods that satisfy certain specifications.

Companies have started using collapsible containers, which are recyclable and cut down on waste volume, as a result of a greater emphasis on recycling and waste reduction. Because they require less money for transit and storage, collapsible containers are frequently more economical. When empty, they can be compressed to maximize space and save on shipping costs. These containers' capacity to stack and collapse contributes to increased storage and transit efficiency. This is particularly useful in sectors where logistics requirements are dynamic and large volume. As sustainability becomes a top priority for consumers and companies alike, there is increasing demand for recyclable and eco-friendly collapsible rigid box options. The key players operating in the market are focused on developing eco-friendly collapsible rigid containers which is estimated to drive the growth of the collapsible rigid containers market over the forecast period.

The high initial investment required for manufacturing units and varying standards and specifications across various region, is expected to restrict the growth of the collapsible rigid containers market over the forecast period. Certain companies, especially smaller ones, may be discouraged from implementing this technology due to the substantial initial outlay needed for high-quality collapsible rigid containers and the related infrastructure. Certain sectors or geographical areas might not have a complete understanding of the advantages of collapsible rigid containers, or they could be reluctant to abandon conventional packaging techniques. It can be difficult and technically demanding to design and manufacture collapsible containers that adhere to particular industry standards and durability criteria; this could result in increased prices and longer lead times.

Rapid industrialization and increasing logistics needs in emerging markets offer significant opportunities for adopting collapsible rigid containers. Incorporating IoT (Internet of Things) and Radio-Frequency Identification (RFID) technologies into collapsible containers can provide real-time tracking and inventory management, improving efficiency and creating new value propositions. Advances in manufacturing technologies, such as 3D printing and automation, can minimize production costs and enhance the efficiency of collapsible container manufacturing. The key players operating in the market are focused on adoption and deployment of the advanced technology for the designing and manufacturing of the collapsible rigid containers, which is estimated to create lucrative opportunity for the growth of the collapsible rigid containers market over the forecast period.

For instance,

The plastic segment held the dominating share of the collapsible rigid containers market in 2024. As plastic is resistant to corrosion and has immense mechanical strength it is extensively utilized for manufacturing collapsible rigid containers. Plastic is lightweight and poses ability to modify the structure because of which it is perfect material for making collapsible rigid containers. The plastic has high durability and are resistant to atmospheric conditions moisture and sunlight. Plastic containers fold up easily, which makes them a popular choice for industries with limited space, such as logistics and storage. Plastic is also less expensive than other material varieties, which makes it a sensible choice for both manufacturers and final users.

The pharmaceutical and food industry are highly responsible for the growth of the plastic collapsible rigid containers. Demand-side and supply-side trends broadly impact the collapsible rigid containers market. Logistics growth is rising the demand for the plastic collapsible rigid containers which is estimated to drive the growth of the segment over the forecast period. Moreover, increasing launch of the new warehouse has risen the demand for the collapsible rigid containers which is projected to fuel the growth of the segment over the forecast period.

The crates segment held the dominating share of the collapsible rigid containers market in 2024. Plastic crates are ideal for transporting perishable items since they are strong, lightweight, and stackable. They are employed in the transportation of an extensive variety of goods between different points in the supply chain, such as fruits, vegetables, dairy products, meat, and drinks. Because of their robust construction, which enables them to withstand heavy loads and rough handling, crates are a popular choice in a variety of industries, including retail, food and beverage, and agriculture. Because of their foldable design, which also makes storage and transportation simple, they are an inexpensive and room-saving option.

As a result, organizations searching for durable and efficient storage and transit solutions always turn to crates. Vegetables, fruits, processed foods, and other goods are frequently carried and stored in crates. Therefore, over the forecast period, it is anticipated that the expanding global demand for packaged foods and door-to-door delivery would continue to fuel the rise of the crates segment. The key players operating in the market are focused on launching new crates for meeting the consumer demand which is estimated to drive the growth of the segment over the forecast period.

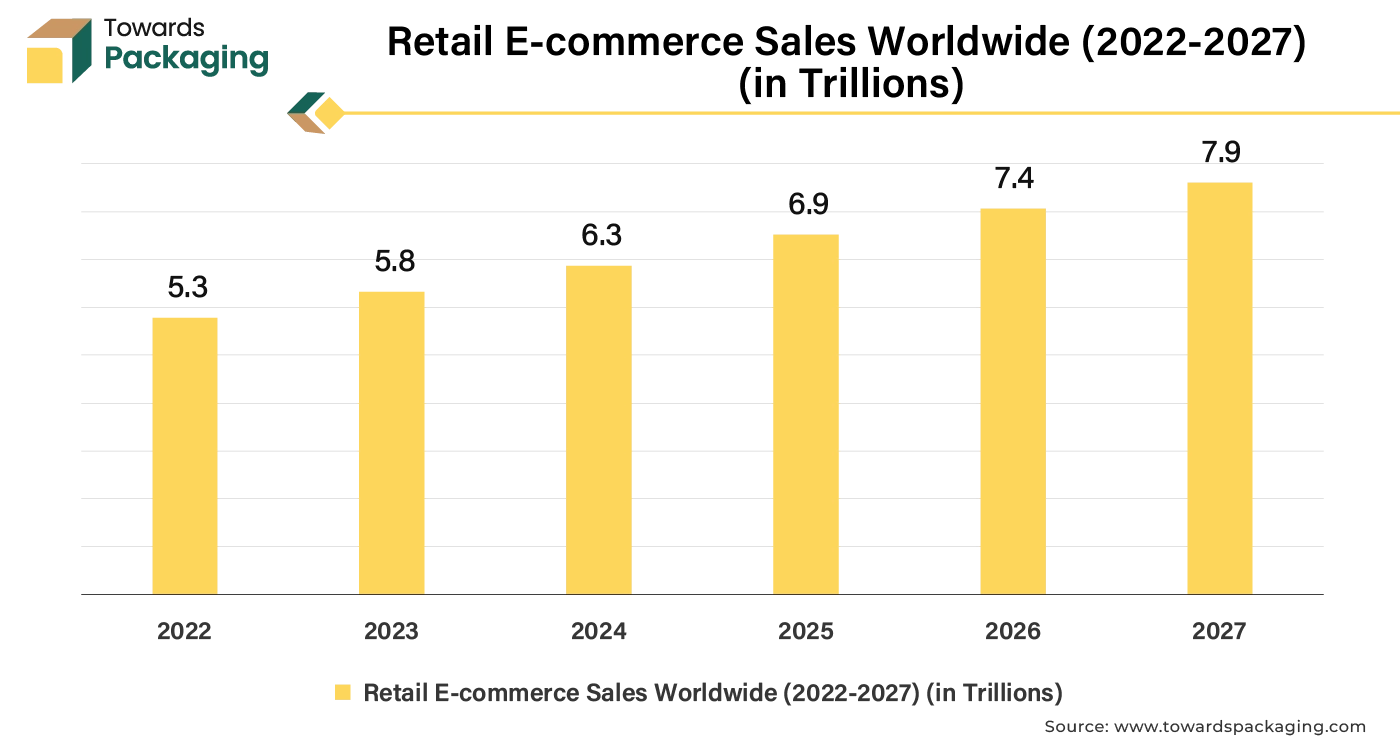

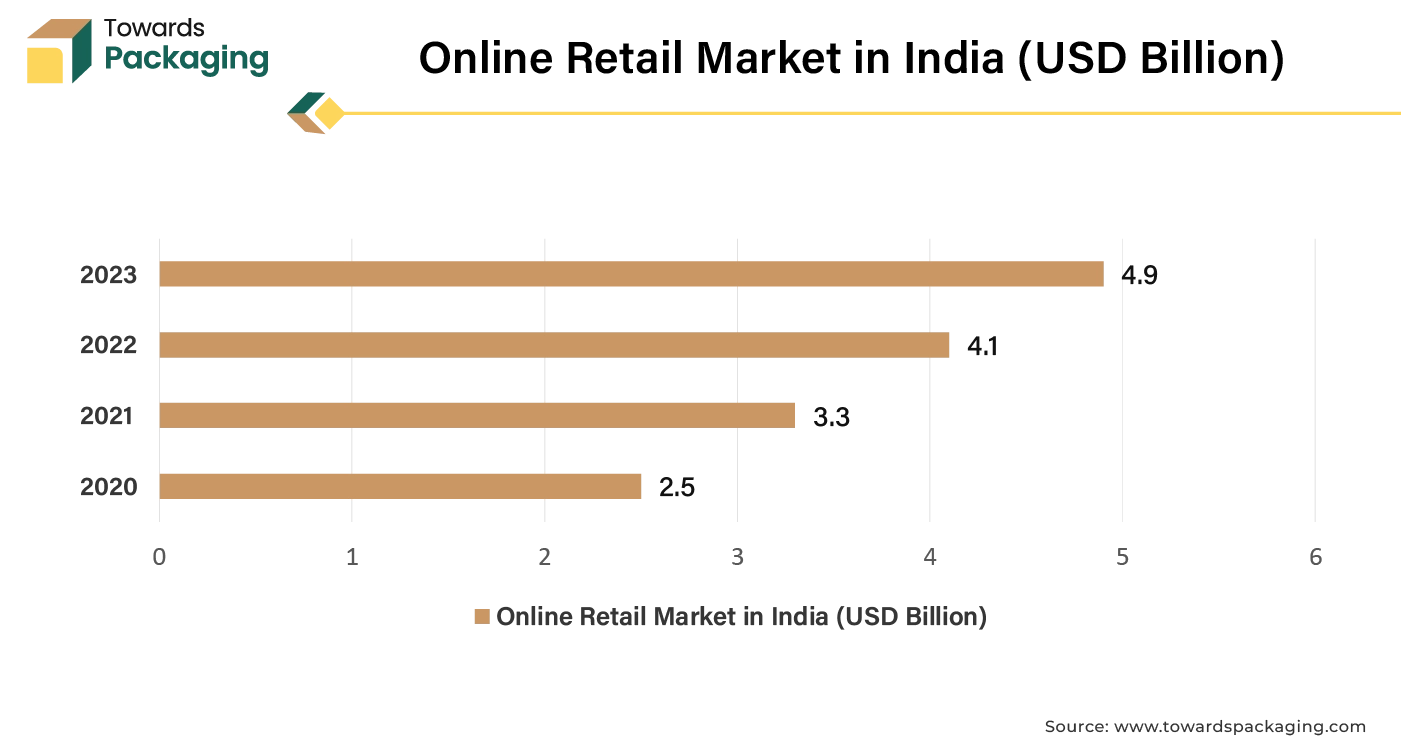

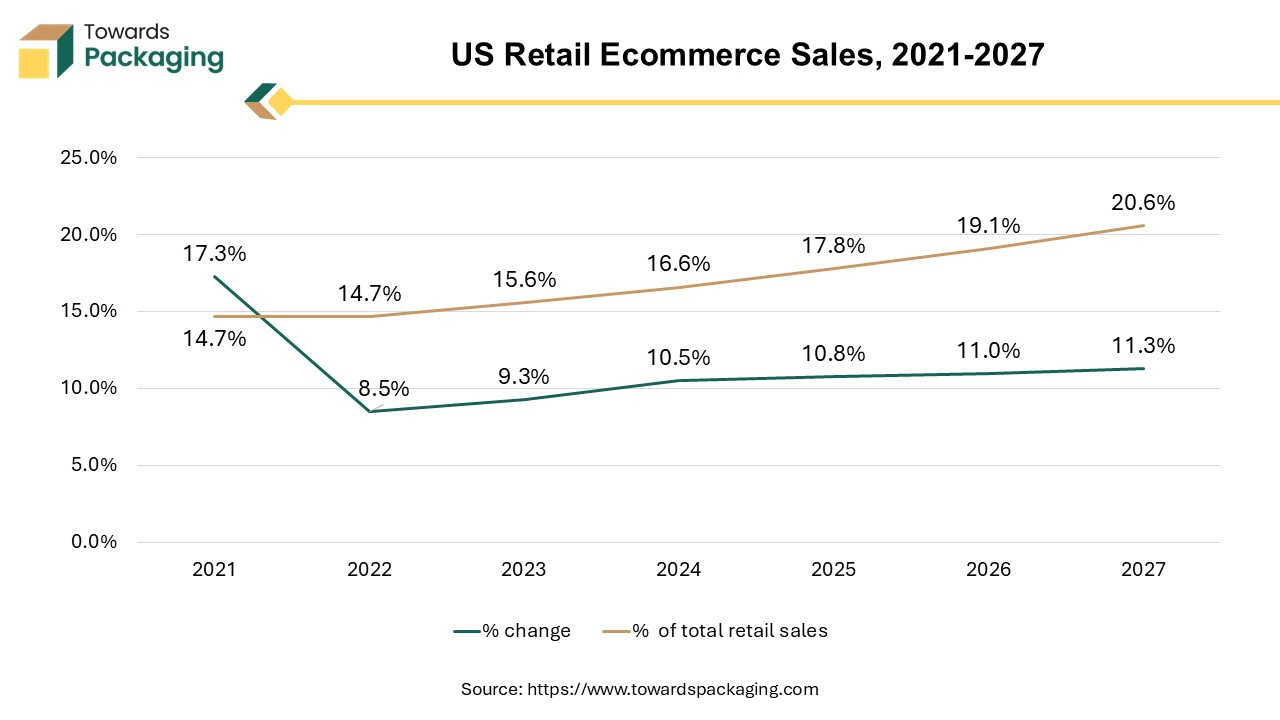

The pallet box segment is estimated to grow at fastest rate over the forecast period. Expansion of the E-commerce is rising the demand for the pallet boxes. Pallet boxes play significant role in managing the transportation and storage of goods in e-commerce fulfilment centers and shipping distribution networks.

Indirect sales channel segment held a significant share of the market. One of the main advantages of using indirect channels is that manufacturers can reach a wider audience and increase their reach. Another advantage of employing indirect sales channels is cost savings, which is particularly important for products like collapsible rigid containers that are used in a variety of industries and applications.

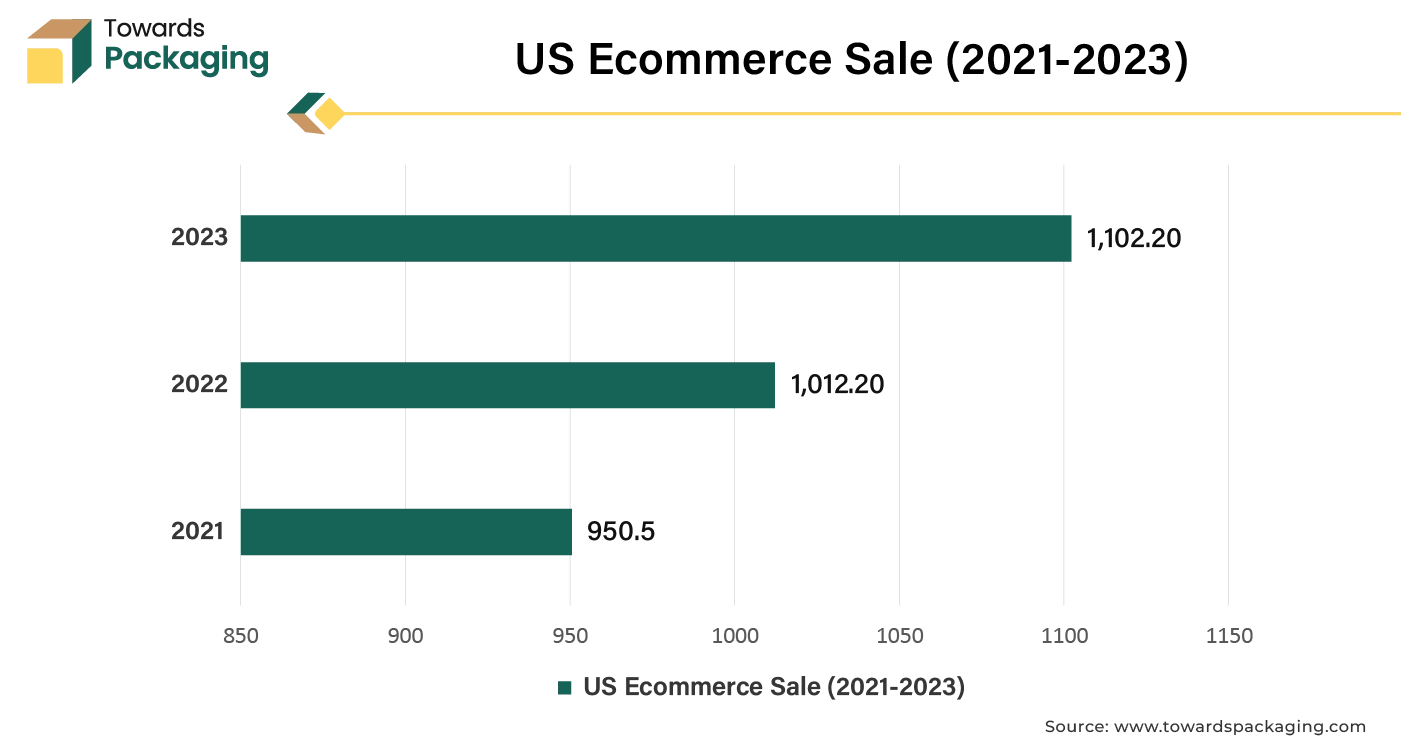

By contracting with outside partners to handle their logistics and distribution needs, manufacturers can avoid the expenses associated with building and managing their own distribution networks. Small businesses can greatly benefit from this, as they frequently lack the resources to create these networks on their own. The direct sales channel is estimated to grow at fastest rate over the forecast period. Rapid urbanization and advancement in technology has developed the direct sales channel. Due to rising trend of online shopping and E-commerce trade, the manufacturers find it easy to reach customers.

The chemical segment is estimated to hold notable share. The handling of combustible and hazardous materials in the chemical industry demands for the adoption of specific packaging solutions that can withstand the rigors of storage and transportation. Thus, the growth and development of the chemical sector will have a significant impact on the collapsible rigid containers market in the near future. The key players operating in the market are focused on launching collapsible rigid containers which is estimated to drive the growth of the segment over the forecast period.

The food & beverage segment is expected to grow at fastest rate over the forecast period. Demand for reusable and collapsible food containers is predicted to increase as sustainability and plastic waste reduction become more important. Due to the growing need for portable and space-saving water storage options, the market for collapsible water containers is also anticipated to rise significantly. There is an increasing demand for portable, lightweight water containers since outdoor activities like hiking, camping, and picnics are becoming more and more popular.

Plastic crates are the best option for effectively transporting perishable items because they are strong, lightweight, and stackable. They are used to move a variety of goods between different points in the supply chain, such as fruits, vegetables, dairy, meat, and beverages. The key players operating in the market are focused on adopting the inorganic growth strategies like partnership or collaboration to develop the collapsible rigid containers which is estimated to drive the growth of the segment over the forecast period.

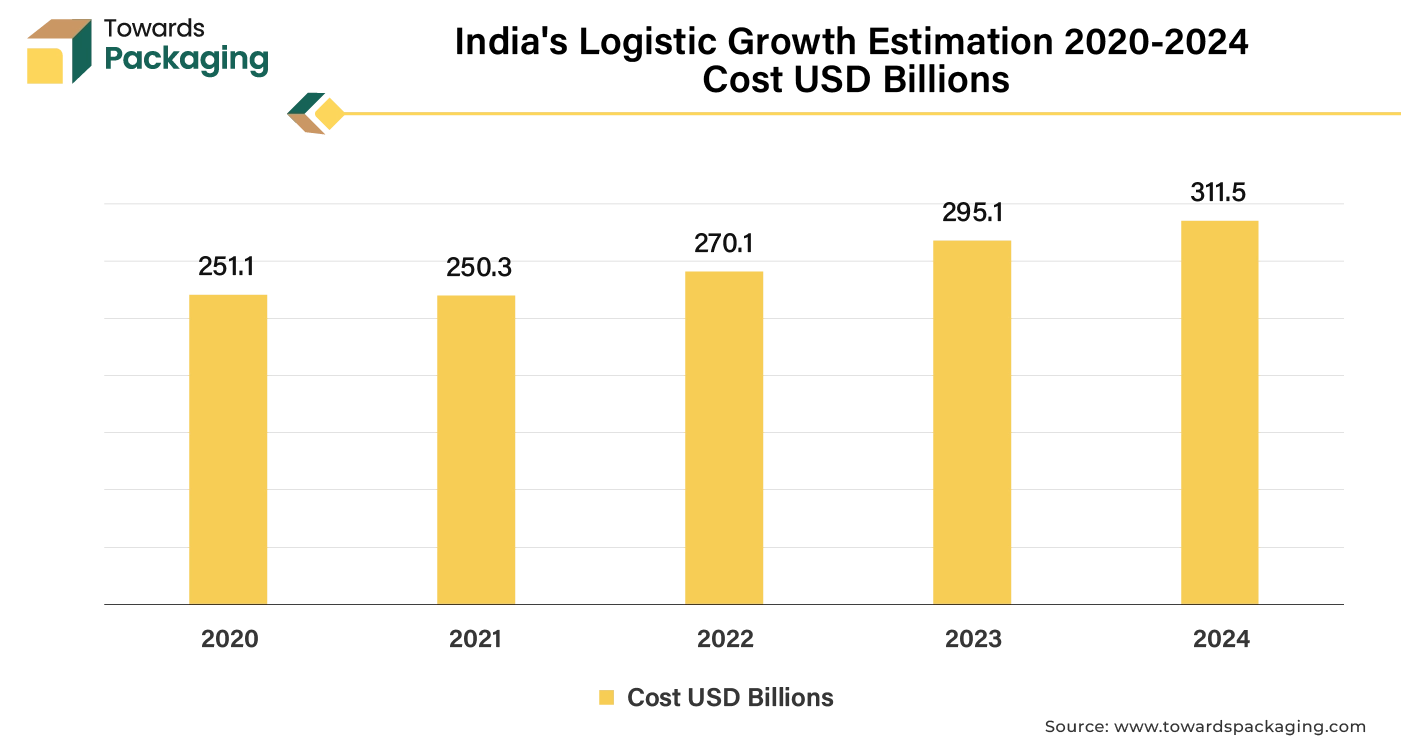

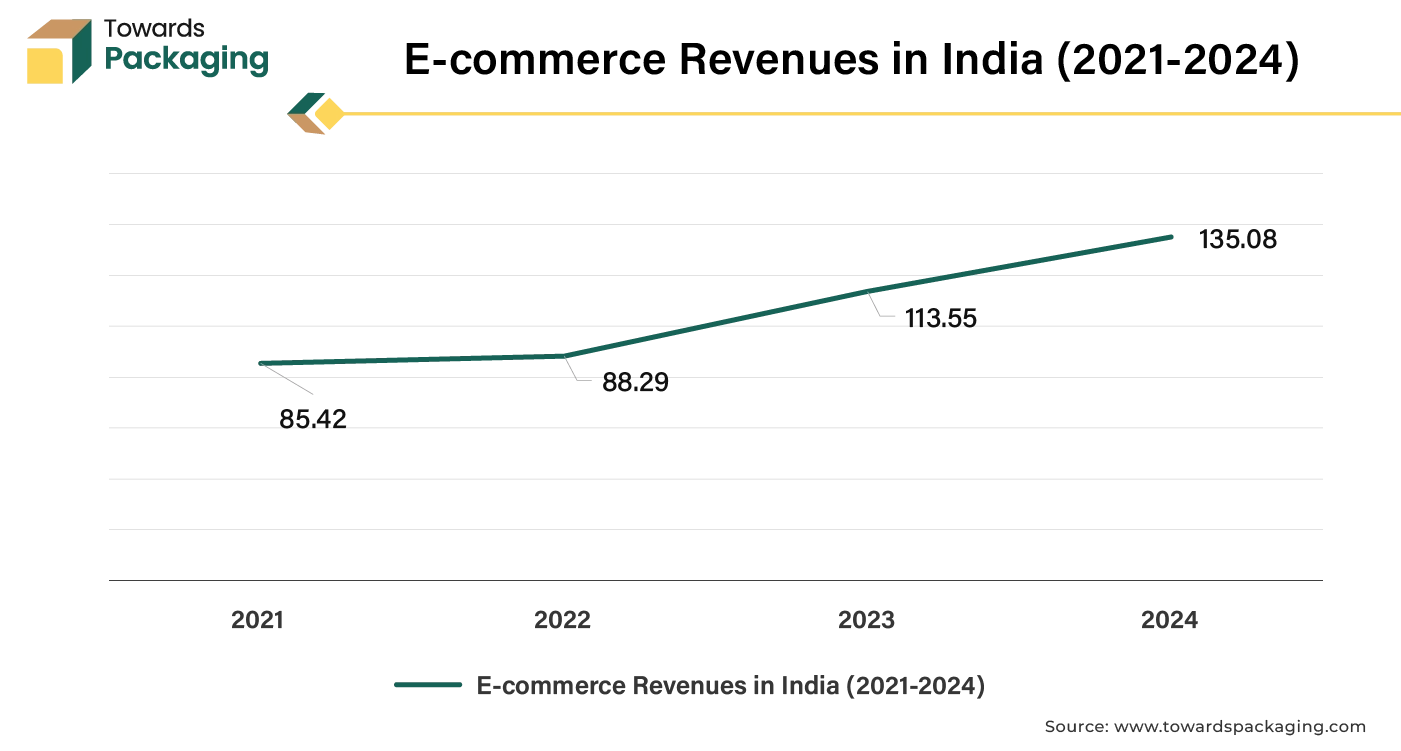

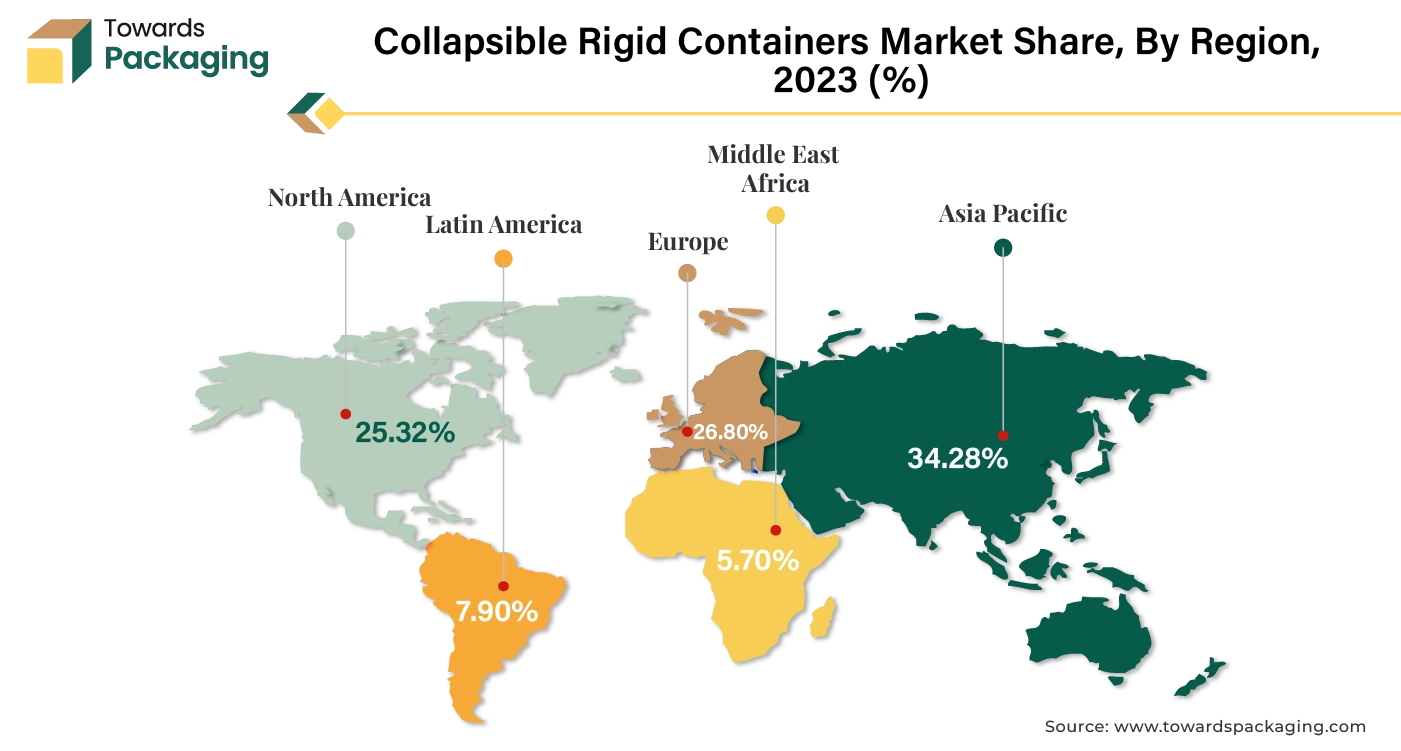

Asia Pacific held dominant revenue shares for the year 2024. Rapid industrialization and urbanization increase the demand for exclusive, versatile and space-saving logistics solutions. The market for collapsible rigid containers is also significantly influenced by the growth of e-commerce and home delivery services. The pandemic-induced shift to online shopping has resulted in a major surge in demand for robust and space-saving packaging. The market in Japan has also been influenced by just-in-time logistics' rising popularity. The need for these containers is growing in Japan as a result of these considerations as well as the growing need for strong, long-lasting containers that can resist the rigors of storage and transit. In India due to changing lifestyle the trend of online shipping is increasing day-by-day, which is expected to drive the growth of the collapsible rigid containers market in India in the near future.

According to same source it is reported that Government e-marketplace (GeM), Government owned & National Public Procurement Portal of India, achieved its highest Gross Merchandise Value (GMV) record of US$ 2011 billion in 2022-2023.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition for expansion of market presence, which is estimated to drive the growth of the collapsible rigid containers market in Asia Pacific.

Europe region is estimated to grow at fastest rate over the forecast period. The growing industrialization and companies have been assisting many end-users, including pharmaceutical, food and beverage, automotive, and retail industries, among others, to meet their changing demands. The use of collapsible rigid boxes can enhance the unboxing experience for consumers, adding to appeal of the product. The key players operating in the market are focused on launching the collapsible rigid containers to meet the rising demand of the consumers, which is estimated to drive the growth of the collapsible rigid containers in Europe over the forecast period.

North America is estimated to hold notable share in the upcoming period. Rapid industrialization, expansion of e-commerce and online retail increases the demand for efficient and flexible packaging solutions to manage varying volumes and types of products. Collapsible rigid containers provide durability and protection for consumer goods, ensuring safe transportation and minimizing product damage.

By Material Type

By Product Type

By Sales Channel

By End Use

By Region

April 2025

March 2025

February 2025

February 2025