April 2025

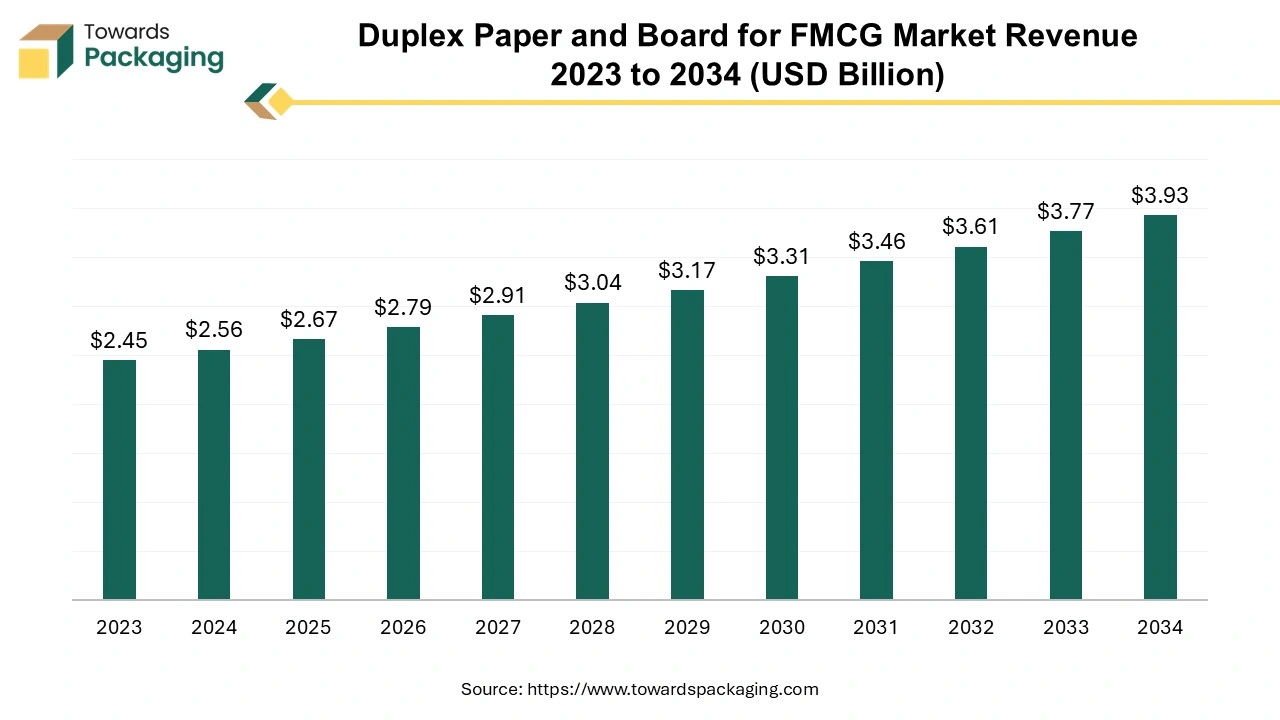

The duplex paper and board for FMCG market is predicted to expand from USD 2.67 billion in 2025 to USD 3.93 billion by 2034, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Key players operating in the market are making efforts to develop advance technology for manufacturing duplex paper and board for FMCG, which is projected to drive the global duplex paper and board for FMCG market over the forecast period.

Duplex paper and board are widely used in the fast-moving consumer goods (FMCG) sector due to their strength, lightweight nature, and cost-effectiveness. The duplex paper and board for FMCG is made from a combination of virgin and recycled fibers. Duplex board is characterized by a smooth surface, which is ideal for printing and packaging applications. Duplex board typically consists of two layers: the top layer (white) and the bottom layer (grey). The white surface is usually made from bleached fibers, while the grey layer is made from unbleached fibers, providing strength and rigidity. These boards can be produced in different thicknesses to suit specific packaging needs. The smooth, printable surface of duplex paper allows for high-quality printing, making it suitable for vibrant graphics and detailed designs.

Duplex paper is often utilized to create eye-catching displays for retail environments, aiding in brand promotion and customer engagement. The duplex paper and FMCG are commonly used for pharmaceuticals, beverages, and dry food products. The rigidity of the duplex board ensures the protection of the contents. Duplex paper is often utilized to create eye-catching displays for retail environments, aiding in brand promotion and customer engagement. The smooth surface of the duplex board allows for high-quality label printing, which is essential for branding and product information. Duplex paper and board play a crucial role in the FMCG sector, offering an effective balance of quality, sustainability, and cost. As consumer preferences evolve and sustainability becomes increasingly important, duplex board is likely to remain a popular choice for FMCG packaging solutions. The global packaging industry size is growing at a 3.16% CAGR.

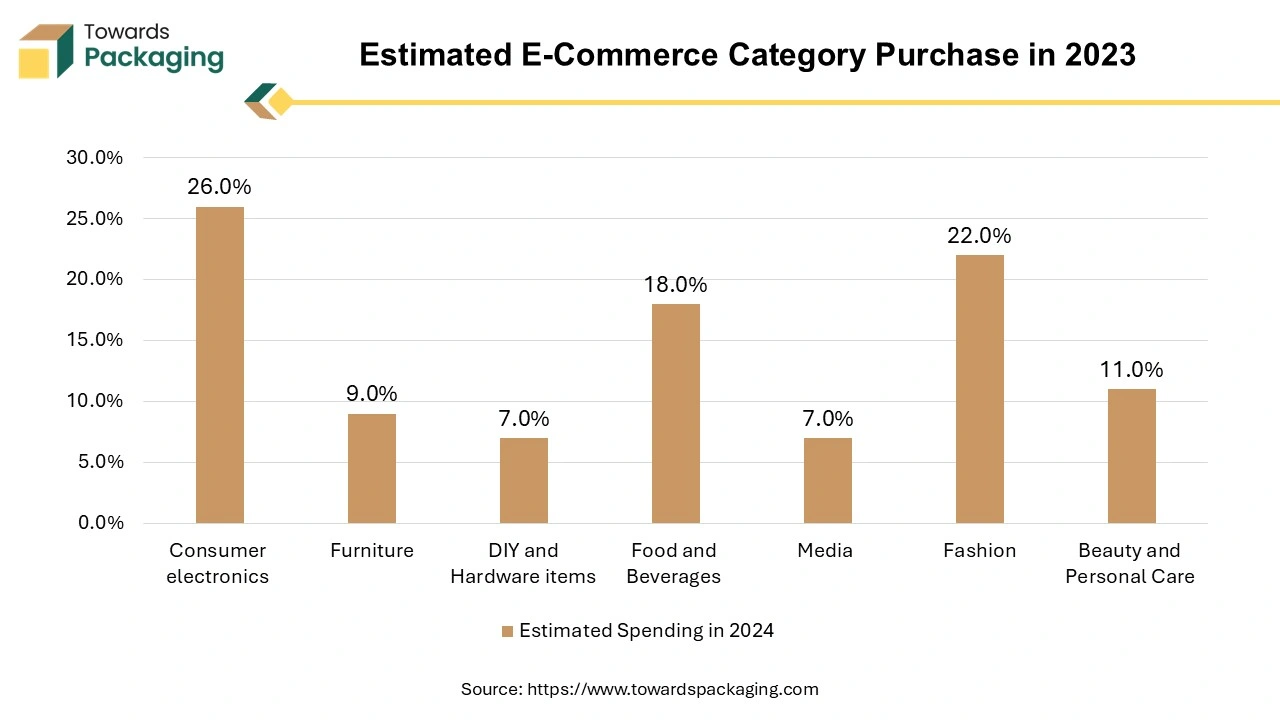

The expansion of e-commerce is increasing the demand for robust and protective packaging solutions, further boosting the use of duplex board in shipping and packaging. As more consumers shop online, the demand for packaging solutions, including duplex paper and board, rises. E-commerce requires sturdy packaging to ensure products arrive safely. Duplex board provides the necessary strength and rigidity to protect products during transit. Its use in boxes, inserts, and cushioning materials has become essential for e-commerce.

E-commerce brands often seek customized packaging solutions to enhance brand visibility. Duplex board allows for high-quality printing, enabling brands to create eye-catching designs. With growing consumer awareness of sustainability, e-commerce companies are increasingly opting for recyclable and biodegradable materials, such as duplex paper, aligning with consumer preferences. Duplex board is lightweight yet strong, optimizing shipping costs and reducing overall carbon footprints, which is attractive to e-commerce businesses focused on efficiency.

Duplex paper and board are being utilized for various applications, from food packaging to cosmetics, due to their versatility. Manufacturers are increasingly adopting duplex paper and board as a cost-effective alternative to plastic and other materials. Developing specialized duplex products for niche markets, such as food service or personal care, can open new revenue streams. The key players operating in the market are raising funds for the expansion of business, which is estimated to create lucrative opportunities for the growth of the duplex paper and board for the FMCG market in the near future.

Asia Pacific dominated the global duplex paper and board for FMCG market in 2024. Rapid economic development in countries like China and India increases consumer spending on packaged goods, driving demand for duplex materials. Increasing urban populations lead to changing lifestyles and heightened demand for convenience products, often requiring effective packaging. Improvements in manufacturing and logistics infrastructure enhance the production and distribution capabilities of duplex materials. The versatility of duplex paper and board allows for a wide range of applications across various FMCG segments, from food and beverage to personal care. Regional market players are focusing on adopting inorganic growth strategies to increase sales, which is estimated to drive the duplex paper and board for FMCG market in Asia Pacific.

North America is anticipated to grow at the fastest rate in the duplex paper and board for FMCG market during the forecast period. North America’s well-developed supply chain and manufacturing infrastructure support efficient production and distribution of duplex materials. A diverse and large FMCG market with major brands actively seeking sustainable packaging options fuels demand for duplex paper and board. Increasing consumer awareness and regulatory pressures promote the use of eco-friendly packaging solutions, driving demand for duplex paper and board. Strong emphasis on research and development in North America leads to advancements in packaging technology, enhancing the quality and functionality of duplex materials. Shifts towards online shopping and convenience in North America drive the need for versatile and protective packaging solutions, benefiting duplex materials. These factors collectively enhance North America's position in the duplex paper and board market within the FMCG sector.

The duplex board segment held a dominant presence in the duplex paper and board for FMCG market in 2024. Duplex board is made from recycled fibers and is recyclable, making it an eco-friendly alternative to plastic and other non-biodegradable packaging materials. With increasing global awareness of environmental issues, consumers and companies are moving toward sustainable packaging solutions.

Many governments are imposing strict regulations on single-use plastics and non-recyclable materials. This has accelerated the shift toward biodegradable and recyclable options, like duplex board. The rise of e-commerce, particularly during and after the COVID-19 pandemic, has resulted in a surge in demand for packaging materials that are lightweight, cost-efficient, and sustainable. Duplex board is widely used for e-commerce packaging due to its strength, printability, and recyclability. Duplex board is highly versatile and can be used for a variety of packaging applications. Its smooth surface on one side makes it suitable for printing, allowing for high-quality branding and product information display. This has led to its increased use in product packaging, cartons, and promotional materials.

The food and beverage segment dominated the market in 2024. Many companies in the food and beverage sector have committed to sustainability initiatives to reduce their reliance on non-recyclable materials. Brands like Nestlé, Unilever, and Coca-Cola are striving to use more sustainable packaging materials, which has driven demand for duplex paper and board. Duplex paper offers excellent printability, which allows companies to create attractive and high-quality packaging. With consumers becoming more particular about the appearance of packaging, especially in premium and organic food segments, duplex paper helps brands create visually appealing, customizable, and informative packaging.

Duplex paper and board are relatively low-cost compared to other packaging materials, such as plastics or solid bleached sulfate (SBS) boards. For the food and beverages industry, which often deals with large volumes of packaging, duplex boards offer an economical option that doesn’t compromise on functionality or visual appeal.

Duplex paper is highly versatile and can be used for various types of food and beverage packaging, including: Cartons for beverages (milk, juices, and soft drinks) Boxes for dry foods (cereals, pasta, snacks) Bakery and confectionery packaging Takeout containers and trays Sleeves for frozen food The ability to customize duplex board for different formats makes it suitable for a wide array of food packaging needs, from small portions to bulk items.

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025