April 2025

Principal Consultant

Reviewed By

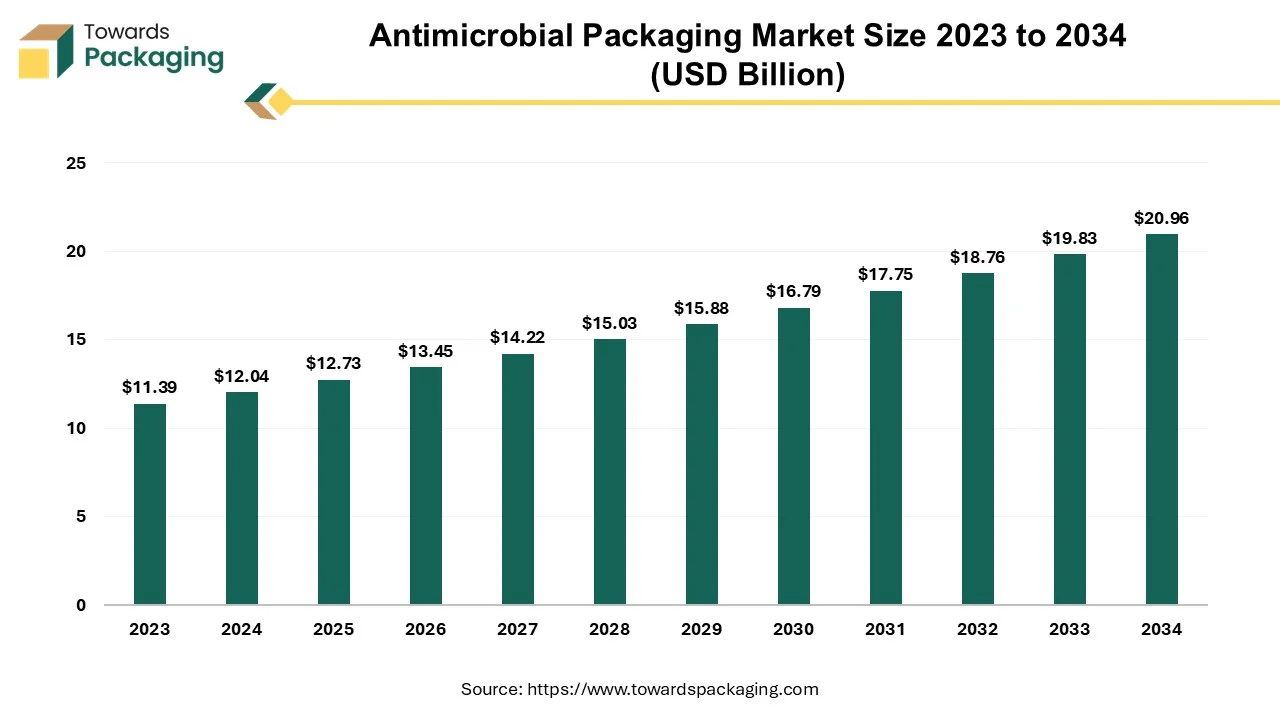

The antimicrobial packaging industry is forecasted to grow from USD 12.73 billion in 2024, with steady growth projected from 2025 to 2034. The market is expected to reach USD 20.96 billion by 2034, achieving a CAGR of 5.7%, driven by rising demand for hygienic packaging solutions.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing antimicrobial packaging which is estimated to drive the global antimicrobial packaging market over the forecast period.

An antimicrobial packaging system can prolong the shelf life of perishable goods and improve the safety of packaged goods by eliminating or preventing the growth of micro-organisms. Target microorganisms can be inhibited or killed by antimicrobial packaging is one of the most advanced form of packaging. Antimicrobial substances within the package area or within meals as well as antimicrobial packaging materials, can be used to construct it.

The introduction of antimicrobial packaging materials with antibacterial compounds in their macromolecular structures often marked the beginning of antimicrobial packaging research. When there is anti-microbial activity in the in-package atmosphere or in packed foods, however standard packaging materials can be used for antimicrobial packaging systems without the need for different packaging materials.

Advancement in Technology: Innovation in packaging technologies, including the development of plant-based antimicrobial coatings and active packaging systems, are enhancing the efficacy of antimicrobial packaging. For instance, researchers are exploring the utilization of compounds synthesized from overripe fruits to release preservatives from packaging materials without direct contact with the food products.

Innovation & Utilization of New Material: The development of nanomaterials for example: silver nanoparticles (AgNPs), Zinc Oxide Nanoparticles (ZnONPs), and Carbon Dots (CDots). Renowned for their broad-spectrum antimicrobial properties, AgNP are effective against bacteria, fungi, yeast and viruses. Zinc Oxide Nanoparticles have been embedded into starch-based biofilms, resulting in biodegradable packaging materials with enhanced antimicrobial effectiveness against pathogens like E. coli and S. aureus.

Usage of Natural Antimicrobial Agents: The chitosan derived from chitosan, chitin is a cationic polymer that shows antimicrobial activity. It has been utilized as a coating material to protect fresh produce from fungal degradation, enhancing shelf-life. Plant-based compounds are also utilized for manufacturing anti-microbial packaging to control microbial contamination of food surfaces, thereby extending shelf-life and improving safety assurance.

Microorganism that have genetic alterations that make them resistant to antimicrobial medications, such as antibiotics, are said to exhibit antimicrobial resistance (AMR). AI which can quickly search through large chemical libraries and predict potential antibacterial compounds is being researched as an alternative to costly and time-consuming conventional methods for fighting anti-microbial.

There is a lot of promise in using AI in medical studies, especially when it comes to treating multi-drug-resistant (MDR) illnesses in order to combat anti-microbial resistant. Algorithms utilized to track antibiotic use, disease incidence, and resistance patterns have an impact on creation of new medications. In order to save time during the development process, researchers can quickly find possible novel medications that might work against bacteria that are resistant to antibiotics due to integration of artificial intelligence.

Artificial Intelligence (AI) has been continuously setting the standard for environmental friendly packaging. Contrary to common opinion, Amazon packaging ultimately selects the best materials for a product by using an AI model that learns from actual customer complaint data to minimize product damage to everything from food to cosmetics to household goods to anything else customers buy when they shop online.

Using this machine learning model, hundreds of thousands of Amazon parcels have seen a 24% decrease in waste, a 5% reduction in shipment damage, and a 5% reduction in shipment expenses. This model’s algorithms can determine when to utilize cushioned mailers, corrugated cardboard, flexible packaging, or plastic packaging for specific commodities or deliveries rather than the same cardboard boxes, which will ultimately result in lighter shipments and safer delivery.

The need for sterile and contamination-free packaging in pharmaceuticals is a significant factor fueling demand. The growing demand for medical industry, including drug delivery systems and medical device packaging, boosts the antimicrobial packaging market. Pharmaceutical products, including drugs, medical devices, and vaccines requires packaging that prevents microbial contamination. Antimicrobial packaging helps maintain sterility, ensuring the safety and efficacy of pharmaceutical products.

The rise of biologics, gene therapies, and personalized medicine demands specialized packaging solutions to prevent microbial degradation. Agencies like the U.S. FDA, EMA, and WHO mandate stringent packaging standards for pharmaceuticals. Expansion of drug delivery systems, growth in pharma logistics and technology advancement of active packaging has driven the growth of the antimicrobial packaging market. Hence, the expansion of the pharmaceutical industries has estimated to drive the growth of the antimicrobial packaging market in the near future.

During the last 12 months (July 2023 to June 2024), the pharmaceutical and healthcare sector recorded 88 deals totalling $11.1 billion, compared to an average of 95 deals totaling US$18.7 billion. Approximately US$3.2 billion will be paid by Eli Lilly and Company to acquire Morphic Holding, a biopharmaceutical company that is creating a line of oral collagen therapies for the treatment of severe chronic illnesses; roughly US$1.6 billion will be paid by Mankind Pharma to acquire Bharat Serums and Vaccines, a biopharmaceutical company that develops and produces pharmaceutical and injectable biological products; and roughly US$1.3 billion will be paid by Boehringer Ingelheim International GmbH to acquire Nero Therapeutics, a biotechnology company. Of the entire deal value in July 2024, these three significant deals accounted for 55%.

The key players operating in the market are facing issue due to high cost of antimicrobial agents, potential toxicity of antimicrobial agents and compatibility issues, which has estimated to restrict the growth of the antimicrobial packaging market. Some antimicrobial compounds, such triclosan, have raised safety concerns, limiting their acceptance and utilization in food & beverage applications. Other preservation technologies, such as active packaging, smart packaging, and refrigeration, offer different ways to extend shelf life, reducing the demand for antimicrobial packaging.

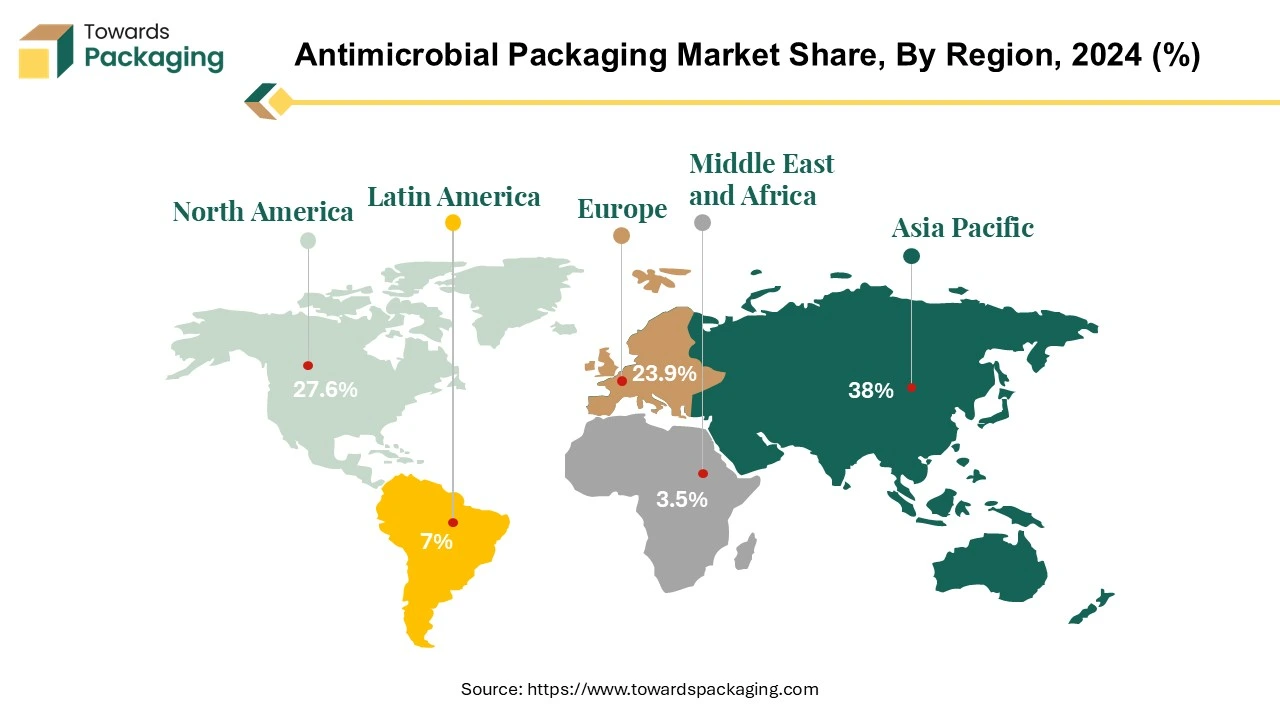

Asia Pacific, Middle East and Latin America are witnessing rising urbanization, increased disposable incomes, and demand for packaged food, creating significant growth opportunities. Government initiatives to improve food safety regulations in these regions further support antimicrobial packaging market expansion.

Post-pandemic, there is a heightened focus on hygienic packaging to prevent microbial contamination in food, pharmaceuticals, and personal care products. The healthcare sector is increasingly using antimicrobial packaging for medical devices, drugs, and hospital supplies. Increasing health & hygiene awareness has increased the demand of the antimicrobial packaging, which has estimated to create opportunity for the growth of the antimicrobial packaging market in the near future.

The plastic segment held a dominant presence in the market in 2024. The plastic material is versatile and processability. Plastics can be easily molded into various shapes and sizes, accommodating diverse packaging needs. Plastics offers excellent barriers against moisture, oxygen and external contaminants. This is important for maintaining the antimicrobial effectiveness of the packaging and protecting the contents from spoilage or contamination.

The bacteriocins enzymes segment accounted for a significant share of the market in 2024. Bacteriocins are naturally produced antimicrobial peptides that are generally recognized as safe (GRAS) for food applications. Their natural origin appeals to consumers seeking “clean label” solutions and minimizes regulatory hurdles compared to synthetic antimicrobials. Bacteriocins can be readily incorporated into various polymer matrices during the manufacturing process. Their integration into packaging films and coatings is relatively straightforward, ensuring consistent antimicrobial performance throughout the product’s life cycle.

The pouches segment led the global antimicrobial packaging market. The pouches offer versatile design options that can be tailored to various product shapes and sizes. Their ability to incorporate complex graphics and tamper-evident features makes them appealing for a range of products. Pouches are generally lighter and use less material compared to rigid packaging, which assists to reduce transportation and production costs. This efficiency is especially valuable in high-volume applications such as food and beverages.

The active packaging technology segment registered its dominance over the global market in 2024. Active Packaging releases or absorbs antimicrobial agents to inhibit bacteria, mold and fungi, reducing food spoilage and contamination. By slowing microbial activity, active packaging ensures food stays fresh for longer, reducing waste and improving product stability.

The food & beverages segment dominated the antimicrobial packaging market globally. Rising awareness of foodborne illnesses has increased the demand antimicrobial packaging. Concerns over food borne pathogens (E. coli, Salmonella, Listeria) drive demand for protective packaging solutions. Regulatory standards are pushing for safer food packaging practices. Growing interest in natural preservatives and minimal chemical additives makes antimicrobial packaging an attractive alternative.

Asia Pacific region dominated the global antimicrobial packaging market in 2024. The Asia Pacific region is experiencing rapid urbanization and growing middle class, which increases consumer demand for safer, longer-lasting food products. Concerns over foodborne pathogens and spoilage drive the adoption of advanced packaging technologies that can extend shelf-life and maintain quality. Governments across Asia Pacific are strengthening food safety regulations and quality control measures. The introduction of stringent standards for packaging materials and food preservation methods creates an encouraging environment for companies to adopt antimicrobial solutions.

Indian antimicrobial packaging market is estimated to grow due to rapid urbanization and rising middle class income has increased the demand for packaged and convenience foods. With a heightened awareness of foodborne illnesses and contamination risks in India, both consumers and manufacturers are looking for packaging that can inhibit microbial growth.

North America region is anticipated to grow at the fastest rate in the antimicrobial packaging market during the forecast period. Both public and private sectors in North America are heavily investing in Research & Development to improve the efficacy and cost-effectiveness of antimicrobial packaging. These investments contribute to faster innovation cycles and more competitive market offerings. Innovations in antimicrobial agents such as silver nanoparticles, essential oils, and organic acids have led to more efficient packaging solutions. These advancements enable more effective and controlled release of antimicrobial substances, ensuring prolonged protection.

Regulatory bodies in the U.S. have enforced strict food safety standards. This has encouraged manufacturers to adopt packaging solutions that actively inhibit microbial growth, ensuring that food and other products remain safe for consumption. The surge in demand for convenience foods, driven by busy lifestyles and urbanization, fuels the need for packaging that not only preserves product quality but also actively prevents spoilage and contamination. The U.S. based packaging solutions provider offers a wide range of products and is actively involved in research and innovation to include antimicrobial technologies in its offerings.

Europe region is seen to grow at a notable rate in the foreseeable future. The European Union has rigorous food safety and hygiene standards that compel manufacturers to adopt advanced packaging solutions. Compliance with these regulations is driving innovation in antimicrobial packaging, ensuring products remain safe and fresh. European consumers are increasingly concerned about food safety, freshness, and sustainability. Packaging solutions that not only protect against microbial contamination but also utilize eco-friendly, recyclable, or biodegradable materials resonate well with this market, fueling faster adoption.

With Europe placing high priority on environmental sustainability, antimicrobial packaging that can extend shelf life and reduce food waste becomes a key component of corporate sustainability strategies, further stimulating market growth. Sealed Air Corporation has a strong presence in Europe, Sealed Air is a leader in food packaging innovation, offering solutions that combine antimicrobial properties with the latest in packaging technology.

By Material Type

By Pack Type

By Technology

By Application

By Region

April 2025

March 2025

March 2025

March 2025