The paper bag packaging market is forecasted to expand from USD 6.45 billion in 2026 to USD 9.75 billion by 2035, growing at a CAGR of 4.7% from 2026 to 2035. This report covers key trends in sustainability, innovative designs like flat bottom bags, and eco-friendly materials such as brown kraft and recycled paper.

Regional insights highlight Asia-Pacific and North America as leading growth markets, driven by rising urbanization and eco-conscious consumers. Competitive analysis includes top players like International Paper and Smurfit Kappa, and discusses market segments such as food packaging, retail use, and agriculture.

Paper bag industry is booming with sustainability issues and regulatory shift in mind mostly in Asia Pacific and North America region. With the growing popularity of environmentally friendly choices, paper bags come in recyclable and biodegradable versions. Innovative design improves the promotion and performance of the brand, which is able to meet customer preferences. flat bottom bags and brown paper bags are revolutionising the market, giving attention to environmental friendliness and practicality. In the food industry, paper bags give us a variety of uses, from packaging to-go meals to sustainability promotion. Key players such as International Paper, Smurfit Kappa, and Mondi are digging into innovation and sustainability in order to remain among the competent ones. The dynamics of the market evince a trend towards green solutions, thus setting in motion the growth and innovation in the sector of paper bags packaging industry.

A paper bag is a packaging solution made from the recycled paper. It’s light and durable, perfect for restaurants or as an additional packing layer for mailer boxes. There are two types of paper bags available white and natural (brown). Paper bags are gaining importance as these bags are 100% reusable, recyclable and biodegradable and at the same time environment friendly and pose less threat to wildlife. it requires less energy for paper bags to be recycled than plastic bags. Paper bags have come a long way since their beginnings in the mid-eighteenth century when some paper bag manufacturers started developing paper bags that are more hardy and long lasting. The paper bags are generally box-shaped in design that allows them to stand upright and hold more goods.

The global paper and paperboard packaging market size is estimated to grow from USD 297.89 billion in 2022 to reach an estimated USD 452.74 billion by 2032, growing at a 4.28% CAGR between 2023 and 2032. Over the past 40 years, worldwide paper consumption has escalated dramatically, increasing by 400%. This surge is vividly reflected in the daily routines of office environments, where the average worker contributes to this trend by printing around 31 pages per day. Despite the digital revolution, a surprising 93% of business information continues to be produced on paper, underscoring the persistent reliance on this traditional medium. Annually, this culminates in the production of an astonishing 21 million tons of paper waste by American businesses.

The paper bags are extensively incorporated in many industries, which is increasing the paper bags demand all over the globe.

| Rank | Country / Region | Export Value (USD) |

| 1 | China | $2.09 billion |

| 2 | European Union | $630.5 million |

| 3 | Germany | $492.3 million |

| 4 | Italy | $467.1 million |

| 5 | Turkey | $215.2 million |

| 6 | Vietnam | $201.3 million |

| 7 | Japan | $168.5 million |

| 8 | United States | $167.9 million |

| 9 | Spain | $158.2 million |

| 10 | India | $156.8 million |

This table presents the leading paper bag exporting countries worldwide in 2022. China dominates the market with exports worth around $2.09 billion, followed by the European Union and Germany. India ranks tenth with approximately $156.8 million in paper bag exports. These nations collectively meet the rising global demand for paper bags, reflecting a growing focus on sustainable packaging solutions.

Asia Pacific market for paper bags is growing fast particularly as a result of some important drivers. The Asia Pacific region occupies highest share of this market due to industrialization growth, and rising urban population in the developing nations. The market sees a corresponding growth not only in demand for consumer goods but also in the rise of sustainable packaging means such as paper bags.

The paper bags market has been, and still is, the major driver of the Asia Pacific market which involves countries such as China, Japan, India, Australia, and Indonesia. China, especially, draws attention as one of the largest contributors, because the country has a fast pace of urbanization and industrialization. The region has undergone a striking rise in imports and it is China and ASEAN countries that enjoy sharp surges of 112% and 97% respectively. This rush in imports covers grades of paper, with uncoated writing and printing paper having the largest hike in Q1 2022-23 of 102%.

India's enhanced imports of paper and paperboard also witness regional demand for packaging materials rise. The first quarter of 2023-24 witnessed 39% growth in paper-based packaging imports in India, indicating the increase in the country’s dependence on paper-based packaging solutions.

Paper bags is applied in a broader area such as food and beverages, cosmetics, and other products that are usually used in Asia Pacific. Increased consumer awareness about environmental sustainability along with the active search for possible eco-friendly packaging options such as paper bags is going to fuel the market growth in the near future.

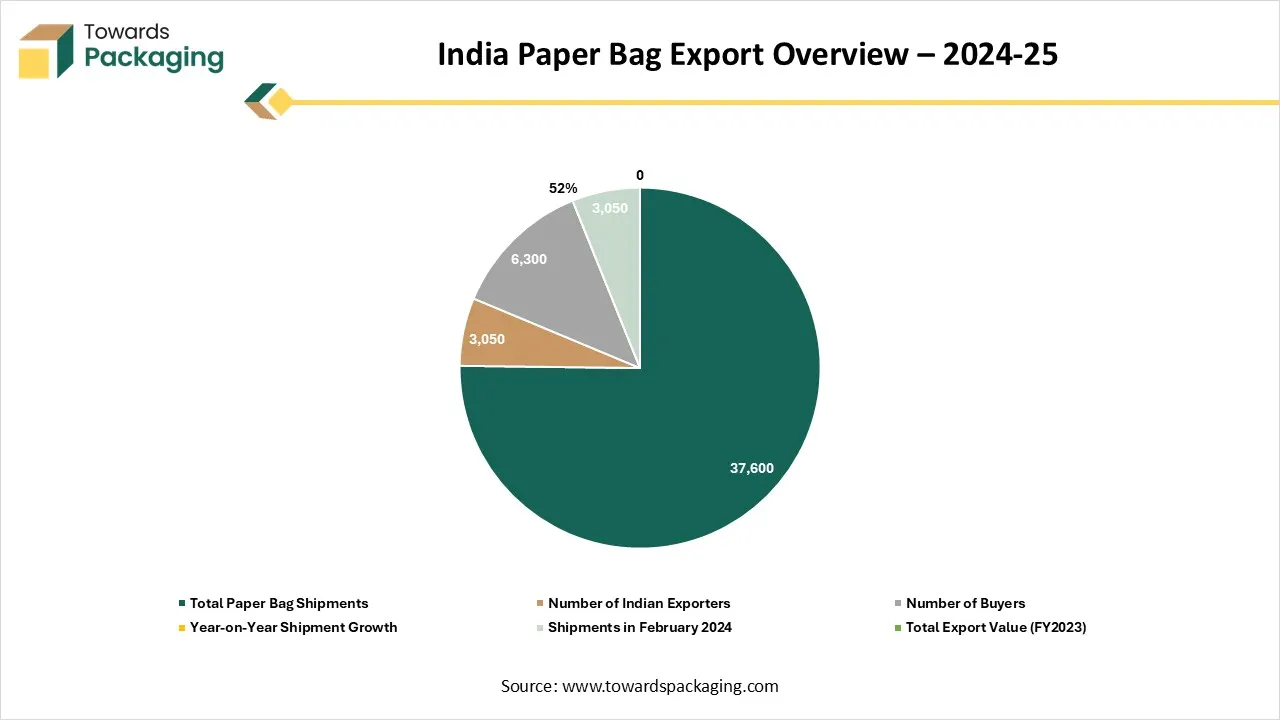

India Paper Bag Export Overview – 2024-25

| Parameter | Value |

| Total Paper Bag Shipments | 37,600 |

| Number of Indian Exporters | 3,050 |

| Number of Buyers | 6,300 |

| Year-on-Year Shipment Growth | 52% |

| Shipments in February 2024 | 3,050 |

| Total Export Value (FY2023) | $3.06 billion USD |

This table summarizes India’s paper bag export performance for the fiscal year 2024-25. India shipped around 37,600 paper bags to international buyers, showing strong growth of approximately 52% compared to the previous year. Over 3,000 Indian exporters supplied paper bags to more than 6,300 global buyers. In February 2024 alone, roughly 3,050 shipments were exported. The total export value for FY2023 was about $3.06 billion USD, highlighting India’s significant role in the global paper bag market.

The manufacturing and demand of paper bags in Europe is highly advanced, driven by strict environmental regulations and a strong push to lower single-use plastics. Countries such as Germany, France, and the UK are leading producers, assisted by well-established paper industries and innovative packaging technologies. Demand from retail, foodservice, fashion, and e-commerce sectors continues to fuel development, with users increasingly favouring biodegradable and recyclable options.

| Country | Integrated Pulp | Market Pulp | Paper for Recycling | Non-Fibrous | Total |

| Austria | 1,252 | 368 | 1,730 | 173 | 3,523 |

| Belgium | 2 | 1,708 | 1,278 | 438 | 3,426 |

| Denmark | 1 | 190 | 68 | 59 | 318 |

| Finland | 2,382 | 1,092 | 583 | 118 | 4,175 |

| France | 598 | 1,918 | 4,620 | 1,018 | 8,154 |

| Germany | 5,725 | 5,218 | 11,805 | 3,278 | 25,990 |

| Italy | 235 | 3,187 | 8,305 | 1,810 | 13,537 |

| Netherlands | 1 | 1,065 | 2,160 | 261 | 3,487 |

| Norway | 7 | 166 | 30 | 33 | 236 |

| Portugal | 1,145 | 298 | 326 | 56 | 1,825 |

| Spain | 960 | 1,743 | 3,098 | 795 | 6,596 |

| Sweden | 4,702 | 568 | 1,220 | 238 | 6,728 |

| Others | 673 | 779 | 1,855 | 790 | 4,097 |

| Total | 17,672 | 18,065 | 44,013 | 9,355 | 84,705 |

The manufacturing of paper bag packaging in Latin America is growing steadily, driven by growing environmental awareness and government regulations that limit the use of single-use plastics. Countries such as Brazil, Mexico, and Argentina are leading the move towards sustainable packaging solutions, with rising demand from the retail, food service, and e-commerce sectors. Manufacturers are investing in biodegradable, recyclable, and durable paper bags to align with user preferences for eco-friendly alternatives. The growing focus on sustainability, coupled with growing production and invention in the region's paper bag packaging industry, is leading to a significant change.

The production of paper bag packaging in the Middle East and Africa is growing rapidly, supported by government initiatives to lower plastic waste and growing consumer preference for eco-friendly alternatives. Countries like the UAE, Saudi Arabia, and South Africa are at the forefront, with growing adoption of paper bags in retail, food service, and supermarkets. The development of e-commerce and quick-service restaurants is also boosting demand for durable and recyclable paper bags.

The paper bag packaging industry market is undergoing a remarkable global fastest growth, with Europe playing the role of a crucial player taking possession of the second-largest market share. Spain, Germany and France are the countries that have set the trend in Europe. This growth is based upon a number of factors, including a greater buy in of environmental sustainability, initiatives from governments calling for alternative solutions with eco-friendly components, and an evolution in buying behaviours towards sustainable packaging.

Europe plays a major role in paper production globally; the increasing importance of paper bag industry is also proportional. By 2023, paper production in Europe was 74.3 million tonnes or approximately 12.8% of the global production. Such profound production capacity not only allows a constant manufacturing of paper bag, but also indicates the region's possible market for the future.

Demand for kraft papers such as sack kraft’s are rapidly growing in European regions. This has greatly increased the demand for paper bags as it is more environmentally friendly as compared to plastic bags. This shift among consumers as well as the worldwide increase in sustainability consciousness is another driver that gives rise to the paper bag packaging market in Europe. The region's leading role in the paper packaging market, due to its paper production capacity and the rising demand for environmentally friendly solutions, reflects Europe's position as the main driving force of the growing paper bag packaging market on a global scale.

The paper bag industry witnessing demand which is set by North America. This increase can be ascribed to a complex of reasons with the US and Canada playing a dominant role. Although, consumers and businesses are paying more attention to the intensive negative impacts of plastic pollution. Unlike plastics, however, paper bags also present an eco-friendly alternative. They are usually recyclable materials and they can be composted or recycled which decreases their impact to the environment.

This change in consumer habits is thus reinforced by government regulations across North America. A number of countries and regions start imposing restrictions or even bans on single-use plastic bags. Such laws result in the change of consumer behavior, they begin to prefer paper bags over the plastic ones and as a result, paper bags become more popular. For instance, the US may have seen a remarkable increase in consumption of brown and kraft papers, which amounted to 2.7 million tons in 2023.

A well-serving supply chain is key to the development of this market. Canada comes onto the centre of the stage. It is a major export of unbleached packaging paper, the key raw material for the making of paper sacks. As for the US, it is a large importer from Canada with 113 000 tons purchased in 2023. In Canada, brands like Kraft and Canfor are some of the key players and ensure that the production of paper bags machines keeps going.

Regulatory matters, environmental issues, a reliable regional supply chain that is mainly served by the exports of Canada are all contributing to this growth. With the increasing demand for eco-friendly options, paper bags are set to become the center of attention in a revolution, replacing their less environment friendly counterparts.

Note: Values are rounded and slightly adjusted for uniqueness. Only the top 20 exporters are included for clarity; full data includes over 100+ countries.

| Country / Region | Export Value (USD 1000) | Quantity (Kg) |

| China | 2,091,500 | 519,000,000 |

| European Union | 628,500 | 176,400,000 |

| Germany | 497,500 | 140,200,000 |

| Italy | 465,000 | 134,000,000 |

| Turkey | 214,000 | 91,500,000 |

| Poland | 201,000 | 70,000,000 |

| United States | 168,200 | 145,000,000 |

| Vietnam | 167,500 | 49,800,000 |

| Spain | 158,200 | 60,000,000 |

| Canada | 157,500 | 44,900,000 |

| France | 129,000 | 26,000,000 |

| Mexico | 119,200 | 47,300,000 |

| Portugal | 99,800 | 37,000,000 |

| Netherlands | 91,900 | 21,500,000 |

| India | 81,500 | 43,800,000 |

| Indonesia | 76,000 | 25,400,000 |

| Belgium | 63,200 | 19,600,000 |

| Austria | 55,400 | 14,900,000 |

| Malaysia | 38,500 | 17,350,000 |

| Japan | 10,400 | 1,915,000 |

This table shows the leading exporters of sacks and bags (including paper cones) in 2022. China is the dominant global exporter, followed by the European Union and Germany. Italy and Turkey are also significant contributors. The data reflects both export value and shipment volume, giving insight into global trade patterns for paper-based packaging materials.

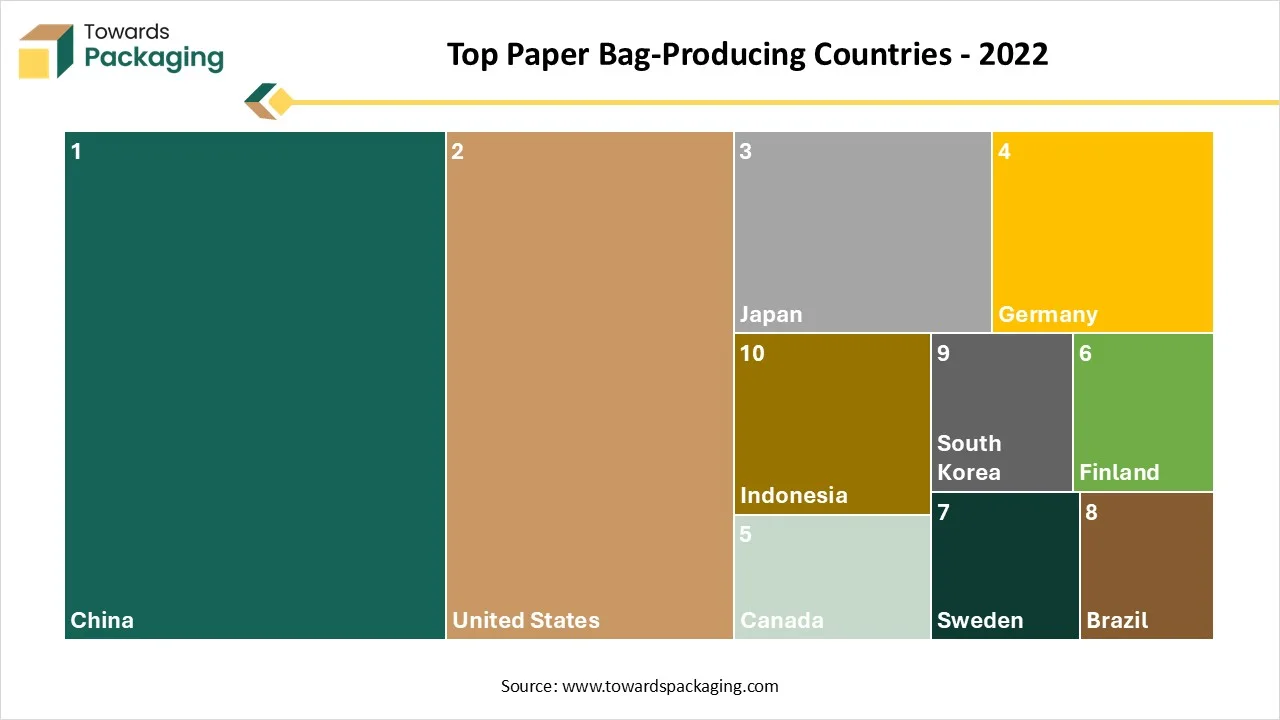

| Rank | Country | Production (1000 tonnes) |

| 1 | China | 100.1 |

| 2 | United States | 75.5 |

| 3 | Japan | 27 |

| 4 | Germany | 23.1 |

| 5 | Canada | 12.7 |

| 6 | Finland | 11.5 |

| 7 | Sweden | 11.3 |

| 8 | Brazil | 10.2 |

| 9 | South Korea | 11.6 |

| 10 | Indonesia | 18.5 |

This table highlights the top 10 paper bag-producing countries in 2022. China leads by a wide margin, followed by the United States and Japan. European nations such as Germany, Finland, and Sweden also have significant production. Indonesia and Brazil represent the major producers from Asia and South America. The figures indicate annual production volumes in thousand tonnes, providing insight into global paper bag manufacturing trends.

The flat bottom design makes carrying large quantities of items a breeze for the user. The design is also used in making the covers of the gift and shopping bags. Flat bottom bags are a universally used container in the broad variety of industries because of their unique characteristics of quite big volume and nice visualization on the shelves. make use of the first-class premium materials which extend the shelf life of the bag's contents and keep it fresh for a longer time.

| Imports of Paper & Paperboards of India (Tonnes, Crores) | ||||||||

| Year | Thousand Tonnes | INR Crores | ||||||

| Total | China | ASEAN | South Korea | Total | China | ASEAN | South Korea | |

| 2022-23 | 1,310.10 | 312.4 | 237.7 | 75.8 | 11,514 | 3,180 | 2,031 | 729 |

There are flat bottom style cargo bags that are the newest entry. These bags are becoming more and more popular and used by companies in the food business industry. The flat bottom bags in the flexible packaging bags category cost the most compared to other types of flexible packaging. Talking about convenience and looking good, these bags are taking the main stage.

India imports the paper & paperboards from china, ASEAN and south corea which will be used in many packaging and other resources. The bottom of the bag is flat chassis which plays the role of saving 15% of packaging material because of its unique design. These bags are called eco-friendly packaging bags, thus. Flat bags will take up less space on the store shelves as they stand very tall and they are not wide compared to stand-up bags. This packaging changes the way they allocate resources, thus paying less supermarket shelf space allows the food manufacturer to save some money. The fact that flat bottom bags have a high market demand is due to the fact that the type of bag offers shelf stability on account of its solid firm base. The surface is flat and stable, which including the containers for the majority of consumer goods such as rice, tea, coffee, breakfast cereals, etc. As a result, the picture for the growth of the world-wide flat bottom bags market is supposed to remain mostly favourable for the fact period.

The brown paper bag business is witnessing a revival due to a rise in environment consciousness among the populace. The increasing trend for consumers to opt for eco-friendly options is here, and brown paper bag, which are mostly unbleached kraft paper, is full and perfect fit.

Kraft paper, because of its environmentally friendly brown color, certainly has benefits. The paper is produced from the wood pulp that's renewable, and it often is made from recyclable materials, which significantly reduce the impact on the environment. Furthermore, it is also strong, degradable, and compostable by nature. Unlike plastic bags that could stay for decades in landfill, paper brown bags can decompose quickly thus reducing the overall waste.

This eco-efficacy is the primary growth driver for the market. When regulations on plastic bags by governments restrict or ban their use, citizens grab brown paper bags. These bags, which not only cover ecological needs, but also fit into the policy of environmentally aware business. It is not just enough to use brown paper bags anymore, but the plastic trend in the industry. The diversity in this type of packaging allows them to find application in multiple sectors starting from supermarkets and cafes to the retail shops and even high-end packaging. Additionally, this is the most important aspect that makes this market grow even more.

The paper brown bag market is doing so well because of its ecologically minded attributes. Now since environmental consciousness is booming, brown paper bags would be used widely by the consumers and the businesses that will leave plastic bags in the past.

Paper bag thickness which is typically indicated by the ply number is the main factor that significantly pushes the market growth. Solid-material paper bags are either 1-ply (or more-ply) construction types. Ply apart from impacting the durability, carrying ability and the output of the bag. Single-ply paper bags weigh less and have lower production costs compared to thicker paper bags and therefore not expensive or useful in cases of short-term use and lightweight items.

Market demand for diverse ply thickness of paper bags is not the same as determined by factors such as purpose of use, consumer tastes, and industry inspection. On the other hand, multi-thickness bags may be more suitable in some sectors where cheaper bags are merely a substitute for bulky ones which can cause considerable damage despite having a high resistance against perforation. Given that the customers are more sustainability-minded and eco-friendly, the market tree may have larger customer demand for the thicker paper bags since these are considered more ecological alternatives to the plastic bags.

Recycled paper bags and paper-based envelope choices are critical issues for food industries The food chain is an ideal place to apply paper bags as a packaging medium. The correct way to bag your product offers the best option for your client to stand the chance of becoming your consistent customer. These totes come in different sizes that can fit every type of food and beverages you carry to and from the sporting events.

| US Packaging Papers & Speciality Packaging Shipments | ||

| Grade | 2023 | 2022 |

| Shipments | 1,936.00 | 1,918.00 |

| Bag and Sack | 1,106.00 | 1,052.00 |

| Converting & Other | 433 | 402 |

| Food Wrapping | 64 | 67 |

Eateries have no choice but be ready for orders from people who would prefer the meals delivered to their location. On account of this fact, paper bags represent a suitable and economic way for consumers to take their merchandise home from the restaurant. French fries, chips, popcorn, and other snacks, that are full of oil and especially nice for carrying in a paper bag. Customers may choose hot dogs from cafes and use the luxury paper bags that offered by cafes too.

Along the lines of running food businesses, various sizes and shades of counter paper bags are also essential, for example, brown and white greaseproof paper bags. Kraft paper supplies brown paper bags, which are recyclable in their entirety. Mcdonald's which is the fastest-growing American fast-food provider transports packagings globally with over 37,000 outlets in more than 100 countries. Per day Mcd provides services to 69 million customers and so it is laudable that the company seeks to value paper as opposed to plastic paper. The organization is looking at the paper packaging as the replacement for the non-recyclable packaging and hence having an intention of making it more recyclable, In Taiwan JiMo uses FSC certified 8500tons of paper packaging every year.

Paper bags serve the role of a sustainable and reusable replacement for plastic bags. Crafted entirely of paper fiber obtained from recycled paper, they are biodegradable and compostable, posing little threat to the environment if, incorrectly, thrown into the nature. Unlike the plastic ones that accumulate in landfills and widen concern over the alarming level of plastic waste in the ocean, paper bags, by biodegrading naturally, reduce the pollution being witnessed in the environment.

Where ocean debris is concerned, the chilling fact is that the oceans will amass a total of eight million tonnes of plastic waste every year based on the current rate of disposal. Therefore, this 80% of all the marine litter is present in the form of floating objects on the surface of the seas as well as the bottom of the deepest seas. The destructive effect of plastic litter on marine faunal and floral niche illustrates the demand of change on sustainable switches like paper bag.

Plastic bags have long been a major cause of pollution and creating more paper bags rather than plastic ones can reduce this dangerous impact on the environment. By virtue of their biodegradability, recyclability, and low environmental impact, paper bag shows a powerful step in sustainable packaging, ensuring that the current and future generations cohabit a cleaner planet.

The competitive landscape of the paper bag packaging market is dominated by established industry giants such as International Paper Company, Smurfit Kappa Group Plc, Mondi Plc, Novolex Holdings, Inc., Langston Companies, Primepac Industrial Limited, Ecobags NZ Source, Ronpak, Welton Bibby and Baron Limited, Prompac LLC, Langston Companies, Inc., United Bag, Inc., Genpak Flexible, Global-Pak, Inc., York Paper Company Limited, PaperBag Limited, and JohnPac Inc. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

International Paper Efforts towards the manufacture of bulk paper sacks for the expanding e-commerce and food delivery outlets can potentially blend with the company's current production of papers.

Smurfit Kappa Premium, customized paper bags for luxury retail and specific fields that targets the high-end retail segment should percolate the innovative design and functionality.

Mondi Exists only because consumers want it. This implies that it is essential to develop sustainability across a product portfolio including paper bags containing recycled content and even exploring bio-based raw materials as a way to appeal to eco-conscious consumers.

Novolex Being a plastics producer, the firm can conceptualize paper-plastic bag hybrids which strike a middle ground between the perception of weakness displayed by paper bags and depicted by plastic bags, hence offering their customers with the uniqueness that they need to distinguish their products from their rivals.

By Product

By Material Type

By Thickness

By End Use

By Region

January 2026

January 2026

January 2026

January 2026