March 2025

The polystyrene (PS) plastic punnets market is on a rapid growth trajectory, with projections indicating a revenue surge reaching hundreds of millions of dollars between 2025 and 2034. This market expansion is fueled by the rising demand for lightweight, cost-effective, and recyclable packaging solutions, particularly in the food, agriculture, and retail sectors.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing polystyrene (PS) plastic punnets which is estimated to drive the global polystyrene (PS) plastic punnets market over the forecast period.

The polystyrene (PS) plastic punnets are containers which are typically made from polystyrene (PS) plastic and used for packaging of fruits, vegetable, and other food items. They are light weight and sturdy in nature which are designed to protect the contents while display and transportation. Polystyrene is commonly chosen for its durability and cost-effectiveness, though concerns about environmental impact have led to increased scrutiny. Polystyrene is a synthetic polymer made from the monomer styrene. Polystyrene is resistant to moisture and impacts, making it a robust choice for protecting food items. Polystyrene is resistant to moisture and impacts, making it a robust choice for protecting food items. The lightweight nature of polystyrene (PS) plastic punnets helps reduce shipping costs and makes them easier to handle.

Polystyrene (PS) punnets are relatively inexpensive to produce, which is beneficial for both manufacturers and retailers. Polystyrene is not biodegradable, which means it can persist in the environment for hundreds of years. Polystyrene plastic punnets play a crucial role in food packaging by providing protection and convenience. However, their environmental impact is prompting a re-evaluation of their use in favour of more sustainable alternatives. As consumer awareness grows, the industry is gradually adapting to meet both packaging needs and ecological responsibilities. The global packaging industry size is growing at a 3.16% CAGR.

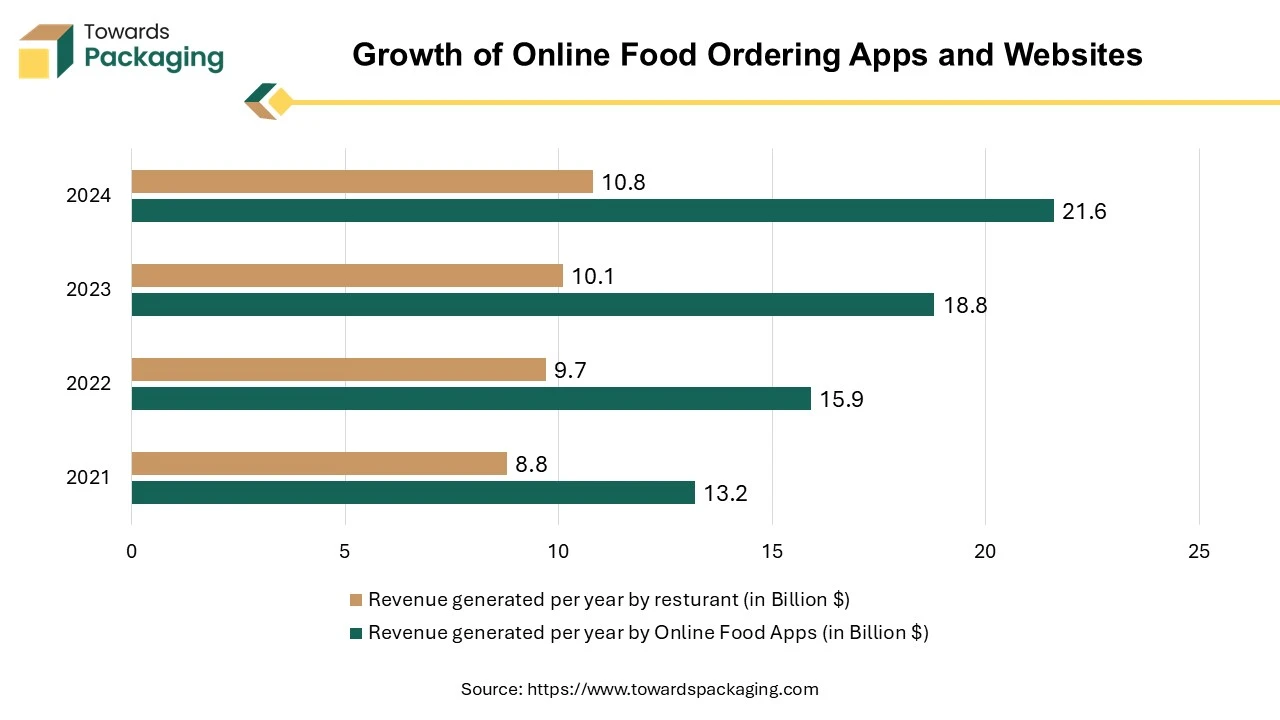

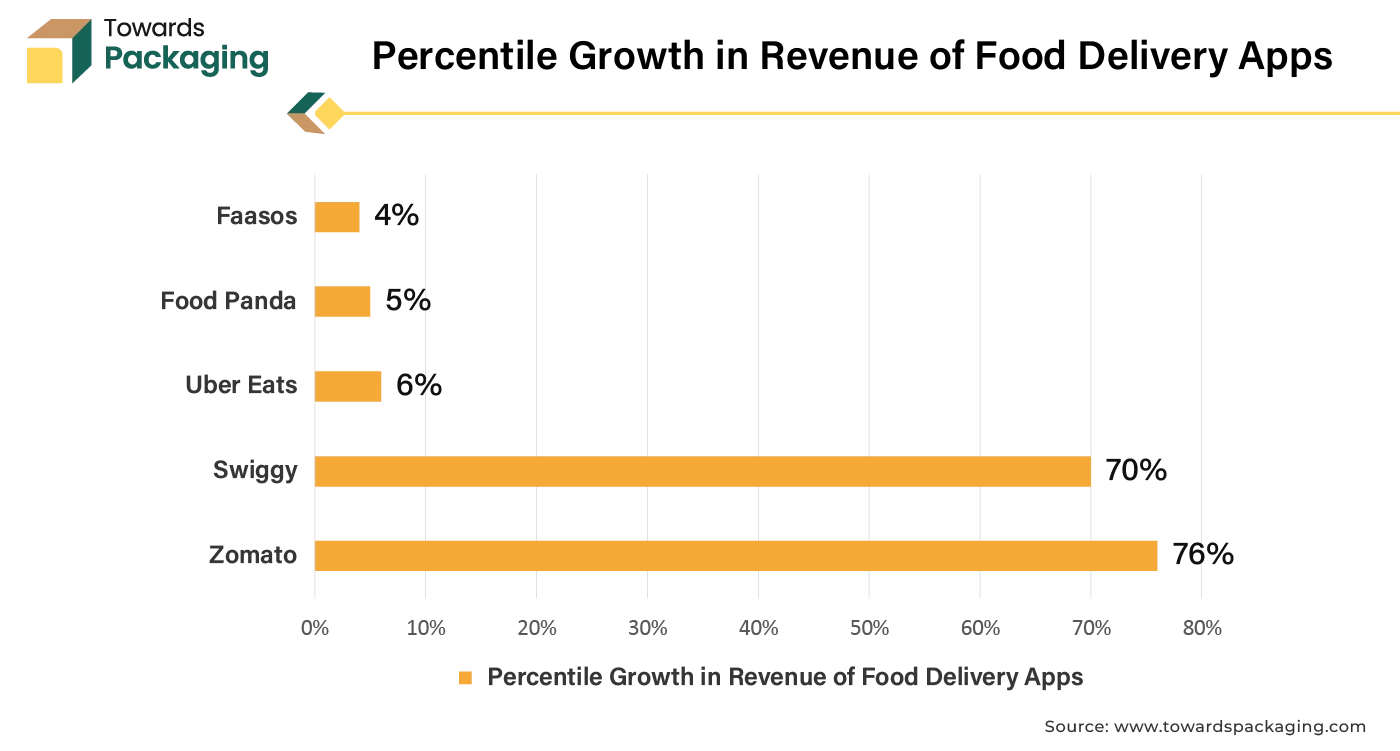

Due to busy lifestyle the convenience of having groceries shipped to door steps is a major factor for driving online grocery shopping. The rise of online grocery shopping necessitates durable and protective packaging for shipping perishable items, further driving the demand for polystyrene punnets. After the covid-19 pandemics the trend of e-grocery and food ordering was observed to grown. The other main reason for shopping grocery and food items from e-commerce platform is that the online platform allows consumers to compare products and take informed buying decisions. The online food delivery apps have many offers and discounts which attracts the consumers to buy from online platform. Hence, increase in the trend of online food and grocery ordering has risen the demand for the polystyrene (PS) plastic punnets for food packaging, which is estimated to drive the growth of the polystyrene (PS) plastic punnets market over the forecast period.

Unlock Infinite Advantages: Subscribe to Annual Membership

Increasing awareness about environmental issues is pushing manufacturers towards more sustainable alternatives. This has led to a gradual decline in PS usage in favour of biodegradable and recyclable materials. Regulations emphasizing food safety and hygiene have increased the demand for reliable packaging materials, including polystyrene, which is recognized for its food-safe properties.

The market is influenced by regional preferences and regulations, with varying demand in North America, Europe, and Asia-Pacific. Overall, while the PS punnet market is currently supported by specific demand factors, the long-term outlook may be challenged by sustainability pressures and regulatory changes. Urbanization trends contribute to changing consumer lifestyles, with a growing emphasis on convenience and accessibility, leading to higher demand for packaged food items.

Polystyrene's strength and resistance to moisture make it an ideal choice for protecting delicate food items during transport and display. Advances in packaging technology, such as improved sealing techniques and enhanced aesthetics, have made polystyrene punnets more appealing to both manufacturers and consumers. The key players operating in the market are focused on introduction of new polystyrene (PS) packaging technology, which is estimated to create lucrative opportunity for the growth of the global polystyrene (PS) plastic punnets market in the near future.

The key players operating in the market are facing challenges in fulfilling guidelines of the regulatory bodies which is estimated to restrict the growth of the global polystyrene (PS) plastic punnets market. Growing awareness of plastic pollution and the environmental impact of single-use plastics is leading to a push for sustainable alternatives. Many regions are implementing stricter regulations on the use of polystyrene, including bans or taxes, which limits its market growth. Polystyrene is not widely accepted in recycling programs, which contributes to waste management issues and reduces its attractiveness as a packaging option.

The emergence of biodegradable and recyclable packaging materials, such as paper and bioplastics, is attracting both consumers and manufacturers. Fluctuations in raw material prices for polystyrene can impact production costs and market stability. Increasing consumer preference for eco-friendly packaging options is shifting demand away from traditional plastics like polystyrene.

North America dominated the global polystyrene (PS) plastic punnets market in 2024. The rising demand for convenient and hygienic food packaging solutions in North America, particularly in the fresh produce sector, boosts the use of polystyrene (PS) punnets. The demand for polystyrene (PS) plastic punnets in North America is primarily driven by the rising consumption of fresh produce and the growth of e-commerce. Increased consumer preference for ready-to-eat and packaged food contributes significantly to polystyrene (PS) plastic punnets market growth in North America. North America has stringent food safety regulations that favour the use of materials like polystyrene, which are effective in protecting food quality.

Asia Pacific region is anticipated to grow at the fastest rate in the polystyrene (PS) plastic punnets market during the forecast period. The countries in Asia Pacific are huge hub for exporting and importing the fruits and vegetables due to huge agricultural base in the region. The Asia-Pacific region is experiencing rapid growth in the PS punnets market due to increasing urbanization, changing dietary habits, and a growing middle class. The explosion of online shopping in countries like China and India is driving the need for effective packaging solutions that protect products during transit. The region presents significant opportunities for growth, particularly in countries with expanding agricultural sectors and a rising demand for packaged food.

The with lid segment held a dominant presence in the polystyrene (PS) plastic punnets market in 2024. As the lids provide an additional layer of protection against contaminants, improving hygiene and safety, which is crucial for fresh produce. If the containers have lid it helps preserve the freshness of food by reducing exposure to air and moisture, thus extending the product's shelf life. Lidded punnets offer easy access and resealability, making them more convenient for consumers who want to store leftovers or transport food. Lids provide additional space for branding and labeling, allowing manufacturers to communicate product information effectively. These factors collectively contribute to the growing preference for polystyrene plastic punnets with lids in the market.

The food industry segment registered its dominance over the global polystyrene (PS) plastic punnets market in 2024. Plastic punnets offer a hygienic barrier against contaminants, ensuring food safety during storage and transportation. They are relatively inexpensive to produce, which helps keep overall packaging costs low for manufacturers and retailers. Plastic punnets are suitable for a variety of food items, including fruits, vegetables, baked goods, and ready-to-eat meals, making them a flexible packaging solution. They are lightweight yet strong, making them easy to handle and transport while protecting the contents from damage. Many plastic punnets are recyclable, aligning with increasing consumer demand for sustainable packaging solutions. These attributes make plastic punnets a popular choice in the food industry, supporting efficient distribution and consumer satisfaction.

By Type

By Application

By Region

March 2025

March 2025

February 2025

February 2025