April 2025

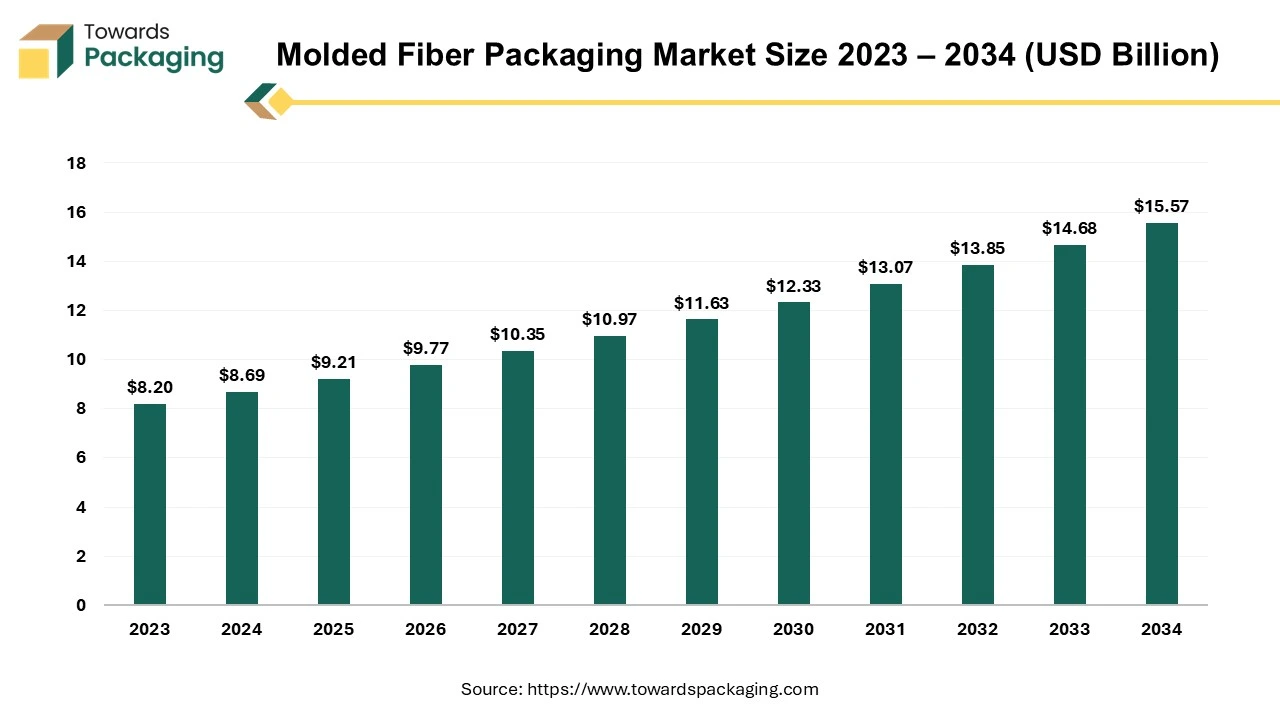

The molded fiber packaging market is forecasted to expand from USD 9.21 billion in 2025 to USD 15.57 billion by 2034, growing at a CAGR of 6% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advanced technology for manufacturing molded fiber packaging, estimated to drive the global molded fiber packaging market over the forecast period.

Molded fiber packaging, or molded pulp packaging, is a sustainable material made primarily from recycled cardboard, paper, or other natural fibers. It is formed by molding the fiber pulp into specific shapes and drying it, developing biodegradable and sturdy packaging solutions. The molded fiber packaging is made from recyclable and renewable materials, making it biodegradable and compostable. Molded fiber packaging can be molded into various shapes to protect products such as electronics, food, beverages, and more.

Molded fiber packaging offers good cushioning, making it suitable for fragile items. It is often used as a substitute for plastic or Styrofoam packaging. This packaging is increasingly popular due to growing environmental concerns and regulatory pressures to reduce plastic waste. The molded fiber packaging industry is experiencing significant growth, driven by sustainability trends, technological advancements, and increasing demand in the food and beverage, e-commerce, and electronics sectors.

Increasing environmental awareness has boosted demand for biodegradable and recyclable packaging. Molded fiber packaging, being eco-friendly and manufactured from renewable materials, aligns with this trend. Growing use of alternative materials like non-wood fibers (e.g., bagasse, wheat straw) to reduce dependence on traditional wood pulp. Development of enhanced compostable and biodegradable molded fiber products to meet stricter environmental regulations. The electronics industry is adopting molded fiber for its shock absorption and customization capabilities, making it suitable for protecting devices during transit.

Adoption of automation and AI-driven technologies to improve production speed, minimize waste, and enhance product quality. Innovations in thermoforming and other molding techniques for higher precision and durability. Rise in demand for aesthetically appealing and brand-customized packaging to improve product presentation in retail. Integrating embossed logos and creative shapes tailored to luxury goods and personal care industries.

Rising utilization in non-traditional sectors like healthcare, electronics, and automotive requires specialized designs. Development of molded fiber products for protective cases, medical trays, and industrial parts. Combining molded fiber with other sustainable materials, like recycled plastics or coatings, for improved durability and moisture resistance.

Integrating AI into the molded fiber packaging industry can drive significant growth and innovation through various enhancements in product design, production efficiency, and market adaptation. The integration of AI can monitor machinery to predict maintenance needs, reducing downtime and increasing production efficiency. AI-driven automation can streamline fiber molding processes, ensuring consistency and reducing waste.

Machine learning algorithms can analyze defects in real time, enhancing quality assurance and minimizing scrap rates. AI-powered software can optimize product designs for strength, material efficiency, and aesthetics, meeting the specific requirements of diverse industries. Generative design algorithms can develop innovative packaging solutions tailored to different applications, such as fragile electronics or heavy industrial goods.

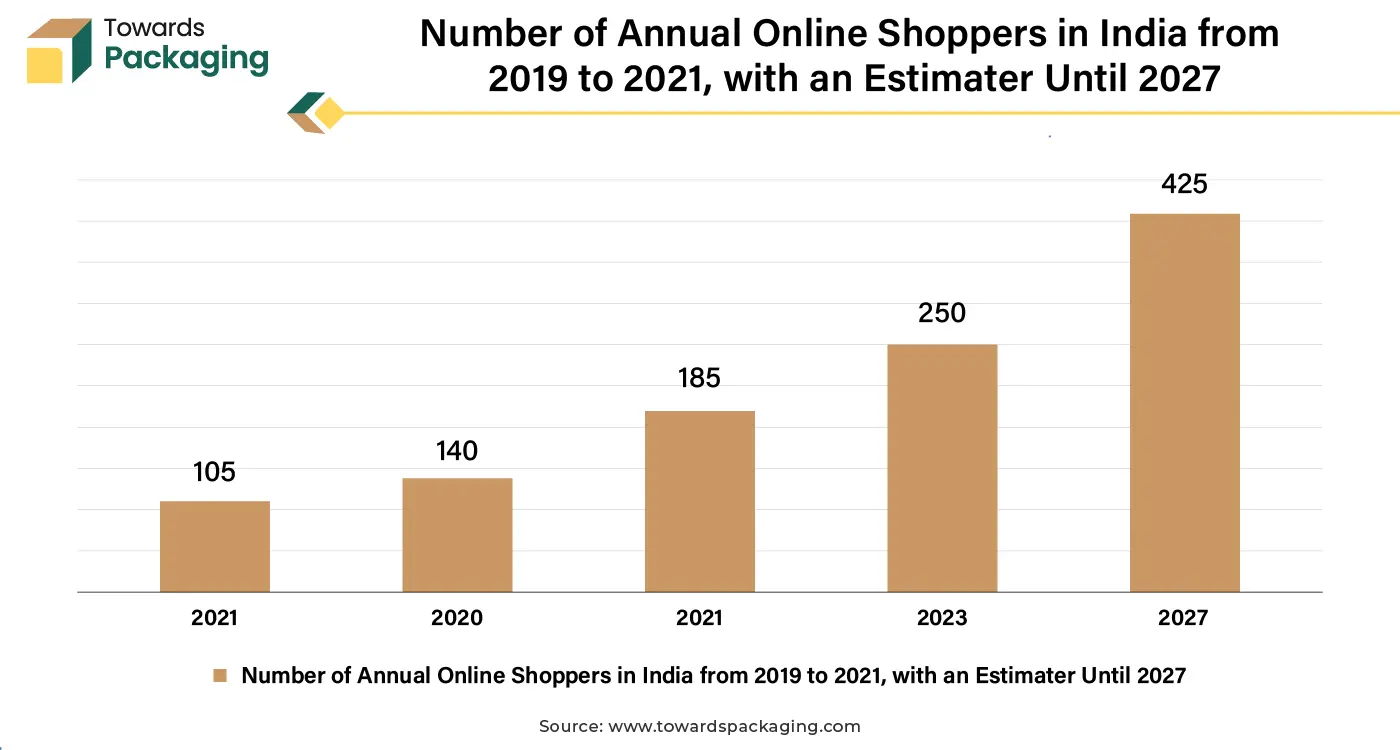

The rise of online shopping has created a demand for durable, lightweight, and protective packaging that minimizes environmental impact during shipping. E-commerce companies face consumer and regulatory pressure to adopt eco-friendly practices. Molded fiber packaging, being biodegradable and recyclable, aligns with these sustainability goals, making it a preferred choice for brands focused on reducing their environmental footprint.

According to the data published by the eCommerce Association of India (ECAI), in 2024, there will be 2.71 billion internet shoppers worldwide. This indicates that 33% of people worldwide shop online. Compared to the prior year, this is a 2.7% increase. By 2025, there will be 2.77 billion online shoppers, a growth in e-commerce driven by greater internet accessibility and convenience.

The major players operating in the market face issues in fulfilling regulatory norms and strong competition from the development of alternative materials restricts the growth of the molded fiber packaging market. The initial investment in machinery and energy-intensive drying processes can make molded fiber production costlier than plastic or other materials, particularly for smaller manufacturers. Dependence on paper and fiber materials, which can fluctuate in availability and cost, impacts production scalability and pricing.

Molded fiber products lack water resistance unless treated with coatings, which can reduce their compostability and add to costs. The material's flexibility and durability might not meet the requirements for all packaging needs, such as heavy-duty industrial applications. Other sustainable materials like biodegradable plastics and hybrid packaging solutions are emerging as competitors, offering similar benefits but with potentially lower costs or greater versatility.

Molded fiber packaging can be bulkier than alternatives, leading to higher logistics costs during shipping. Scaling up production to meet large-scale demand, especially in emerging markets, may be constrained by limited manufacturing infrastructure.

Developing new types of molded fiber, such as water-resistant or hybrid solutions can expand the use of molded fiber in diverse industries, including healthcare, electronics, and luxury goods. Rising innovation of new designs and materials has been estimated to create a lucrative opportunity for the growth of the molded fiber packaging market shortly.

Opportunities exist to penetrate markets like automotive, industrial goods, and healthcare by developing molded fiber solutions tailored to their needs. Governments worldwide are incentivizing sustainable manufacturing practices, offering subsidies and tax benefits to companies adopting eco-friendly packaging.

The packaging of alcoholic and non-alcoholic beverages (apart from milk, wine, aromatized wine, and spirits), transportation and sales packaging, and grouped packaging are all expected to meet specific reuse standards by 2030. Under specific circumstances, member states may grant a five-year exemption from these rules. It will be necessary for final distributors of drinks and food to allow customers to bring their containers.

Academic databases and reports released by governmental and non-governmental organizations, including environmental charities, were used to compile literature inside and outside the United Kingdom. Findings from a workshop with subject-matter experts from various industries, including government, manufacturing, and academia, were added to the evidence from the literature. Alternative materials and products (such as natural fires, biomass-based biopolymers, biopolymers made from bioderived monomers, and microorganism-produced biopolymers) were divided into two categories.

The transfer molded segment held a dominant presence in the molded fiber packaging market in 2024. Transfer molding allows for the creation of detailed, complex shapes and fine features, making it suitable for packaging products with intricate designs or delicate structures. The process produces a smoother surface on the packaging, enhancing its aesthetic appeal and making it suitable for applications where appearance is important.

This method ensures a consistent thickness and material distribution, minimizing material wastage and improving overall efficiency. Transfer molding is ideal for creating thin and thick-walled products, making it suitable for various uses, from protective cushioning to retail packaging.

These feature attributes make transfer-molded pulp packaging a preferred choice for consumer goods, food service, electronics, and more industries where sustainability and product protection are key concerns.

The trays segment accounted for a considerable share of the molded fiber packaging market 2024. Tray packaging can accommodate various products, from food items like eggs and fruits to industrial components and consumer goods. It provides excellent cushioning and support, protecting fragile items during storage and transit. Trays are extensively used in the food and beverage industry, particularly for packaging eggs, fruits, vegetables, and takeout meals. These sectors have a consistently high demand for molded fiber trays. Trays are relatively simple to design and produce in bulk, which keeps production costs low and makes them more accessible for extensive use.

The food & beverage segment registered its dominance over the global molded fiber packaging market in 2024. Consumers increasingly demand environmentally friendly packaging and molded fiber, which is biodegradable, recyclable, and compostable. Food and beverage companies are under pressure to adopt sustainable practices, and molded fiber packaging helps them reduce plastic use and meet sustainability goals.

Molded fiber packaging is safe for food contact and offers excellent moisture resistance when coated or treated, maintaining product quality. It protects fragile food items (such as eggs) during transportation and storage. Molded fiber packaging is cost-efficient for large-scale food and beverage operations due to its low production costs and the availability of raw materials like recycled paper and agricultural residues.

These factors, combined with the global trend toward cutting down on our collective carbon footprint and overall environmental impact, make the food and beverage sector a major contributor to the growth of the molded fiber packaging industry.

Asia Pacific dominated the molded fiber packaging market in 2024 and is observed to sustain the position during the forecast period. As urban areas expand and industries grow awareness of the environmental impact of traditional packaging materials like plastic increases.

Countries like China, India, and Japan are introducing bans or restrictions on single-use plastics, driving the shift to eco-friendly packaging like molded fiber. The rapid expansion of e-commerce and online food delivery platforms in Asia-Pacific has significantly increased the need for protective, sustainable, and durable packaging solutions. Consumers and companies are seeking alternatives to plastic, boosting the adoption of molded fiber packaging.

Asia-Pacific has a rich supply of raw materials, such as agricultural residues (e.g., sugarcane bagasse wheat straw) and recycled paper, essential for producing molded fiber. The availability of low-cost labor and raw materials reduces production costs, making molded fiber packaging more accessible.

North America region dominated the global molded fiber packaging market in 2024. Consumers and businesses in North America are increasingly prioritizing environmentally friendly practices. Governments in the U.S. and Canada have introduced stringent regulations on single-use plastics, driving demand for biodegradable and recyclable molded fiber packaging. North America has well-established manufacturing capabilities and access to advanced technologies for producing high-quality molded fiber packaging. Innovation in design and production processes enables manufacturers to meet diverse industry needs efficiently.

By Pulp Type

By Product Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025