February 2025

.webp)

Principal Consultant

Reviewed By

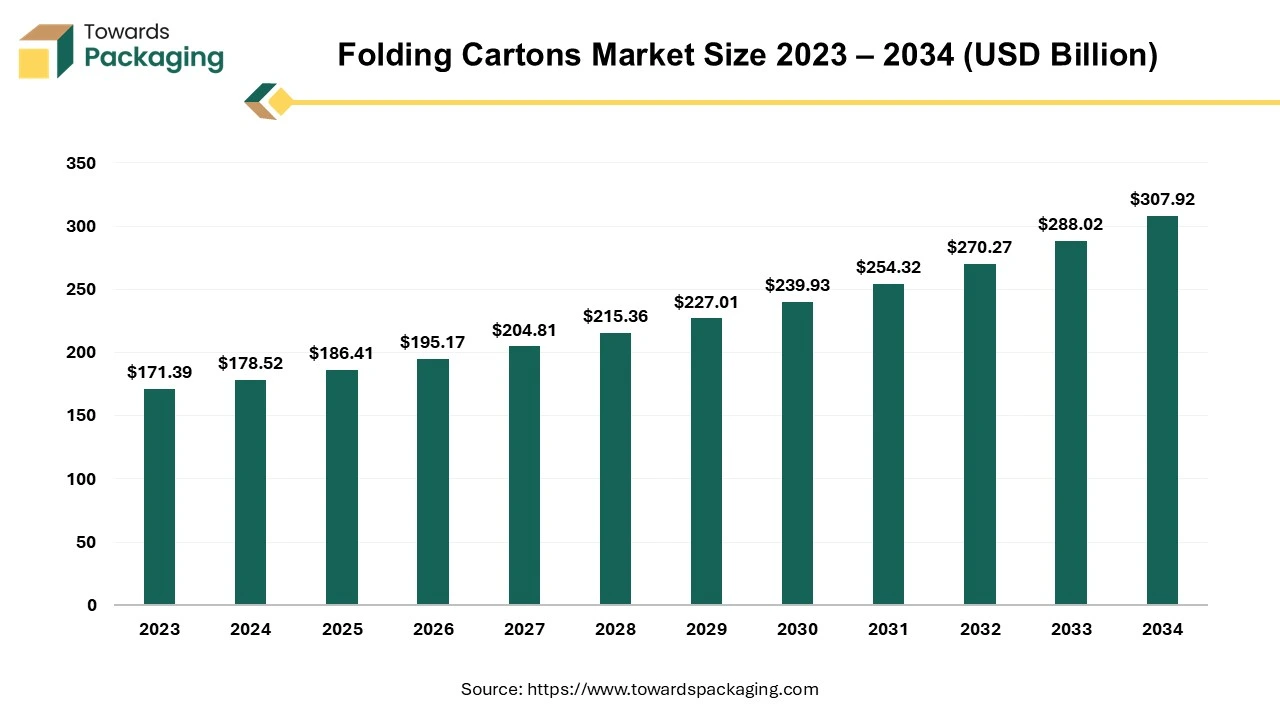

The global folding cartons market is estimated to reach USD 307.92 billion by 2034, up from USD 178.52 billion in 2024, at a compound annual growth rate (CAGR) of 5.46% from 2025 to 2034.

The folding cartons market is likely to register impressive growth during the projected forecast period. One of the most often used product packaging formats nowadays is the folding carton, which may be utilized for transporting almost anything. Products like electronics, food, and cosmetics are all packaged in folding cartons. Folding cartons are boxes or box sleeves developed with either single-ply paperboard or corrugated cardboard and are manufactured with the help of special machine in the required shape and size. Foldable cartons have many advantages as compared to the other methods of packaging. They can be customized to meet specific needs and are available in nearly any size and form imaginable. Additionally, they can be imprinted with unique images and writing and are available in a range of finishes. They are inexpensive to make as paperboard, a reasonably priced material, is used to make them. Also, folding cartons ship flat, this minimizes the cost of handling and shipping.

The rapid expansion of the e-commerce sector along with the growing environmental awareness that has led brands and consumers to prioritize recyclable packaging is expected to augment the growth of the folding cartons market during the forecast period. Furthermore, the improvements in the printing technology as well as the adoption of the eco-friendly coatings/adhesives are also anticipated to augment the growth of the market. Additionally, the rise in the demand for ready-to-eat foods along with the increasing focus of the brands on premium, innovative packaging options for the cosmetics and personal care products is also projected to contribute to the growth of the market in the near future.

The global surge in the online shopping is expected to fuel the growth of the folding cartons market during the projected timeframe. This is owing to the convenience, increased internet accessibility and changing consumer preferences. As per the Mobile Economy 2024 report by the GSM Association, mobile internet usage accounted for 58% of the global population at the end of 2023, with 4.7 billion users, up 2.1 billion compared to 2015. This number is expected to reach 5.5 billion by 2030 that is almost 65% of the population. As the mobile internet access becomes more widespread, consumers can shop online conveniently from their smartphones, fueling growth in the e-commerce activity. This shift creates a demand for secure, durable and customizable packaging, like folding cartons that can protect the products during transport and provide a high-quality unboxing experience.

The reality is that physical retail has begun to die off and the only companies that have the ability to look to the future with hope are those who have successfully established a multi-channel web platform alongside their physical operation. Online retail is expected to continue to grow rapidly in the near future, according to all estimates. Buyers on the internet are concerned and attentive regarding the product freshness, quality, delivery, choice and trustworthy service—all that packaging labels and folding cartons need to deliver. The folding carton serves as the primary brand representative in addition to being the most necessary product protection option, whether it is seen at e-commerce site, on the shelf, or with the customer at home. The most popular packing material for online retailers are folding cartons crafted from cardboard or corrugated paper since they are easy to visualize in the online store, satisfy logistical needs and they are one of the most eco-friendly packaging material.

The competition from alternative packaging choices is expected to hamper the market growth within the estimated timeframe. Flexible packaging options such as plastic pouches and bags act as strong substitutes that attract the manufacturers and consumers alike. One of the key emerging packaging options in a variety of industries is pouch packaging, specifically stand-up pouches. Pouches are normally made from a range of flexible materials, which facilitates convenient storage over the span of their lifetime. All of the pouches weigh less than other materials like cardboard or glass. Due to this, they are less expensive to transport and use less fuel when being moved. Also, the branding and messaging of the business are displayed on the pouch's printing surfaces. A customer will undoubtedly be drawn to the attractive packaging while looking for a specific food item and want to buy it.

Furthermore, another popular alternative in the retail, cosmetic, and pharmaceutical sectors is blister packaging, however it is also becoming more prominent in other areas. The packaging is visually appealing and protects the items since each item inside the blisters has its own space. The fact that blister packing makes products visible to customers is among its most important advantages. Customers can check whether every item is there and in good condition owing to the plastic front. Additionally, retailers can alter this type of packaging to make their products more aesthetically pleasing, which improves the perceived worth of the item. Thus, brands may opt for these packaging choices over folding cartons to gain a competitive edge in terms of cost efficiency and product protection, challenging the market share of the traditional folding cartons.

The expansion of the healthcare and pharmaceutical industries are projected to fuel the growth of the folding cartons market in the years to come. This is owing to the aging populations, rising prevalence of chronic diseases and increased healthcare spending. In a developing global economy, the research-based pharmaceutical sector helps to ensure future competitiveness and restore global prosperity. According to the European Federation of Pharmaceutical Industries and Associations, R&D expenditures in Europe were anticipated to be €50,000 million in 2023. In the developing economies like India, China and Brazil the market and the research landscape is been growing substantially. North America made up 53.3% of the global pharmaceutical sales in 2023, while Europe made up 22.7%. As reported by IQVIA (MIDAS May 2024), the US market accounted for 67.1% of sales of the newly introduced medications during the 2018–2023 period, while the European market accounted for 15.8%.

Folding cartons are mainly utilized as exterior packaging for liquid, solid, and semi-solid medical products in the healthcare and pharmaceutical industries. They are also used to pack medicinal supplies. Cardboard packaging is subject to strict requirements from the pharmaceutical business. Due to their exceptional printability, which is important for regulatory compliance and capacity to satisfy these precise specifications, folding cartons are the perfect option for pharmaceutical packaging. The requirements consist of bending, whiteness, sturdiness, thickness, creasability, and codability. Companies take extra precautions to guarantee that every product complies with FDA and GMP requirements as well as ECMA Best Practice Guidelines. Thus, this presents a strong growth opportunity for the manufacturers in this sector as they meet the rising demand for health-related products.

The paperboard segment held considerable market share of 79.61% in 2024. Over the past few years, paperboard folding cartons have consistently been the most commonly utilized packaging material and they continue to do so today. Paperboard is a lightweight, adaptable material that offers the resilience and strength required for packaging. Since it's typically manufactured from recycled fibers or wood pulp, it's a popular option for organizations that care about the environment. Recycled paper is becoming popular as a raw material as sustainability becomes a top concern. It minimizes the need for the virgin fibers and lowers the negative effects of packing on the environment. Many coatings and inks are applied to folding cartons to improve their look and performance. These can include UV and water-based coatings as well as biodegradable inks, all of which improves the carton's appearance while guaranteeing that it satisfies industry requirements. The rise in the awareness about the plastic pollution has further pushed brands to adopt paperboard over plastic materials, predominantly in the food and beverage and personal care sectors.

The food & beverages segment held the largest market share of 60.59% in 2024. This is owing to the consumer shift towards packaged and ready-to-eat foods mostly in the urban areas. Folding cartons are particularly suited for a wide variety of food products such as frozen foods, baked goods, confectionery and snacks, as they provide structural stability and can be customized to improve the brand visibility on the store shelves. Specific beverage applications consist of beer bottle, coffee, ice cream and juices. Also, the increased focus on the food safety and hygiene, mainly post-pandemic, has further elevated the need for reliable and tamper-evident packaging solutions, which folding cartons effectively provide. These factors combined are likely to contribute to the growth of the segment during the estimated timeframe.

Asia Pacific held the largest market share of 38.25% in 2024. This is due to the increasing urban populations and rising incomes across the region. Also, the expansion of e-commerce and retail sectors is likely to contribute to the regional growth of the market. As per the E-commerce Market Survey by the Japan’s Ministry of Economy, Trade and Industry (“METI”), in 2022, the B2C (business-to-consumer) e-commerce sector was estimated to be worth $162.4 billion, with a 5.37 percent increase in sales of goods over the previous year. Also, in 2022, Japanese customers spent $2.5 billion on cross-border purchases made online from U.S. retailers, a 5.9% increase over the year before. Furthermore, the growing healthcare infrastructure and rising pharmaceutical production is also expected to contribute to the regional growth of the market.

North America is likely to grow at considerable CAGR of 4.13% during the forecast period. This is owing to the strong presence of the pharmaceutical industry along with the growth in the personal care and cosmetics market across the region. According to the U.S. Census data, cosmetics generated over $43 billion in revenues in the United States in 2021, with several thousand of cosmetic formulations and items available for purchase. Also, as per the data by the International Trade Administration, the Canadian cosmetics industry generated in about USD 1.24 billion in 2021. By 2024, industry income is predicted to increase by 1.45% a year to reach USD 1.8 billion. Additionally, the advancements in the printing and design technologies as well as the growing awareness of environmental issues are also anticipated to promote the growth of the market in the region in the near future.

By Material

By Type

By End-Use

By Region

February 2025

February 2025

February 2025

February 2025