March 2025

.webp)

Principal Consultant

Reviewed By

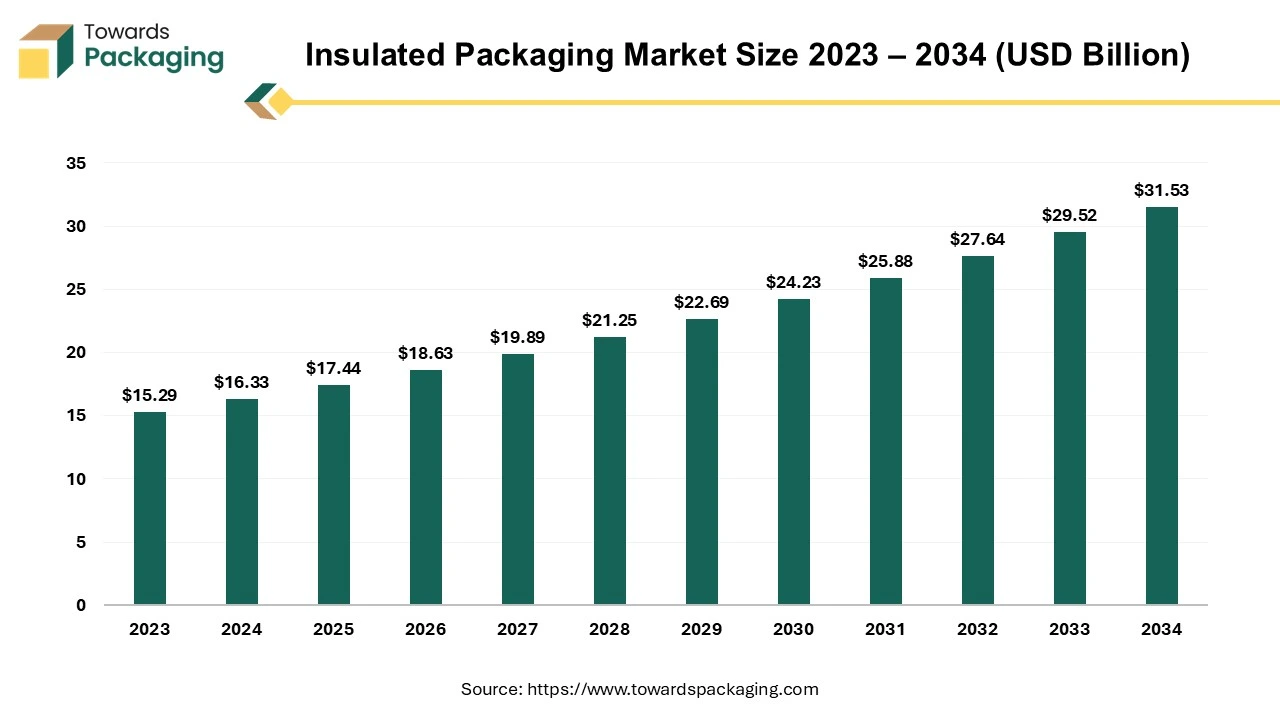

The global insulated packaging market size reached US$ 15.29 billion in 2023 and is projected to hit around US$ 31.53 billion by 2034, expanding at a CAGR of 6.8% during the forecast period from 2024 to 2034.

Changing consumer purchasing patterns driven by increasing health and wellness awareness are compelling, significant brands in the food & beverages, pharmaceuticals, and related industries to closely monitor rapid technological advancements and innovations in the packaging sector. End-user companies, especially those in the food & beverages and pharmaceutical sectors, are growing in preference for sustainable, eco-friendly, and health-focused packaging solutions. This enables them to uphold product quality, extend shelf life, and appeal to health-conscious consumers.

Additionally, the development of innovative insulated packaging products made from recycled and recyclable materials, such as jute, is expected to boost the adoption of these eco-friendly packaging solutions in the future. These significant factors are anticipated to fuel the growth of the global insulated packaging market.

The global insulated packaging market is experiencing significant growth due to rising disposable income and consumer preference for products packed with safe and environmentally friendly solutions in developed and developing regions. Additionally, the market is propelled by the expanding use of insulated packaging products in the chemicals sector, where producers increasingly focus on handling hazardous bulk chemicals carefully. Furthermore, the growing demand for packaged and frozen food items is expected to drive market growth during the forecast period. However, challenges such as fluctuations in raw material prices and stringent government regulations are impacting the adoption of insulated packaging products to some extent. These factors are anticipated to hinder the global insulated packaging market's overall size and growth performance. Businesses in this industry need to navigate these challenges strategically to capitalize on the market's potential and ensure sustainable growth.

Insulated packaging plays a crucial role in the pharmaceutical industry, utilizing materials like cotton fiber pads to effectively block heat and maintain high-quality standards during transit. This type of packaging ensures the temperature of packages is comfortably maintained between 2-8 degrees Celsius for over 24 hours. Apart from temperature control, insulated packaging offers medical sterilization by providing a robust sterile barrier. Its heat resistance properties contribute to increased shelf life and ease of use, making it highly valuable for pharmaceutical applications.

This technology finds extensive use in hospitals and is adopted by medical equipment and medical disposables manufacturers. Moreover, it opens new service avenues, enabling patients with chronic illnesses to receive medications conveniently delivered to their homes. The pharmaceutical industry relies on insulated packaging to preserve the integrity of medical products during transportation and enhance healthcare accessibility and patient convenience.

Artificial Intelligence (AI) has gained momentum in the packaging industry. AI technology has helped improve operational efficiency, reduce costs of labor, maintain consistent quality and minimize human errors in production, distribution and supply chain of the insulated packaging market. AI has a number of applications, which are slowly being explored in various packaging industries. The process of designing and labelling packaging requires a high level of precision where AI can help. With AI based tools, analyzing patterns of consumer behavior along with quicker designing process makes a big impact on the brand identity. Integration of smart packaging that can detect temperature, are tamper proof etc., can be possible through AI. In healthcare, there is a rising personalized medicine demand. The insulated packaging industry can utilize AI to create smart packaging, that is personalized for the pharmaceutical sector to accommodate the growing demand. Artificial Intelligence (AI) can be a game change in creating sustainable packaging.

In developing countries like China, India, Brazil, there is a significant opportunity for the insulated packaging market in the logistics. The range and availability of raw materials in high in these countries. These countries have a strong economic development especially, India and China which has helped push the growth of the manufacturing sector for industries such as food and beverage, electronics, automobile, packaging, and chemicals. An increasing urban population, low labor costs, changing lifestyle patterns and growing manufacturing sectors in these countries is increasing demand for various packaging. The insulated packaging industry could explore the potential of this region and optimize their market growth and revenue share.

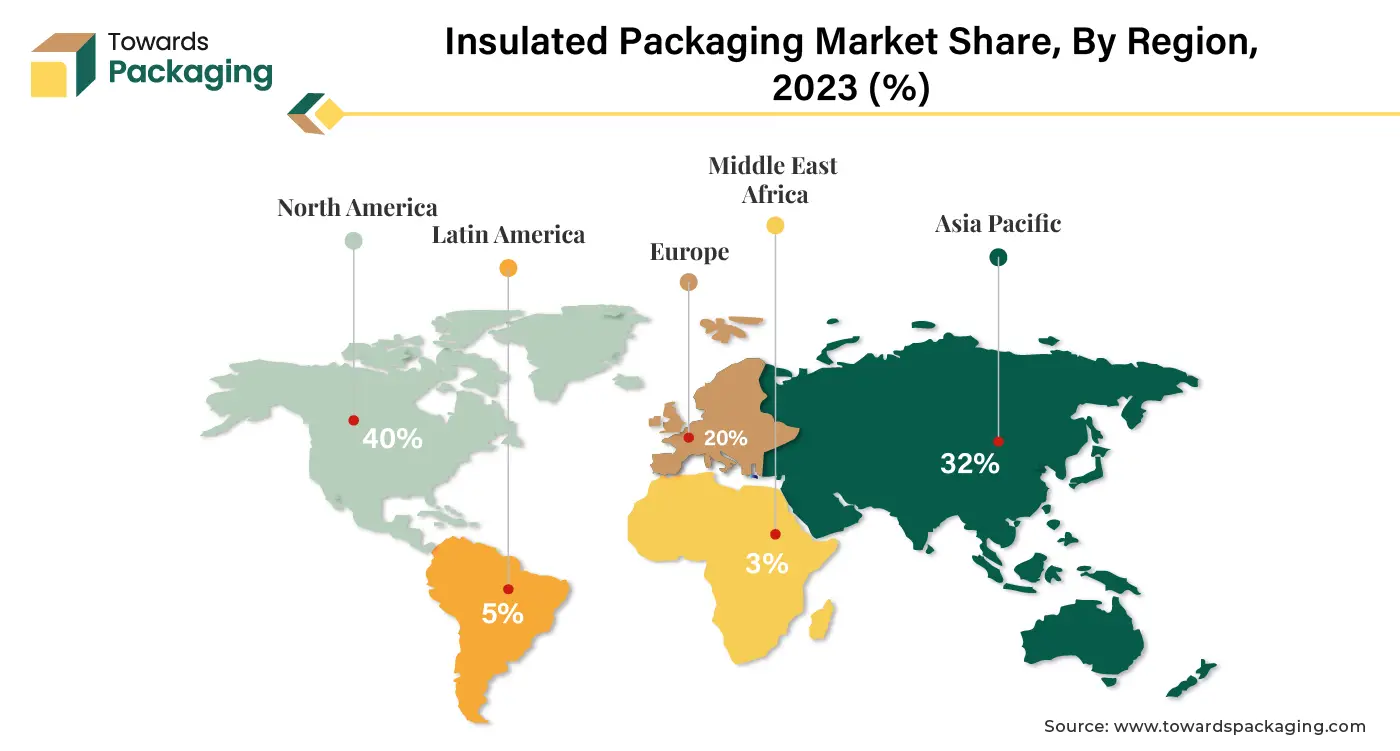

The insulated packaging market is experiencing significant global growth driven by various regional factors reshaping the industry landscape. North America's market is thriving due to the increasing demand for temperature-sensitive goods, such as pharmaceuticals and perishable food items.

Government initiatives in Mexico are fueling substantial growth in the regional industrial sectors. The deliberate push for industrialization has created a conducive environment, attracting investments due to favorable conditions and a readily available workforce. These factors are instrumental in driving the region's industrial growth. Furthermore, the established smart packaging sector and the government's efforts to offer technologically advanced packing solutions are anticipated to boost the market significantly in the foreseeable future.

Financial support from esteemed organizations like the Organization for Economic Co-operation and Development (OECD) for manufacturing activities, combined with the rising demand for smart packaging products, particularly in the food and beverages sector, is expected to further propel the intelligent packaging market in the region. This trend is indicative of a positive trajectory for the market.

The growth of the IP industry in the region is also being bolstered by rapid urbanization, robust government financial standings leading to increased infrastructure investments, and a rise in disposable income among consumers. Government entities have engaged in strategic Public-Private Partnerships (PPPs) to foster the development of the electronics and automobile sectors. These collaborative efforts, driven by the governments, aim to deliver efficient, modern electronics, further stimulating growth in the Intelligent packaging industry. Businesses in this sector are positioned to benefit from these evolving market dynamics, offering ample opportunities for expansion and innovation.

Asia-Pacific is emerging as a key player in the global insulated packaging market, primarily due to the rapid growth of the e-commerce sector in countries like China and India. The rising middle-class population and changing consumer preferences have led to a surge in online shopping, fueling the demand for insulated packaging solutions. In addition, the pharmaceutical industry in Asia-Pacific is expanding, with several countries becoming significant hubs for pharmaceutical manufacturing. This growth has created a need for insulated packaging to transport temperature-sensitive drugs and vaccines safely.

India's burgeoning population and rapid urbanization create a sustained demand for infrastructural development. Recognizing this need, the government has prioritized infrastructural growth to enhance trade competitiveness and manage the challenges posed by the country's exponential population growth. Key initiatives such as the implementation of Goods and Service Tax (GST) for simplified taxation and the "Make in India" campaign promoting domestic manufacturing activities are pivotal drivers propelling the intelligent packaging market in India.

India is witnessing the establishment of numerous Special Economic Zones (SEZs) to cater to the rising demand for commercial office spaces, mainly by multinational companies and IT hubs. Additionally, the country's population, income levels, and organized retail sector have experienced significant growth. Young consumers are inclined toward premium consumer goods, driving demand for higher living standards. This confluence of factors is expected to influence the IP market in India positively throughout the forecast period.

Businesses in the intelligent packaging sector are poised to benefit from these favorable conditions. The growing emphasis on infrastructural development and government initiatives aimed at simplifying taxation and promoting domestic manufacturing creates a conducive environment for the industry's expansion. Moreover, the evolving consumer preferences and the increasing demand for premium products provide lucrative opportunities for innovation and market growth within the IP sector in India.

The demand for efficient and sustainable packaging solutions has become paramount in the ever-expanding global market. Insulated packaging stands out as a crucial segment, ensuring the safe transportation and storage of temperature-sensitive products. In this context, corrugated cardboard has emerged as a versatile and eco-friendly material, playing a pivotal role in the insulated packaging market.

Corrugated cardboard, composed of multiple layers of paperboard, is renowned for its strength, durability, and cost-effectiveness. This material is an excellent insulator, providing a protective barrier against temperature fluctuations. Its inherent insulation properties make it ideal for creating insulated packaging solutions, especially for perishable goods such as pharmaceuticals, food, and beverages. The ability of corrugated cardboard to maintain the desired temperature within the packaging, shielding products from external heat or cold, is instrumental in preserving their quality and extending shelf life.

One of the primary drivers of the insulated packaging market is the growing emphasis on sustainability and environmental consciousness. Corrugated cardboard, biodegradable and recyclable, aligns perfectly with these eco-friendly trends. Businesses and consumers alike are increasingly seeking packaging solutions that minimize environmental impact. The use of corrugated cardboard in insulated packaging addresses this demand, allowing companies to adopt greener practices while ensuring the safety of their products. Furthermore, corrugated cardboard is lightweight, reducing transportation costs and carbon emissions, thus making it an environmentally friendly logistics choice.

With its environmental benefits, corrugated cardboard offers versatility in design and customization. Manufacturers can engineer corrugated structures tailored to specific insulation requirements. These customizations include varying the number of layers, incorporating additional insulating materials, or creating multi-layered barriers. Such flexibility ensures that insulated packaging solutions are effective and adaptable to diverse products and transportation needs. The ease of printing and branding on corrugated surfaces further enhances its appeal, allowing businesses to reinforce their brand identity and communicate vital information to consumers.

The insulated packaging market, bolstered by corrugated cardboard, is witnessing notable growth in various sectors.

For instance,

As the market continues to evolve, businesses are investing in research and development to enhance the insulating properties of corrugated cardboard further. Innovations such as advanced coatings, phase change materials, and vacuum-insulated panels are being integrated into corrugated structures, pushing the boundaries of thermal insulation capabilities. These advancements cater to the current market demands and pave the way for future applications, including in the rapidly expanding e-commerce sector, where reliable, insulated packaging is essential for delivering temperature-sensitive goods directly to consumers’ doorsteps.

The synergy between the insulated packaging market and corrugated cardboard represents a significant stride toward sustainable, efficient, and adaptable packaging solutions. The strategic integration of this eco-friendly material not only addresses the pressing environmental concerns and meets the evolving needs of businesses and consumers worldwide. As industries continue to prioritize the safe transportation and storage of temperature-sensitive products, corrugated cardboard stands as a stalwart, providing reliable insulation and fortifying the foundation of the insulated packaging market in the years to come.

In the fiercely competitive arena of insulated packaging, the comparative landscape is shaped by a select group of key players that have set industry standards and continuously drive innovation. Companies in this space are relentlessly pursuing cutting-edge solutions that balance thermal efficiency, environmental sustainability, and cost-effectiveness. Among the prominent players, Sonoco Products Company stands out as a market leader, renowned for its comprehensive range of insulated packaging solutions catering to diverse industries. Their ability to customize products according to specific client requirements has positioned them as a preferred choice for businesses requiring tailored thermal protection. Eco-Products, Inc., another significant player, has garnered attention for its sustainable approach. Their insulated packaging maintains temperature integrity and is made from eco-friendly materials, resonating strongly with environmentally conscious consumers.

Huhtamaki Group, a global packaging giant, has made significant strides in the insulated packaging sector, emphasizing durability and product safety. Their solutions, particularly in the food and pharmaceutical segments, have earned them a reputation for reliability and quality. ThermoSafe Brands, a unit of the Sonoco family, specializes in temperature-assured packaging for the pharmaceutical and life sciences industries, offering an array of cutting-edge, validated solutions for temperature-sensitive products. Lastly, Pelican BioThermal, recognized for its innovative reusable packaging solution, provides a range of high-performance insulated containers suitable for the pharmaceutical, biotech, and life sciences sectors.

These key players dominate the market and serve as trendsetters, pushing the boundaries of insulated packaging technology while setting new benchmarks for quality and sustainability. Their strategic initiatives, including mergers, acquisitions, and collaborations, continue to shape the competitive landscape, ensuring that the industry remains dynamic, responsive, and always at the forefront of thermal protection solutions. Concierge Care of Florida, LLC 3800 Hillcrest Drive Hollywood, FL 33021.

Amcor PLC, Cryopak, Davis Core & Pad Company, DS Smith PLC and Innovative Energy Inc., Eco-Products, Inc., Huhtamaki Group, ThermoSafe Brands, Pelican BioThermal.

By Type

By Product

By Application

By Regional

March 2025

March 2025

March 2025

March 2025