April 2025

Principal Consultant

Reviewed By

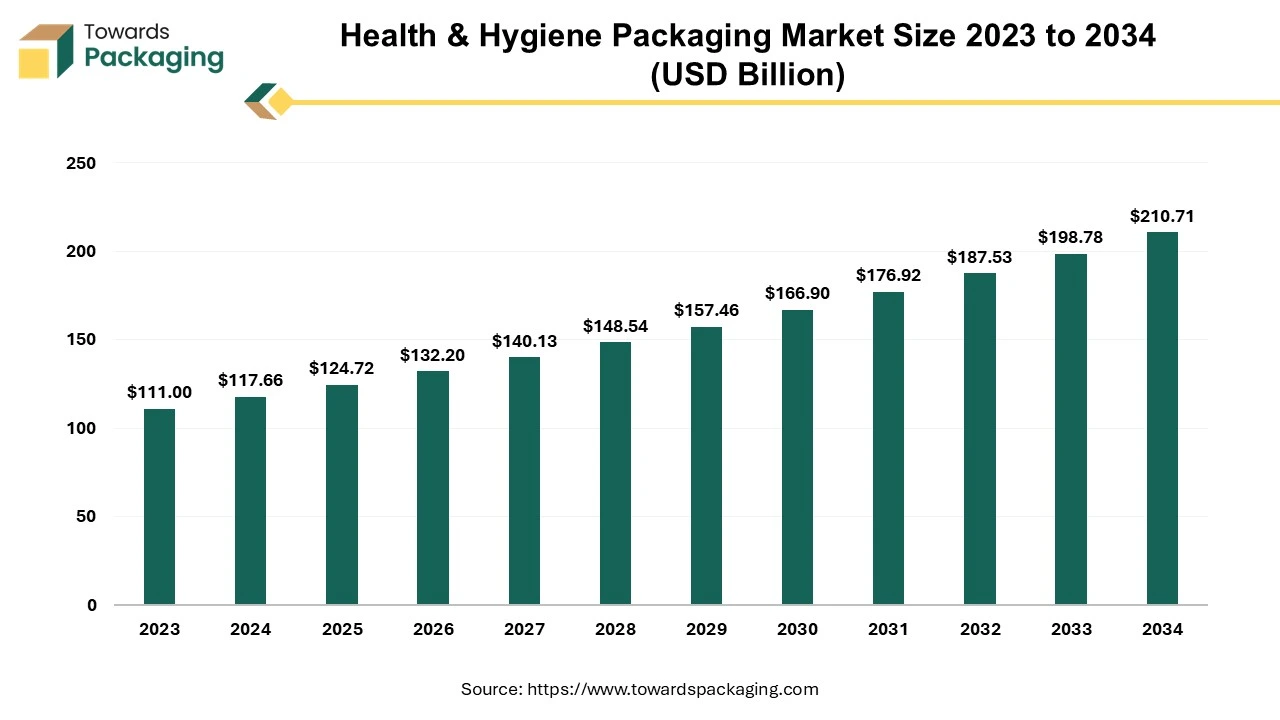

The health and hygiene packaging market is forecast to grow at a CAGR of 6%, from USD 124.72 billion in 2025 to USD 210.71 billion by 2034, over the forecast period from 2025 to 2034.

Urbanization and changing lifestyles, including increased focus on personal care, contribute to higher consumption of health and hygiene products and, consequently, packaging demand. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing health & hygiene packaging which is estimated to drive the global health & hygiene packaging market over the forecast period.

Health & hygiene packaging refers to the specialized packaging solutions designed to protect, contain, and deliver products related to health and personal hygiene. This type of packaging is crucial for ensuring the safety, efficacy, and quality of products used in healthcare and hygiene contexts. Packaging for medications, including tablets, capsules, liquids, and injectable, needs to ensure product stability, dosage accuracy, and tamper evidence. Packaging for medical devices, such as surgical instruments and diagnostic tools, must maintain sterility and protect against contamination and damage.

Packaging for medical devices, such as surgical instruments and diagnostic tools, must maintain sterility and protect against contamination and damage. Nutraceuticals packaging include vitamins, supplements, and other health-related products that require packaging to preserve potency and prevent contamination. Items like shampoos, conditioners, and soaps require hygiene packaging that ensures ease of use and prevents spills or leaks.

Effective health and hygiene packaging provides a barrier against environmental factors like moisture, oxygen, and light to maintain product stability and shelf life. Packaging often includes features to indicate if the product has been tampered with, ensuring consumer safety. In summary, Health & Hygiene Packaging encompasses a broad range of packaging solutions tailored to maintain the quality, safety, and efficacy of health-related and personal hygiene products. It combines functionality with regulatory compliance, consumer convenience, and increasingly, environmental sustainability. The packaging industry size is growing at a 3.16% CAGR.

AI can analyze consumer trends and forecast demand, enabling manufacturers to optimize production schedules, reduce waste, and better align inventory with market needs. AI-powered vision systems can detect defects in packaging materials and ensure consistent quality, reducing the risk of product recalls and ensuring consumer safety. AI can facilitate personalized packaging designs and features based on consumer preferences and usage patterns, enhancing user experience and engagement.

AI algorithms can optimize logistics and supply chain operations by predicting disruptions and recommending adjustments, leading to more efficient distribution and lower costs. AI can help in developing more sustainable packaging solutions by analyzing the environmental impact of materials and suggesting eco-friendly alternatives.

AI can enable smart packaging technologies such as sensors and Radio Frequency Identification (RFID) tags that provide real-time information on product condition and usage, improving consumer safety and product management. By leveraging these AI capabilities, companies in the Health & Hygiene packaging sector can achieve greater efficiency, innovation, and responsiveness to market demands.

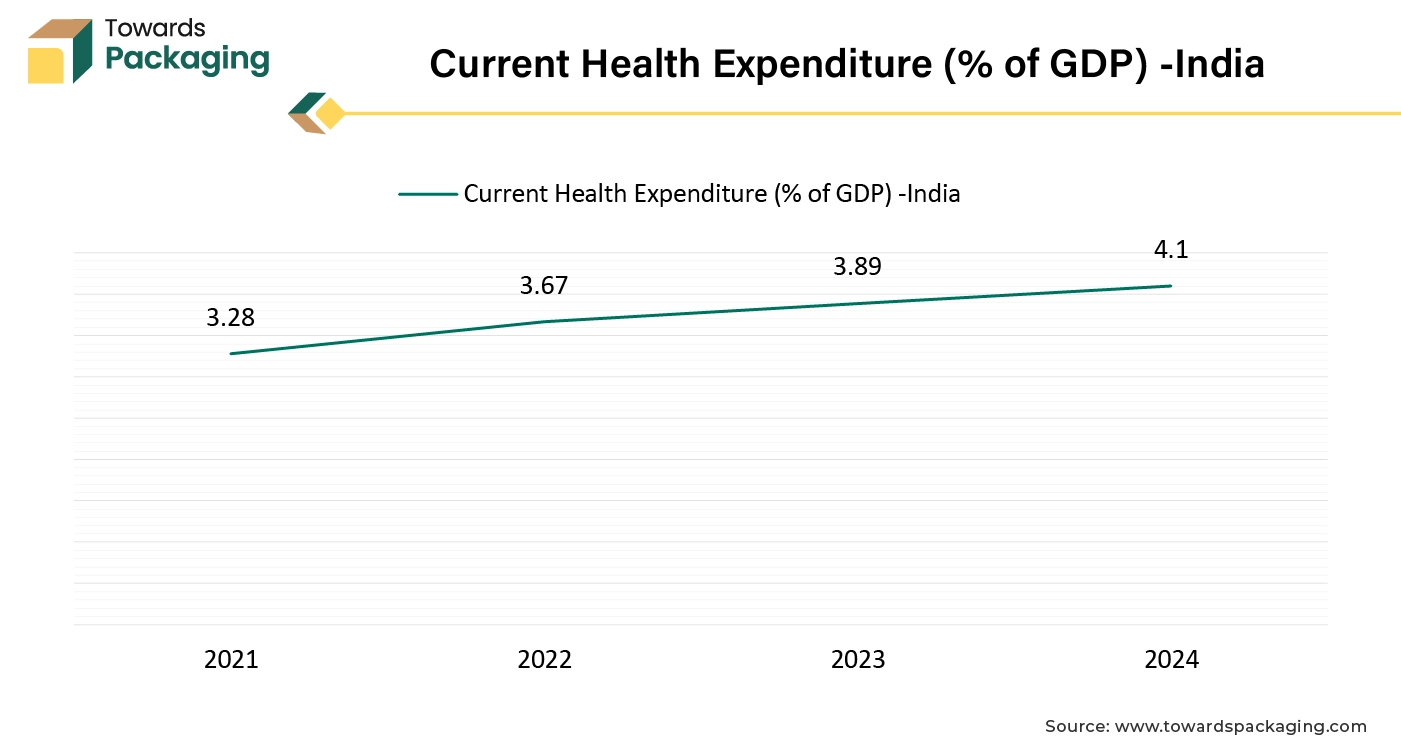

The expansion of the healthcare industry, including pharmaceuticals and medical devices, necessitates advanced packaging solutions to maintain product integrity. Rising global health issues and an aging population are leading to greater demand for medications and medical supplies. Higher spending on healthcare often leads to greater production of pharmaceuticals, medical devices, and other health-related products, increasing the need for diverse and high-quality packaging solutions. With more funds available, companies are likely to invest in advanced packaging technologies that enhance safety, efficacy, and user convenience, driving health & hygiene packaging market growth. Increased healthcare spending often results in a wider range of products, including specialty drugs and personalized treatments, which require specialized and sometimes more complex packaging.

Rising healthcare budgets can facilitate market expansion into emerging regions, driving demand for packaging that meets local regulations and logistical requirements. More expenditure can lead to stricter regulatory standards, necessitating more sophisticated and compliant packaging solutions. Higher healthcare budgets often lead to greater investment in packaging that improves patient safety, adherence, and ease of use, spurring market growth.

For instance,

The key players operating in the market are facing stringent regulatory challenges and strong competition within the market, which is estimated to restrict to the growth of the health & hygiene packaging market. Stringent regulations and compliance requirements can increase costs and complexity for manufacturers, potentially limiting market growth. Advanced packaging materials and technologies can be expensive, posing a barrier to market expansion, particularly for smaller companies. Issues such as raw material shortages or logistical challenges can impact production and delivery, affecting market growth.

Increasing pressure for sustainable packaging solutions can lead to higher costs and complexity, which may deter investment in traditional packaging options. Slow adoption of new technologies or limited innovation in packaging solutions can restrict market development. Intense competition can lead to price wars and reduced profit margins, which might constrain growth opportunities for companies. Economic downturns or fluctuations can impact consumer spending on health and hygiene products, thereby affecting the packaging market.

The rise of online shopping for health and hygiene products increases the need for packaging that ensures product protection during transit and enhances customer experience. Increasing healthcare awareness and infrastructure development in emerging markets provide new avenues for growth in health and hygiene packaging. The heightened emphasis on hygiene and cleanliness, accelerated by global health events, drives demand for packaging that ensures safety and prevents contamination.

As demand for eco-friendly and recyclable materials grows, investing in sustainable packaging options can attract environmentally conscious consumers and comply with regulations. The key players operating in the market are focused on launching sustainable packaging for health & hygiene packaging products to meet the consumers demand, which is estimated to create lucrative opportunity for the growth of the health & hygiene packaging market in the near future.

For instance,

A mono-material polyethylene (PE) laminate that works with a variety of package types is the latest packaging option. For 3D thermoformed packaging, which are used for drapes and protective materials, catheters, injection and tubing systems, etc., it can replace non-recyclable lidding with recyclable lidding. The laminates could also be used in 2D bags holding items like gloves and supplies for treating wounds.

On September 10, 2024, PakTech, a company focused on manufacturing of 100% recyclable injection molded handles unveiled the launch of the TwinKlip Applicator. With the release of the Twinklip Applicator, PakTech hopes to offer 'precise, consistent, and automatic' application of PakTech Twinklip Handles to a range of products, including body wash, conditioner, and shampoo. The device appears to feed loose bottles via a single-file conveyor, applying one Twinklip Handle automatically to each pair of bottles. With the application, which PakTech claims can process 12 bottles per batch at 10 cycles per minute and has a 15% overspeed potential for brief bursts, the company wants to increase efficiency and streamline end-of-line operations. The Twinklip Applicator, according to the business, boosts production, decreases labor costs, and allows for the adjustment of several goods on a single machine without compromising speed.

The films and sheets segment held the dominating share of the health & hygiene packaging market in 2024. Films and sheets provide excellent barriers against moisture, oxygen, and contaminants, which is crucial for maintaining the integrity and safety of health and hygiene products. They are generally less expensive to produce and process compared to other packaging materials, making them a cost-effective option for manufacturers. Films and sheets can be easily customized in terms of size, thickness, and properties to suit various products, including wipes, bandages, and medical pouches.

Films and sheets can be engineered to meet stringent regulatory requirements for health and hygiene products, ensuring safety and compliance. Advances in materials technology have led to the development of eco-friendlier films and sheets, addressing environmental concerns and aligning with the trend towards sustainable packaging solutions. The key players operating in the market are focused on introduction of the sustainable films for packaging healthcare & hygiene packaging products to meet the consumers demand which is estimated to drive the growth of the segment over the forecast period.

For instance,

The flexible packaging segment accounted for a significant share of the market in 2024. Flexible packaging is lightweight, easy to handle, and often features resealable options, making it highly convenient for both manufacturers and consumers. It generally requires less material and energy to produce compared to rigid packaging, leading to lower production and transportation costs. Flexible packaging can offer excellent barrier properties, helping to extend the shelf life of products by protecting them from moisture, light, and oxygen.

Flexible packaging allows for innovative and attractive designs, including custom shapes and sizes, which can enhance product appeal and branding. Many flexible packaging options are designed to be more sustainable, with advancements in recyclable and biodegradable materials contributing to reduced environmental footprints. Increasing consumer demand for convenient, portable, and resealable packaging solutions has driven the growth in flexible packaging.

Innovations in materials and manufacturing technologies have improved the performance and functionality of flexible packaging, making it suitable for a wide range of products. Flexible packaging can be engineered to meet stringent safety and regulatory requirements, ensuring it is suitable for diverse applications, including food, pharmaceuticals, and personal care products. These factors collectively contribute to the growing popularity and adoption of flexible packaging across various industries. The key players operating in the market are adopting inorganic growth strategies like collaboration to introduce the material/ technology for flexible packaging of healthcare and hygiene products is estimated to drive the growth of the segment over the forecast period.

For instance,

With the use of ProAmpac's flexible blown film technology and Aptar CSP's exclusive 3-Phase Activ-PolymerTMM technology, this next-generation platform technology creates a flexible packaging solution that is patent pending and absorbs moisture. In order to reduce the danger of degradation, preserve potency, and enhance product performance, this is the first in a series of active microclimate management packaging solutions.

The non-porous segment led the global health & hygiene packaging market. Non-porous materials provide effective barriers against contaminants such as bacteria, moisture, and oxygen. This protection is crucial for maintaining the sterility and efficacy of health and hygiene products. The non-porous nature of these materials helps prevent the infiltration of external contaminants, reducing the risk of infection and ensuring the products remain safe for use. Non-porous packaging assists to preserve the chemical stability and effectiveness of sensitive products, such as pharmaceuticals and personal care items, by preventing degradation caused by exposure to environmental factors.

Many health and hygiene products are subject to strict regulatory standards that require packaging to be non-porous to ensure product safety and integrity. Overall, the non-porous nature of the packaging materials aligns with the stringent requirements of the health and hygiene industry, providing safety, efficacy, and reliability. Increasing launch of the disinfectants has risen the demand for the non-porous packaging which is estimated to drive the growth of the segment in the near future.

For instance,

The tertiary segment registered its dominance over the global health & hygiene packaging market in 2024. The tertiary shipping form is extensively utilized for transporting large quantity of the hygiene products and medical devices to retailer and distributors from the manufacturing company. Tertiary shipping forms facilitate the efficient movement and handling of large quantities of goods. They streamline the loading and unloading processes, making logistics operations smoother and more cost-effective. These shipping forms provide additional protection to products during transportation. They help safeguard goods from damage due to rough handling or environmental conditions. By optimizing space and reducing the need for secondary packaging, tertiary shipping forms can lower overall shipping costs. They also help in maximizing storage space in transport vehicles and warehouses.

Tertiary packaging is often compatible with automated systems, such as conveyor belts and robotic systems, enhancing the efficiency of modern warehousing and distribution operations. Overall, the growing demand for tertiary shipping forms reflects their role in enhancing logistics efficiency, reducing costs, and supporting sustainability in supply chain management. Overall, the growing demand for tertiary shipping forms reflects their role in enhancing logistics efficiency, reducing costs, and supporting sustainability in supply chain management.

The hypermarkets/supermarkets segment accounted for a considerable share of the market in 2024. These retail formats attract a large number of customers, increasing the visibility and sales of health and hygiene products. They offer a broad selection of products under one roof, including various health and hygiene items, which meets diverse consumer needs. Hypermarkets and supermarkets often leverage economies of scale to offer competitive prices and promotions on health and hygiene products.

Their extensive network of locations provides convenient access to health and hygiene products for consumers, making them a preferred shopping destination. These stores employ effective in-store marketing and merchandising strategies to promote health and hygiene products, influencing consumer purchase decisions. Many hypermarkets and supermarkets offer private-label health and hygiene products, which can attract cost-conscious consumers and build brand loyalty. These factors combined create a favourable environment for selling health and hygiene packaging products.

The direct sales segment to grow at fastest rate over the forecast period. Due to shifting consumer tastes and business conditions, the direct sales distribution channel for personal care packaging is expanding. In order to build stronger relationships with customers, brands are using direct sales methods to provide individualized shopping experiences and access to exclusive products. With the growth of e-commerce platforms, direct-to-consumer sales are made easier by doing away with middlemen and simplifying distribution.

The home care & toiletries segment dominated the health & hygiene packaging market globally. Rising awareness about health and hygiene, driven by global health crises like the COVID-19 pandemic, has led to greater demand for home care and personal hygiene products. As living standards improve, more people can afford to invest in quality home care and toiletries, driving up demand. Population growth and urbanization increase the need for home care and personal hygiene products in households. Continuous innovation in product formulations and packaging enhances the appeal and effectiveness of home care and toiletries, attracting more consumers.

The expansion of e-commerce platforms makes it easier for consumers to access a wide range of home care and toiletries products, boosting sales. Busy lifestyles and increased focus on convenience drive demand for easy-to-use and effective home care and personal hygiene solutions. The key players operating in the market are focused on launching new toiletries and home care products in the market to meet the rising demand of the customers, which has observed to grow the need for health and hygiene packaging.

For instance,

North America region dominated the global health & hygiene packaging market in 2024. There is a growing emphasis on health and wellness, leading consumers to seek products that promise better hygiene and health benefits, which drives demand for specialized packaging. Enhanced awareness and practices around hygiene, particularly following the COVID-19 pandemic, have led to higher demand for packaging solutions that ensure product safety and hygiene. Advancements in packaging technology, including features like tamper-evident seals, child-resistant packaging, and sustainable materials, are attracting both manufacturers and consumers.

The growing preference for convenient, easy-to-use packaging options that offer longer shelf life and better product protection contributes to market growth. The key players operating in the market are focused on introduction of the services and products for manufacturing, packaging and commercialization of life science technologies and medical devices in the North America region.

For instance,

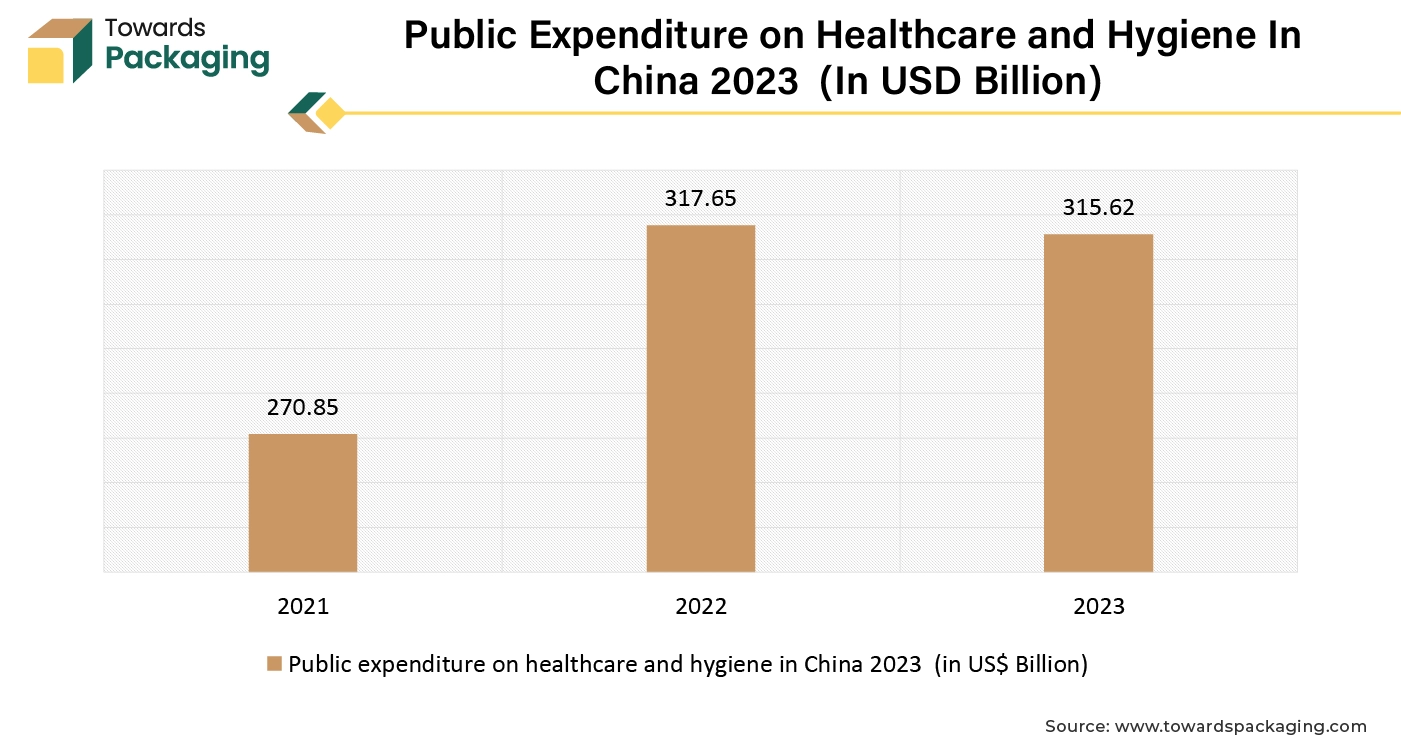

Asia Pacific region is projected to host the fastest-growing market in the coming years. Increasing health consciousness among consumers is driving demand for products that promise better hygiene and safety, which in turn boosts the need for specialized packaging. Rapid economic development and rising incomes in many Asia-Pacific countries enhance consumer spending power, leading to increased purchases of health and hygiene products.

Rapid urbanization in the region increases the demand for convenient and effective health and hygiene products, along with packaging solutions that cater to modern lifestyles. Enhanced infrastructure and logistics networks support the distribution of packaged health and hygiene products, making them more accessible across diverse markets. Moreover, the rising sales of pharmaceutical products along with the rising production of domestic pharmaceuticals is seen to promote the market’s growth. The following graph shows the overall increased sales of pharmaceutical products in China between 2021-2024.

The heightened focus on hygiene practices, partly due to recent global health crises, has spurred greater demand for packaging that supports health and safety. There is a rising preference for premium and innovative packaging solutions that offer added benefits, such as better preservation, ease of use, and sustainability. The key players operating in the market are focused on launching the sustainable packaging solutions for health & hygiene products which is estimated to drive growth of the health & hygiene packaging market in Asia Pacific region over the forecast period.

For instance,

By Product Type

By Form

By Structure

By Shipping Form

By Distribution Channel

By End-Use Industry

By Region

April 2025

March 2025

March 2025

March 2025