April 2025

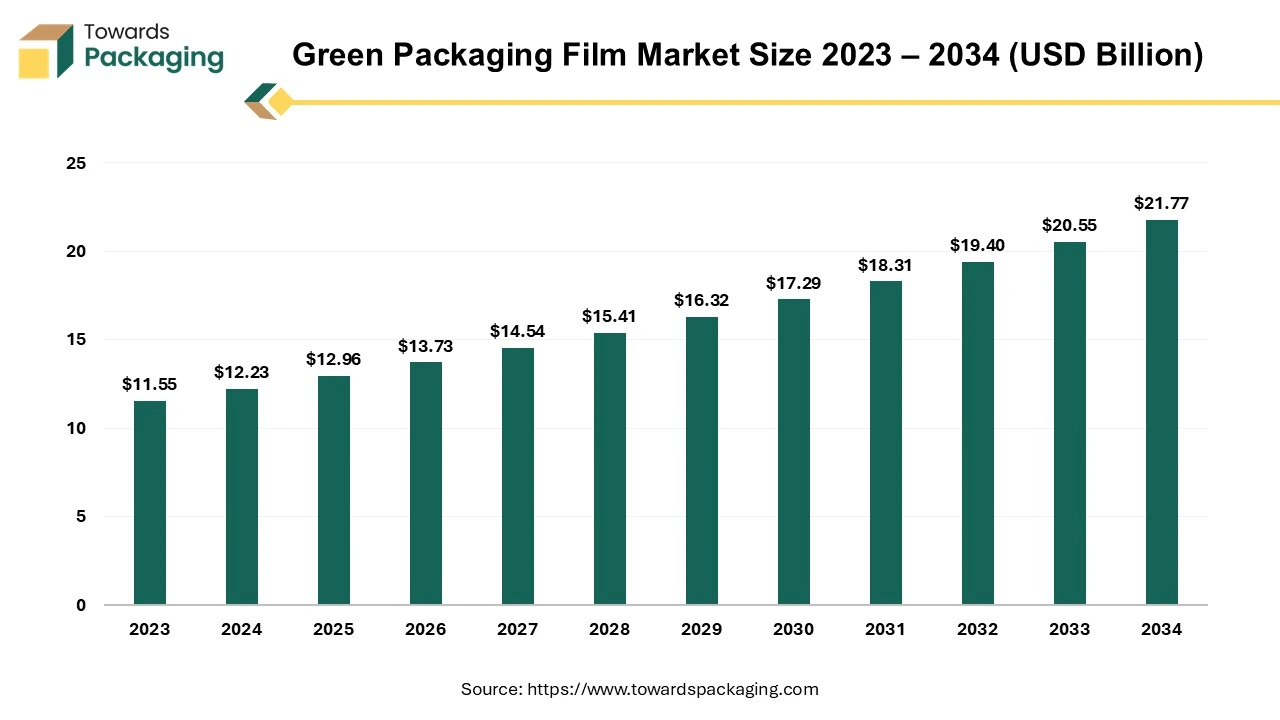

The green packaging film market is set to grow from USD 12.96 billion in 2025 to USD 21.77 billion by 2034, with an expected CAGR of 5.93% over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The term "green packaging" describes the creation and application of sustainable and ecologically friendly packaging. Compostable, biodegradable, or recyclable materials are used in green packaging. This involves using materials that are easily repurposed or decomposable without leaving behind hazardous residues, as well as recycled content. Reduction The goal is to use less packaging material overall. This is creating packages that are more compact or effective in order to reduce waste and preserve resources. Rather than using petroleum-based plastics, green packaging frequently uses materials made from renewable resources, such as plant-based materials (like bamboo, hemp, or cornstarch). Reducing greenhouse gas emissions and energy consumption are the two main goals of the green packaging production process.

The creation of recyclable and environmentally friendly package designs using green and biodegradable raw materials that might lessen the burden of environmental pollution is known as "green packaging." These days, packaging serves as a brand concept that fully reflects the psychology of the buyer. It directly affects what consumers buy and how they use items, and packaging is a strong way to create affinity.

In the food sector, food packaging is essential because it helps to maintain product quality, reduces product loss, facilitates transportation, enables safe storage, reduces food waste, and acts as a form of product advertisement. In addition, there are other categories into which sustainable packaging choices can be divided based on the materials used and the disposal method. Recyclable packaging is one type of green packaging that may be found in conventional facilities. The global packaging market size growing at a 3.16% CAGR.

AI can accelerate the research and development process by predicting the performance of new materials and identifying the most promising biodegradable compounds. Machine learning models can analyse vast amounts of data on material properties and environmental impact to help design better, more efficient packaging solutions. AI can enhance supply chain efficiency by predicting demand, managing inventory, and optimizing logistics. This helps in reducing the carbon footprint associated with packaging materials. AI algorithms can optimize the manufacturing processes of biodegradable films. This includes improving the efficiency of production lines, reducing waste, and ensuring consistent quality.

AI-driven analytics can provide insights into consumer preferences and trends related to green packaging films. This information can guide companies in developing products that align with market demands. AI-powered image recognition and sensor technologies can be used for real-time quality control during the production of biodegradable films, ensuring that defects are minimized and standards are maintained.

Increasing awareness about environmental issues, such as plastic pollution and climate change, is pushing consumers and companies to seek sustainable alternatives, which is projected to growth the green packaging film market. Governments and regulatory bodies are implementing stricter regulations on plastic use and encouraging the adoption of eco-friendly packaging solutions. There is a growing demand from consumers for products packaged in environmentally friendly materials, leading companies to adopt green packaging solutions. Governments and regulatory bodies are implementing stricter regulations on plastic use and encouraging the adoption of eco-friendly packaging solutions. There is a growing demand from consumers for products packaged in environmentally friendly materials, leading companies to adopt green packaging solutions.

Innovations in materials science are creating new, more effective green packaging options, such as biodegradable and compostable films. Companies are setting sustainability targets, including reducing their carbon footprint and using recyclable or biodegradable materials, which drives the adoption of green packaging. Companies use green packaging as a differentiator to appeal to environmentally conscious consumers and enhance their brand image. The key players operating in the market are focused on adopting inorganic growth strategies like collaboration agreement to develop green packaging film technology for sustainable packaging based market which is estimated to drive the growth of the green packaging film market over the forecast period.

For instance,

The key players operating in the market are facing shortage of technology which used to manufacture green film packaging material as well as packaging solutions, which is estimated to be the restricting factor for the growth of the green packaging film market. Green packaging films, often made from biodegradable or renewable materials, can be more expensive than traditional plastics, which can deter adoption, especially for price-sensitive industries. Some green packaging films may not always match the performance characteristics of conventional films, such as durability or barrier properties, leading to concerns about their suitability for certain applications.

The availability of raw materials for green packaging films can be limited, affecting production scalability and supply chain consistency. Lack of awareness or understanding of the benefits of green packaging can limit market demand and acceptance. The technology for producing high-quality green packaging films is still evolving, and current limitations can impact the efficiency and cost-effectiveness of production. Hence, the above mentioned factors are responsible for hampering the growth of the green packaging film market.

There is growing consumer demand for products that are environmentally friendly. Companies that use green packaging can enhance their brand image and appeal to eco-conscious buyers. To meet the rising demand of costumers the key players operating in the market are engaged in carrying out research and development activities which is estimated to create lucrative opportunity for the growth of the green packaging film market over the forecast period.

For instance,

In June 2024, the Berry Global Group, Inc., sustainable packaging company, revealed the launch of the whitepaper on advancing user-centric, biodegradable and sustainable packaging with Artificial Intelligence (AI). The world leader in sustainable packaging, Berry Global Group, Inc., examines how recent advancements in artificial intelligence (Al) can complement human intelligence and creativity to revolutionize packaging design and development in their new, in-depth whitepaper and how Artificial Intelligence (AI) can advance user-centric, sustainable packaging design.

The whitepaper delves deeply into how Berry combines Al's aptitude for interpreting visual design language with the company's internal design studio's capacity to turn creative product concepts into workable, computer-aided designs, so fast-moving consumer goods brands can stay ahead of rapidly shifting market trends and consumer preferences. Al provides chances to learn more about the preferences, behaviours, and trends of his customers by examining a plethora of data from many sources, such as social media, online reviews, sales information, and customer surveys.

The pouches segment held the dominating share of the green packaging film market in 2024. Emphasize the use of eco-friendly materials and production processes. The pouches are made from recyclable, biodegradable, or compostable materials to appeal to environmentally conscious consumers. Hence, the key players operating in the market promote and develop innovative pouch designs that enhance functionality, convenience, and appeal. Pouches are more beneficial due to its features such as ergonomic shapes, easy-pour spouts, and resealable closures which can attract consumers and meet specific needs.

The key players are even providing customizable pouch options to meet the unique requirements of different food, cosmetics products and brands. This includes various sizes, shapes, and printing options that can enhance brand identity and consumer engagement. They reduce landfill waste compared to non-recyclable materials and can be processed to recover valuable resources. Recyclable pouches often use less material and energy compared to traditional packaging. They align with growing consumer preferences for sustainable and eco-friendly products. Align with current consumer trends such as convenience, portability, and on-the-go consumption. Pouches are often preferred for their easy handling and resealability, which fits well with modern lifestyles.

Moreover, pouches offer superior protection and preservation of products. Advances in barrier technology can improve shelf life and maintain product quality, making pouches an attractive option for various goods. The key players operating in the market are focused on adopting inorganic growth strategies like partnership to develop compostable pouches, which is estimated to drive the segment over the forecast period.

For instance,

The bags segment is expected to grow at fastest rate over the forecast period. Biodegradable bags are beneficial because they break down more quickly than traditional plastic bags, reducing their environmental impact. Unlike conventional plastics, which can persist for hundreds of years and contribute to pollution, biodegradable bags are designed to decompose into natural components when exposed to environmental conditions. This can help decrease litter, reduce the strain on landfills, and lessen the potential harm to wildlife.

However, the effectiveness of biodegradation can vary based on the conditions and materials used, so it's important to consider proper disposal methods and overall sustainability. Bags can be compressed, folded, or rolled, saving storage space both before and after use. They can be used for a wide range of products, from food and beverages to clothing and electronics. Bags are generally cheaper to produce and transport compared to rigid packaging options. Bags can be printed with branding and product information, enhancing marketing and consumer appeal. The key players operating in the market are focused on developing and introducing new biodegradable bags utilized for various purposes, which is estimated to drive the growth of the segment over the forecast period.

The polylactic acid (PLA) segment held the dominating share of the green packaging film market in 2024. Compared to petrochemical-based polymers, polylactic acid (PLA) has several advantages in packaging, including being 100% naturally sourced, biodegradable, having a lower carbon footprint, reducing greenhouse gas emissions, and being easier to manipulate the relationship between structure, property, and processing.

For instance,

The Polybutylene Adipate Terephthalate (PBAT) segment is expected to grow at fastest rate over the forecast period. Compostable and biodegradable plastic films, such as those for grocery bags, food packaging, and agricultural films, are produced using Polybutylene Adipate Terephthalate (PBAT). Polybutylene Adipate Terephthalate (PBAT) is compostable and breaks down into natural substances under composting conditions, reducing environmental impact compared to conventional plastics. It can be blended with other biodegradable polymers to enhance its properties and performance, making it versatile for various packaging needs.

For instance,

The food industry segment held the dominating share of the green packaging film market in 2024. The green packaging film is widely used for packaging food as these materials are designed to break down more quickly and safely in the environment compared to traditional plastics, which can take hundreds of years to decompose. This helps reduce pollution and the strain on landfills. Green packaging often uses renewable resources or materials that are less harmful to the environment during production. This can contribute to lower carbon emissions and reduced use of fossil fuels. Increasingly, consumers are prioritizing sustainability and eco-friendly practices.

Companies use biodegradable and green packaging to align with these values and meet customer expectations. Many governments are implementing stricter regulations on single-use plastics and waste management. Using biodegradable and green packaging helps companies comply with these regulations and avoid potential fines.

On online food ordering sites like Deliver Hero, Domino's, Swiggy, Zomato, Eat club, Uber Eats, iFood, etc., it is easier to compare prices and find deals or discounts online. Online shopping saves time by allowing people to order from home and have groceries or meals delivered to their doorsteps. Online stores often offer a wider selection of products than physical stores, including specialty and international items. Online food ordering eliminates the need for travel and in-store browsing, making it a quicker option.

Moreover, ordering food online eliminates the need for travel and in-store browsing, making it a quicker option. Online shopping helps avoid busy stores and long lines, which can be appealing, especially during peak times. Many services offer fast or scheduled delivery, catering to different needs and preferences. People with mobility issues or busy schedules find online shopping more accessible and practical. Hence, increase in trend of ordering food online due to busy and fast life style is estimated to drive the segment growth over the forecast period.

For instance,

Moreover, the key players operating in the market are focused on launching new compostable food packaging tray which is estimated to drive the growth of the segment over the forecast period.

For instance,

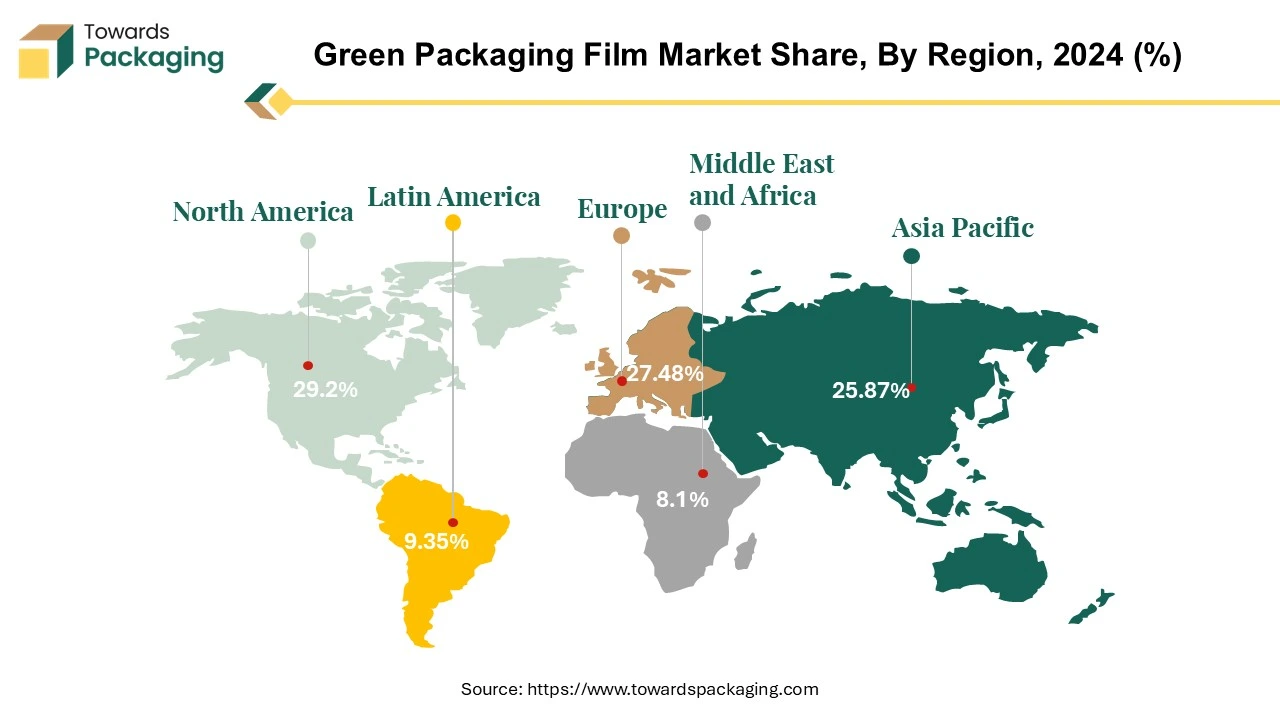

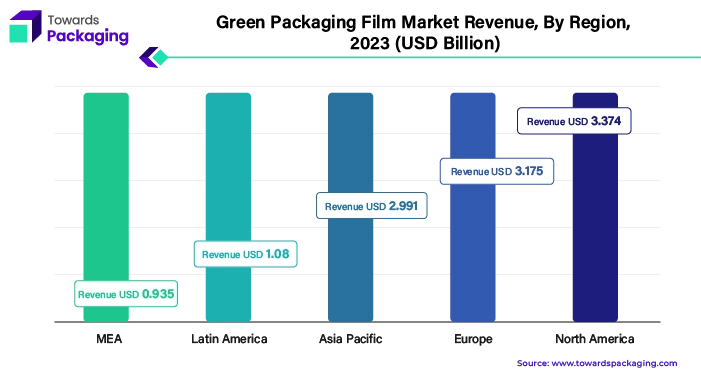

North America witness the highest revenue shares of 29.20% for the year 2024. Growing awareness about environmental issues in North America and the need to reduce plastic waste has driven both consumers and companies to seek more sustainable packaging solutions in North America. Governments and regulatory bodies are implementing stricter regulations on plastic use and waste in North America, encouraging the adoption of eco-friendly packaging options. There is a rising consumer preference for products with environmentally friendly packaging, which influences companies to adopt green packaging solutions to meet market demands.

Many companies in North America are setting sustainability goals and commitments to reduce their carbon footprint, leading them to invest in green packaging materials. Advances in green packaging technology in North America and the availability of new, more effective biodegradable and recyclable materials have made green packaging solutions more viable and attractive. The key players operating in the are focused on launching new policy for reduction of plastic waste which is estimated to drive the growth of the green packaging film market in North America over the forecast period.

For instance,

Asia Pacific is estimated to grow at fastest rate over the forecast period. The Asia Pacific green packaging film market is investing more in recycling infrastructure and developing new materials and technologies as a result of rising awareness of the importance of circular economy concepts in promoting sustainability and decreasing waste. In addition, as the demand for fast-moving consumer goods (FMCG) in the area rises, so does the creation of environmentally friendly packaging options for their transportation and protection. This has led to an increase in the requirement for environmentally friendly packaging options that can satisfy the demands of the FMCG sector while simultaneously lowering waste and negative effects on the environment, which fuels the demand for green packaging.

For instance,

Due to a number of laws and policies, including the Prevention and Control of Environmental Pollution by Solid Wastes policy, which limits the dumping and disposal of solid wastes, China is a significant manufacturer and consumer of green packaging film in the Asia Pacific region. In order to comply with regulations and satisfy the growing demand from customers for sustainable packaging, a number of shops are also implementing green packaging solutions.

For instance,

Europe is estimated to be the second dominating region of the green packaging film market. This is because there is a growing need for green packaging solutions in Europe industries including food and beverage and healthcare, as well as a growing consumer awareness of the negative environmental effects of plastic packaging materials. Because bioplastics from renewable resources, such sugarcane or corn starch, offer better biodegradability and lower carbon emissions in applications like food packaging and shopping bags, their use has also aided in the growth of the market.

German is making significant progress because of numerous government programs encouraging sustainable packaging in the nation, a number of suppliers and manufacturers of personal care products, like HP Packaging (Hewlett-Packard Company), have embraced green packaging. These include the Green Dot system, which promotes the use of recyclable materials in production, manufacturing, and packaging, and the Packaging Act, which mandates that businesses collect and recycle their packaging waste. This contributes to the market's desire for eco-friendly packaging.

By Product Type

By Material

By End Use

By Region

April 2025

April 2025

April 2025

April 2025