April 2025

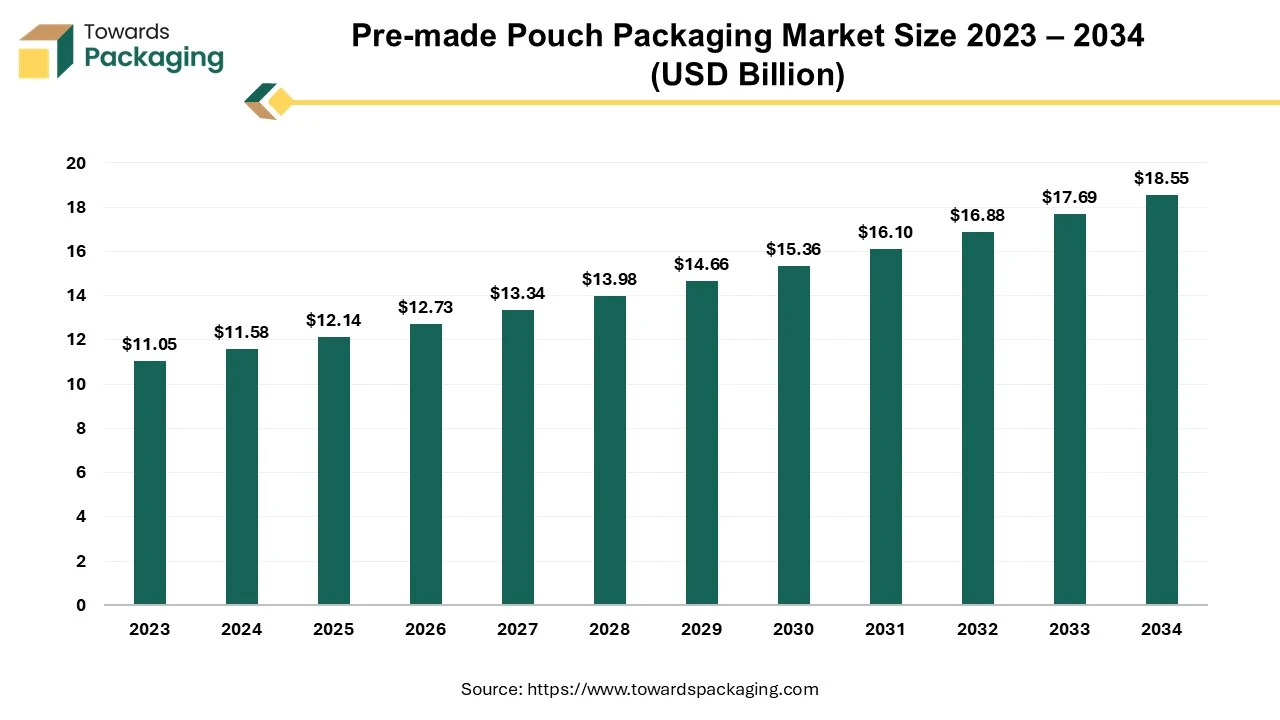

The global pre-made pouch packaging market, valued at USD 11.58 billion in 2024, is anticipated to reach USD 18.55 billion by 2034, growing at a CAGR of 4.82% over the next decade.

The pre-made pouch packaging market is set to grow prominently during the forecast period. Premade pouches make up a significant portion of the packaging market and are pre-formed and fillable pouches produced by flexible packaging converters. This technological advancement has transformed the process of packaging, making it faster, simpler as well as more adaptable to the different types of products. In current fast-paced market, premade pouches provide the ideal balance of the functionality and style. Premade pouches are developed by specialists in the flexible packaging, many of whom constantly make investments in the pouch technology and the new materials. Premade pouches are typically lower in cost, have less product scrap waste and provide more features with a variety of pouch shapes and sizes.

Premade pouches are probably in demand for a variety of reasons. The key factor is that a growing number of people are able to meet their basic necessities for clothing and food. Consumers started pursuing products with appealing look as well as excellent consumer usability when the popularity of casual snacking increased. Furthermore, the prefabricated pouch packaging line's overall cost has decreased as a result of packaging automation's maturity. To meet the consumer expectations, the corporation is more likely to utilize prefabricated pouches that conserve materials and waste due to the growing popularity of sustainable practices and environmental protection.

Additionally, the expansion of the food and beverage industry as well as the growing importance of longer shelf life and fresh product preservation is also likely to contribute to the growth of the market in the years to come. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

The growing consumer demand for convenience is likely to support the growth of the market during the forecast period. Consumer packaged goods organizations are seeing a significant increase in the consumer satisfaction with their packaging as a result of the trend towards the convenience. Consumers are requesting for more variation in terms of both the type of the product along with the size of the packaging and these options give them flexibility to express their specific preferences and tastes. Variety also enables working customers to make better decisions on the go and receiving this range in appealing, healthy and functional packaging gives them the convenience they desire. Consumer trends are increasingly being fueled by the desire for more variety, more portion control and more personal choice.

Furthermore, customers appreciate being able to travel with their favorite products, whether it's for a road trip, an informal dinner, or just relaxing on their own back porch. It used to be customary to pack the snacks in family or a party size bags to take to the barbecues and other gatherings. For events and cookouts, snack-sized packets of chips and wide range packs with various flavored snacks have become popular since they allow for flavor and the right portion to suit each guest's preference. Also, the item within the bag remains identical to what was stored previously. This transformation is being driven by this type of packaging option. More significantly, compact or the individual-sized packaging gives customers more control over the size of the portions and flexibility to select from a variety of the alternatives without having to buy an excessive amount of a single item. With this growing demand for convenience and portability, the demand for pre-made pouch packaging is also expected to increase as popular packaging choice among everyone.

Multiple layers of different materials are put together to create flexible packaging, such as bags, pouches and other flexible items, in multi-material multilayer structures. In the FMCG (fast-moving consumer goods) sector, this kind of packaging is frequently used for goods like food, beverages and toiletries. By weight, the multi-material multilayer plastic packaging is thought to make up around 28% of the flexible packaging market. However, they pose a challenge to the current recycling methods, going against the fundamentals of the circular economy. It is therefore advised that the customers should search for the products that are packaged without lining or that are shipped in different formats, like laundry detergent strips, which do not need to be packed in plastic.

Several materials might make recycling more critical since it can be difficult for recycling facilities to properly sort and recycle each and every component. Consumers may become confused by the recycling complications as various materials might demand different disposal procedures, which can be further complicated by the imprecise labeling, resulting in the improper disposal techniques being used. In addition, a report found that the recycling systems require urgent revision and better standardization, making the current infrastructure insufficient for processing and sorting the multi-material packaging. Since the collecting networks, processing facilities and the ultimate location of the recycled materials vary by region, current frameworks continue to be fragmented.

Furthermore, packaging pollution is still a major problem during collection and shipping, as well as from improper consumer disposal it has been discovered that 84% of households unknowingly contaminate their recycling. This could minimize the value and quality of the recycled materials, which might drive up the cost of processing. The challenge of multilayered packaging lies not only in the difficulty of separating materials that are clearly different from one another, but also in materials that share similarities or appear to be single-material packaging while they're certainly not. Such complications may increase the difficulty as well as again the expenses of the recycling packaging, hence reducing the recycling rates. These increasing concerns are expected to hinder the growth of the market during the forecast period.

The shift towards sustainable packaging offers significant growth opportunities for the pre-made pouch packaging market in the near future. This is owing to the increasing consumer environmental awareness as well as the initiatives by the government with introduction of various appropriate laws and regulations. For instance

The Australian government has established an objective to adopt packaging that is entirely recyclable by 2025.

For some of the packaging materials, the Dutch government has also established recycling or reuses percentages that increase steadily over time. In 2024, the lowest reusage or the percentages for few packaging materials is 47% for plastics, 55% for wooden, 86% for glass, 85% for paper and carton, 78% for aluminum and 94% for ferrous metals. Furthermore, many companies have developed green packaging as a result of these actions.

There are several instances like this, demonstrating the widespread adoption of sustainable packaging. To keep a significant position in this competitive market, the majority of businesses will need to switch to the sustainable packaging.

The plastic segment captured largest market share of 47.35% in 2023. One type of flexible packaging that is frequently used is pre-made plastic pouches. High-density polyethylene, light density polyethylene, linear low-density polyethylene and polypropylene, among others are some of the plastic materials used for making these pouches. The increasing demand from various industry verticals is likely to support the segmental growth of the market during the forecast period. They are used by the pharmaceuticals industry to pack drugs such as analgesics, antibiotics, etc. In the food industry these pre-made pouches are utilized to store as well as transport different type of foods like the cereals, nuts, meats, dog and cat biscuits and bird seeds as they extend the shelf-life of the keep food. The cosmetic industry utilizes these pre-made plastic pouches to package the beauty products as the products retain their quality.

The food segment held largest market share of 48.34% in 2023. This is owing to the increase in growing inclination towards ready-to-eat, convenient and the on-the-go food choices. The snacking segment of the food industry is growing as the customers look for easy and quick methods to fulfill their hunger in between the meals. This presents an enormous potential for the producers to innovate and gain the market share. Furthermore, nowadays consumers are choosing healthier options over the less tasty ones since they are more concerned about their health. The growing attraction of the plant-based snacks, high-protein alternatives and the clean-label items lacking of preservatives and artificial ingredients is evidence of this transition. This is expected to increase the demand for pre-made pouches in the food industry.

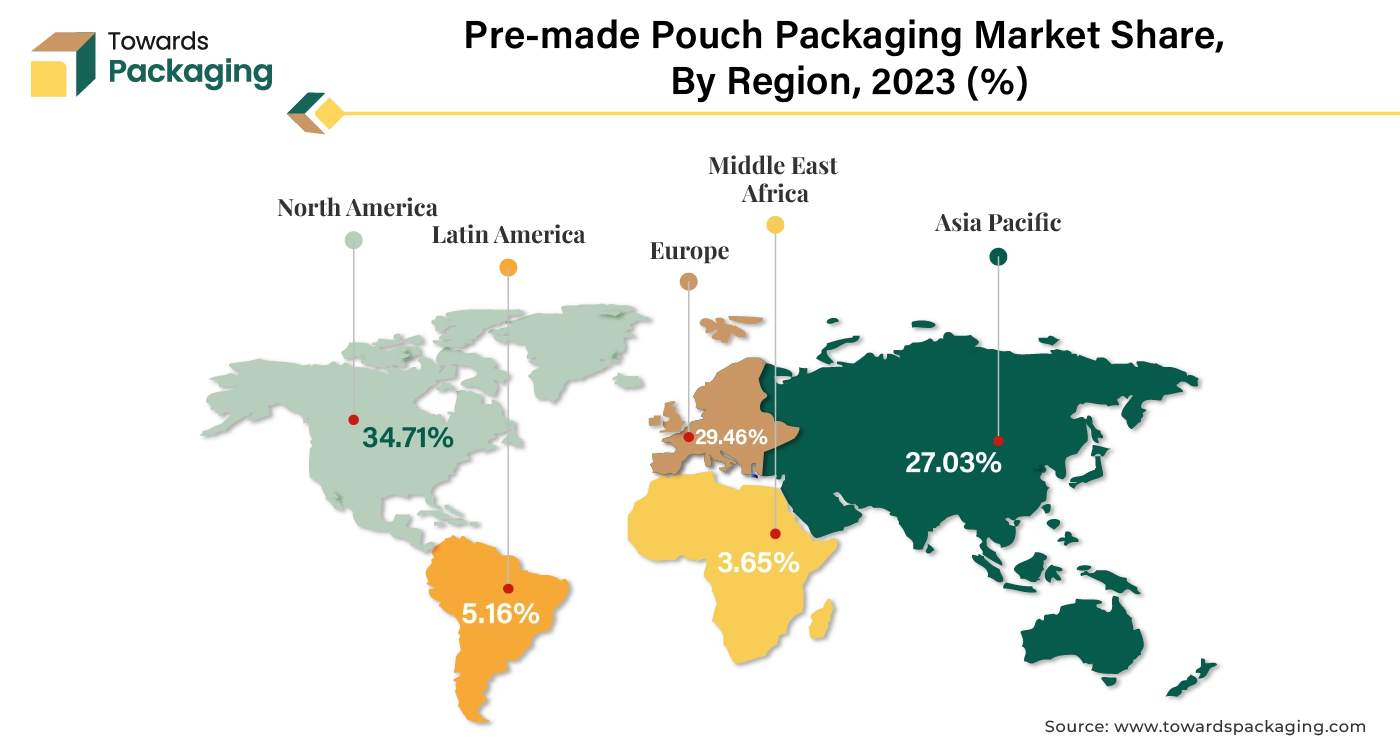

North America held largest market share of 34.71% in 2023. This is owing to the demand for easy-to-use and portable options from the consumers across the region. Furthermore, the presence of major players such as Berry Global Inc., Sealed Air Corporation, ProAmpac and Sonoco Products Company, among others is also expected to contribute to the regional growth of the market during the forecast period. Additionally, the rapidly evolving food and beverage industry is and the continuous approach by the food manufacturers to cater to the diverse consumer preferences is also anticipated to promote the growth of the market in the region in the years to come.

Asia Pacific is expected to grow at a substantial CAGR of 6.81% in 2023. This is due to the increase in the demand for packaged ready-to-eat food products along with the rising middle-class population with increased disposable incomes across the region. Also, the growth of the e-commerce and online grocery shopping is further expected to support regional growth of the market in the years to come. As per the data by the State Council of the People's Republic of China, in the first half of 2024, the cross-border e-commerce volume of trade in China reached 170.95 billion US dollars (1.22 trillion Yuan), an increase of 10.5 percent year over year. Furthermore, the escalating demand from the populated economies like India and China is also expected to support the regional growth of the market in the near future.

By Material

By Closure Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025