April 2025

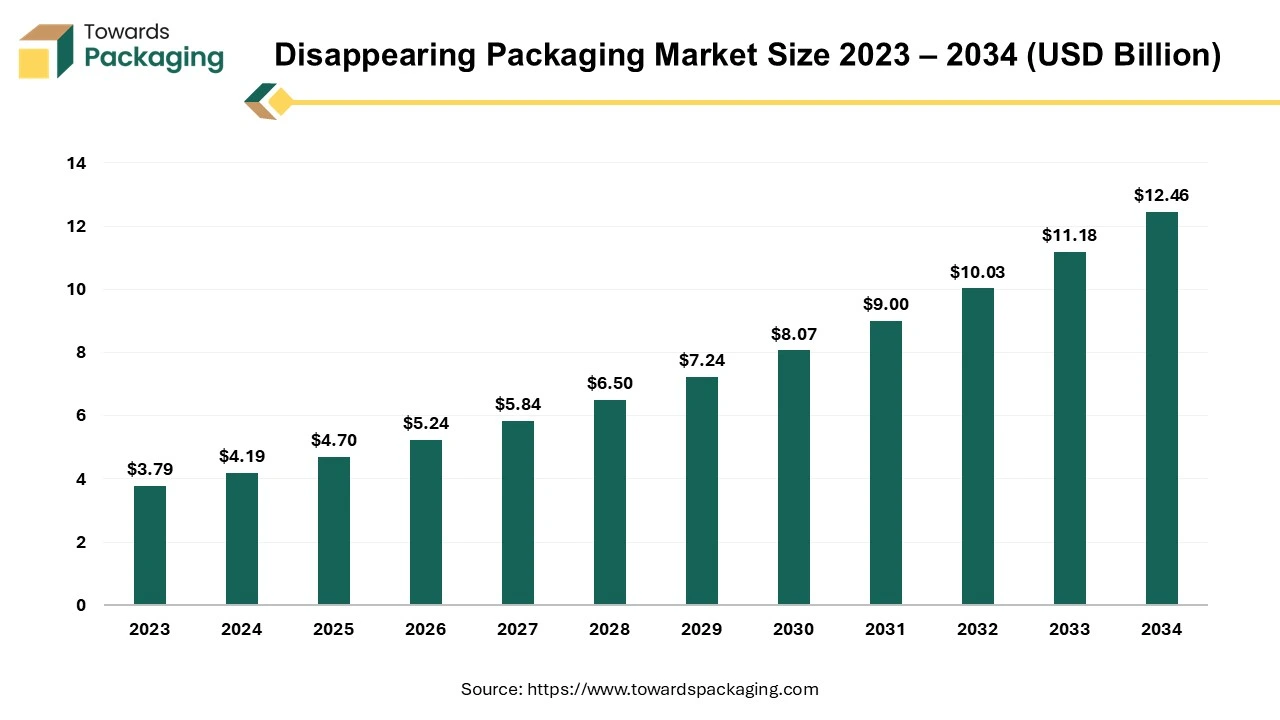

The global disappearing packaging market size reached US$ 4.19 billion in 2024 and is projected to hit around US$ 12.46 billion by 2034, expanding at a CAGR of 11.45% during the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing disappearing packaging which is estimated to drive the global disappearing packaging market over the forecast period.

The innovative, sustainable packaging solutions which has ability to dissolve, decompose or otherwise vanish after use, leaving little to zero waste is known as disappearing packaging. It is designed to reduce environmental impact by eliminating traditional plastic waste. The edible packaging is manufactured from materials like seaweed, starch or rice, these can be safely consumed (e.g., edible water pods). The dissolvable packaging is manufactured from biodegradable films (like PVA) that dissolve in water (e.g., laundry detergent pods). The compostable packaging is manufactured from materials that naturally degrade over time when exposed to microorganisms. This concept is gaining popularity in food, cosmetics, and retail industries as companies look for eco-friendly alternatives to plastic.

The innovation of new materials has significant shift towards materials that minimize environmental impact. Water-soluble packaging, made from bioplastics that dissolve in water, offers a zero-waste alternative to traditional plastics. Additionally, regenerative packaging utilizes materials from agricultural practices that restore and enhance ecosystem health. Edible packaging, such as seaweed-based materials, is also expanding, providing waste-free solutions.

The industry is moving away from traditional inks towards water-based alternatives. These inks reduce volatile organic compounds (VOCs), making them safer for both the environment and consumers. This shift aligns with the growing demand for sustainable packaging options.

Eco-friendly barrier coatings, derived from natural or biodegradable materials like starch or cellulose, are replacing plastic coatings, offering moisture and oxygen resistance while being compostable or recyclable. Active packaging technologies, incorporating components like oxygen scavengers or antimicrobial agents, extend product shelf life and enhance safety without excessive preservatives.

Leading companies are committing to reducing packaging waste. For instance, Tesco aims to halve its food waste and ensure all its own-brand packaging is fully recyclable by the end of 2025. The company has also introduced collection points for soft plastics and is exploring reusable packaging systems.

One of the best ways to preserve the quality and shelf life of dairy-based food products over an extended period of time is through edible packaging, which minimizes oxidation and lowers the microbial load. By reducing the rate of oxidation and limiting the growth of dangerous microorganisms, many researchers have found that the use of edible packaging made of biopolymers, both with and without active agents, can extend the shelf life of dairy-based food products.

The artificial intelligence integration significantly improves the disappearing packaging industry by assisting in material selection and development, production optimization, quality control, waste management and tracking, and consumer’s engagement. Al algorithms are capable of analyzing data on various biodegradable materials, such as cellulose, starch, and plant-based polymers, to determine the best choices based on the required qualities (cost, strength, and rate of breakdown) and the impact on the environment. Research and development can be accelerated by using machine learning models to forecast how a novel biodegradable material will behave in different scenarios.

Al and machine learning are stepping up to help firms reduce their environmental impact as disappearing packaging becomes a bigger concern in the packaging sector. To suggest the most environmentally friendly choices, computers can examine transportation, production processes, and packaging materials.

For instance, Unilever, consumer packaged goods company has optimized container design using Al to use less material without sacrificing product protection. By determining the ideal size, shape, and material for packing, machine learning algorithms help make sure that goods are neither overly nor underprotected. Companies are also using Al-driven technologies to assist them create packaging that is completely recyclable or biodegradable, consumes fewer resources, and lowers transportation costs.

Due to busy lifestyle and since the Covid -19 pandemic the online shopping culture has flourished to large extend. The growth in the online shopping and ecommerce platform has estimated to drive the growth of the disappearing packaging market in the near future.

According to the data published by the B2B eCommerce Association, in January 2025, according to visitor traffic, the most popular e-commerce websites are Amazon, Walmart, eBay, and AliExpress. These four businesses now control the majority of the internet sales market and are well-known. Many internet buyers choose them because they provide a large selection of goods at affordable costs.

The key players operating in the market are facing issue due to limited scalability and shorter shelf life of the disappearing packaging which has estimated to restrict the growth of the disappearing packaging market in the near future. Many disappearing packaging solutions are still in the early stages, with limited large-scale production capabilities. Lack of infrastructure for mass production slows adoption. Edible and biodegradable packaging materials are often more sensitive to moisture, temperature, and handling, leading to a shorter shelf life. They may not provide the same level of protection as plastic, limiting their use in certain industries.

Most current food and beverage supply chains are optimized for traditional packaging materials. Retailers and manufacturers may be reluctant to invest in new storage and transport methods. Alternatives like paper-based packaging, compostable bioplastics, and reusable containers may be more practical or cost-effective.

Rising consumer awareness about plastic pollution and environmental sustainability is driving demand for eco-friendly alternatives. Governments and businesses are setting sustainability goals, increasing adoption of biodegradable packaging. The key players operating in the market are focused on innovating and launching new disappearing packaging solutions which has estimated to create lucrative opportunity for the growth of the global disappearing packaging market in the near future.

Many countries are banning single-use plastics, developing a favourable market for disappearing packaging. Incentives for sustainable packaging startups can drive innovation and investment. The key players operating in the market are getting support from the regulatory bodies for launching new disappearing packaging which has estimated to create lucrative opportunity for the growth of the disappearing packaging market in the near future.

The starch segment held a dominant presence in the disappearing packaging market in 2024. Starch is extensively available and derived from renewable sources like potatoes, corn, and cassava. It is relatively low-cost compared to other biodegradable materials like seaweed or alginate. Starch can be blended with other biopolymers to enhance flexibility, durability, and moisture resistance. It is compatible with existing manufacturing processes, making it easier for companies to adopt. Starch is non-toxic, food-safe, and widely accepted by consumers as a natural material. It offers an eco-friendly alternative to plastic without significant changes in consumer habits.

The food & beverage packaging segment to led the market in 2024. Disappearing packaging is widely used in the food and beverage as it reduces plastic waste and pollution, aligning with global sustainability goals. Fully biodegradable or edible, eliminating the need for disposal. The food & beverage packaging is made from natural ingredients like seaweed, starch, or gelatin, ensuring it is food-safe. The food and beverage packaging industry is free from harmful chemicals. Growing interest in eco-friendly products boosts demand for sustainable alternatives. Many countries are restricting single-use plastics, encouraging businesses to switch to biodegradable packaging. Major food and beverage brands are investing in sustainable solutions to meet regulatory requirements.

North America region dominated the global disappearing packaging market in 2024. Several states, including New York, California, and Washington, have banned single-use plastics. The U.S. Plastic Pact aims to make 100% of plastic packaging reusable, recyclable, or compostable by 2025. American consumers are increasingly eco-conscious and prefer biodegradable packaging. Fast-food giants in North America like McDonald's and Starbucks are shifting to sustainable packaging.

U.S. Packaging Industry Trends

Amazon and Walmart are pushing for biodegradable and water-soluble packaging to meet sustainability targets. U.S. research institutions and universities are developing starch-based, seaweed-based, and water-soluble packaging. For instance, in April 2023, An industry-leading Greenhouse Learning Center has opened at Frito-Lay and Quaker's headquartered in Purchase, New York research and development headquarters. In order to accelerate the rate of innovation, compostable packaging will be field tested, measured, and analyzed at the Learning Center. In order to meet the company's PepsiCo Positive (pep+) packaging target of having all packaging designed to be recyclable, compostable, biodegradable, or reused by 2025, this facility is a significant milestone.

Asia Pacific region is anticipated to grow at the fastest rate in the disappearing packaging market during the forecast period. The Plastic Waste Management Rules in India and China’s National Sword Policy push for sustainable alternatives. Countries like China, India, Japan, and Indonesia are enforcing strict bans on single-use plastics. Increasing consumer preference for eco-friendly and biodegradable packaging in food, beverages, and e-commerce. Growing e commerce shopping in countries like India and China supports the demand for sustainable products. Leading online retailers like Alibaba, Flipkart, and Shopee are adopting biodegradable packaging.

Major online retailers like Flipkart and Amazon India are adopting biodegradable and water-soluble packaging. Increased government pressure on e-commerce companies to reduce plastic waste. Indian startups like Bakeys (edible cutlery) and Evlogia Eco Care (biodegradable straws) are leading innovation. Investment in R&D for biodegradable polymers and water-soluble films is increasing.

Europe is observed to grow at a considerable growth rate in the upcoming period. The European Green Deal and the EU Plastics Strategy aim to make all packaging recyclable or compostable by 2030. The Single-Use Plastics Directive (SUPD) bans plastic straws, cutlery, plates, and packaging materials. European consumers are highly eco-conscious and willing to adopt biodegradable and edible packaging alternatives.

The demand for zero-waste and plastic-free products is increasing in countries like Germany, France, and the UK. European startups and companies like Notpla (UK), Lactips (France), and BioPak (Germany) are pioneering dissolvable and edible packaging solutions. Major brands like Nestlé, Unilever, and Danone are integrating biodegradable packaging into their products. European e-commerce giants like Zalando and IKEA are switching to biodegradable packaging for shipping. Regulatory pressure on online retailers to reduce plastic waste is driving demand for sustainable alternatives.

Germany hosts several companies offering disappearing packaging solutions some of which has mentioned as follows: Naturabiomat GmBH company specializes in biodegradable and compostable packaging. BioPak (Duni Group) is headquartered in Germany and offers a range of environmentally conscious takeaway products, such as plates, bowls, coffee cups and cutlery.

By Raw Materials

By End Use

By Region

April 2025

April 2025

April 2025

April 2025