July 2025

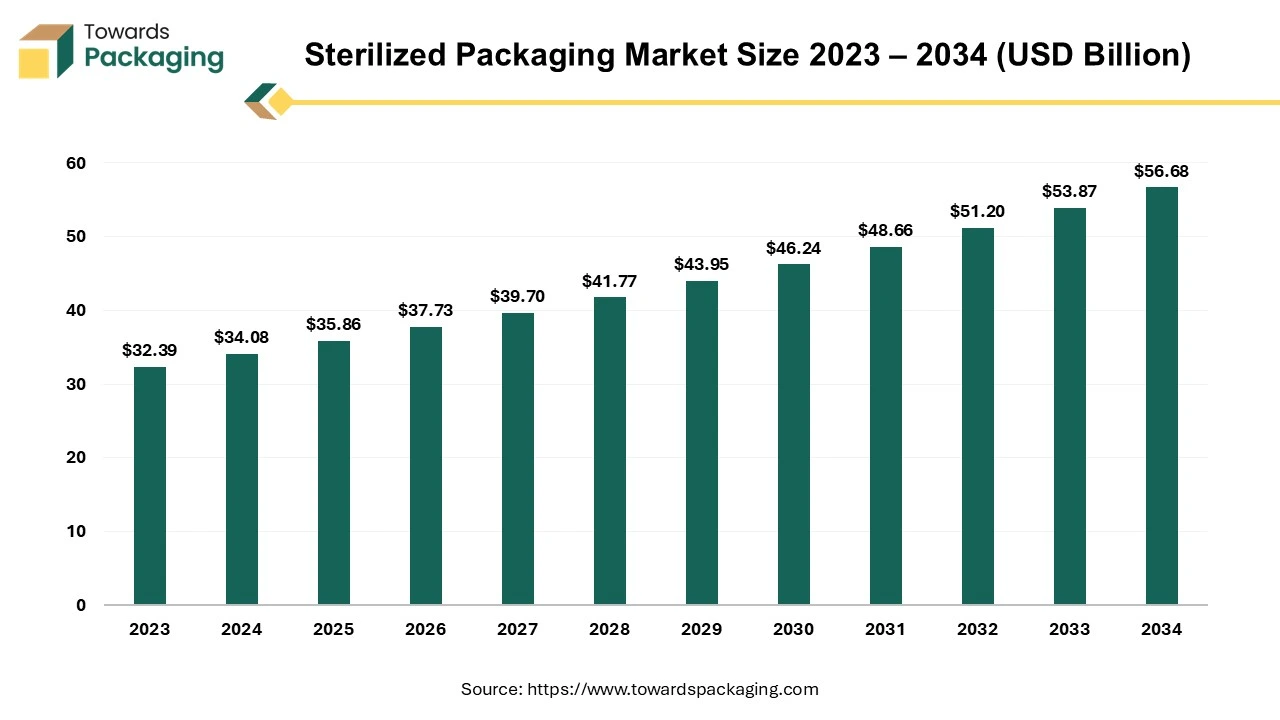

The sterilized packaging market is projected to reach USD 56.68 billion by 2034, expanding from USD 35.86 billion in 2025, at an annual growth rate of 5.22% during the forecast period from 2025 to 2034.

The sterilized packaging market is anticipated to witness significant growth during the forecast period. The term "sterilized packaging" relates to non-reusable plastic shells, wrappings, and other packing materials which undergo terminal sterilization. Manufacturers employ this type of packaging to guarantee that medical devices, instruments and other products remain free of germs. Sterile packaging offers numerous benefits to patients, manufacturers as well as healthcare providers. The most important factor in a successful operation is the packaging of aseptically processed food; the product must be packaged in the desired form to obtain the anticipated advantages after sterilization, but this quality of aseptic packaging gives the food product more shelf life and so more transportability, which will increase the processor's profit margin. The global packaging market size is to grow at a 3.16% CAGR between 2025 and 2034.

The increasing global healthcare expenditure along with the stringent regulatory requirements mandate the use of sterilized packaging is likely to contribute to the growth of the sterilized packaging market within the estimated timeframe. The growing rising prevalence of chronic diseases and the successive increase in the production of biologics and biosimilars are also projected to support the market growth during the forecast period. Furthermore, the growing emphasis on food safety and the prevention of foodborne illnesses as well as the increased consumer awareness regarding hygiene and safety is also anticipated to augment the growth of the market in the years to come.

The increasing healthcare spending globally is anticipated to augment the growth of the market during the forecast period. This is owing to the demographic shifts, technological advancements and an increasing burden of chronic diseases. Furthermore, the rising prices in the health sector along with the increasing demand for health services have also increased the healthcare expenditures. When the COVID-19 epidemic emerged in 2020, almost every economy saw a sharp increase in the health care spending. Spending has decreased since then, but it is still higher as compared to the previous years. The United States spent 17.8% of GDP (gross domestic product) on the health services in 2021, which is almost two times as much as the average OECD nation. This escalating spending is likely to increase the demand for sterile packaging for guaranteeing the safety and efficacy of medical devices and pharmaceuticals as well as in guaranteeing the patient safety.

Additionally, the surge in demand for the vaccines, medical supplies, devices and the personal protective equipment has led to unparalleled growth in the healthcare spending worldwide. This is further increasing the need for reliable as well as effective sterilized packaging in the healthcare industry. Sterile packaging will continue to be essential in guaranteeing the efficacy and the safety of the pharmaceutical and the medical products as healthcare systems develop and thrive, supporting the steady growth of the market during the estimated timeframe.

The rising environmental concerns are expected to limit the growth of the sterilized packaging market within the estimated timeframe. It is well recognized that the healthcare industry contributes significantly to the environmental pollution. Healthcare systems contribute from 4 to 5 percent of the greenhouse gas emissions worldwide and 8.5% of emissions within the country; supplier chains account for 82% of emissions in this industry. The extensive utilization of the single-use polypropylene packing for cleaning of surgical tools causes a significant amount of plastic waste and environmental damage; in the United States alone, this trash is estimated to be 115 million kilos annually. Furthermore, PET, PE and PP are more regularly used as principal packaging materials; these materials are coupled with paper and barrier materials like oPA and EVOH.

Products made of polyethylene are frequently used just once before being discarded. This is harmful for the environment since it increases the produce and waste. Also, polyethylene can persist in nature for more than 400 years and does not decompose readily. The majority of it winds up in the ocean or the landfills since just over ten percent of it gets recycled, which pollutes the environment and damages the wildlife habitats. The PP production process also contributes significantly to the carbon dioxide emissions and with polypropylene's widespread utilization estimated to emit 1.3 billion tonnes of CO2 into the environment. Thus, the use of plastic in the packaging not only impacts the environment but also adds to the growing global concern of carbon emissions and the climate change. As plastic is a major source of the pollution it is posing a challenge in balancing the sterility requirements with the sustainability goals of various manufacturers.

In the modern era, as sustainable practices are more important than ever, firms from all industries are actively looking for ways to minimize their environmental imprint. One such area of concentration is packaging, wherein a trend toward environmentally friendly options is gaining popularity. Amongst these options, sterile poly bags are an excellent choice for the organizations seeking to assure product safety while reducing the environmental impact. When it comes to industry sectors like pharmaceuticals, healthcare and food, product safety is critical. Sterilization is required for storage of the medical supplies, packaging drugs or delivering the food items to maintain their quality as well as safety.

Since sterile poly bags are made particularly to keep an environment sterile and avoid contamination, they provide a dependable solution in these situations. They are an essential tool in businesses where product safety is a top priority as its airtight seal and impermeability act as a barrier against the moisture, dirt as well as the viruses. In comparison to the other packaging options, sterile poly bags are also lightweight and require less material. In addition to limiting the quantity of the non-biodegradable garbage produced, this also minimizes the energy used for the transportation, which further lowers the carbon emissions.

Furthermore, Amcor has created SureForm Pro ICE® Forming Films, a medical packaging that is ready to be recycled. By adapting the tried-and-true line to fulfil the sustainability objectives, it is intended to protect the lightest swab or strongest medical item. When it comes to the material performance, SureForm Pro ICE® Forming Films always follow the standards set by the industry. When taking into consideration recyclability, the exceptional abrasion resistance of the films actually results in some considerable sustainability improvements including a 40% weight reduction in the plastic usage when compared to the ordinary forming films and a 54% decrease in the carbon footprint.

Additionally, these films passed the polyethylene film stream's Critical Guidance testing process administered by APR, indicating that they are suitable for use in the North America's recycling stream. This focus on the innovation, sustainability as well as the environmental responsibility is not only driving innovation but also opening up new market opportunities.

Before the pandemic, the pharmaceutical packaging industry was already experiencing growth driven by the rise of e-commerce in developing regions, a push for sustainable materials, and the integration of cutting-edge technology. However, the COVID-19 crisis has brought new challenges and opportunities, particularly for packaging that addresses health and safety concerns.

With a heightened focus on health due to the pandemic, there has been a notable increase in the demand for packaging that prioritizes sterility and antiviral properties. This is evident as companies pivot towards sterile formats to meet the surge in need for critical medical supplies, including biologics and vaccines. Packaging solutions such as rigid plastics, pumps, and flexible blister foils are becoming essential as they help ensure the safety and efficacy of these products.

At the same time, consumer anxiety about viral transmission via packaging surfaces has intensified, affecting both the pharmaceutical and food packaging sectors. This growing concern has created an opportunity for the development and adoption of packaging formats that offer antibacterial and antiviral benefits. In the pharmaceutical sector, where packaging regulations are particularly stringent, sterile and antiviral packaging is becoming increasingly important. Companies are responding by investing in new technologies and expanding production capacities to meet these emerging needs.

Overall, the COVID-19 pandemic has accelerated the shift towards packaging solutions that enhance safety and reduce the risk of virus transmission, setting a new standard for both pharmaceutical and food packaging industries.

The chemical segment captured largest market share of 46.31% in 2024. Chemical procedures use a broad range of chemicals in a variety of gases and liquids to sterilize and disinfect packaging materials and equipment. Moreover, chemical sterilization is widely used to sanitize surfaces that come into touch with food. Chemicals are employed to destroy bacterial types, yeast and molds with the goal make the packaging material and contact surface economically sterile. Chemical sterilizing chemicals such as hydrogen peroxide, low-temperature hydrogen peroxide gas plasma (LTHPGP) sterilization, exposure to gaseous ethylene oxide, peracetic acid, and ethyl alcohol have been used to sterilize food contact surfaces and packaging materials.

One of the most used sterilants for sanitizing the packaging materials is hydrogen peroxide. In many aseptic packaging systems, packaging materials and other surfaces that come into the contact with the food are sterilized with the use of hydrogen peroxide at ratios of between 30 and 35%. This is subsequently followed by hot air to intensify the sterilizing effect and disperse any extra hydrogen peroxide. Temperature and peroxide concentration both improve the sterilizing performance. Additionally, the pre-sterilizing of paperboard cartons and plastic packing materials is also been done using the ethylene oxide sterilization.

The medical and surgical segment held largest market share in 2024. This is owing to the growing prevalence of chronic diseases and the increasing number of surgical procedures across the globe. Approximately 60% of the American adults suffer from one or more chronic illnesses. The 2022 International Agency for Research on Cancer (IARC) report stated that there were 9.7 million cancer-related deaths and 20 million new cases worldwide, with lung and the breast cancer accounting for the majority of the cases. Thus, the demand for the medical equipment and surgical instruments that require packaging to preserve their sterility as well as the efficacy until they are used is growing along with the prevalence of these diseases. This trend is also particularly prominent in the aging populations, where the need for medical interventions is higher, further driving the demand for sterilized packaging in this segment of the market during the forecast period.

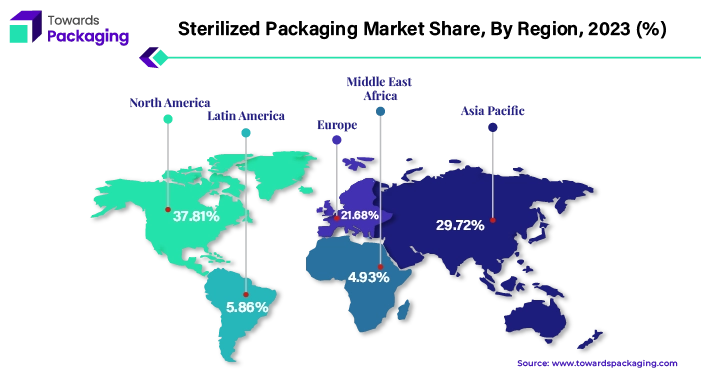

North America held largest market share of 37.81% in 2024. This is owing to the rapid well-established healthcare system along with the presence of stringent regulatory standards imposed by organizations such as the U.S. Food and Drug Administration (FDA) and Health Canada. Furthermore, the adoption of advanced sterilization techniques, such as electron beam and gamma radiation is also likely to support the regional growth of the market. Additionally, increased focus on preventing the healthcare-associated infections (HAIs) is also expected to contribute to the regional growth of the market in the years to come.

Asia Pacific is expected to grow at a fastest CAGR of 7.50% during the forecast period. This is due to the increasing investment in the expansion of the healthcare infrastructure and the growing government initiatives to improve healthcare accessibility and quality across the region. Also, the increasing healthcare expenditure and growing prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and cancer is further expected to drive the demand for sterilized packaging in the years to come. Furthermore, the growing awareness of hygiene and safety standards among consumers and healthcare providers is also expected to support the regional growth of the market in the near future.

By Product

By Material

By Sterilization Method

By End-user Industry

By Region

July 2025

July 2025

July 2025

July 2025