April 2025

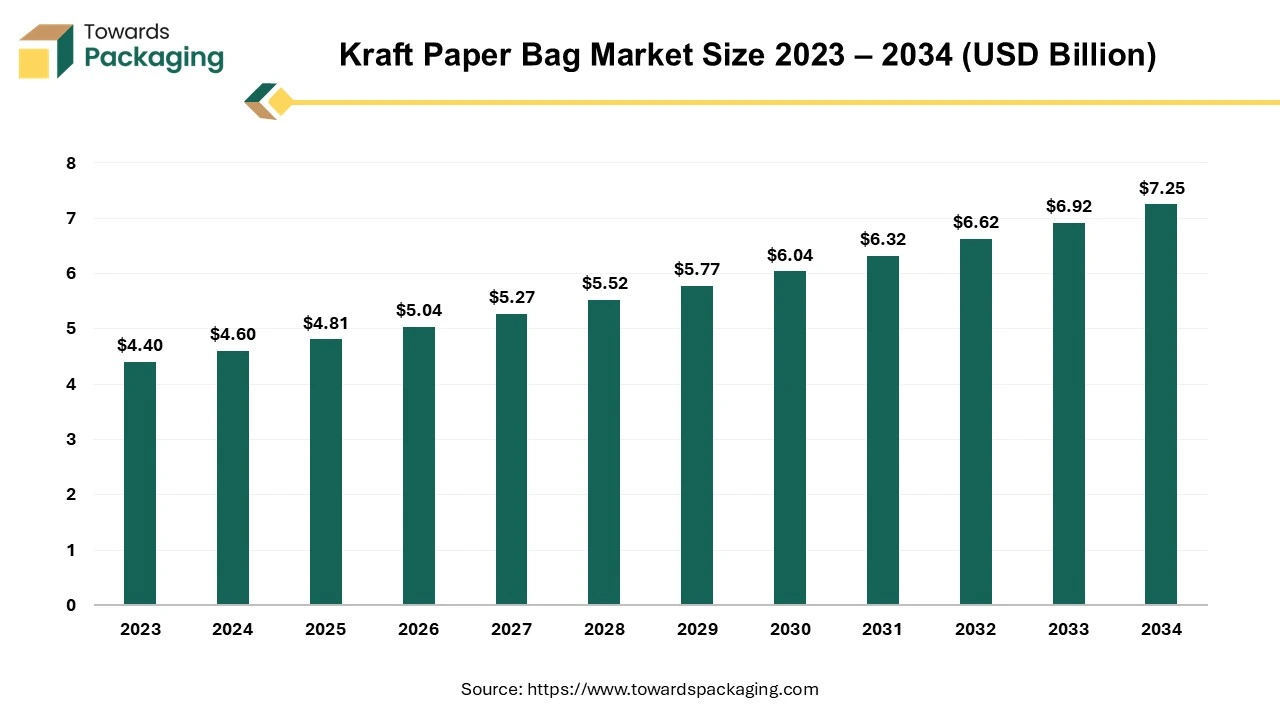

The kraft paper bag market is forecast to grow from USD 4.81 billion in 2025 to USD 7.25 billion by 2034, driven by a CAGR of 4.65% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing kraft paper bag which is estimated to drive the global kraft paper bag market over the forecast period.

The kraft paper bag is majorly made up of recyclable fiber and is compostable and biodegradable. Kraft paper, a thick, resilient, and rip-resistant paper product that is frequently used for packaging and supermarket shopping, is used to make kraft paper bags. Kraft paper bag packaging is a sustainable and versatile packaging solution used across industries for its strength, eco-friendliness, and aesthetic appeal. Derived from the German word "kraft," meaning "strength," kraft paper is produced using the kraft process, a method that involves chemically converting wood into wood pulp, ensuring durability and a natural brown appearance.

Kraft paper is known for its high tear resistance and tensile strength, making it ideal for packaging heavy or bulky items like flour, sugar, or hardware supplies. Made from renewable resources, kraft paper is biodegradable and recyclable. It aligns with sustainable practices, making it a preferred choice for environmentally conscious businesses.

Increase in requirement for biodegradable and recyclable packaging solutions is driving the adoption of kraft paper bags. Consumers and businesses alike are prioritizing sustainability, particularly in sectors like food & beverages, cosmetics, and retail

Advanced designs like pinch-and-seal zippers and stand-up pouches are gaining popularity for convenience and enhanced product protection. Food & beverage remains the largest application segment, with packaging solutions that align with consumer preferences for organic and wholesome branding.

Recycled kraft paper is becoming increasingly favoured for heavy-duty applications due to its durability and environmental benefits. Bleached kraft paper is rising in popularity for its aesthetic appeal and suitability for high-end branding.

Improved barrier properties and lightweight designs make kraft paper bags a versatile choice for diverse sectors, including pharmaceuticals and electronics.

The integration of artificial intelligence can exclusively improve the kraft paper bag market by optimizing production, improving sustainability, enhancing customer experience, and driving innovation. The AI-powered systems can monitor machinery in kraft paper bag production lines, identifying potential failures and reducing downtime. The integration of AI can analyze production data to optimize raw material utilization, minimize waste, and ensure consistent quality in kraft paper bags.

The AI-enabled robotics can streamline tasks like folding, cutting, and printing, reducing labor costs and enhancing speed. AI can assists develop new formulations for kraft paper that are lighter yet stronger, improving eco-friendliness and cutting-down costs. The AI integrated machine learning models can optimize production to reduce raw material wastage and enhance recycling efficiency.

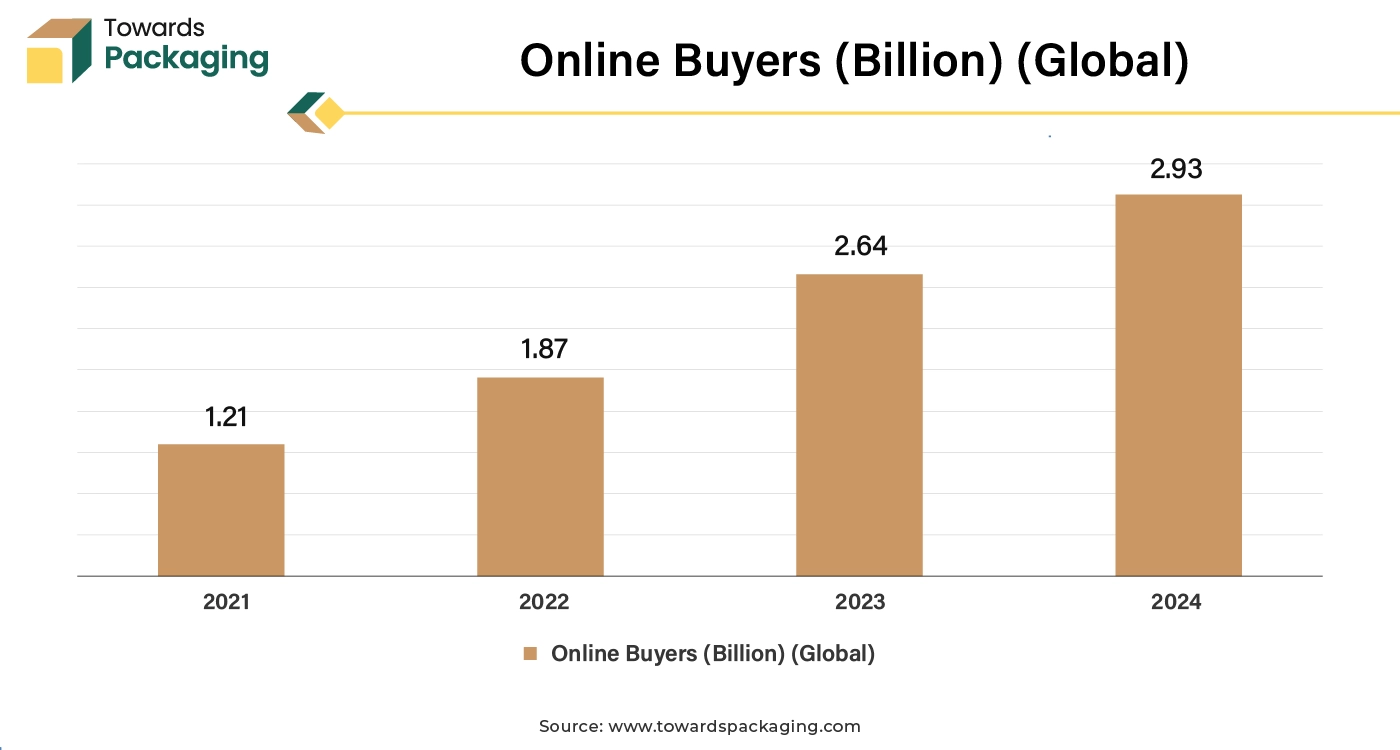

The growth of e-commerce and online retail requires lightweight, durable, and sustainable packaging solutions, making kraft paper bags a preferred choice. Retail brands utilize kraft paper bags to reinforce an eco-friendly brand image, especially in the food, fashion, and cosmetics sectors.

The key players operating in the market are facing issue in fulfilling regulatory norms as well as competition from the alternative packaging solutions, which can hamper the growth of the kraft paper bag market over the forecast period. Kraft paper bags are less durable than plastic, especially in wet or heavy-duty applications, limiting their usability for certain products, such as liquids or heavy goods. The availability and cost of raw materials, such as wood pulp, can fluctuate due to deforestation concerns, environmental regulations, or supply chain disruptions, affecting production. While kraft paper is recyclable, recycling facilities may be limited in certain regions.

Contamination by food or grease can also minimize recyclability. Although considered eco-friendly, kraft paper production is resource-intensive, requiring significant energy and water, which raises concerns about its overall environmental footprint compared to recycled plastic alternatives. Reusable bags made from fabric or other biodegradable materials pose competition to kraft paper bags, as they offer higher durability and perceived sustainability.

Increasing concerns over the environmental impact of plastic packaging have driven a shift towards biodegradable and recyclable alternatives, such as kraft paper bags. Businesses are adopting kraft paper bags to align with global sustainability goals and reduce their carbon footprint. Policies banning or restricting single-use plastics in regions like North America, Europe, and Asia-Pacific have spurred demand for kraft paper bags as eco-friendly substitutes. Incentives for sustainable packaging solutions encourage businesses to switch to kraft paper.

For instance, The Department of the Interior has taken proactive steps to phase out single use plastic products, which pollute waterways, harm wildlife, and pose risks to human health. Issued on June 8, 2022, Secretary's Order 3407 (SO 3407) aims to reduce the procurement, sale and distribution of single-use plastic products and packaging, with a goal of phasing out all single-use plastic products on Department-managed lands by 2032. It is part of the implementation of President Biden's Executive Order 14057, which calls for federal agencies to take actions to reduce and phase out procurement of single-use plastic products to the maximum extent practicable.

The brown kraft paper segment held a dominant presence in the kraft paper bag market in 2024. Brown kraft paper is made from unbleached wood pulp using the kraft process, which results in long, strong fibers. This gives the paper excellent tensile strength and tear resistance, making it ideal for carrying heavy or bulky items. Since brown kraft paper is unbleached, it requires less processing and fewer chemicals compared to bleached kraft paper. This minimizes production costs, making it a more economical choice for manufacturers. Brown kraft paper is biodegradable, recyclable, and often manufactured from recycled materials, aligning with increasing consumer demand for sustainable packaging solutions.

Brown kraft paper is highly versatile and can be utilized for a variety of bag types, from grocery bags to luxury shopping bags. It can also be easily printed on, laminated, or coated for enhanced functionality or branding. Kraft paper has natural breathability, making it ideal for packaging perishable goods, such as fruits and vegetables, as it helps maintain freshness by allowing air circulation. The combination of these factors makes brown kraft paper a practical, cost-effective, and environmentally friendly choice for making kraft paper bags.

The white kraft paper segment is expected to grow at the fastest rate in the kraft paper bag market during the forecast period of 2024 to 2034. White kraft paper provides a clean, polished, and premium look, making it ideal for luxury retail, high-end brands, or special occasions. It offers an excellent background for printing vibrant logos, designs, or text. Its white surface enhances print quality and color vibrancy, making it more suitable for branding and promotional purposes than brown kraft paper. The durability and strength allows it used for the premium product packaging.

Like brown kraft paper, white kraft paper is also made using the kraft process, retaining good strength and tear resistance. It can be used for carrying light to moderately heavy items. White kraft paper is versatile and can be used for various bag types, including shopping bags, food packaging, and gift bags. Its bright appearance makes it suitable for diverse industries, such as fashion, retail, and food service.

The pasted valve segment accounted for a significant share of the kraft paper bag market in 2024.

Pasted valve kraft paper bags are widely used due to their functional, economic, and environmental benefits. These bags are designed to efficiently store, transport, and dispense a variety of materials. Pasted valve kraft paper bags are made from multiple layers of kraft paper, which provides excellent strength and tear resistance. They are ideal for carrying heavy and bulk materials like cement, chemicals, and grains.

The pasted valve design allows for quick and automated filling, improving production efficiency. Once filled, the valve self-seals due to the pressure of the material inside, reducing the need for additional sealing equipment. These bags are used across various industries, including construction (for cement and plaster), agriculture (for fertilizers and seeds), food (for flour and sugar), and chemicals (for powders and granules).

The 1 ply segment dominated the kraft paper bag market globally. Due to its widespread utility and cost-effectiveness, 1-ply kraft paper is readily available in various sizes, finishes, and types (e.g., coated or uncoated), making it accessible for small and large-scale users. 1-ply thickness kraft paper is widely used in various applications due to its balance of functionality, cost, and versatility. 1-ply kraft paper is economical to produce, making it a cost-efficient choice for businesses. Its single-layer structure reduces material and production costs while still meeting many packaging needs.

Although thinner than multi-ply alternatives, 1-ply kraft paper provides adequate strength for lightweight packaging and wrapping, such as grocery bags, bakery bags, or gift wrap. It can handle moderate loads without unnecessary material usage. The thinness of 1-ply kraft paper makes it flexible and easy to fold, crease, or cut, making it suitable for diverse applications like wrapping, arts and crafts, or lightweight envelopes. 1-ply kraft paper is biodegradable, recyclable, and often manufactured from recycled materials, aligning with growing consumer and regulatory demands for sustainable packaging options.

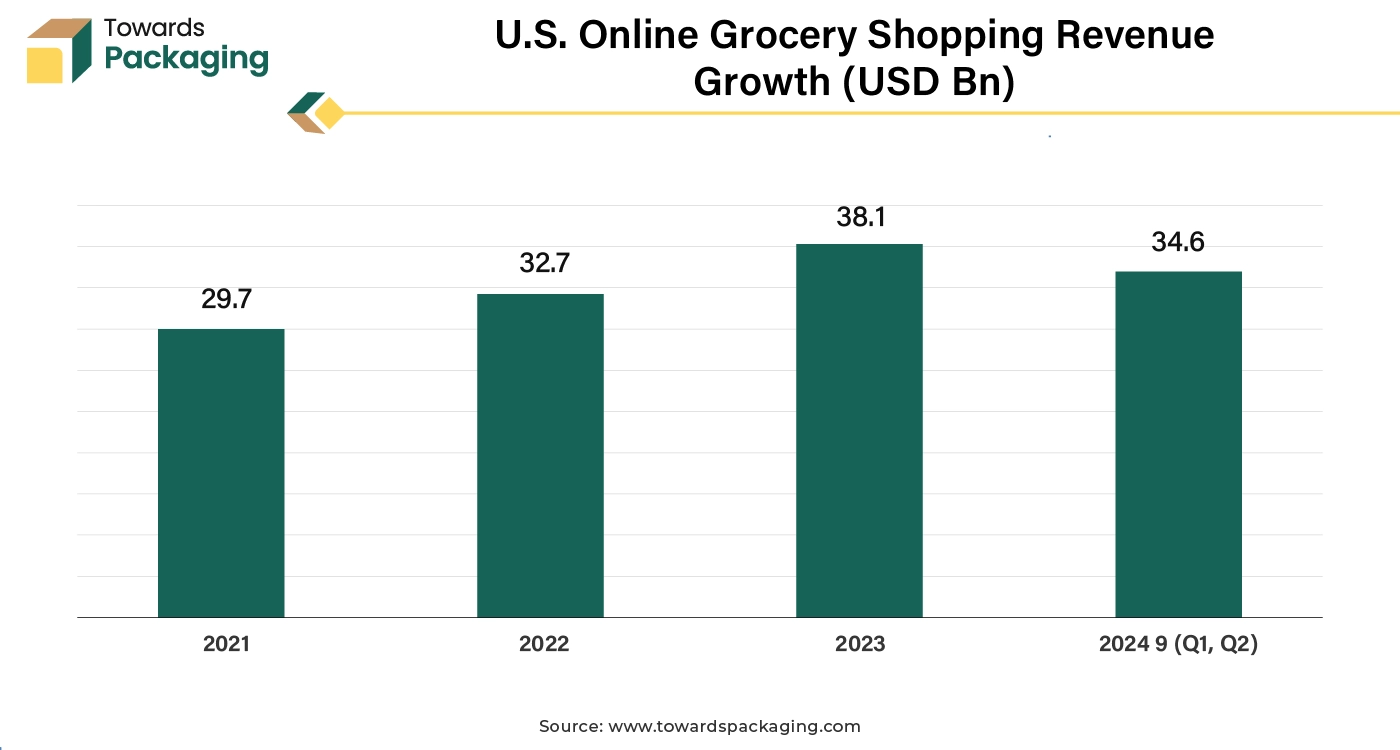

The food service segment led the global kraft paper bag market in 2024. With the rise of eco-conscious consumers and stricter regulations on single-use plastics, food service businesses are transitioning to sustainable packaging solutions like kraft paper bags. These are biodegradable, recyclable, and align with environmental goals, making them a preferred choice for restaurants, cafes, and takeaway outlets.

Asia Pacific dominated the global kraft paper bag market in 2024. Online shopping generates high demand for packaging materials to protect and transport goods. Kraft paper bags, known for their durability and eco-friendliness, are increasingly used as secondary or primary packaging, especially for smaller, non-fragile items. With increasing environmental awareness and government regulations in countries like China, India, and Japan, e-commerce companies are adopting kraft paper bags to reduce their reliance on plastic packaging. This transition aligns with consumer preferences for eco-friendly packaging. Rising incomes, urbanization, and improved internet penetration in countries like India, China, Indonesia, and Vietnam have boosted online shopping, leading to increased demand for packaging solutions like kraft paper bags.

The region has a rapidly growing population and middle class, with more consumers shopping online for fashion, food, electronics, and other goods. This drives demand for packaging materials, including kraft paper bags for items like apparel and groceries.

North America is projected to host the fastest-growing kraft paper bag market in the coming years. Numerous North American states and municipalities have banned or restricted plastic bags, which has prompted companies to switch to more environmentally friendly options like kraft paper bags. These laws encourage sustainability and foster a positive market for goods made of kraft paper. As laws change, other areas will probably follow suit, increasing the market for kraft paper bags. Businesses and consumers are increasingly turning to paper-based alternatives as worries about plastic pollution grow.

Compared to plastic bags, which take decades to break down and seriously damage the environment, kraft paper bags are more environmentally friendly because they are manufactured from recycled and renewable materials. The transition to paper packaging has been further encouraged by the numerous states and municipalities in the U.S. that have banned or taxed plastic bags.

Paperworld Middle East has added the Kraft and Packaging section to meet the rising demand for the segment as the industry shifts towards adopting more sustainable materials and practices," said Syed Ali Akbar, Show Director for Paperworld Middle East and Gifts and Lifestyle Middle East, in reference to the new addition.

By Paper

By Product

By Thickness

By End Use

By Region

April 2025

April 2025

April 2025

April 2025