April 2025

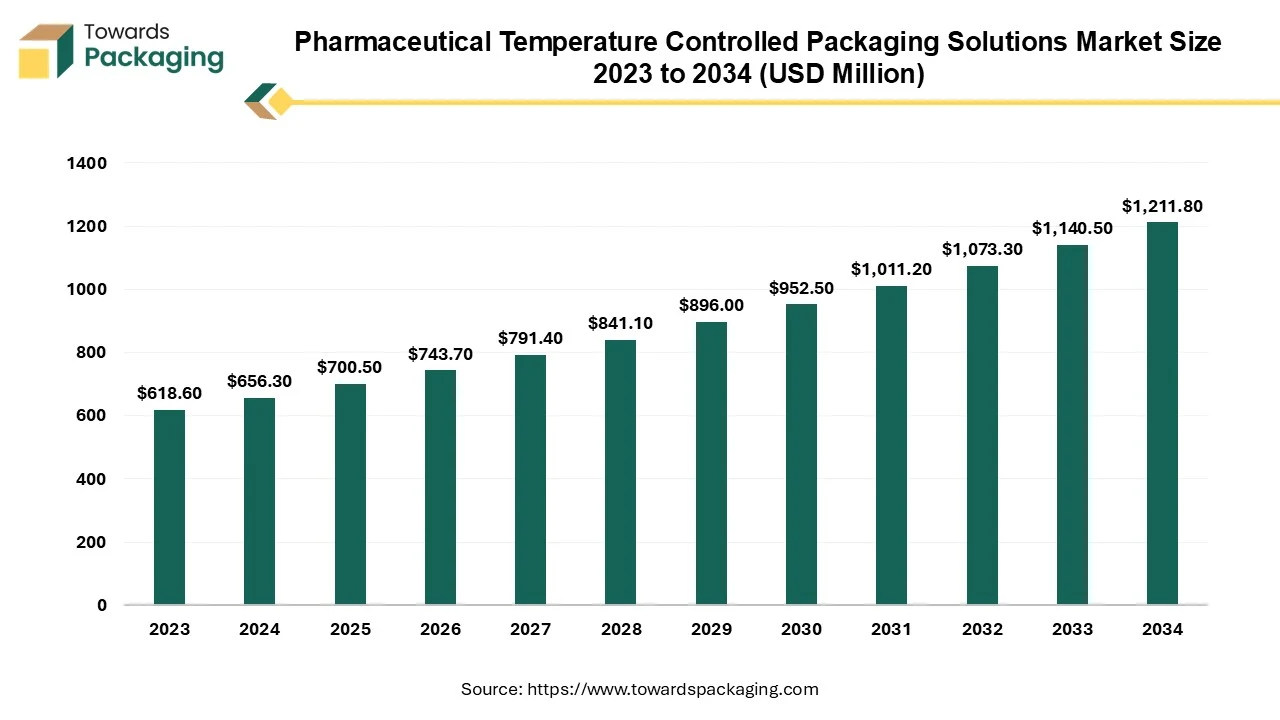

The pharmaceutical temperature controlled packaging solutions market is projected to reach USD 11.03 billion by 2034, expanding from USD 6.38 billion in 2025, at an annual growth rate of 6.30% during the forecast period from 2025 to 2034.

Pharmaceutical temperature-controlled packaging solutions refer to specialized packaging systems designed to maintain a specific temperature range for sensitive pharmaceutical products during storage and transportation. These solutions are critical for preserving the stability, efficacy, and safety of temperature-sensitive drugs. Many pharmaceuticals, especially biologics, vaccines, insulin, monoclonal antibodies, and some antibiotics can degrade or become ineffective if exposed to temperatures outside their safe range. This can compromise patient safety and lead to regulatory non-compliance or product recalls.

Key Temperature Ranges in Pharma Packaging: Cold Chain (2°C to 8°C): Most common for vaccines, biologics, and certain injectables; Controlled Room Temperature (15°C to 25°C): For drugs stable at ambient temperature; Frozen (-20°C): Some drugs require freezing to maintain stability; Ultra-Cold (-70°C or below): Used for advanced biologics like mRNA COVID-19 vaccines. Types of Temperature-Controlled Packaging Solutions: Passive Systems, Active Systems, and Hybrid Systems among others.

Artificial Intelligence integration has improved the efficiency of the pharmaceutical packaging by 80%. AI-enabled sensors can continuously track temperature, humidity, shock, and light exposure. AI systems can flag anomalies instantly, enabling real-time alerts if a shipment is at risk of going out of spec. AI can analyse historical data (weather, transit delays, route conditions) to predict potential risks to cold chain integrity. The AI integration helps pre-empt issues before they occur, reducing spoilage and product loss.

AI algorithms can automate packaging inspection, checking for proper sealing, insulation, and labelling. The AI integration reduces human error and speeds up production lines while ensuring regulatory compliance. AI can simulate thermal behaviour across different packaging types, helping design customized packaging based on product sensitivity and route. The artificial intelligence integration optimizes material usage, cost, and performance. AI integrates with IoT systems to track shelf life, storage conditions, and batch performance across the supply chain.

The AI integration enables FEFO (First Expired, First Out) logistics and reduces waste. AI can maintain digital records of all temperature data, route logs, and handling events. The artificial integration simplifies compliance reporting with agencies like the EMA, FDA, and WHO. End-users (pharmacies, hospitals, patients) can access packaging condition data via QR codes or apps. Increases transparency and trust in product integrity.

More consumers receive medications directly at home, increasing demand for single-use, reliable cold-chain packaging. The e-commerce deliveries and direct-to-patient deliveries requires temperature-controlled packaging that is lightweight, trackable, and easy to dispose of. Hence, the rise in e-commerce and direct-to-patient deliveries has estimated to drive the growth of the pharmaceutical temperature controlled packaging solutions market in the near future.

The key players operating in the pharmaceutical temperature controlled packaging solutions market are facing issue due to limited infrastructure in developing regions and complex supply chain logistics which has estimated to restrict the growth of the market. Maintaining consistent temperature during long-distance or multi-modal shipping is difficult. Variability in climate, infrastructure, and customs clearance can lead to cold chain breaches. In many low-and middle-income countries, cold storage and distribution infrastructure is underdeveloped. Hinders safe delivery of temperature-sensitive drugs, especially in rural or remote areas.

Ongoing global vaccination efforts, including for COVID-19 variants, influenza, and new infectious diseases, require scalable and secure cold chain packaging. Increased global access to medication, especially in developing and emerging markets, requires robust packaging that ensures product stability over long distances and variable conditions. Hence, increase in demand for vaccine distribution has risen demand for pharmaceutical temperature controlled packaging solutions market in the near future.

The reusable solutions segment held a dominant presence in the pharmaceutical temperature controlled packaging solutions market in 2024. Reusable solutions are becoming increasingly dominant in the pharmaceutical temperature-controlled packaging solutions market due to their cost efficiency, sustainability, and superior performance. While the initial cost is higher, reusable containers deliver long-term savings when used over multiple shipping cycles. Ideal for companies with high-volume or regular shipments, reducing total cost of ownership.

Growing pressure to reduce single-use plastics and packaging waste is driving adoption. Reusable systems align with corporate sustainability goals and help companies comply with evolving green regulations. Reusable containers often incorporate advanced insulation materials (e.g., vacuum-insulated panels, phase change materials) that offer longer temperature stability (often 72+ hours). Crucial for shipping biologics, vaccines, and temperature-sensitive drugs across long distances. Reusable systems are often pre-qualified or validated for pharmaceutical use, reducing the need for repeated testing.

The reusable pharmaceutical temperature controlled packaging solutions helps streamline compliance with GDP, FDA, and WHO cold chain guidelines. Reusable packaging solutions are built for rugged handling and consistent performance over time. The reusable packaging solutions reduces the risk of packaging failure, which is critical in preserving product integrity and patient safety. Many reusable systems support IoT-enabled tracking (temperature, humidity, shock, GPS).

The reusable packaging solutions enhances visibility across the supply chain and allows for real-time intervention if temperature excursions occur.

More pharma companies and 3PLs are developing closed-loop systems where reusable containers are returned, cleaned, and reused. The reusable temperature controlled packaging solutions supported by advancements in reverse logistics and asset tracking. Use of reusable, high-performance packaging reflects a commitment to quality and sustainability. The reusable packaging builds customer and partner confidence, especially in high-stakes areas like biotech and clinical trials.

The temperature-sensitive pharmaceuticals segment registered its dominance over the global pharmaceutical temperature controlled packaging solutions market in 2024. The rising demand for temperature-sensitive pharmaceuticals is a key driver fueling the growth of the pharmaceutical temperature-controlled packaging solutions market.

Biologics, vaccines, insulin, and monoclonal antibodies are highly sensitive to temperature variations. These drugs require tight temperature control (2°C to 8°C or lower) during storage and transportation, creating sustained demand for advanced packaging solutions. Emerging therapies like CAR-T cell treatments and mRNA vaccines are extremely fragile and often require ultra-cold storage (as low as -80°C). This fuels demand for specialized packaging systems with robust insulation and thermal protection.

Post-pandemic efforts and rising immunization programs globally are boosting shipments of temperature-sensitive vaccines. These programs require massive volumes of insulated packaging capable of maintaining integrity across diverse climates and long distances. Global regulatory bodies (e.g., FDA, EMA, WHO) mandate strict temperature control throughout the supply chain for sensitive drugs.

Compliance pushes pharma companies to invest in validated, high-performance packaging systems. With the rise of home healthcare and telemedicine, temperature-sensitive drugs are increasingly shipped directly to patients. This drives demand for compact, secure, and user-friendly packaging that maintains temperature without professional handling. Temperature-sensitive drugs are high-value products, any temperature excursion can result in billions in losses. This risk increases investment in reliable, intelligent packaging solutions to prevent spoilage.

As global distribution networks expand, pharma products are shipped over greater distances and through more climate zones. This increases the need for packaging that provides consistent temperature control over extended periods (often 72+ hours). In essence, the more the pharma industry leans on biologics and personalized medicine, the greater the demand for innovative, secure, and compliant temperature-controlled packaging.

North America region held the largest share of the pharmaceutical temperature controlled packaging solutions market in 2024, owing to advanced logistics and strong cold chain infrastructure for pharmaceutical industry. North America is dominant in the pharmaceutical temperature-controlled packaging solutions market due to a combination of strong healthcare infrastructure, advanced pharma manufacturing, and regulatory enforcement.

Home to major pharma and biotech firms like Johnson & Johnson, Amgen, Pfizer, Moderna, and Merck. These companies produce a large volume of temperature-sensitive drugs, requiring advanced packaging for both domestic and global distribution. North America, particularly the U.S., has a highly developed logistics and cold chain system. This includes specialized warehouses, temperature-controlled vehicles, and 3PL providers experienced in pharma logistics.

The region leads in the development of biologics, vaccines, and cell & gene therapies, which are extremely temperature-sensitive. This increases demand for sophisticated temperature-controlled packaging solutions that can ensure product stability. Agencies like the FDA enforce Good Distribution Practices (GDP) and mandate strict cold chain compliance. Drives companies to adopt validated and high-performance packaging to meet regulatory demands and avoid penalties.

North America leads in integrating smart packaging, IoT sensors, and AI-based tracking. This creates a market for tech-enabled temperature-controlled packaging that offers real-time monitoring and data logging. Rapid growth of online pharmacies and home delivery of medications, especially post-COVID, has expanded the need for secure, portable cold chain packaging. Includes specialty medications like insulin, oncology drugs, and fertility treatments. North American companies are investing in reusable cold chain packaging solutions to reduce environmental impact and meet ESG goals.

U.S. Market Trends

U.S. pharmaceutical temperature controlled packaging solutions market is driven by rising clinical trial in the country. The U.S. conducts the largest number of clinical trials globally, often involving temperature-sensitive investigational drugs. The rise in personalized therapies creates demand for small-batch, high-performance packaging.

Asia Pacific region is anticipated to grow at the fastest rate in the pharmaceutical temperature controlled packaging solutions market during the forecast period. Countries like India, China, South Korea, and Singapore are major hubs for pharma production and export. The need to transport temperature-sensitive drugs globally drives investment in advanced cold chain packaging. Growing prevalence of chronic diseases, cancer, and lifestyle disorders has increased demand for biologics, insulin, and vaccines, which require temperature-controlled logistics. Governments across the Asia Pacific region are investing in public health programs, immunization drives, and pharmaceutical access in rural areas. Asia Pacific is becoming a hotspot for clinical trials, especially in China, India, and South Korea. These often involve temperature-sensitive investigational drugs, increasing the need for specialized packaging solutions.

Economic growth in countries like Vietnam, Indonesia, and the Philippines is expanding the middle class, boosting spending on advanced therapies and medications. This fuels demand for quality-controlled packaging and drug delivery systems. Major investments in cold storage, distribution centers, and airport pharma zones across Asia Pacific are improving the reliability of the cold chain network.

China Market Trends

China pharmaceutical temperature controlled packaging solutions market is driven by the rising research and development activities for launching vaccines and Injectable medicines. With a large and aging population in China, the demand for accessible healthcare and temperature-sensitive medications is surging.

India Market Trends

Rapid urbanization in India improves distribution infrastructure, facilitating the adoption of cold chain systems. This boosts the need for reliable temperature-controlled packaging to ensure drug efficacy during distribution. Major exporters like India ship large volumes of temperature-sensitive drugs globally, requiring robust cold chain packaging for long-haul transport.

Europe region is seen to grow at a notable rate in the foreseeable future. Europe is home to global pharma leaders like GlaxoSmithKline, Roche, Sanofi, Novartis, and AstraZeneca. These companies manufacture and distribute large volumes of temperature-sensitive drugs regionally and globally. The European Medicines Agency (EMA) enforces Good Distribution Practices (GDP) and stringent cold chain regulations. Pharmaceutical companies must use validated, high-performance packaging systems to ensure compliance and product integrity. Europe has a highly developed logistics network with specialized cold storage, packaging providers, and temperature-controlled transport services.

Countries like Germany, Switzerland, and the Netherlands are key logistics hubs for pharma exports. Europe is a leader in the development and production of biologics, biosimilar, and advanced therapies (e.g., cell & gene therapy), all of which are highly temperature-sensitive. European governments and companies emphasize eco-friendly and reusable packaging solutions. This drives innovation in sustainable temperature-controlled packaging, especially reusable containers with minimal environmental impact. Many European countries have centralized healthcare and drug distribution systems, enabling consistent application of cold chain standards. The key players

Germany Market Trends

Germany is one of Europe’s largest pharmaceutical producers, hosting major players like Boehringer Ingelheim, Bayer, Merck KGaA, and BioNTech. These companies produce temperature-sensitive products like vaccines, biologics, and insulin, requiring advanced cold chain packaging. Germany enforces EU Good Distribution Practice (GDP) and other stringent national regulations to ensure the integrity of temperature-sensitive medicines. This drives the adoption of validated, compliant packaging systems. The country has a growing market for biologics, oncology treatments, and personalized medicine, all of which require precise temperature control during storage and transportation.

Germany is a key logistics hub within Europe and globally, especially with major pharma logistics centers in Frankfurt. Drugs produced or transiting through Germany need reliable cold chain packaging to maintain efficacy during long-distance transport. Germany's highly developed healthcare infrastructure supports the use and distribution of temperature-sensitive therapies across hospitals, pharmacies, and direct-to-patient models. German companies are investing in smart packaging technologies (e.g., IoT sensors, real-time tracking) and sustainable, reusable systems to enhance efficiency and meet environmental goals. With high investment in pharmaceutical R&D and clinical trials, Germany requires secure, traceable temperature-controlled packaging for investigational drugs and biologics.

By Product

By Application

By Region

April 2025

April 2025

April 2025

April 2025