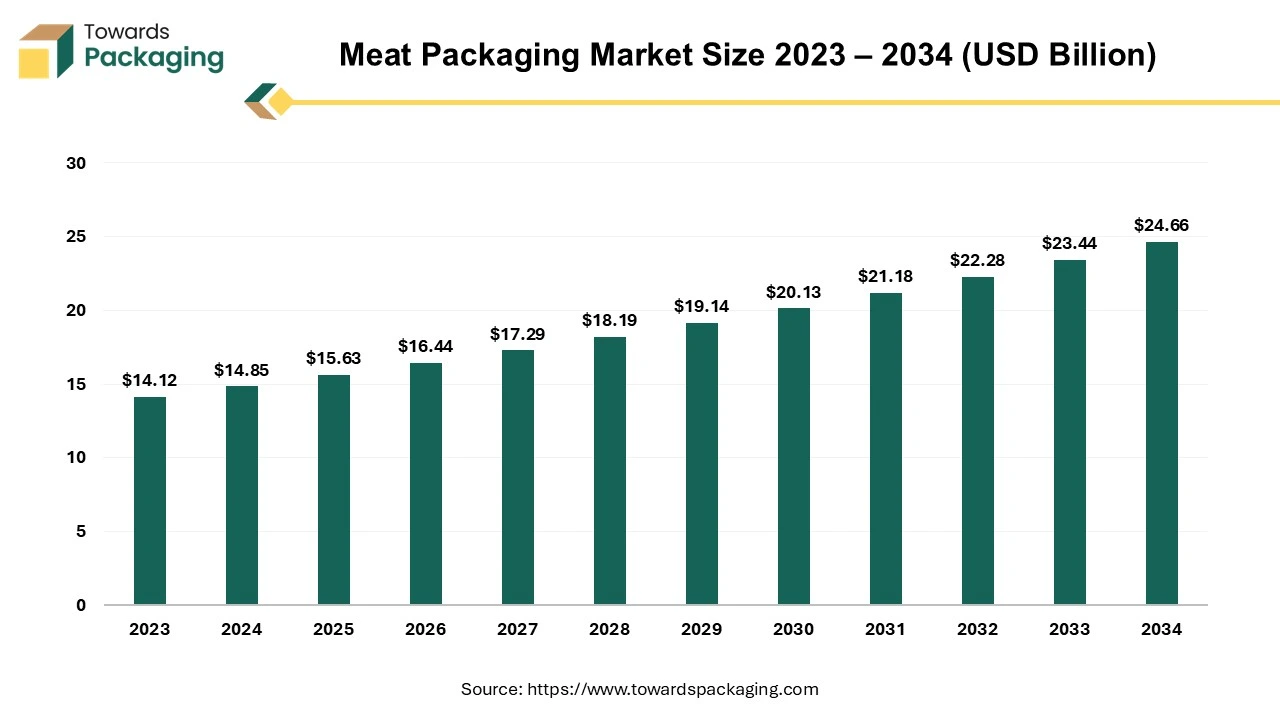

The meat packaging market is forecasted to expand from USD 16.43 billion in 2026 to USD 25.94 billion by 2035, growing at a CAGR of 5.2% from 2026 to 2035. The market analysis includes key regional data with North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, alongside valuable segments of flexible, semi-rigid, and rigid packaging materials. The competitive landscape highlights major players like Amcor, Mondi Group, and Winpak Ltd., as well as insights into the market's evolving value chain. Detailed trade data and manufacturers' perspectives are included for a comprehensive understanding of the meat packaging sector.

The role of the meat packaging market is crucial in maintaining the quality, safety, and appeal of meat products throughout the supply chain, from production to consumption. As a critical component of the food industry, the meat sector is a leading agricultural commodity, alongside rice, milk, and wheat. Global meat production is expected to increase by 12% to 382 million metric tonnes (Mt) by 2032, driven by population growth and rising incomes. Over the next decade, the global consumption of beef proteins is projected to increase by 14%. This expected growth is likely driven by economic factors such as rising disposable income and demographic changes, presenting potential market opportunities.

Per capita meat consumption is expected to plateau in high-income countries due to aging populations, shifting consumer preferences, and slower population growth rates. Customers will be drawn to more expensive meat cuts due to this change. By 2032, an estimated 41 million more tonnes of meat will be produced worldwide, primarily due to increases in the production of poultry and pigmeat. It is anticipated that the latter would recover from major blows inflicted by African Swine Fever (ASF) epidemics in Asia in the early years of the next decade.

Packaging is a scientific strategy for protecting the integrity and safety of meat products from production to consumption while increasing their visual appeal to consumers. Adequate packing prevents contamination and spoiling and allows for controlled enzymatic activity, improving tenderness and preserving attractive colors, such as the cherry-red hue found in red meat. Furthermore, product packaging is an important marketing tool influencing customer purchase decisions and communicating brand values. As the meat business grows, packaging solutions will become increasingly crucial in satisfying functional and marketing goals in this dynamic market environment.

| Top 10 Country Meat Consumption (Kg / Person) | ||

| No | Country | Total Consumption |

| 1 | Hong Kong | 136.31 |

| 2 | United States | 128.63 |

| 3 | Australia | 121.53 |

| 4 | Mongolia | 111.56 |

| 5 | Argentina | 110.16 |

| 6 | Nauru | 105.14 |

| 7 | Macau | 103.67 |

| 8 | Spain | 101.87 |

| 9 | Israel | 99.37 |

| 10 | Brazil | 99.15 |

Hongkong is the largest consumer of meat followed by united states. Argentina is the country that consumes the most beef and veal annually, averaging 39.9 kg per person. The two nations that consume the most pork per capita are China and the 27 members of the European Union, at 30.5 and 30.4 kg, respectively. Israel consumes more poultry—64.9 kg per person yearly—than any other country. Kazakhstan consumes the most sheep annually, averaging 8.5 kg per person.

Through 2022, there is a predicted 1.7% annual increase in meat consumption. Scientists are becoming increasingly concerned about how eating meat affects the environment since producing beef, particularly on an industrial scale, as is done in many nations, causes soil degradation through overgrazing, rising carbon-based fuel usage, and excessive water use.

For Instance,

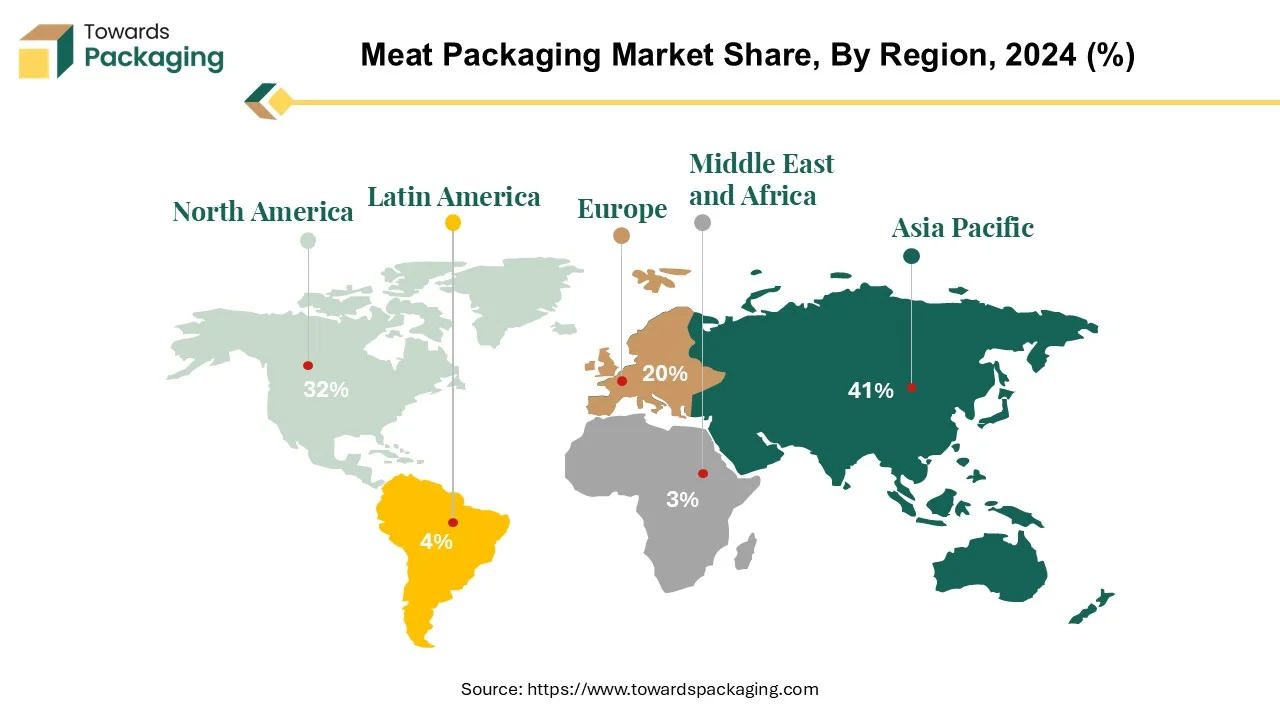

The Asia Pacific dominates the meat packaging market, owing to increased international meat commerce supported by rising demand from Asian countries. Following a fall during the African Swine Fever (ASF) crisis, Asia and the Pacific's market share is expected to recover to 41%, due to advancements in China, the world's largest meat producer. China is expected to return to its long-term economic track by 2023, as the impact of the ASF on domestic pigmeat pricing fades. Notably, pigmeat is projected to account for a sizable share of the overall growth in meat consumption by 2030, with China accounting for 70% of the surge.

Global meat consumption per capita is expected to increase at a 0.3% annual pace, reaching 35.4 kg in retail weight equivalent by 2030, driven primarily by increased per capita consumption of poultry meat. Furthermore, sheep meat output is expected to increase, notably in Asia, with China, Pakistan, and India leading the way. Significant production gains are also likely in Africa, notably in the least developed countries of Sub-Saharan Africa, despite problems such as urbanization, desertification, and feed availability limits.

India has emerged as a formidable force in the poultry meat industry, securing a spot among the top global producers. The country's expanding urban population and escalating income levels have sparked a substantial surge in meat demand and consumption. By 2023, poultry meat consumption in India is projected to surpass four million metric tonnes, underscoring the country's potential for investment in this sector.

The meat packaging industry is experiencing rapid improvements in packaging technologies, such as active and intelligent packaging, and innovations in engineering science that enable flexible packaging solutions for food products. Furthermore, there is a noticeable shift towards eco-friendly practices among food packaging firms, with a greater use of biodegradable packaging materials that are recyclable, renewable, and reusable. These trends will likely drive the Asia Pacific food packaging market over the forecast period, in line with consumer desires for environmentally friendly and technologically sophisticated packaging solutions.

For Instance,

The meat packaging industry's second-biggest market is North America. It is projected that by 2030, there will be a significant 6% increase in beef production in the region's most extensive producing areas. Being a substantial participant in North America, the US has a thriving meat sector, with meat department sales expected to reach $122 billion in 2023—a 3.2% rise over the previous year. Nevertheless, despite these encouraging signs, several market-leading companies face growth roadblocks due to changing customer tastes, inflationary pressures, and demand-related problems.

In the United States, a sizable portion of people identify as "meat eaters," making up over 78% of the population, whereas a relatively small percentage, or 7%, identify as vegans or vegetarians. This demographic landscape highlights the American consumer market's persistent preference for meat products.

Product quality and look are the most essential elements for meat purchases, closely followed by price per pound and overall package cost. Customers prioritize these factors when selecting from the many meat products on the market, highlighting the packaging's critical role in improving product appeal and communicating quality. As the meat packaging business in North America evolves, stakeholders must be alert to shifting consumer trends and preferences. Adapting to rising demands and implementing creative packaging solutions that correspond with consumer expectations will be critical for firms looking to remain competitive and develop in this dynamic market scenario.

For Instance,

Flexible packaging is the principal material used in the meat packaging industry, providing variety and convenience to both manufacturers and customers. This category includes polyethylene, cellophane, polypropylene (PP), polyamide, polyvinyl chloride, polyester film, and aluminum foil. Companies specializing in flexible packaging for meat, poultry, and seafood saw a significant 49% growth in volume, showing a growing desire for this packaging type in the industry. Approximately two-thirds of fresh meat items are packaged in plastic before being exhibited on store shelves. This packaging consists typically of a translucent, breathable plastic film covering an absorbent pad and a foam tray, which helps to keep the meat fresh during storage.

Almost two-thirds of fresh meat products are wrapped in plastic when put on store shelves. To preserve the freshness of the meat during storage, this packaging usually comprises a transparent, breathable plastic film covering an absorbent pad and a foam tray. Controlled oxidation is made possible by the film's permeability, which permits oxygen from the air to reach the meat. This packing method is the least expensive and most influential of the choices available, but the meat's shelf life is shortened due to its constant exposure to oxygen.

This increased shelf life helps various stakeholders in the supply chain: merchants enjoy less shrinkage, consumers can reduce food waste, and processors gain access to new markets, even far away, thanks to improved product longevity.

Adopting novel packaging options, such as flexible and skin packaging, demonstrates the industry's dedication to solving environmental concerns while satisfying consumer needs for convenience and freshness. As packaging technology advances, the meat packaging market is positioned to extend shelf life, minimize waste, and improve overall product quality, resulting in reciprocal benefits for all parties involved.

For Instance,

Beef contributes around 4 billion pounds and $15 billion in sales annually. Because the beef sector serves so many markets, there are significant demands on the production, distribution, sales, and marketing of beef products to different groups. The beef sector uses various packaging technologies to provide its customers with safe, high-quality, fresh products. Beef packages must serve multiple tasks. Packages must prevent contamination and deterioration, make the product visible, and show label information. Packages also serve a commercial purpose and must appeal to buyers. The multiple uses and packaging technologies available for consumer items pose obstacles for those designing packages for beef, including fresh, cooked, and frozen beef products.

Beef is the most popular meat consumed in the US, followed by hog and chicken. A significant section of the population's food habits and preferences are reflected in this trend. American cuisine has traditionally relied heavily on beef because of its robust flavour and adaptability in the kitchen. Pork is also a popular choice among consumers, especially popular pieces like bacon, gammon and pork chops. Furthermore, chicken is a staple in American diets due to its lean protein content and adaptability in a variety of cuisines.

Beef packaging needs to be resilient to various storage environments, including freezing, harsh lighting, and refrigeration. It also needs to be able to tolerate misuse. Retailers of beef merchandise fresh meat using a diverse range of packaging. Over the past few years, the number of packages falling into the general category known as "case-ready" has expanded. A package labeled "case-ready" has been transported directly from the beef processing facility and doesn't need to be repackaged in the store to be put in the meat case. Case-ready packaging bears the proprietary USDA establishment number given to the processor that packaged the beef and a USDA inspection emblem. Various kinds of case-ready packaging are available, including vacuum and modified-atmosphere packages.

For Instance,

Fresh meat is a delicate product that must be carefully preserved to meet consumer expectations of a 10-day minimum shelf life. To ensure its quality, appropriate packaging materials and techniques are required. When choosing packing materials, mechanical qualities and gas barrier properties, particularly oxygen and carbon dioxide, are important considerations. The amount of fresh meat packaged for sale in retail outlets has expanded significantly in recent years. Given the sensitivity of fresh meat, the packaging system must be tailored to the product contents to ensure that consumers receive safe and healthful foods.

Fresh meat packaging alternatives include Modified Atmosphere Packaging (MAP) systems, a popular alternative. These systems typically include trays composed of deep-drawn plastic films with a liquid absorbent sheet and a clear top. Polypropylene (PP) is a popular material for these trays despite having a higher oxygen transfer rate than other plastics such as Polyethylene Terephthalate (PET). However, PP successfully retains the proper oxygen and carbon dioxide levels within the package throughout its shelf life.

For Instance,

Flow packs are an affordable packaging solution for raw foods such as fresh meat. These packs' design prioritizes sanitation to reduce the danger of product contamination. Engineers concentrated on developing a self-supporting machine design that provides easy access to all components, such as the infeed conveyor, sealing rollers, and cross-sealing assemblies. This design strategy accelerates cleaning procedures and minimizes downtime, resulting in efficient and hygienic packing processes.

For Instance,

Choosing proper packaging materials and techniques is critical to protecting the freshness and safety of fresh meat. MAP systems and flow packs are two popular packaging techniques for fresh beef, each providing significant benefits regarding shelf-life extension, hygiene, and cost-effectiveness. By optimizing packaging techniques to fit the unique needs of fresh meat, manufacturers may offer goods that fulfill customer expectations for freshness, safety, and quality.

Our latest research has uncovered clear consumer preferences for what should be included on meat packaging, regardless of the type or cut. These preferences fall into three main categories:

Inspiration through appealing "foodie imagery" has the most significant impact on purchasing decisions. Consumers are drawn to images of delicious, well-presented dishes, making it essential to include strong foodie imagery on packaging.

For example, in our study, more than half of the shoppers preferred labels with foodie imagery for pork medallions (64%), pork loins (57%), and beef steaks (56%).

Providing information on health benefits and the origin of the meat boosts consumer confidence and trust. This messaging is particularly valuable for less familiar cuts, such as lamb, where clear cooking instructions can make a significant difference.

Consumers also value reassurance about the environmental impact and farming methods used in meat production. This information helps shoppers feel good about their purchases and supports sustainable practices.

Including these key elements on meat packaging can greatly influence consumer choices and enhance their overall shopping experience.

The competitive landscape of the meat packaging market is characterized by established industry leaders such as Amcor Plc, Mondi Group, Winpak Ltd., Bollore Group, Amerplast Ltd. Cascades Inc., Uniflex Packaging, Berry Global Inc., Flavorseal and Revopak. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences.

Amcor provides a diverse selection of packaging solutions adapted to the individual requirements of meat producers and retailers. These methods increase the shelf life of meat products, keep them fresh, and assure their safety during storage and transportation.

Mondi Group is a critical player in the meat packaging sector, providing innovative solutions and using its knowledge in sustainable packaging. These solutions frequently include modern technology to improve product protection, shelf life, and convenience for consumers. With an emphasis on environmental responsibility, Mondi's packaging solutions strive to reduce waste and the overall environmental impact of meat packing processes.

Bollore Group's logistics and supply chain management expertise allows it to deliver specialized packaging solutions that ensure the effective and safe transit of meat products from production facilities to distribution centers, retailers, or customers.

By Packaging Material

By Product Type

By Region

December 2025

December 2025

December 2025

December 2025