April 2025

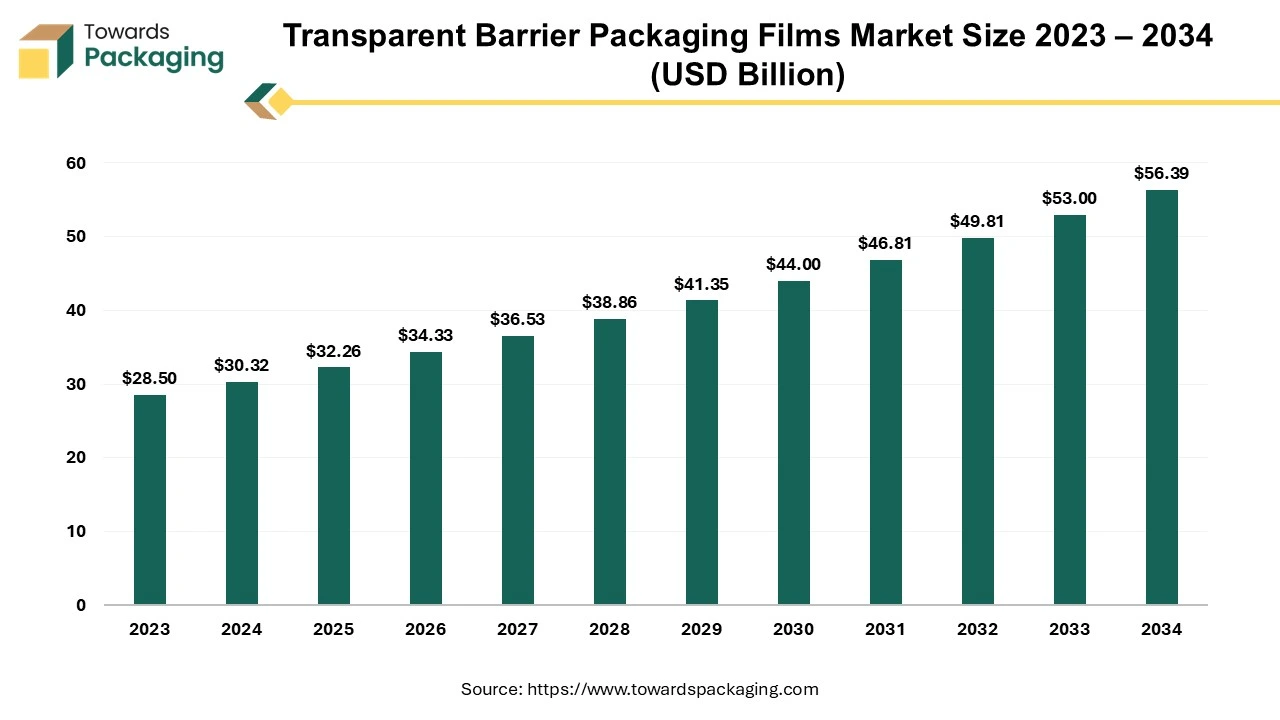

The transparent barrier packaging films market is set to grow from USD 32.26 billion in 2025 to USD 56.39 billion by 2034, with an expected CAGR of 6.40% over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing transparent barrier packaging films which is estimated to drive the global transparent barrier packaging films market over the forecast period.

Transparent barrier packaging films are specialized materials utilized in packaging that combine clarity (transparency) with barrier properties, meaning they protect the packaged product from external factors like light, moisture, oxygen, or aromas. These films are commonly used in the food, pharmaceutical, and cosmetic industries to maintain product freshness, quality, and shelf life while allowing the consumer to see the product.

The transparent barrier packaging films are clear, offering a good view of the product inside, enhancing product appeal. They prevent gases (like oxygen and carbon dioxide), moisture, or aromas from permeating through the packaging, ensuring the product stays fresh and uncontaminated. Many are lightweight, flexible, and suitable for various packaging formats like pouches, wraps, or bags. The transparent barrier packaging films can be tailored to meet specific needs such as heat-sealable, anti-static, or UV-resistant properties.

The transparent barrier films are manufactured from or coated with materials such as Polyethylene Terephthalate (PET), Polypropylene (PP), Polyvinylidene Chloride (PVDC), and EVOH (Ethylene Vinyl Alcohol). The transparent barrier packaging films is used for food packaging, for snacks, fresh produce, meat, and dairy to retain freshness and prevent spoilage snacks, fresh produce, meat, and dairy to retain freshness and prevent spoilage. It is used to protect medicines from moisture and oxygen. The transparent barrier packaging films maintain fragrance and product integrity.

Increasing demand for recyclable and biodegradable films is shaping the market. Manufacturers are focusing on producing transparent barrier films manufactured from bio-based materials or that are easier to recycle. Advanced recycling technologies are also being adopted to address plastic waste challenges.

There is growing interest in films with enhanced performance capabilities, such as improved moisture and oxygen barriers. These films are particularly sought after in industries like healthcare, electronics, and food where product protection and extended shelf life are critical.

With the rising popularity of ready-to-eat and convenience foods, microwave-safe barrier films are becoming more prevalent. These films combine transparency with functionality, meeting consumer demand for convenience.

AI integration can significantly improve the transparent barrier packaging films market across multiple areas, from product development to supply chain management and customer engagement. AI-powered sensors and analytics can monitor machinery, predict failures, and reduce downtime, increasing manufacturing efficiency and lowering costs.

The integration of artificial intelligence can improve the quality control. Machine learning (ML) algorithms can analyze production line data in real-time to detect defects or irregularities in films, ensuring consistent quality. AI can optimize multi-layer film manufacturing processes, improving precision in layering, thickness, and barrier properties. AI-driven simulations can accelerate the development of eco-friendly or bio-based films by predicting the performance of new materials and formulations.

The integration of artificial intelligence can help in achieving customized designs. AI can analyze consumer preferences and market trends, enabling manufacturers to design products tailored to specific needs, like microwave-safe or high-performance films.

With e-commerce booming, there is increased demand for protective packaging films to ensure safe delivery of goods. eCommerce demands packaging that can withstand the rigors of shipping and handling. Transparent barrier films offer an effective solution by provide excellent protection against moisture, oxygen, and other contaminants, ensuring product integrity during transit. Consumers purchasing cosmetics, food, and pharmaceutical products online expect freshness and high quality upon delivery. Transparent barrier films are ideal for preserving perishable goods, maintaining their quality over longer supply chains.

Compared to traditional packaging materials like glass or metal, transparent barrier films are lightweight, minimizing shipping costs and carbon emissions—critical factors for eCommerce logistics. Transparent films allow consumers to see the product inside, boosting confidence and satisfaction in online purchases. This visual clarity is particularly important for food, cosmetics, and premium products.

With increasing consumer and regulatory pressure for sustainable packaging, eCommerce companies are adopting eco-friendly transparent barrier films, aligning with their green initiatives and reducing plastic waste.

eCommerce frequently involves individual or smaller packaging units compared to traditional retail. Transparent barrier films are cost-effective and scalable for such requirements, making them an attractive choice for retailers. eCommerce platforms facilitate cross-border trade, requiring packaging that meets diverse regulatory and quality standards. Transparent barrier films, with their consistent performance, are well-suited for global markets.

According to data published by the B2B eCommerce Association, online sales are expected to generate over US$6 trillion in 2024, an 8.4% rise over the previous year. With combined sales of about US$2.32 trillion in 2023, the United States and China are the two biggest contributors to world trade.

The market relies on materials like polyethylene (PE), polypropylene (PP), and ethylene vinyl alcohol (EVOH), which are derived from petroleum. Fluctuations in crude oil prices impact production costs and profitability. While transparent barrier films are widely used in food and healthcare, their adoption in industrial and heavy-duty applications is limited due to lower durability compared to traditional packaging materials. In developing regions, lack of access to advanced manufacturing technologies and recycling infrastructure hinders the adoption of high-performance or sustainable barrier films.

The pharmaceutical industry's need for secure and transparent packaging to protect sensitive products from moisture, light, and contamination is fueling demand. Hence, the growth in the pharmaceutical and healthcare packaging industry has increased the demand for the transparent barrier packaging films, which has estimated to create lucrative opportunity for the growth of the transparent barrier packaging films market over the forecast period.

The Polyethylene (PE) segment held a dominant presence in the transparent barrier packaging films market in 2024. Polyethylene (PE) is widely used for manufacturing transparent barrier packaging films due to its unique combination of properties that make it ideal for packaging applications.

Polyethylene can be manufactured with high clarity and transparency, making it suitable for applications where product visibility is important. Polyethylene (PE) offers a moderate barrier to moisture and gases, which can be improved by co-extrusion or laminating with other materials like EVOH (ethylene-vinyl alcohol) or aluminum oxide. This makes it effective for preserving food freshness and extending shelf life. PE is a lightweight material, which reduces transportation costs and makes it more convenient for handling.

Polyethylene is relatively inexpensive compared to other polymers, making it an economical choice for mass production of packaging films. Polyethylene (PE) films are easy to thermoform, seal, and laminate, which simplifies the production process and enables compatibility with high-speed packaging machines. These characteristics make polyethylene a versatile and practical choice for transparent barrier packaging films, particularly in pharmaceutical, food, and industrial packaging industries.

The polyamide (PA) segment is expected to grow at the fastest rate in the transparent barrier packaging films market during the forecast period of 2024 to 2034. Polyamide provides an excellent barrier to gases like oxygen, helping to preserve food freshness and extend shelf life. It prevents the loss of flavours and aromas, making it ideal for packaging foods and beverages. Polyamide films can be manufactured with high clarity and gloss, making them suitable for applications requiring product visibility, such as food and retail packaging. Polyamide films have excellent heat resistance, making them suitable for high-temperature processes like sterilization, pasteurization, and cooking (e.g., boil-in-bag or vacuum packaging).

The food & beverages segment registered its dominance over the global transparent barrier packaging films market in 2024. Transparent films allow consumers to see the product inside, which builds trust and enhances the perceived quality. Clear visibility of the product can influence purchasing decisions by highlighting quality, freshness, or aesthetic appeal. These films provide excellent barriers against moisture, oxygen, and UV light, helping to maintain product freshness and extending shelf life.

Protects food and beverages from contamination or degradation caused by external factors. Transparent barrier films are lightweight, which reduces shipping costs while maintaining durability to protect the product during transport and storage. These films are suitable for a wide range of food and beverage products, including fresh produce, dairy products, snacks, and beverages. They can be utilized for vacuum packaging, modified atmosphere packaging (MAP), and more.

Asia Pacific region held the largest share of the transparent barrier packaging films market in 2024. Expansion of modern retail formats and FMCG (fast-moving consumer goods) brands increases demand for aesthetically appealing and protective packaging, boosting market adoption. Local production facilities can reduce logistics costs and cater to region-specific packaging preferences, making the products more affordable and accessible to businesses. Asia Pacific's pharmaceutical industries are increasingly facing stringent regulatory requirements regarding product safety and traceability.

Transparent barrier films, particularly those with tamper-evident and child-resistant features, can help pharmaceutical companies comply with these regulations. Packaging films can also be designed to carry printed labels and barcodes, ensuring traceability and adherence to regulations in multiple markets within the region. With the rise of biopharmaceuticals and specialty drugs in the Asia Pacific region, the need for advanced packaging solutions is growing.

Transparent barrier films can be used for packaging injectable drugs, syringes, and medical devices, where maintaining sterile conditions and preventing contamination is critical. Packaging innovation can be tailored to ensure compatibility with sensitive compounds, improving pharmaceutical companies' ability to deliver high-quality products.

Many APAC pharmaceutical companies are increasingly prioritizing sustainability as part of their corporate social responsibility (CSR) efforts. Transparent barrier films made from recyclable or biodegradable materials can help reduce the environmental footprint of pharmaceutical packaging. Transparent barrier films are also used in secondary packaging, such as blister packs and pouches, for pharmaceuticals. As the Asia Pacific region’s pharmaceutical market grows, especially in countries like India, China, and Japan, there will be an increased need for secondary packaging solutions that offer transparency, convenience, and security.

North America region is anticipated to grow at the fastest rate in the transparent barrier packaging films market during the forecast period. North America, particularly the U.S., has a large and diverse food and beverage market, with high demand for convenience and ready-to-eat products. Transparent barrier packaging films are used extensively to maintain the freshness and quality of packaged food items while offering a visually appealing presentation to consumers.

North America has a well-established packaging industry that continuously invests in research and development. This enables the creation of advanced transparent barrier films that offer superior performance, such as better oxygen, moisture, and UV protection, along with greater flexibility and strength. The presence of leading packaging companies, such as Amcor, Berry Global, and Sealed Air, in the region fosters innovation and the development of new and improved transparent barrier films. These companies often lead the way in implementing cutting-edge technologies and introducing sustainable packaging materials.

The North American market is driven by stringent food and pharmaceutical packaging regulations, especially those set by the FDA (Food and Drug Administration) and other health agencies. These regulations ensure that packaging materials meet specific standards for safety, product preservation, and traceability. Transparent barrier films, which offer protective and compliant features, are essential to meeting these standards.

North American consumers and industries are increasingly focused on sustainability, which has created a demand for eco-friendly packaging solutions. Transparent barrier films that are recyclable or biodegradable are gaining popularity as part of broader efforts to reduce plastic waste and environmental impact. Companies in North America are actively working on developing and adopting sustainable packaging technologies, such as plant-based barrier films and films that use less plastic while maintaining their protective properties.

By Material

By Application

By Region

April 2025

April 2025

April 2025

April 2025