April 2025

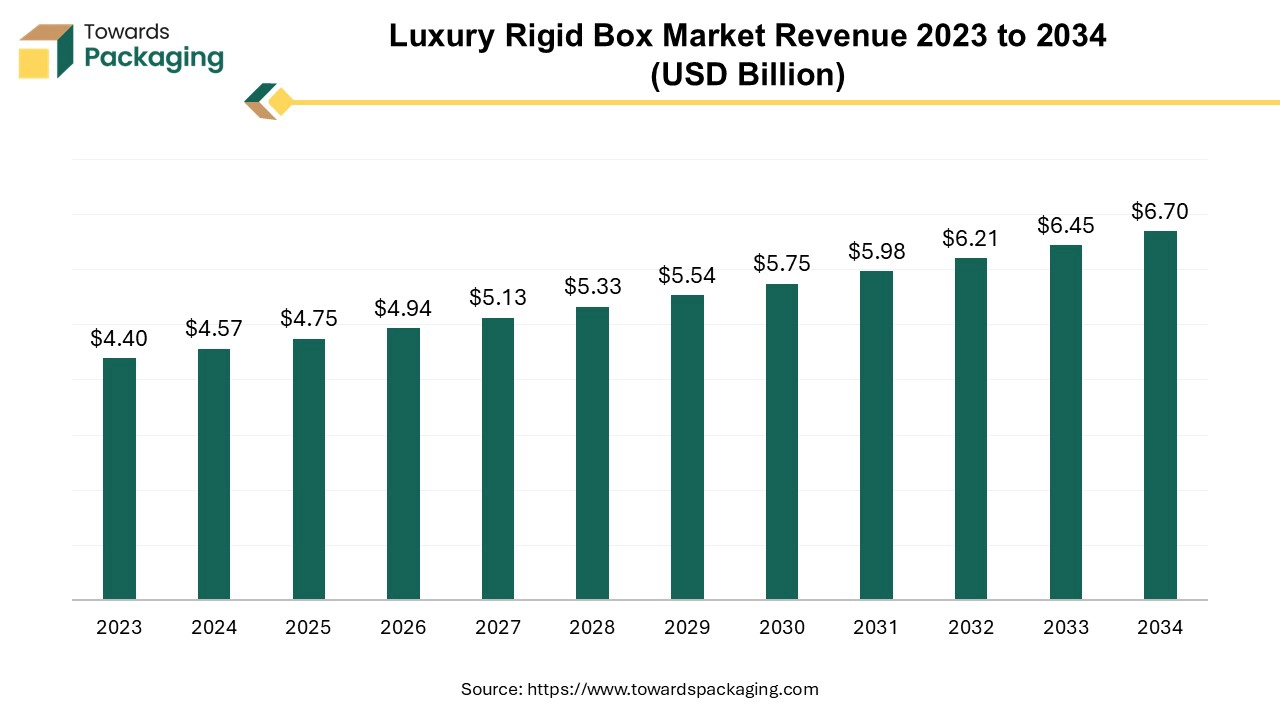

The luxury rigid box market is expected to increase from USD 4.75 billion in 2025 to USD 6.70 billion by 2034, growing at a CAGR of 3.9% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

There is a rising demand for eco-friendly materials and practices within the luxury rigid box market. Brands are increasingly seeking sustainable packaging options that maintain luxury aesthetics while minimizing environmental impact. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing luxury rigid box which is estimated to drive the global luxury rigid box market over the forecast period.

The luxury rigid box market refers to the segment of the packaging industry focused on high-quality, sturdy boxes used primarily for luxury goods. These boxes are distinguished by their durability, aesthetic appeal, and premium materials, which contribute to their high perceived value. A luxury rigid box is a type of high-end packaging that is distinguished by its structural integrity, premium materials, and aesthetic design. It is often used to package luxury items such as high-end cosmetics, jewellery, watches, designer apparel, and other upscale products. Unlike collapsible or flexible packaging, luxury rigid boxes are manufactured from dense materials such as paperboard or chipboard. These materials are layered and bonded to create a firm and sturdy structure that offers excellent protection for the contents.

The choice of materials is important in luxury rigid boxes. High-quality materials such as specialty paper, thick cardboard, or eco-friendly options are utilized. Some luxury boxes may also incorporate additional materials like metal, wood, or fabric for a more upscale feel. Luxury rigid boxes are highly customizable to match the brand’s identity and product specifications. Customization can include unique sizes, shapes, and construction styles. Common features include magnetic closures, hinged lids, or slipcase designs.

AI can help create complex and inventive designs, by examining trends and customer preferences. It can reduce the need for several iterations by generating design prototypes and suggesting improvements.

By anticipating demand trends and automating restocking procedures, artificial intelligence (AI) can enhance inventory management and logistics. This lowers expenses and waste by guaranteeing timely production and delivery. Rigid box quality can be examined using AI-powered image recognition systems, which can find flaws or irregularities that human eyes might overlook.

This guarantees a higher caliber of product. By evaluating client data, AI may provide customized features and designs, enabling unique packaging solutions. By providing customized packaging alternatives, this elevates the premium experience. Through predictive analytics, AI can forecast production costs and optimize material usage, helping to manage expenses more effectively.

AI is able to give insightful analysis of market trends and customer feedback, enabling brands to modify their approach to better align with the needs and preferences of their target audience. In general, the luxury rigid box industry can benefit from AI integration through increased customer satisfaction, improved design capabilities, and operational efficiencies.

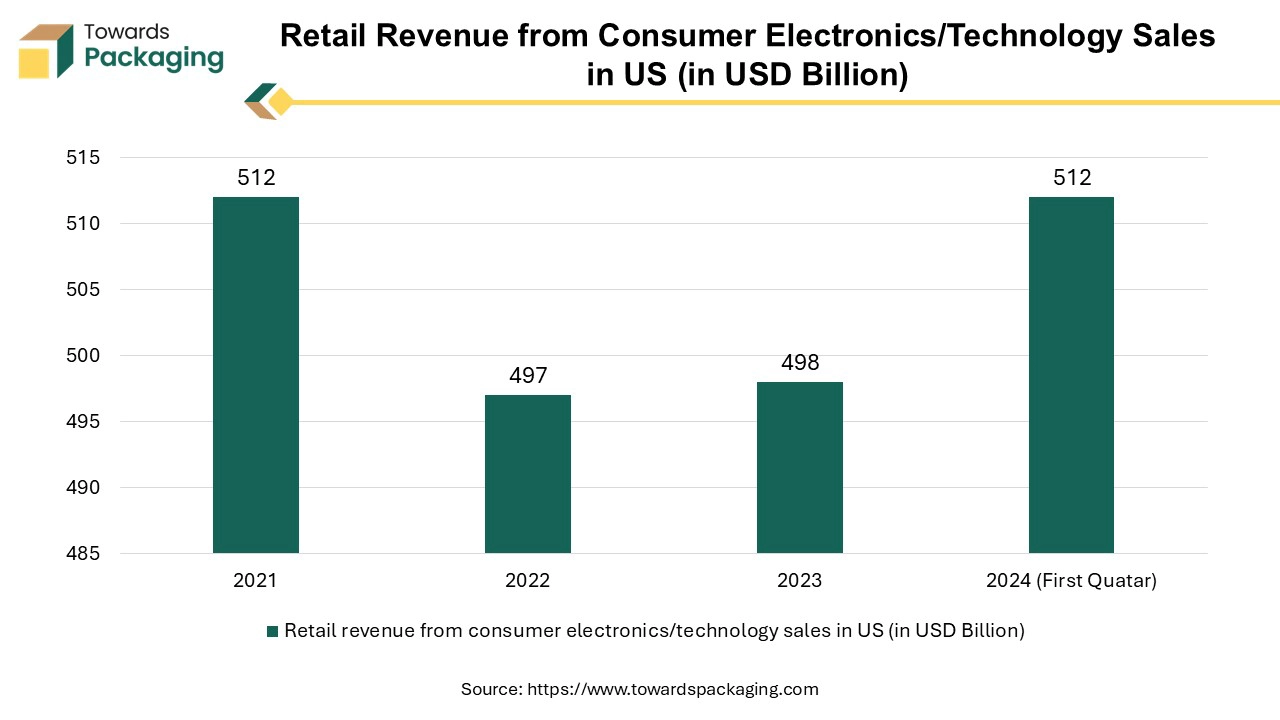

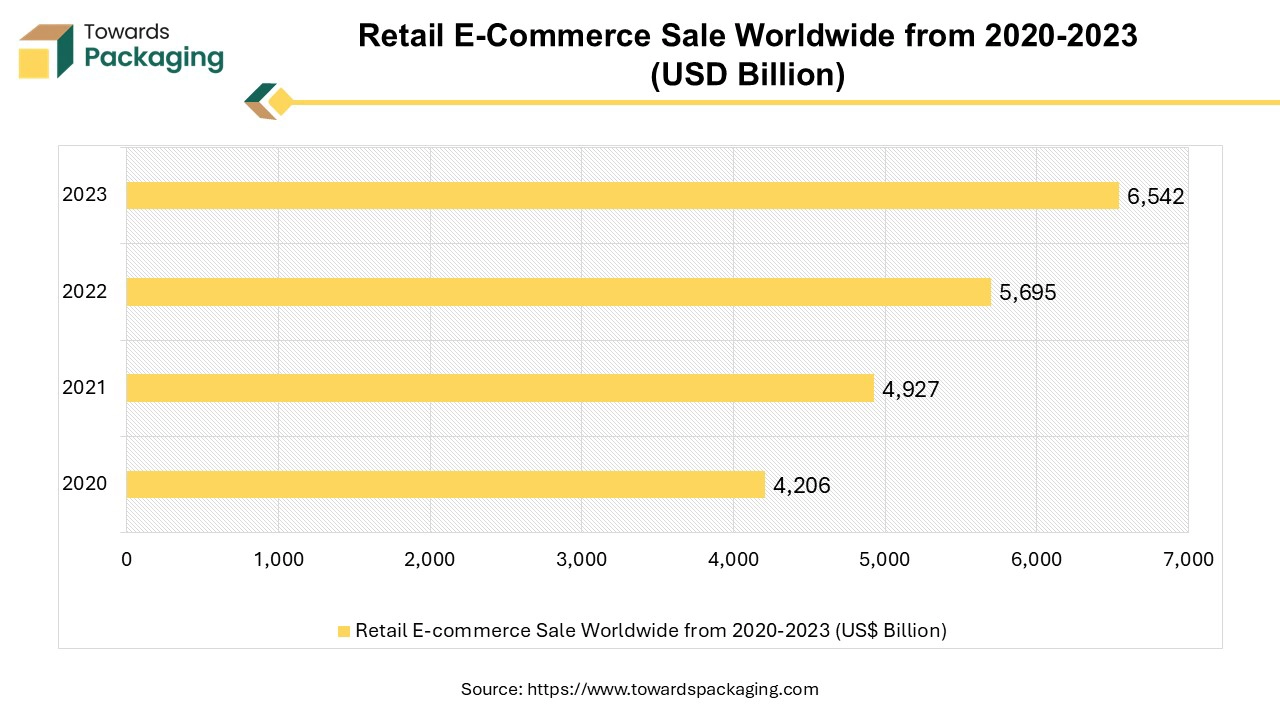

The rise of online shopping platforms has made it easier for consumers to access and purchase a wide range of electronics, contributing to sector growth. Continuous innovation in technology, such as the development of faster processors, improved displays, and new functionalities, drives consumer interest and demand for the latest gadgets. The emphasis on the unboxing experience is significant in the luxury market. Rigid boxes are designed to provide a memorable and tactile experience, enhancing the overall perception of the brand and product. Increasing launch of the new consumer electronics products is estimated to drive the growth of the luxury rigid box market.

The high cost for deployment of the manufacturing facility for luxury rigid box units is slowing down the production of premium rigid box which is restricting the growth of the luxury rigid box market. The materials and manufacturing processes for luxury rigid boxes can be expensive, which may deter some companies from investing in them. The materials and manufacturing processes for luxury rigid boxes can be expensive, which may deter some companies from investing in them.

During economic slowdowns or recessions, luxury goods, including high-end packaging, often see reduced demand as consumers and businesses cut back on spending. Shifts in consumer preferences towards minimalism or more sustainable options could affect the demand for traditional luxury packaging. The demand for advanced technology and skilled labor to create high-quality luxury rigid boxes can be a barrier for new entrants or smaller companies.

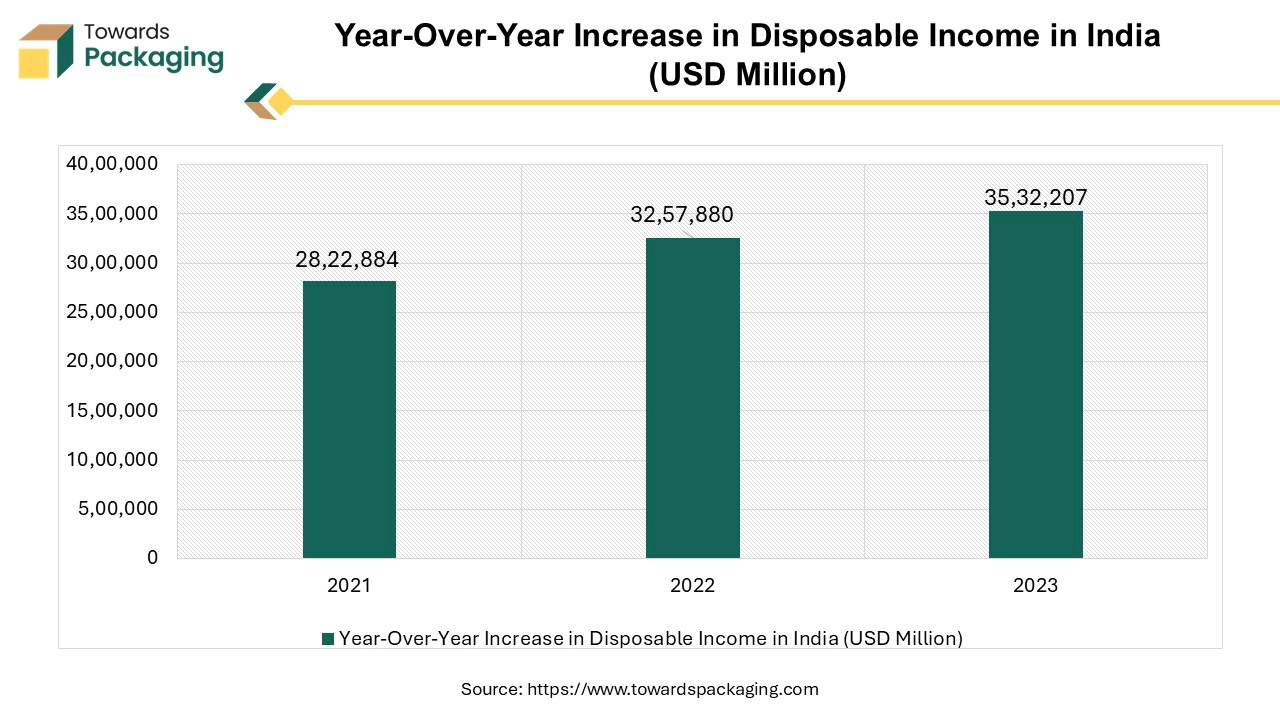

As disposable incomes rise globally, more consumers can afford luxury items, which boosts demand for high-quality packaging by acting as an opportunity for the luxury rigid box market. Brands are increasingly utilizing luxurious packaging to stand out in competitive markets, enhancing their brand image and customer experience. There is growing trend in sustainable and eco-friendly packaging solutions, providing opportunities for luxury rigid box manufacturers to innovate with recycled or biodegradable materials.

The two-piece box segment held the dominating share of the luxury rigid box market in 2024. The two-piece rigid structure box offers excellent protection for the contents, ensuring they are secure during transit and handling. The two-piece design—consisting of a separate lid and base-gives the packaging a high-end, sophisticated look that enhances the perceived value of the product. It can be customized with various finishes, such as embossing, foil stamping, and special coatings, which add to the luxury appeal. The lid can be easily removed and replaced, making the box practical for repeated use and providing a more premium unboxing experience. The box's exterior provides ample space for branding and messaging, making it an effective marketing tool. The key players operating in the market are focused on launching the new two-piece luxury rigid box for packaging of the cosmetics which is estimated to drive the growth of the segment over the forecast period.

The paper & paper board segment held the dominating share of the luxury rigid box market in 2024. Paperboard is recyclable and often made from recycled materials, aligning with growing consumer preference for eco-friendly packaging solutions. Paperboard rigid boxes offer extensive customization options, including printing, embossing, and finishing techniques, allowing brands to create unique and attractive packaging. Compared to other high-end materials, paperboard can be more affordable while still providing a premium appearance and durability. Paperboard is lighter than many alternatives, which can reduce shipping costs and ease handling. The key players operating in the market are focused on launching new advanced technology for manufacturing the paper and paperboard luxury rigid box to meet the rising demand of the consumers.

In May 2024, Temperpack Technologies Inc., a company focused on manufacturing sustainable insulated packaging solutions, unveiled the introduction of the WaveKraft machine with capability to manufacture the paper and paperboard luxury rigid box out of used papers and cardboard. The newly launched WaveKraft machine is leading producer of the sustainable paperboard rigid box packaging solutions to the food and cosmetic industry costumers.

The magnetic closure segment held significant share of the luxury rigid box market in 2024. The magnetic closure mechanism allows the box to open and close smoothly with minimal effort, providing a user-friendly experience. Magnets ensure that the box stays securely closed, protecting the contents from accidental spills or exposure, while still being easy to open. The clean and seamless look of a magnetic closure adds to the overall aesthetic of the box, contributing to a sophisticated unboxing experience.

The magnetic mechanism is durable and reliable, maintaining its functionality over time without wear or degradation, which enhances the longevity of the box. The design often incorporates a simple yet elegant latch, which can make the interaction with the box feel more premium and intuitive. The key players operating in the market are focused on launching new luxury accessories in the magnetic closure luxury box which is estimated to drive the segment in the near future.

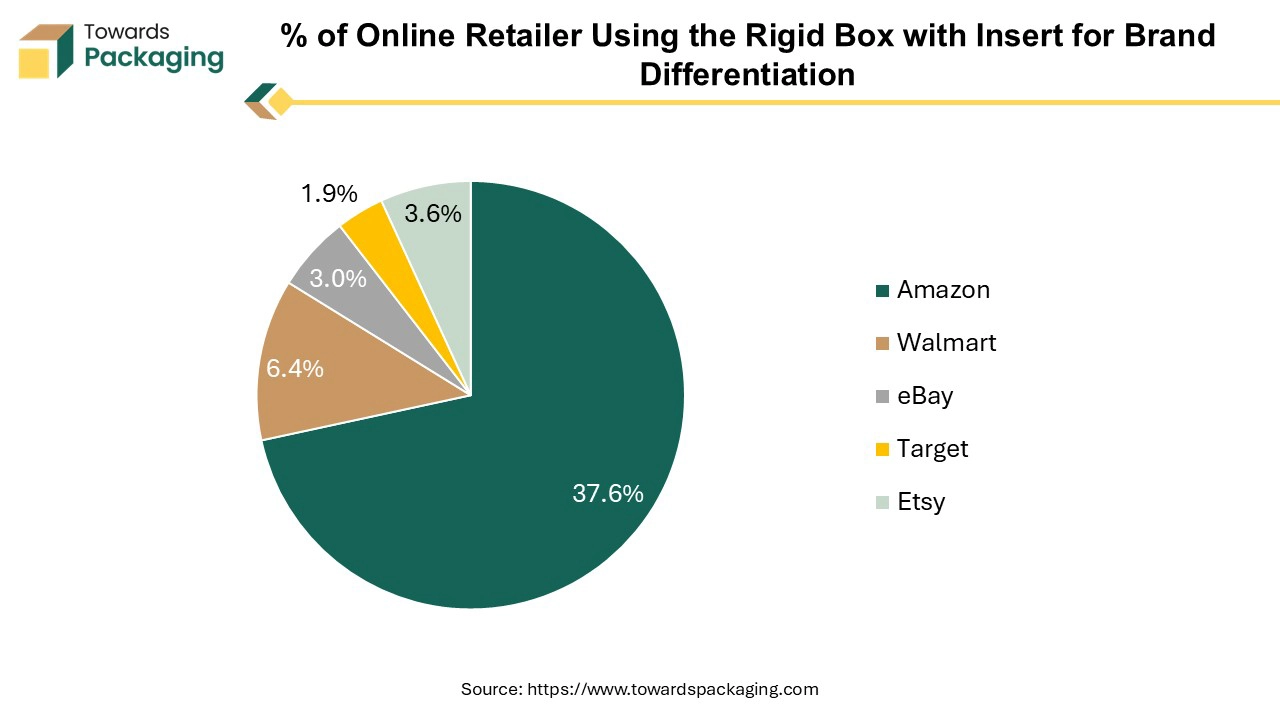

The with inserts segment shows the notable share in the luxury rigid box market in 2024. The luxury rigid box often come with foam inserts, paper inserts or plastic inserts. The inserts enhance the protection, premium presentation and increase the brand value, hence they are more in demand by the consumers and has projected significant share in the market in 2024. Inserts provide secure compartments or cushioning, which protects delicate or valuable items during transit and handling, reducing damage and returns. Inserts help in organizing and presenting products neatly within the box, enhancing the overall unboxing experience and making the product look more attractive and upscale.

Inserts can be tailored to fit specific products, allowing for customization that meets the unique requirements of different items, which appeals to both brands and consumers. High-quality, well-organized packaging with inserts reflects positively on the brand, creating a more memorable and professional image that can help differentiate products in a competitive market. Inserts can be designed to hold products in place, reducing movement and preventing damage, which is particularly beneficial for high-value or fragile items. Rigid boxes with inserts are suitable for a wide range of products, from electronics and cosmetics to luxury goods, making them a versatile packaging solution that appeals to many industries. Rise in online shopping by different apps has increased the market for the luxury rigid box with inserts.

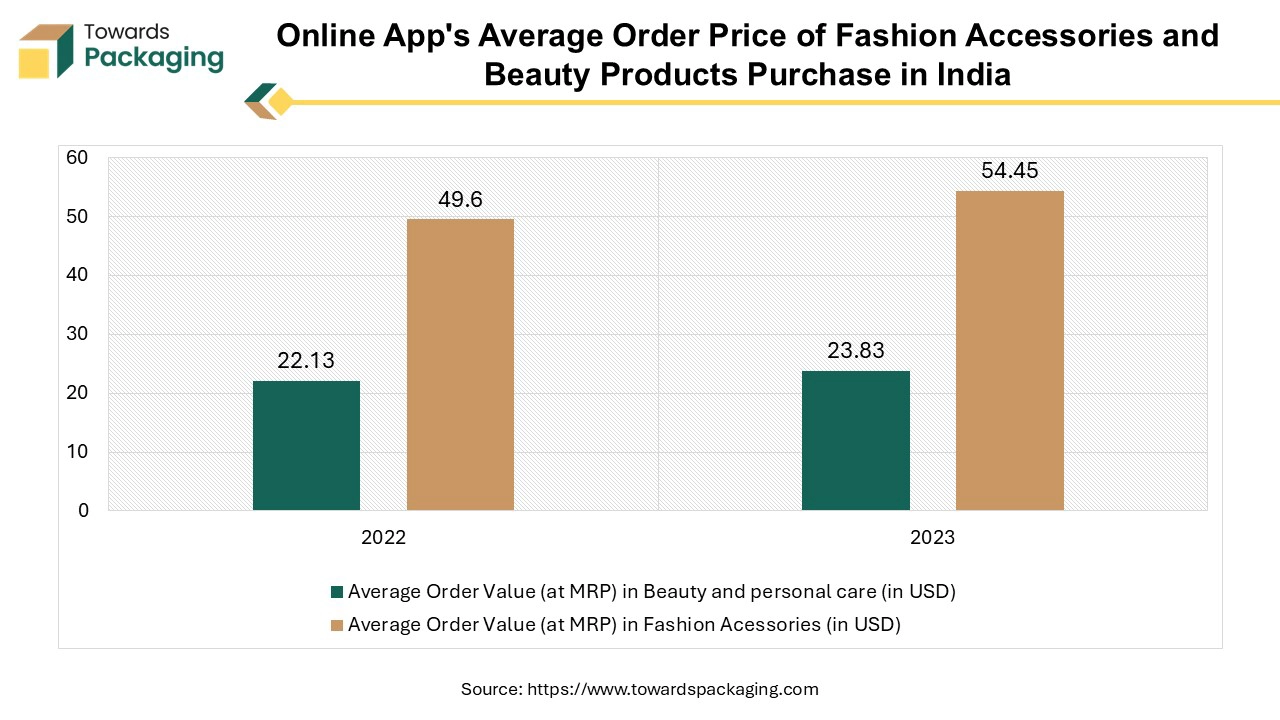

The fashion accessories & apparel segment to held the dominating share of the luxury rigid box market in 2024. Online shopping has made fashion more accessible to a broader audience, facilitating easier and more frequent purchases. The rapid production and turnover of trends by fast fashion brands keep consumers engaged and buying new items more often. Platforms like Instagram Reel and TikTok drive trends and influence purchasing decisions, expanding the reach of fashion brands. There is an increasing demand for specialized and niche products catering to various tastes and needs, from luxury to sustainable fashion. International trade and cultural exchange have expanded the availability and appeal of diverse fashion styles and brands across different regions.

The Europe region held a significant share of the luxury rigid box market in 2024. Many European countries have high levels of disposable income, allowing consumers to spend more on luxury and high-quality beauty and fashion products. Europe has a long-standing tradition in fashion and beauty, with many iconic brands and a deep-rooted appreciation for style and aesthetics. European brands are often at the forefront of fashion and beauty trends, driving innovation and attracting consumers interested in the latest styles and products. The growth of online shopping has made it easier for consumers to access a wide range of beauty and fashion products, boosting market reach and sales.

The European market is diverse, with a broad range of preferences and trends across different countries, which encourages brands to innovate and expand their offerings. Europe's popularity as a travel destination contributes to increased sales in the beauty and fashion sectors, as tourists often shop for local and luxury items. The key players operating in the market are focused on launching fashion and beauty brands in Europe which is estimated to drive the growth of the luxury rigid box market in Europe in the near future.

Asia Pacific is estimated to grow at fastest rate over the forecast period. Rapid industrialization and urbanization in countries like China, Japan, India, and South Korea has increased the demand for luxury rigid box packaging in Asia Pacific region. The rise in the disposable income and adoption of foreign fashion trends has risen the market for fashion accessories, beauty, electronics in Asia Pacific. Asia Pacific luxury rigid box market is investing more in developing new materials and technologies and recycling infrastructure as a result of rising awareness of the importance of circular economy concepts in supporting sustainability and decreasing waste. The key players operating in the market are focused on launching new technology for manufacturing luxury rigid box which is estimated to drive the growth of the luxury rigid box market in Asia Pacific region.

By Packaging Type

By Material Type

By Closure Type

By Inserts

By End Use

By Region

April 2025

March 2025

March 2025

March 2025