April 2025

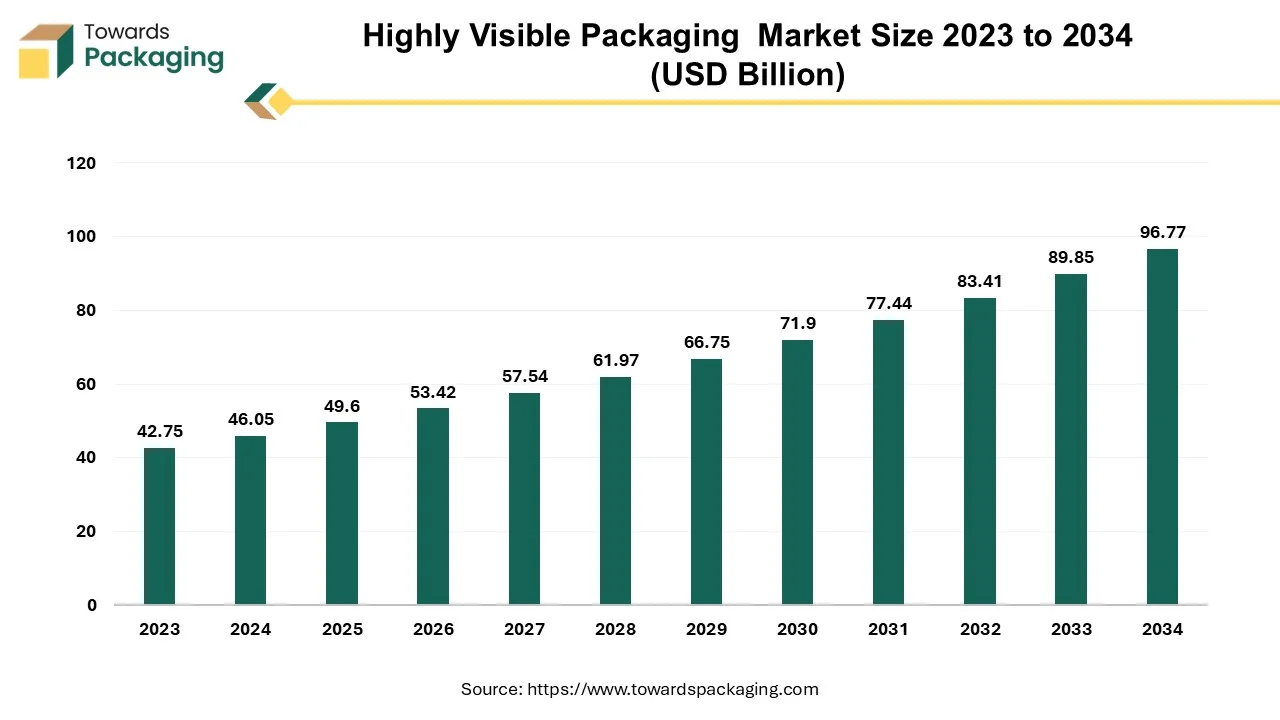

The highly visible packaging market is expected to see growth from USD 46.05 billion in 2024 to USD 96.77 billion by 2034, expanding at a CAGR of 7.71%.

Unlock Infinite Advantages: Subscribe to Annual Membership

The highly visible packaging market is anticipated to augment with a considerable CAGR during the forecast period. A very useful tool, high-visibility packaging allows the customer to view the product when it is still within the container. It is commonly recognized that consumers make 70% of their brand-related purchases in-store, and that brands only have a little window of time to grab their consumer's interest before they go to a rival. An additional benefit of high-visibility packaging for manufacturing processes is that it allows for faster product identification, which boosts production efficiency.

The changing consumer preferences for packaging coupled with the growing need for brand differentiation in crowded markets is anticipated to augment the growth of the highly visible packaging market within the estimated timeframe. The inclination of retailers towards the packaging that improves the in-store shopping experience and draws attention to the products along with advancements in printing technology that enables more vibrant and intricate packaging along with the growing importance of customization and personalization in packaging are also expected to support the market growth. Furthermore, the rise of e-commerce as well as the trend towards sustainability is also likely to contribute to the growth of the market in the years to come. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

The increased demand for transparent packaging is expected to contribute to the growth of the market during the forecast period. Consumers of today demand integrity and transparency. A growing movement in packaging design toward more visibility meets their need to comprehend the goods they purchase. Simple, straightforward designs promote consumer confidence in the product's quality by enabling them to see it before they purchase it. Ecological beliefs of customers are also connected to sustainable clear materials.

Packaging designs that are difficult to read or that hide information that consumers want to know are less likely to connect with consumers than those that clearly notify them about ingredients, absence of substances, and additional functional elements that enhance health. They’re influenced by what they see on store shelves, and in that context, packaging has the greatest chance of interacting with them. From scannable QR codes to creatively designed labeling to health-educational advertising, there are various methods for package designs to be more instructive about health-related CPG qualities.

Furthermore, to maintain their transparent image, numerous companies have implemented the visible packaging. The body care firm Lush highlights the pure nature of their product by letting customers see the fresh and natural components in their package. For several of its limited-edition cookies, Oreo has also used visible food packaging, which has excited the customers who can view the product and desire to try it. Frito-Lay is another company that modified their packaging to make it clear that there are just three ingredients in their potato chips. This step gives the customers more confidence about a product that many view as a tiny pleasure and helps them learn what goes into their favorite snack foods. By being transparent, food may be better evaluated by the customers to establish its quality and the freshness. Thus, if customers can see through the packaging of the product, they feel reassured and are more inclined to buy it.

The growing environmental concerns and various packaging regulations and standards across different regions are likely to hinder the growth of the highly visible packaging market within the estimated timeframe. Due of its longevity and transparency, plastic packaging has been the preferred option since a long time. It does, however, come with a number of environmental issues. Plastic waste is becoming a bigger problem as a result of the overuse of plastic in packaging. There is no exception for clamshells, shrink wrap, or blister packs. Approximately 100,000 tonnes of plastic are manufactured annually for use in drug packaging just in the healthcare sector.

The fact that the conventional plastic blister packs and clamshells are composed of multiple elements makes them difficult to recycle, especially those made-up of PVC. This implies that after being thrown with the usual trash, they frequently wind up as part of the pollution in landfills or incinerators. Additionally, there is a large carbon footprint associated with the manufacturing of the plastic materials, which depends on fossil fuels. This increases greenhouse gas emissions in addition to depleting the non-renewable resources. Likewise, materials used in the plastic packaging cannot decompose. This implies that they could damage ecosystems and species for many decades while remaining in the environment.

Furthermore, Governments have used legislation more frequently in the last few years to address the issue of the plastic pollution. For instance, PVC, the third most produced synthetic plastic polymer worldwide, is prohibited from being used in certain nations. PVC is frequently used in packaging. The material's challenges in recycling and comparatively higher detrimental effects on the human health have drawn heavy criticism. The Republic of Korea has outright prohibited the use of the PVC plastic in packaging, whereas Spain has imposed a fee on non-reusable plastic packaging. Regulations pertaining to the plastic garbage could become more expensive and liable, or they could restrict the market access for organizations that take time complying with them.

The increasing shift of various organizations towards recycling and eco-friendly packaging is expected to create a substantial opportunity for the growth of the highly visible packaging market in the years to come, driven by the increasing consumer awareness and demand for sustainable products.

For instance,

Furthermore, recycling and sustainable packaging not only satisfy the customer preferences but also comply with the growing legislative requirements in many regions, which are pushing for the use of recyclable materials and tightening the limitations on the package waste. This will preserve the packaging's usefulness as well as the visual appeal while reducing its environmental impact and satisfying the high visibility standards.

The blister packaging segment captured largest market share of 37.24% in 2023. In today's world of security-conscious consumers and governing bodies, the blister pack is becoming prominent packaging choice. Blister packing aids in anti-counterfeiting efforts in addition to functioning well with the serialization and track & trace procedures. Furthermore, whether it's an innovative clinical-trial drug or an OTC (over-the-counter) pain reliever, the blister pack continues to be the most effective packaging option for improving patient compliance. Blister packaging is further predicted to be utilized more frequently owing to the increasing rate of population along with the global spread of new diseases, as companies try to meet the growing demand for over-the-counter and the prescription medicines. Since blister packaging offers stability of the product, and consumer convenience, today's educated pharmaceutical consumers support it.

The food and beverage segment held considerable market share in 2023. This is owing to the increasing demand for convenience and transparency from consumers and the rise of health-conscious consumers. Furthermore, growth of the on-the-go lifestyle as well as the growing demand for fresh foods and increasing disposable income is also likely to support the segmental growth the market. Additionally, most of the organizations are focusing on launching new products with sustainability to maintain their brand image towards consumers.

For instance,

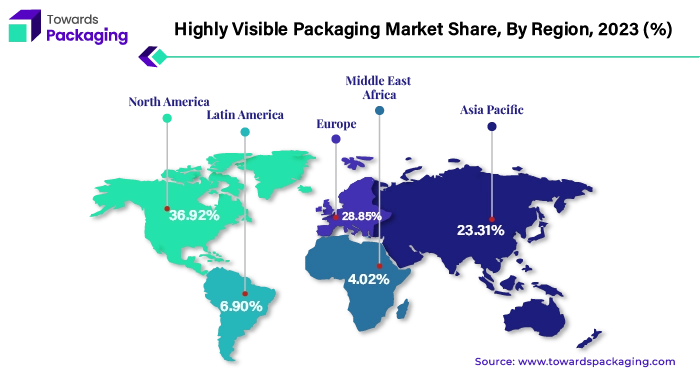

Asia Pacific is expected to grow at a fastest CAGR of 10.05% during the forecast period. This is owing to the increase in purchasing power of consumers along with the growing middle class in economies like China and India. Furthermore, the increasing rise in e-commerce is also likely to support the regional growth of the market. According to the report by the Ministry of Economy, Trade and Industry in Japan, the business-to-consumer (B2C) e-commerce sector was valued at USD 170 billion (¥22.7 trillion) in 2022, representing a 9.9% annual growth. From USD 100 billion (¥11.2 trillion) in 2013, the value of this market has since more than doubled over the last nine years. Additionally, increasing awareness about health and wellness is also expected to contribute to the growth of the market in the region.

North America held largest market share of 36.81% in 2023. This is due to the highly developed retail sector, including large supermarkets, hypermarkets, and convenience stores across the region. Also, the growing food and beverage industry along with the growing demand for packaging that highlights nutritional information and product quality is further expected to support regional growth of the market in the years to come. Furthermore, the growing consumer demand for transparency which helps build trust and enables consumers to assess product quality before making a purchase is also expected to support the regional growth of the market in the near future.

By Type

By End-user Industry

By Region

April 2025

April 2025

April 2025

April 2025