April 2025

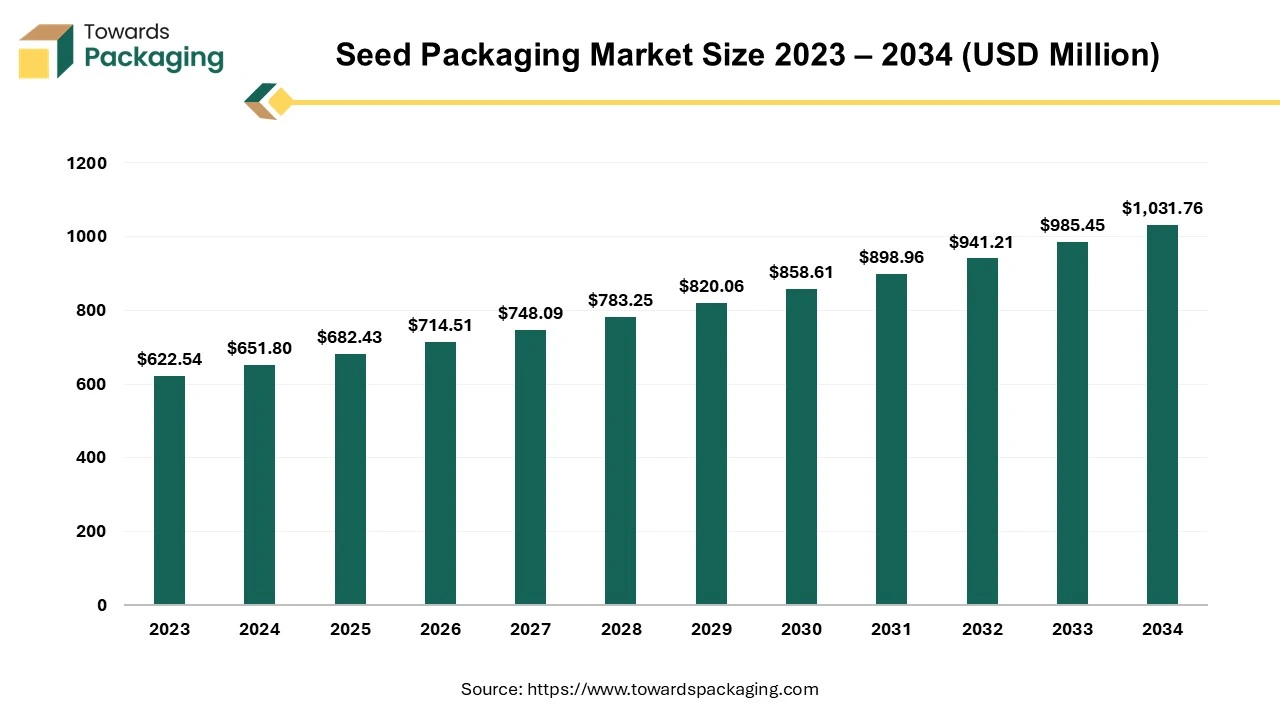

The seed packaging market is anticipated to grow from USD 682.43 billion in 2025 to USD 1031.76 billion by 2034, with a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2034.

The seed packaging sector is essential in agriculture as a link between producers and farmers. Its primary activities include developing, manufacturing, and marketing packaging materials that protect seed integrity and ease planting processes. The growing global population and increased worries about food security have highlighted the importance of premium seed quality, fuelling the expansion of the seed packaging market, which grew by a noteworthy 6.3% globally. Recent years have seen a revolutionary surge of technological improvement in seed packing. These improvements have permitted the development of novel materials and procedures to improve seed preservation, extend shelf life, and increase handling efficiency.

A greater emphasis on environmental sustainability has accelerated the adoption of eco-friendly packaging solutions, significantly impacting market dynamics. Agricultural policies, the impacts of climate change, and changing customer tastes all impact the seed packaging industry. Market participants constantly react to these changes by providing customizable packaging alternatives, expanding their product offerings, and maintaining strict quality assurance standards.

The seed packaging market is poised for significant growth, aligning with agricultural advancements and shifting market landscapes while meeting farmers' and producers' changing needs globally.

For Instance,

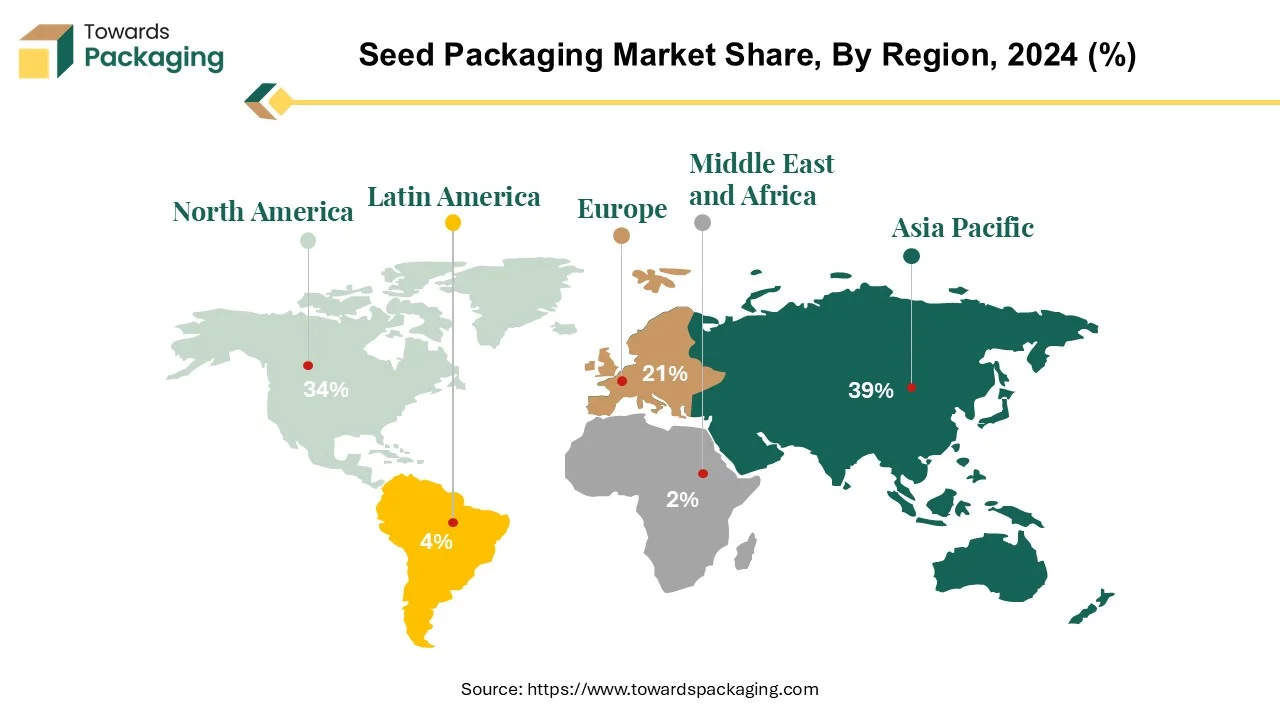

The Asia-Pacific area is a prominent market in the seed packaging business for a variety of reasons. For starters, the region is home to some of the world's greatest agricultural producers, such as China and India, who strongly demand quality seeds to sustain their extensive agrarian sectors. According to original data from the Indian Council of Agricultural Research (ICAR), the official seed supply system comprises 53.25% of the public sector and 46.75% of the private sector. This high demand for seeds necessitates the development of effective seed-packing methods. Rapid urbanization and population growth in Asia-Pacific countries have strained agricultural production, driving demand for high-quality seeds and packaging. As more land is converted for urban expansion, improved seed varieties and packaging are required to enhance yields in limited agricultural areas.

The Asia-Pacific region has significantly invested in agricultural technologies and infrastructure in recent years. These developments have increased seed production and sparked innovations in seed packaging, such as creating environmentally friendly materials and more effective packaging designs. Government regulations and programs that promote agricultural modernization and sustainability have helped to drive growth in the Asia-Pacific seed packaging industry.

The Asia-Pacific seed packaging market is driven by solid agricultural demand, population expansion, technical improvements, and supporting regulations, propelling it to the forefront of the worldwide seed packaging industry.

For Instance,

North America is the second-largest region in the seed packaging market for various reasons. Its advanced agricultural sector requires sophisticated packaging solutions for efficient and high-yield crop production, particularly in the United States and Canada. North America had a 5% growth rate. Central and South America, on the other hand, had a tremendous 16.5% increase, boosted by increasing crop prices and rising seed prices, particularly for soybeans and cotton.

Global seed sales are expected to grow by 8.5% and 13% in 2022, respectively, in North America and Central and South America. This expansion in North America is aided by high energy and relatively high commodity prices, contributing to an upward trend in average seed prices.

North America's position as a significant participant in the global seed packaging business is further cemented by the region's established network of seed producers, distributors, and retailers, facilitating effective market penetration and distribution of seed packaging goods.

For Instance,

Plastic is essential in seed packing because of its versatility, durability, and affordability. Plastic packaging, such as seed bags, pouches, trays, and containers, is commonly used in the seed industry for various purposes. Its capacity to resist moisture and defend against external influences guarantees that seeds remain intact and viable during storage and transportation.

Plastic packaging is often used for accepting various seed types and sizes, providing flexibility and convenience to seed manufacturers and farmers. Furthermore, plastic packaging can be personalized with printing and labelling to include important information such as seed kind, planting directions, and expiration dates.

Plastic consumption in seed packaging fluctuates with market demand, regulatory policies, and technical improvements. Developed regions, such as North America and Europe, often have higher plastic use due to enhanced agriculture sectors and increased adoption of contemporary packaging options. In contrast, emerging economies in Asia-Pacific and Latin America are experiencing increased demand for plastic packaging in the seed sector, driven by increased agricultural activity and infrastructural investment.

For Instance,

Pouches are essential in seed packaging because they provide variety, convenience, and protection to seeds throughout their lifecycle. These adaptable packaging solutions are widely utilized in the seed business for various applications because they protect seed quality while providing efficient storage and transportation. Pouch packaging is frequently utilized for seed packs. Pouches are perfect for packing specific seed varieties or mixes in tiny quantities, making them easy for farmers and home gardeners to distribute and plant. Pouches' compact size and lightweight nature make them ideal for retail contexts where space minimization and shelf visibility are critical.

Pouches can be customized with branding, labelling, and instructions, giving consumers important information about seed kinds, planting guidelines, and handling warnings. This ensures consumers' clarity and convenience, improving the overall user experience. Pouches are preferred for their ability to withstand moisture and guard against external elements such as light and air, which can impair seed quality with time. This ensures seeds' long-term viability and germination capability, increasing yields and agricultural production.

For Instance,

The primary function of agricultural seed packaging is to preserve and protect seeds during storage, transportation, and distribution. Seed packaging is critical for maintaining seed quality, viability, and integrity, producing optimal germination and crop yields. It protects seeds from moisture, pests, physical damage, and environmental variables, preserving their genetic purity and germination potential.

Seed packaging is used to brand, label, and provide farmers with important information such as seed variety, planting instructions, and expiry dates. This allows for more efficient seed handling, storage, and identification, increasing operational efficiency and production in agriculture. Seed packaging is an essential component of modern agriculture, acting as a key link between seed producers and farmers while also contributing considerably to global food security and sustainable agriculture.

For Instance,

The retail industry is a significant user of seed packaging because of its critical role in reaching end users, namely gardeners and hobbyists. Seed packaging for retail purposes is intended to be visually appealing, educational, and user-friendly. It frequently incorporates eye-catching images, thorough planting directions, and product descriptions to entice shoppers and provide vital information for successful gardening.

Retail seed packaging comes in various shapes, including packets, pouches, and display boxes, each customized to the specific demands of retailers and consumers. These packaging solutions are carefully designed to improve shelf visibility, enable handling, and maintain product freshness.

Retail seed packaging is essential to brand promotion and marketing because it demonstrates seed companies' commitment to quality, innovation, and consumer pleasure. Thus, ensuring beautiful and functional seed packaging is critical for success in the competitive retail sector.

The competitive landscape of the seed packaging market is dominated by established industry giants such as DS Smith Plc, Winpak Ltd., Smurfit Kappa Group, Bemis Company Inc., Mondi Group, Schur Flexibles Group, Huhtamäki Oyj, Parakh Agro Industries, American Packaging Corporation, ProAmpac LLC, Berry Global Group Inc., Omag-Pack, Amcor plc, Uflex Ltd., WestRock Company, Sonoco Products Company, Qingdao Funuoda Packing, Knack Packaging and DuPont de Nemours, Inc. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

DS Smith emphasizes customization and flexibility in its packaging solutions, catering to the diverse needs of seed producers and farmers. By offering a range of customizable options, they aim to provide tailored solutions that optimize seed preservation and planting efficiency.

Leading seed companies and agricultural associations work with Winpak to create customized packaging solutions and bolster their brand awareness. By establishing strategic alliances, they learn about consumer preferences and industry trends, which enables them to predict demand and provide better packaging options.

By Material

By Product Type

By End Use

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025