April 2025

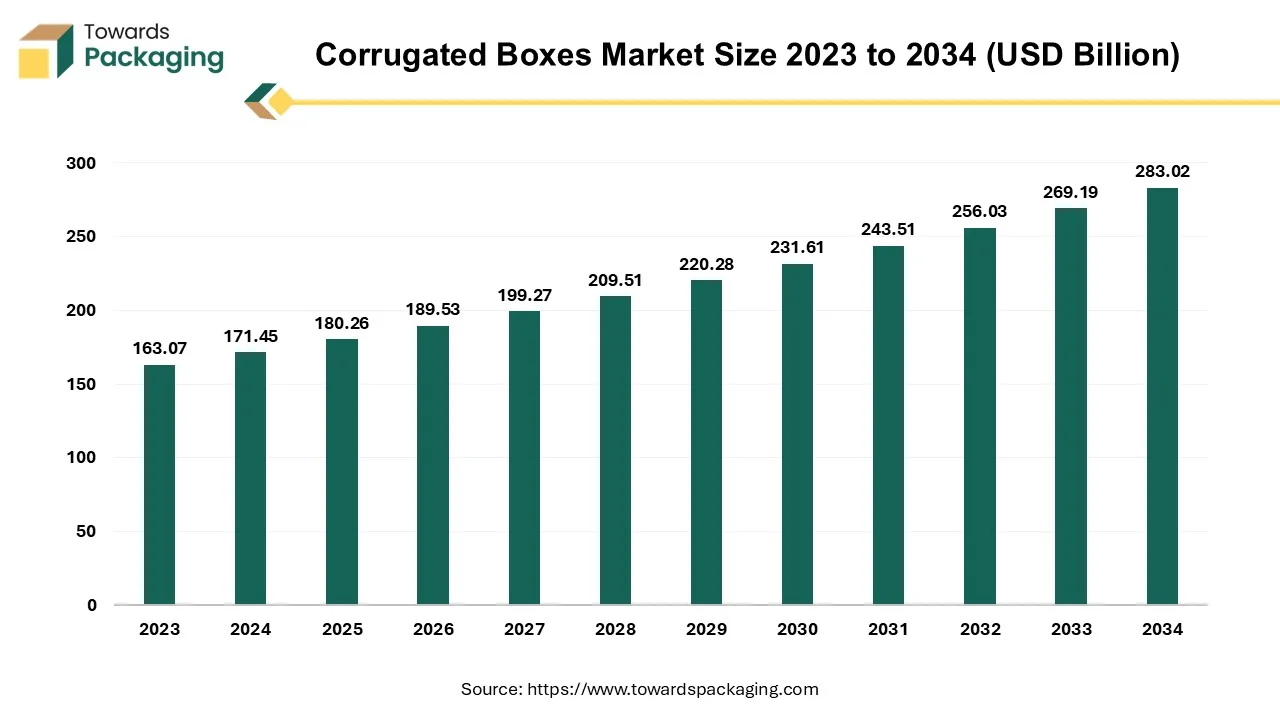

The global corrugated boxes market size reached USD 171.45 billion in 2024 and is projected to hit USD 283.02 billion by 2034, expanding at a CAGR of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

Unlock Infinite Advantages: Subscribe to Annual Membership

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

Corrugated boxes are shipping containers with significant functional and financial implications that are used for transport packing. One common usage for corrugated boxes is as shipping containers. From product manufacture, to distribution, sale, and occasionally end-use, boxes must hold the product. While boxes can protect products to some extent on their own, they frequently need inside elements like blocking, bracing, and cushioning to help shield delicate contents. The specific logistics system in use determines a lot of the shipping risks.

Corrugated boxes vary in their qualities, applications, and strengths. To create corrugated packaging boxes, the corrugated sheets are cut and folded into a variety of sizes and shapes. Shipping boxes, pizza delivery boxes, retail packaging, and other uses for corrugated boxes are all possible. According to the data published by the National Center for Biotechnology Information, in the US, corrugated boxes are used for the shipment of almost 95% of all goods. In the US, about half of all recycled paper is made of corrugated paperboard.

| Consignee Name | Shipper Name | Product Description | Loading Port | Unloading Port | Quantity | Weight (kg) |

| Pan American Properties Corp | FAG Artigrafiche Spa | Corrugated or Solid Box Containers | Cartagena | San Juan, Puerto Rico | 718,350 | 146,855 |

| Universal Chemical Corp | Empaques de Colon S.A. | Corrugated or Solid Box Containers | Panama Canal – Caribbean | San Juan, Puerto Rico | 356,835 | 147,628 |

| Veritiv Operating Company | Shandong Changyu Glass Co. Ltd | Corrugated or Solid Box Containers | Qingdao | Oakland, CA | 236,680 | 76,025 |

| New Frontier Foods Inc | New Frontier Foods Intl. Co. | Corrugated or Solid Box Containers | Long | Beach, CA | 185,600 | 24,450 |

| Latin Shots Inc | Alianza Grafica S.A. | Corrugated or Solid Box Containers | Cartagena | San Juan, Puerto Rico | 157,439 | 9,560 |

The evolution in e-commerce logistics has significantly impacted packaging demands. The need for secondary corrugated board packaging that not only protects products but also enhances brand image during home delivery has become crucial. Converters in the packaging industry are adopting advanced technology to deliver high quality graphic designs as shipping boxes, as these packages serve as a direct representation of the brand in the consumer’s home, not just at the retailer store. This shift reflects a boarder trend towards ensuring that every touch point in the logistics chain reinforces brand identity and consumers experience. The key players in the market are focused on introduction of the innovative corrugated boxes to meet the demands of consumer which is estimated to drive the growth of the global corrugated boxes market over the forecast period.

For instance,

The easy availability of the alternative of packaging options like plastic packaging and fluctuating raw material prices have imposed restriction on the growth of the corrugated boxes market over the forecast period. For manufacturers and retailers, flexible plastic packaging offers the biggest benefit since it can save shipping and warehousing costs by reducing the weight of the packaging, requiring a lot less space. As compared to rigid packaging, flexible packaging is 40% less expensive overall, resulting in a 50% decrease in landfill waste and a 62% reduction in greenhouse gas (GHG) emissions. Moreover, the cost for manufacturing the linerboard, flutes is higher as compared to the flexible plastic packaging.

The expanding e-commerce sector is an additional catalyst boosting the demand for the corrugated boxes. To address the rising demand for the corrugated boxes, the key players operating in the market are focused on adopting inorganic growth strategies like acquisition, which is projected to create lucrative opportunity for the growth of the global corrugated boxes market over the forecast period.

On the bustling streets of South Korea, older residents pushing carts laden with discarded cardboard have become a poignant symbol of the country's elderly poverty crisis. These seniors, often in their late 70s and 80s, roam the streets collecting cardboard boxes to sell to recycling centers in a bid to survive.

A recent report by the Ministry of Welfare highlighted the dire situation faced by these elderly cardboard collectors. The report, based on a nationwide survey, revealed that between February and May of this year, 14,831 South Koreans aged 65 or older were engaged in this activity. This figure translates to at least 1 out of every 650 seniors in the country. These elderly individuals have an average monthly income of 766,000 won ($553), which includes state livelihood subsidies and pensions. However, the ministry did not disclose how much of this income specifically comes from collecting and selling cardboard. The average age of these cardboard collectors is 78.1 years.

The survey, which is the first of its kind in South Korea, compiled data from the country's 229 local administrative entities, including city and county governments. It painted a bleak picture of regional disparities, with Seoul having the largest number of elderly cardboard collectors at 2,530, followed by Gyeonggi Province with 2,511, South Gyeongsang Province with 1,540, and Busan with 1,280.

In terms of personal wealth, those with assets of less than 25 million won comprised the largest group among the elderly cardboard collectors, making up 25.2 percent. This was followed by those with assets between 50 million and 100 million won at 19.9 percent, and those with assets between 100 million and 150 million won at 13.7 percent. Age-wise, the largest group of cardboard collectors were those aged 80-84, accounting for 28.2 percent of the total. They were followed by the 75-79 age group at 25.2 percent and the 70-74 age group at 17.6 percent.

Despite being the world's 13th-largest economy and boasting a per-capita income of $33,745, which ranks 22nd globally, South Korea faces a chilling problem of elderly poverty. According to the Organization for Economic Cooperation and Development (OECD), South Korea's elderly poverty ratio – the proportion of seniors with less than half of the median income – stood at 40.4 percent in 2020. This was the highest among the 37 OECD members and 2.8 times higher than the 14.4 percent average for the G5 advanced economies of the US, Japan, the UK, France, and Germany.

The plight of South Korea's elderly cardboard collectors underscores the broader issue of senior poverty in the nation. As these individuals continue to struggle for survival, their stories serve as a stark reminder of the challenges faced by the aging population in one of the world's most developed economies.

The slotted boxes segment is held the dominating share of the global corrugated boxes market in 2024. The most common layouts and constructions of corrugated printed boxes are slotted carton boxes. Typically, corrugated board is used to make one or more pieces of slotted box types. To enable folding, the board is cut on the die-cutting machine. At the point where one side panel and one end panel are brought together, the die-cutter forms a joint. After that, flat boxes are sent to the factory to be packaged as products. Workers in the factory put together the box, load the goods inside, and shut the flaps. These types are referred labeled as Slotted-Type Carton Boxes by the International Fibreboard Case Code and as Conventional Slotted Carton Boxes by the carrier classifications. Storage bins, retail packaging, and product packaging, including food packaging design, can all be made with standard slotted containers.

The most common type of corrugated box with slots is the conventional slotted corrugated box. This has two exterior flaps that are half the width of a corrugated box and all of the flaps are the same length. It is simple to personalize slotted corrugated boxes in terms of size, strength, and printing choices. Their adaptability enables them to serve a broad spectrum of goods and sectors, encompassing everything from food and drink to electronics and car components. Increasing launch of the heavy electric equipment has risen the demand for the slotted boxes for packaging and transportation of equipments, which is estimated drive the growth of the segment over the forecast period.

The rigid boxes segment is expected to grow at fastest rate over the forecast period. Compared to conventional paper boxes, rigid boxes are four times thicker and offer a far more sophisticated and robust feel to the packing. Strong protection and great strength are attributes of rigid boxes. Because of their distinct lid and base designs, they provide sturdy protection for bulky or fragile products during handling and transportation. They are perfect for packaging things that need special protection, such gift packaging, glassware, and car parts, because of this property. Moreover, increasing launch of the new design and sustainable material rigid boxes is expected to drive the growth of the segment over the forecast period.

The linerboard segment held the largest share of the global corrugated boxes market in 2024. The linerboard imparts strength to the corrugated boxes. The linerboard is derived from the kraft paper making process, using the woodfiber that offers strength properties. A linerboard is a flat piece of material that makes up a corrugated sheet’s upper and lower surfaces. It serves as a sandwich for the medium or flutes. For printing graphics, text, and product details on the exterior of corrugated boxes, linerboard offers a smooth surface. Additionally, it strengthens the box’s structural integrity and protective qualities, guaranteeing that the contents are safely enclosed and safeguarded throughout handling and transportation. Since linerboard makes up a large amount of corrugated boxes, it has a significant share.

Various types of linerboard are even present in several flute patterns. Each of these flute type differs across factors, including strength, durability, endurance, and thinness. They include B-flute, C-flute, E-flute, F-flute. Smaller flute profiles more flexible structural and graphic performance, while bigger flute profiles often offer superior cushioning and vertical compression strength.

Moreover, the key players operating in the market are focused on expansion of the manufacturing facility for linerboard production which is expected to drive the growth of the segment over the forecast period.

The medium segment is expected to progress at fastest rate over the forecast period. The kraft paper that is put in between the linerboards and shaped into arches is called medium. These flute tips produce robust columns that can support a great deal of weight when a flat surface board is placed on top of them. By maintaining their separation, the flutes strengthen the bending rigidity of the linerboard sheets.

The flexographic printing segment held the largest share of the global corrugated boxes market in 2024 owing to wide range of advantages provided by the flexographic printing technology. A cylinder, an imaged sleeve, or a plate are used in flexographic printing to apply text or graphics to a substrate. Flexographic is ideally suited for large-scale runs and offers crisp branding and printing on packaging as well. Its low setup time and low cost make it an even more advantageous solution, which helps explain its large market share. Flexography is a roll-feed web printing technique with high speed. It can move at up to 2000 feet per minute in linear feet. Flexible packaging and labels in large quantities are frequently printed with flexographic printing. Flexography is renowned for producing high-quality results quickly and efficiently. Even though many printing industries have fully embraced digitalization, this kind of printing is still very common. Since flexography lowers the cost per unit, it can produce prints with a consistently high quality on a variety of materials and substrates without the need for specific coatings. Compared to competing print solutions that might only work with a very limited range of substrates, this is a huge advantage.

Flexographic printing works quickly. The packaging printing business used presses built between 2000 and 2002 that could operate at 150 to 300 feet per minute (FPM) on average, with 400 FPM being considered the standard. This capacity has been boosted to over 600 FPM by modern Flexo presses, providing a significant advantage to companies that have made the decision to invest in more modern machinery. Printing continuous patterns is another innovation made feasible by the use of rotating print heads, which enables printers to finish complicated designs in a single print run. Numerous industries, such as textile, packaging, label, and more, can benefit from the use of flexographic printing. Because of the machines' adaptability, print enterprises can vary their market appeal and maintain their competitiveness by customizing presses to fit various order types.

The food & beverages segment dominated the corrugated boxes market in 2024. Food and beverages products need to be packaged with utmost care to maintain freshness, avoid contamination, and adhere to food safety regulations. Corrugated boxes offer superior protection for perishable goods during storage, transportation, and display, so they are an indispensable part of food packaging. Corrugated boxes are also widely used in retail settings for primary and secondary packaging of food and beverages products, and they are an integral part of food and beverages companies overall marketing and sales strategies. The corrugated boxes are mainly used for the transportation of the huge quantity of fruits, vegetables, packaged food and cereals as well as beverages bottles. The capacity of corrugated boxes to prevent foodborne pathogens makes them appealing to carry food items. Corrugated boxes are made by bonding materials together with intense heat. Most bacteria cannot withstand heat levels above 180 degree Fahrenheit, which might take place. The corrugated boxes act as barrier against light, oxygen and moisture, preventing damage and preserving the taste, aroma and texture of the food and beverages.

Moreover, the key players operating in the market are focused on adopting inorganic strategies like partnership and collaboration to develop new paper based corrugated boxes for food packaging.

The e-commerce and parcel delivery segment is estimated to grow at fastest rate over the forecast period. The demand for the corrugated boxes has increased dramatically as people choose to buy online more and more. This trend was intensified by the COVID-19 epidemic, as more people started buying a variety of goods, such as groceries, gadgets, clothes, and more, online. Products are well cushioned and protected by corrugated boxes, which lowers the possibility of damage occurring during transit. Corrugated boxes are ideal choice for making sure that products reach customers in good conditions because of their strength and durability. Moreover, increasing online sale of liquor has risen the demand for the corrugated boxes for packaging of glass beverages bottles safely, which is estimated to drive the growth of the segment over the forecast period.

The corrugated boxes are widely used as they are lightweight yet strong, allowing for easy transportation and handling. The use of corrugated boxes for online shopping and home delivery reduces shipping costs and minimizes the risk of damage during transit. In addition, the increase in the use online shopping stores has projected to rise in demand of the corrugated boxes, which is estimated to drive the growth of the segment over the forecast period.

Asia Pacific led the corrugated boxes market in 2024. The food and beverage, electronics, and personal care industries, particularly in India, Korea, Japan, and China—have efficient demand and supply cycles, which is responsible for Asia Pacific strong market share. The growth of e-commerce is driving the local market. Its strong market share is also a result of the substantial presence of corrugated box makers in this area. Moreover, the key players operating in the Asia Pacific are focused on adopting advanced technology for expanding their product portfolio by deployment new packaging patterns which is estimated to fuel the growth of the corrugated boxes market in the Asia Pacific region.

For instance,

With companies like Bohui Group, Nine Dragons Worldwide (China) Investment Group Co., Ltd., and Lee & Man Paper Manufacturing Ltd. among others, the Chinese market is extremely competitive. Since Chinese firms produce large quantities, they get benefits through economies of scale. Because of this, they can manufacture corrugated boxes at a lower cost than other nations, giving them a significant competitive advantage in both home and foreign markets.

Additionally, a sizable amount of China's produced commodities is headed for foreign markets due to the country's export-oriented economy. Corrugated boxes are in greater demand as a result of the need for durable packaging solutions for these commodities to be transported safely. Moreover, increasing initiative by the government of China to produce sustainable packaging is estimated to drive the growth of the corrugated boxes market in the China region.

The expanding industrial sector in Japan is the main driver of the corrugated boxes market. The Japanese manufacturing industry is divided into four categories, according to the Ministry of Economy, Trade and Industry (METI) fabricated metals, industrial machinery, iron and steel, and chemicals. The demand for corrugated boxes to package goods for export is expected to rise as a result of the Japanese government's invitation to foreign direct investments to establish manufacturing facilities in the nation. The Japan External Trade Organization (JETRO) reports that foreign direct investment (FDI) into Japan increased by 8.5% in 2022 for transportation equipment and by 35.3% in 2022 for electrical machinery.

North America is the most fastest growing and lucrative market, significantly driven by the rapid urbanization and development in the automation industries. North America's corrugated boxes market is anticipated to expand at the fastest rate possible between 2024 and 2030 because of the expansion of the e-commerce industry in the area. Customers now find it simpler to shop online due to advancements in digital infrastructure, such as increased internet speeds and the widespread use of mobile devices. Improved user interfaces, payment methods, and website designs all add to a smooth online buying experience, which in turn fuels the growth of online shopping and bodes well for the North American market.

The increasing prominence of e-commerce in the U.S. is estimated to drive the demand for corrugated boxes. In July 2024, according to the U.S. Department of Commerce, e-commerce’s share of total retail sales was 15.9% in the first quarter of 2024, reflecting a significant rise from second quarter of 2023. This surge suggests a robust market demand for corrugated boxes, essential for packaging goods in online retail transactions.

Moreover, increasing adoption of the inorganic growth strategies like collaboration by the key players operating in the U.S. to launch advanced technology automated machinery for developing corrugated printed box is estimated to fuel the growth of the corrugated boxes market over the forecast period.

For instance,

By Product Type

By Material Type

By Printing Technology

By End Use

By Region

April 2025

March 2025

March 2025

March 2025