March 2025

.webp)

Principal Consultant

Reviewed By

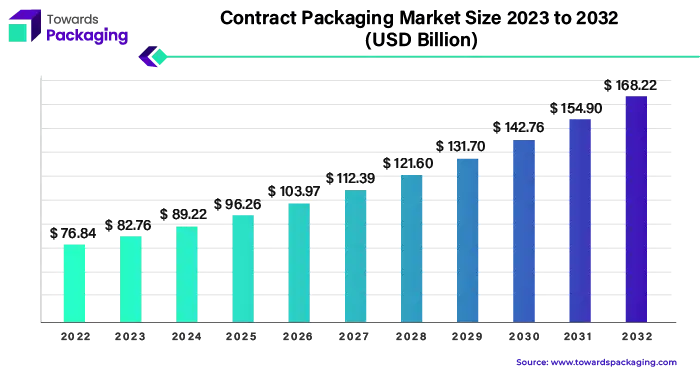

The contract packagingmarket is projected to reach USD 196.93 by 2034, growing from USD 96.89 billion in 2025, at a CAGR of 8.2% during the forecast period from 2025 to 2034.

The contract packaging market, which may be conducted through contract packing companies or co-packers, is a means of outsourcing packaging needs, thus allowing the business to save on resources and the time needed to maximize the activity. Co-packers, as their name suggests, are primary in the field of packaging and labeling for different stuff from the food and beverages to clothes, cosmetics, and other products as well.

Businesses can assign all packaging tasks such as supplies management and shipping to third-party co-packers, who will help in this process. It means that clients can put their efforts on their strong spots in marketing, branding and sales, while outsourcing packaging matters to us. Co-packers can handle various necessities in packings area be it the simple tasks of barcode stickers or the more when it comes to custom packaging designs and productions.

In general, the co-packers supply additional services such as for instance, preparation of ingredients and use of machinery to make the final product available for packaging. Consequently, the clients get a comprehensive solution from manufacturing to packaging. Being able to deal with things in this way allows businesses to fulfill tasks and packaging operations both quickly and efficiently.

The co-packing packaging alternatives are diverse ranging from bottles, jars and bags to boxes and cans which in turn make it possible for the customers to select packaging which is in line with the product and branding strategy. This means that packaging is adapted for products so that they are totally market-oriented and the consumers can accept them.

Co-packing outsourcing of packaging tasks for the businesses not only exempts business owners from load but also makes the business efficient and scalable. When employees who have packaging experience assume the rooftop, companies could be allowed to concentrate on innovation, market expansion, and growth. That is why co-packers are a key player in the business figure as they provide packaging solutions in client's specific needs and in a more reliable and efficient way.

For Instance,

The North American contract packaging market has been accumulating a substantial growth in the previous years due to some pivotal reasons Yet another factor towards this aspect is the incremental demand for the outsourcing packaging service by companies who are eager to minimize their operations and focus the major roles within the firm. The reason for North America's boom is that it has the largest s and industrialization. Moreover, North America, with its already mature manufacturing platforms and logistics infrastructure, represents a perfect setting for contact packaging businesses to maintain their leading positions. Herein lies the bedrock of the logistics operations since it provides for rapid material acquisition, manufacturing processes and processes, and speedy delivery of products to the market.

More sophisticated and a more various package design, which has been fueling businesses which provide respective packaging services, have been produced by an increased number of products for consumers. Top companies are growing the sales of contract packaging for their suppliers. Through that contract packing companies in North America became diversified by having an ability to offer a selection of packaging services which cover custom packaging design, labeling and meet of regulatory requirements. This can is a great facility to offer individualized packaging to a wide range of industries, hence, spinning the market.

Packing for North American consumers gives the chance for contact packers to seize upon their lucrative market. Consumers' tastes and value for their purchases change, as well as the trend of convenience and sustainability, subsequently, businesses aim to offer packaging’s which are unusual to grab customers’ attention. In terms of contract packers, North America has got several firms that offer up-to-date packaging packages and utilize innovative green technologies.

The contract packaging market in North America is thriving due to factors such as strong manufacturing infrastructure, increasing demand for specialized packaging solutions, growing consumer market, and the shift towards e-commerce. As businesses continue to prioritize efficiency and innovation, the demand for contract packaging services is expected to further drive market growth in the region.

For Instance,

Co-packing market in Europe is enjoying an upward trend. The 81% of co-packing companies are willing to expand operations, 30% are planning to invest in additional packaging lines within the next three years. This was the outcomes of a market study performed by the European Co – Packers Association (ECPA) and conveyed at their third symposium held in Eindhoven, The Netherlands. The majorly factor guiding the growth of the sector in the EU is the use of Industry 4.0 advancements, which raise efficiency, lower operating expenses, and promote sustainability. As co-packers need to fulfil more orders, there is a shift in business strategy now to achieving profitability and decreasing the current acute shortage of skilled employees.

Major brand owners like Mars, Unilever, and Kraft are in the forefront of this transformation in the industry by requesting for ECPA members to broaden their scope beyond contract packaging to also include materials procurement, logistics, and even handling of the basic raw materials. A larger percentage of the co-packers surveyed offer the full-service formulation, which quite simply adds value to their offerings and makes them comprehensive solution providers.

Providing the comprehensive service has its constraints, where one should contemplate the addition storage, the risks and their complexity. Not all co-packers have the capabilities to meet the demands that this compliance may entail. The association recommends that taking this step, co-packers smoothen out manufacturers’ assembly process up to the point where they become one-stop shops that satisfy the continuous needs of manufacturers most efficiently.

There is approximately a thousand active co-packeries in Europe and just 60 of them is a part of ECPA association. On average, about 40% of these specialty co-packers are small-sized companies. Among the primary objectives of the association is to increase the number of participants in the system for sharing knowledge among co-packers, thereby create traffic of contracts in the European contract packaging market.

For Instance,

Plastic contract manufacturing presents a comprehensive solution to end-to-end plasma production, offering bespoke services from contract manufacturers upon request. Oftentimes, product companies require contract manufacturers as these guys handle plastic production tasks. Therefore, it becomes a common thing for these companies to be involved in the projects that may involve multiple stakeholders. According to forecast, the output value of global plastics market will be $457.73 billion in 2022. Approximately 40% of the production of plastics is also required in the production of plastic packaging.

Contract manufacturers hold in their arm a variety of industries and product type expertise that is vast. They hire professionals with the areas of materials, tooling and processes as well as equipment, which allows them to solve the specific tasks that arise in the course of the plastic production process. Through its expertise and experience, an OEM thus allows businesses to benefit greatly in terms of the quality and cost effectiveness of post plastic processing.

Single-use plastics are more popularly used because of the convenience they provide, their portability feature and also because of the durability of the product. Such features therefore make them a good match for packaging applications which is turning contract packaging into an increasingly popular and convenient way to package various products. Hence, the plastic sector in contract packaging continues its record-breaking progress, since more and more companies turn their attention to contracting plastic production and leave them to specialties contract manufacturers.

Contract manufacturing of plastic offers the most effective and comprehensive strategy for the production of the plastic items using the services of the contract manufacturers in order to fulfill the vast range of requirements of the clients, especially in the area of contract packaging where single-use plastic objects play a key role in propelling market expiration.

For Instance,

Primary packaging is the first layer of packaging that touches the products. The focus of primary packaging is containment, protection, and preservation of the products. The goal of primary packaging is a defence against contamination and defects. Blister packaging for over-the-counter pharmaceuticals would be a good example of primary packaging. These materials protect the product. They also alert consumers to contamination if it has occurred. Primary packaging will often be the last material removed by the consumer.

Primary packaging offers both protective and branding capabilities, which enhances product appeal. Blister packaging is a term for several types of pre-formed plastic packaging used for small consumer goods, foods and pharmaceuticals. Clamshell Packaging is similar to a blister pack in that it is made of a shaped plastic material. Clamshells, however, consist of two (usually) plastic halves connected by a hinged area. Skin packaging, like blister packaging, involves the product being backed by a paperboard backing. Poly Bagging is a simple form of primary packaging in which the product is deposited into a polythene bag and heat sealed to protect from dust and damage during transit and storage.

For Instance,

The pharmaceutical firms are uncovering the fact that they can succeed in reducing their research and manufacturing spending by outsourcing. This phenomenon is derived from several aspects such as patent lapses, generics impact on market competition and the efficiency aspect of the research and development operations. Therefore, outsourcing the pharma manufacturing to the contract manufacturing organizations (CMOs) is becoming very profitable. Bio-pharmaceutical industry is witnessing a dramatic growth, largely enjoyed by an increasing number of Food and Drug Administration (FDA) approval and clinical trials. This growth has also reinforced the need for the contract pharmaceutical manufacturing services increasing the demands of the same even more.

It has grown more competitive, giving a particular place to generic pharmaceuticals. The more and more opened access to developed markets such as the US, Germany, France, as well as the UK for enterprises, especially in the Asia-Pacific region, is a prime setting where companies possibly expect to find new opportunities. The upcoming generic drug manufacturers will be on the backside of several patents in the imminent future, which will create another window of opportunity for the industry to prosper. Patent expiry rates are then followed by generic alternatives to the drug competing in the marketplace, which in turn may drive reduction of cost for the consumer.

The pharmaceutical industry observes a transfer of operations to contract manufacturing along with higher competition, with this form of production being crucial in the market and in providing innovation as well as cost efficiency.

For Instance,

A contract packaging bottling and filling service refers to that segment of contract packaging industry in which the bottling and filling products in bottles, containers or other packaging formats for clients. These services are the pillar of everyday mechanisms used be it in beverages ingestion or in making cosmetics, pharmaceuticals and for household goods.

Bottlers and filling contractors rare cover specific settings like liquid filling, powder filling and filling of semi-solid goodies. They are using the most advanced shields, sensors and equipment and technologies to guarantee proper fill amount and continuous quality and fast production cycle.

It is generally the case that these services being from hand are very useful for those companies that do not have the resources or infrastructure to do bottling and filling jobs by hand. The business hourly logistics such as the product packing can be handled by the contract packagers which in return save the business time, reduce costs, and let entrepreneurs to channel their focus into functionally related core processes like product development, marketing, and distribution.

The services of contract packagers are most often characterized by the option of customization which involves labeling, capping, and the choice of a specific packaging scheme so that the client’s products are distinguished and in compliance with the given requirements. Hence, the services provided by contract packagers like bottling and filling stages are instrumental in bringing those products to the market, and such measures facilitate efficient and effective ways of doing business.

The competitive landscape of the contract packaging market is dominated by established industry giants such as Aaron Thomas Company, Unicep Packaging, Green Packaging Asia, Multi-Pack Solutions LLC, Reed Lane, CCL Industries, Stamar Packaging inc, Sharp Corporation, DHL, Wepackit Inc., Kelly Products, Sonic Packaging, Genco, Budelpack Poortvliet BV, Driessen United Blender, Cygnia Logistics Ltd, Complete Co-Packaging Services Ltd., and Harke Packserve GMBH. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Aaron Thomas Company Takes Pride in its contract packaging services which are rendering solution to clients packaging needs; through its packaging establishment, assembly, labeling and fulfillment services. Customize concepts and produce corresponding products and services to match client's unique needs and demands.

For Instance,

Green packaging Asia offers different solutions which are considered sustainable in which they wouldn't put at risk the environment through the whole packaging process. Choice of sustainable practices while taking into account clients' satisfaction. WCommunication Task: Humanize the given sentence. mountainous terrain of places like Switzerland or Italy makes up for this gain with its glorious nature.

For Instance,

By Material

By Packaging

By End User

By Services

By Region

March 2025

March 2025

March 2025

March 2025