March 2025

Principal Consultant

Reviewed By

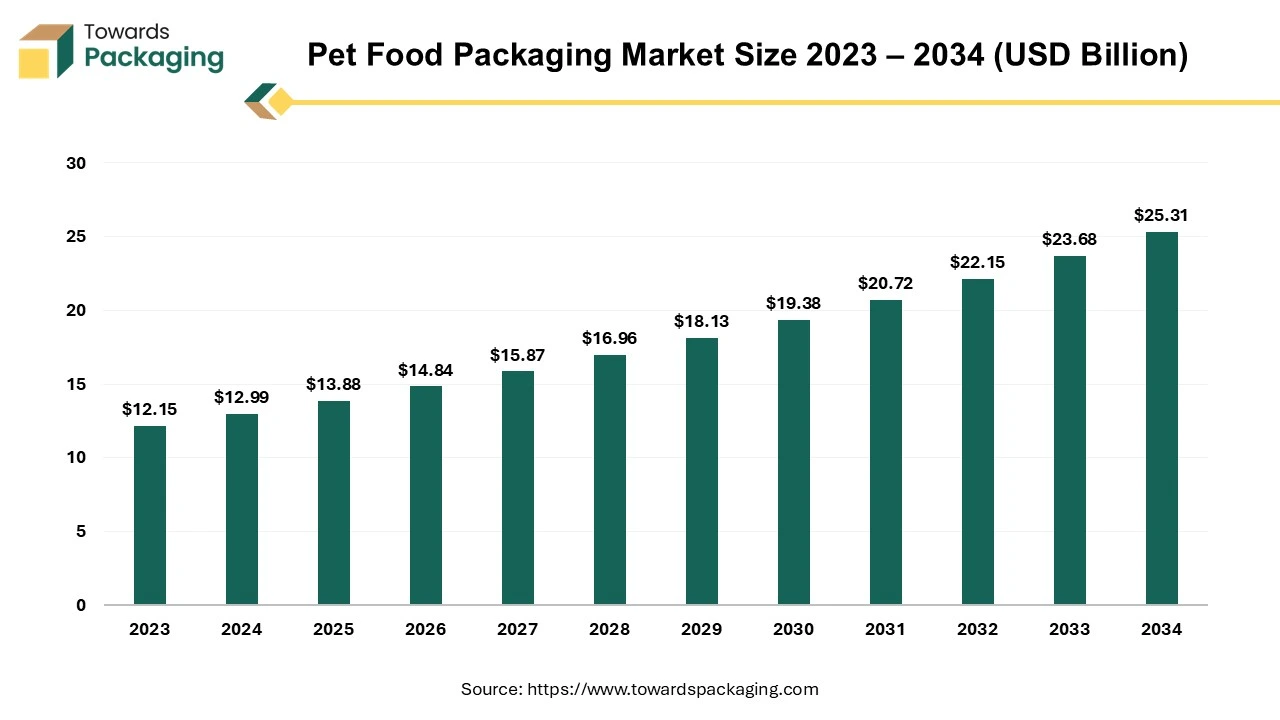

The pet food packaging market is projected to reach USD 25.31 billion by 2034, expanding from USD 13.88 billion in 2025, at an annual growth rate of 6.9% during the forecast period from 2025 to 2034.

Pet food packaging plays a vital role in safeguarding pet food products' integrity and nutritional value. Beyond its protective function, packaging is an essential source of factual and legal information for pet owners who seek to make informed choices about the food they provide for their pets.

Diverse packaging formats, including pouches, cans, bags, and trays, cater to various pet food types and consumer preferences. The materials employed in these packaging options range from paper and cardboard to plastic and aluminum. Manufacturers meticulously choose the most suitable material based on factors such as preserving freshness, ensuring hygiene, upholding safety standards, and adhering to sustainability principles.

Ultimately, the careful selection and design of pet food packaging contribute to the product's overall quality and longevity and the transparency and communication of essential information between pet food producers and consumers. This multifaceted role of pet food packaging underscores its significance in meeting the needs of both pets and their owners.

With the evolving social dynamics and the increasing tendency to regard pets as cherished family members, there has been a notable shift in the societal agreement. This shift has led to the rise of the premium pet food category as a logical outcome. As pets are increasingly seen as integral parts of families, the demand for higher-quality pet food that aligns with human dietary standards has surged.

This shift has prompted the growth of the premium pet food market and paved the way for the emergence of new brand players in the industry. Expanding premium pet food options has also increased product variations, resulting in a wider range of Stock Keeping Units (SKUs). This diversity in offerings has led to an innovative packaging landscape where dramatic and attention-grabbing packaging designs are becoming more prevalent.

As the pet food industry evolves to meet the changing expectations of pet owners who consider their pets as valued family members, the connection between premium pet food and creative, eye-catching packaging continues to strengthen. The interplay between shifting social norms, the demand for premium products, and impactful packaging designs are driving the evolution of the pet food industry and influencing consumer choices in this space.

Indeed, the pet food industry is undergoing significant transformations driven by evolving consumer preferences and regulatory advancements. Flexible packaging solutions and lightweight containers are gaining prominence due to their ability to combine premium product protection with high-definition printing. These packaging innovations cater to the growing demand spurred by increased pet ownership and consumer trends like wet treats, high protein content, and the inclusion of supplements.

As the US pet food production landscape evolves to meet safety standards established by the Food Safety Modernization Act (FSMA), packaging is taking on a role of transparency and authenticity. Packaging designs often incorporate features such as windows that allow consumers to view the actual food product inside, fostering trust and accountability. Furthermore, there's a shift towards highlighting natural ingredients prominently on the packaging to align with the increasing demand for healthier and more wholesome pet food options.

Integrating these packaging strategies aligns with the broader trends shaping the pet food industry – ensuring safety, responding to evolving pet food preferences, and fostering consumer trust through transparent packaging designs. As pet ownership continues to grow and pet owners prioritize their animals' well-being, packaging innovations are playing a pivotal role in enabling processors to effectively communicate product attributes and meet the changing needs of pet owners.

The pet food packaging industry has encountered a dual impact on product demand over recent months, stemming from the widespread lockdowns enacted in response to the global COVID-19 pandemic. The pandemic introduced various challenges to packaging manufacturers, which were initially expected to be temporary. Lockdown measures gave rise to disruptions across the supply chain, scarcity of raw materials essential for manufacturing, labor scarcities, volatile pricing that could affect production budgets, shipping complexities, and other associated issues.

Notably, the pandemic also catalyzed a discernible trend of increased pet adoption in select countries, India being a notable example. As individuals spent more time at home due to lockdowns and adherence to social distancing protocols, a noteworthy surge in pet adoptions emerged. Initiatives such as the adoption drive conducted collaboratively by The Hindu and Amazon Prime Video in April 2022 further accentuated this trend. This endeavor motivated individuals to welcome stray animals into their households. It emphasized the significance of adopting strays instead of acquiring expensive breeds, many of which may need to be better suited to the local climatic conditions.

The substantial escalation in pet adoption and the enduring trend of embracing pets as companions during the pandemic wield significant ramifications for the pet food packaging sector. With an increasing number of households adopting pets as integral parts of their lives, the demand for pet food packaging is poised for notable growth. Manufacturers and packaging providers stand to gain from this trend by addressing the packaging requisites of pet food products, ensuring their safety, extended shelf life, and resonance with pet owners.

Artificial intelligence (AI) is finding applications across different industries and packaging is no different. Slowly, AI has been making waves in the packaging industry with integrating this technology at different levels of production, supply chain, logistics and operations. The pet food industry is growing at an incredible rate, leading to rise in demand for reliable pet food packaging. With AI technology, it is easier to develop packaging material that is safe and ensures that the food value is not compromised. It can run tons of data combined with machine learning (ML), to help make the process less time consuming and accurate.

Smart packaging solutions ensure safety and efficiency of supply chain with helps keep up with the demand. Many manufacturers are trying to implement to AI as it increase efficiency of overall processes, cost-saving, optimization and safety, while opening up new avenues of growth for the pet food packaging industry.

Many key players of the pet food packaging industry are recognizing the need for emphasis on packaging solutions that add value to their brand and help in creating brand awareness. Innovative packaging solutions like smart packaging are helping change the traditional ways of packaging for manufacturers and consumers alike. With personalized nutrition becoming a part of life offer new opportunities like personalized packaging that could provide portion control, specific nutritional value etc., for example. It can also optimize the supply chain with RFID tags, freshness indicators or QR codes etc.

Such additions look to engage the consumers, making the process more interactive and help build brand loyalty. The constant innovations and upgrades to technologies like AI (Artificial Intelligence), and IoT (Internet of Things) will keep creating new dynamics for the pet food packaging market during the forecast period.

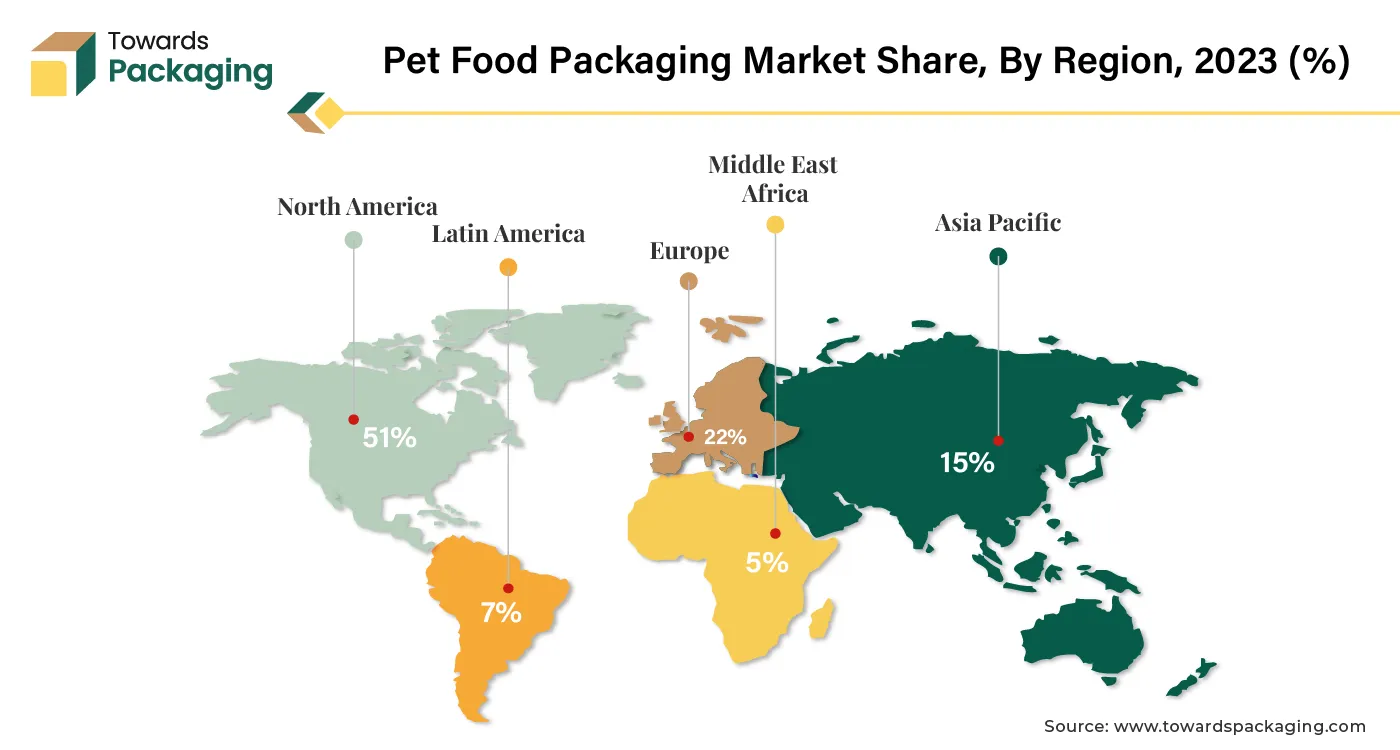

The North American region has established itself as a dominant global pet food packaging player, securing the largest market share. A notable trend among U.S. consumers, characterized by the inclination to treat their pets as integral family members, has driven a surge in the premiumization of pet food products and their corresponding packaging solutions within this geographical segment. The United States stands as the principal market in this region, with Canada following suit.

While the sale of packaging products for dog food has historically been robust, the industry is projected to experience heightened demand for packaging solutions designed for cat food. This shift can be attributed to the growing consumption of cat food products, particularly within the wet cat food segment. As a result, the foreseeable future is expected to witness a significant uptick in demand for packaging solutions tailored to cater to the evolving preferences within the pet food sector.

The escalating demand for pet food packaging within North America can be closely linked to the rising trend of pet adoption in the region, particularly the adoption of rescue dogs. Data from the National Pet Owners Survey of 2021-2022 conducted by the American Pet Products Association (APPA) underscores this connection. The survey reveals that approximately 71% of households in the United States, totaling around 91.5 million families, are proud pet owners.

The expanding prevalence of pet ownership, especially the growing number of households that have chosen to welcome pets, underscores a burgeoning market for pet food packaging solutions in North America. This surge in pet adoption translates into increased demand for high-quality and effective packaging options that cater to the diverse needs of pet owners while ensuring the safety, freshness, and convenience of pet food products.

The surge in pet and rescue animal adoption has sparked innovation within the packaging industry, particularly in premiumization and safety for pet food products. Manufacturers are leveraging packaging solutions to capture the attention of cat and dog owners who prioritize sustainable options, personalized pet diets, and appealing ingredients even to human sensibilities.

Pet humanization stands as a major transformative force within the pet care sector. A survey conducted by Mondi highlighted that 75% of respondents expressed an intent to increase spending and displayed a more positive disposition towards brands that embrace sustainable packaging practices. This emphasizes the growing resonance of sustainability in consumer preferences. Brands in the pet food industry actively seek packaging solutions that align with their corporate values, with sustainability ranking as a prime consideration.

The packaging requirements for dry pet food bags necessitate careful consideration. These bags must exhibit a unique construction: an interior layer that safeguards the contents and an exterior layer that boasts aesthetic appeal without permitting grease stains to permeate the inner layer.

In light of these needs, companies like Mondi offer innovative pet food packaging solutions, exemplified by products like BarrierPack Recyclable. These offerings encompass premade pouches and FFS (Form-Fill-Seal) roll-stock, employing recyclable plastic laminates that can be processed in regions where flexible packaging recycling is available, often through store drop-off programs. This commitment to sustainability is executed without compromising packaging functionality, presenting a comprehensive and forward-thinking approach to the evolving demands of the pet food industry.

Pet dogs in India have significantly transformed their role within households. Over the years, their status has evolved from that of a protective watchdog to that of a cherished and indispensable family member. This shift in perspective has also been mirrored in the changing behaviors of dog owners, which is evident in their expenditure patterns on dog food and care-related products.

Nevertheless, despite this evolving perspective, the penetration of packaged dog food in the Indian market remains relatively low, hovering around 11 to 13%. A considerable proportion of dog owners in India still opt to feed their pets home-cooked meals. This analytical piece delves into the intricacies of India's packaged dog food segment, exploring the dynamics that shape the preferences of dog owners and examining the factors influencing the market's growth trajectory. By assessing the nuances of this market, the analysis sheds light on the trends and challenges that impact the adoption of packaged dog food within India's unique cultural and economic context.

In India's dog food realm, Mars International emerges as the frontrunner, commanding a significant market share of 30%. This dominance is bolstered by its renowned brands, such as Eukanuba and Pedigree, which have garnered strong consumer loyalty.

The Indian market has recently attracted the attention of several new entrants aiming to capitalize on the evolving preferences of pet owners. Brands like Hill’s Science (a division of Colgate-Palmolive) and N&D (Farmina) are actively exploring opportunities to establish their presence in the Indian pet food landscape. Furthermore, Purina PetCare India Pvt Ltd has initiated its foray by introducing its Supercoat brand.

These developments exemplify the growing interest and competition within the Indian dog food market. As brands vie for consumer attention, this landscape is poised for transformation, marked by innovative offerings and heightened choices for pet owners seeking optimal nutrition and care for their canine companions.

The pandemic has notably influenced various facets of consumer shopping behaviour; however, sustainability remains a paramount concern and a prominent topic for consumers globally. Notably, the recent decline in carbon emissions from COVID-related restrictions has contributed to the amplification of discussions regarding sustainability and the envisioned trajectory in a post-pandemic context. This reinforces the enduring importance of environmental sustainability and stimulates contemplation on the shape of the future in a post-COVID landscape.

An analysis of European pet owners' purchasing patterns unveiled that a substantial majority, surpassing two-thirds, of pet owners in France, Germany, Italy, and the UK regard climate change and plastic pollution as the foremost environmental apprehensions. This sentiment marks a noteworthy shift, as the drive to diminish environmental impact increasingly eclipses price considerations as the primary determinant for purchase decisions among many consumers.

When presented with a scenario of selecting from four identical product packs boasting superior quality, taste, and health advantages for their pets, 91% of pet owners conveyed their willingness to incur additional costs for a packaging option that aligns with sustainability principles. This reflects a growing inclination among consumers to prioritize ecological responsibility and actively support packaging choices that contribute to a more sustainable future.

Research has also revealed that disregarding the significance of eco-friendly pet food packaging can jeopardize brand loyalty among pet owners. The findings emphasize that failing to address the environmental considerations of packaging choices can lead to a decline in consumers' attachment to a brand and their willingness to remain loyal. As sustainability becomes an increasingly central concern for consumers, a brand's failure to align with eco-friendly packaging practices could undermine its reputation and connection with environmentally conscious pet owners, ultimately impacting brand loyalty negatively.

78% of consumers express their readiness to switch brands to secure packaging that aligns with sustainability principles. Despite this inclination, many consumers need clarification on the sustainability information associated with pet care products. This presents an advantageous avenue for pet care brands to position themselves as sustainability advocates. Brands can leverage transparent and prominent logos and concise messaging to aid consumers in comprehending the sustainability attributes of various packaging options.

In this context, pet care brands can distinguish themselves as sustainability champions. By adopting clear and conspicuous logos and communication strategies, brands can facilitate consumers' understanding of the ecological merits of diverse packaging choices.

To further enhance their grasp of the comprehensive carbon footprint of their packaging and identify avenues for improving environmental performance, Amcor is equipped to offer pet care brands a packaging lifecycle assessment through ASSET, our certified lifecycle assessment methodology endorsed by the Carbon Trust. This provides brands an invaluable tool to comprehensively evaluate their packaging's environmental impact and foster sustainable product advancements.

The ongoing COVID-19 pandemic is expediting a transformation towards eCommerce that has already been redefining the pet care landscape. The imperative of social distancing has triggered a notable upsurge in online purchases and has catalyzed the expansion of novel business models, including direct-to-consumer solutions. This shift is reshaping the way pet care products are bought and sold, highlighting the increasing prominence of digital platforms in meeting consumers' pet care needs.

Prominent players in the pet eCommerce sector emerged as notable achievers in 2020. Chewy, Zooplus, and Pets at Home exceeded their initial online growth projections. Euromonitor's analysis reveals a projected decline of 4% in global store-based retail compared to the preceding year. This decline is attributed to pet owners progressively adopting the convenience of home delivery and recognizing the cost-effective advantages of a broader range of online product choices. This trend underscores the evolving shopping preferences of pet owners, favoring the flexibility and options offered by eCommerce platforms in contrast to traditional in-store purchases.

As the demand for online purchases of pet care products is anticipated to gain momentum in 2022 and beyond, it becomes imperative for brands to proactively prepare their primary packaging for the impending surge in eCommerce activities. Products shipped directly to consumers traverse a multitude of touchpoints, rendering them more susceptible to potential damage compared to traditional retail scenarios. It's worth noting that the average eCommerce package experiences approximately 17 instances of being dropped during its journey.

With this heightened risk profile in mind, brands are encouraged to enhance the robustness and protective attributes of their primary packaging. Reinforcing packaging designs to withstand the rigors of the eCommerce distribution process will be instrumental in ensuring products arrive intact and in pristine condition to customers. As the retail landscape evolves towards increased online engagement, fortifying packaging strategies is prudent for brands seeking to deliver an optimal and secure shopping experience.

Amcor inaugurated two state-of-the-art eCommerce testing laboratories, dedicated to the meticulous evaluation and validation of packaging solutions for clients across the globe. Within these facilities, our packaging experts subject packaging materials to rigorous testing procedures and subsequently certify them for efficacy. This initiative aligns seamlessly with Amcor's participation as an official member of the Amazon Packaging Support and Supplier Network (APASS). A noteworthy facet of our laboratories lies in their certification to conduct testing according to ISTA 6A standards, the International Safe Transit Association 6 certification, which is a coveted industry benchmark. This certification necessitates that packaging successfully clears a battery of tests meticulously designed to emulate the comprehensive journey a package undertakes from its origin to its eventual delivery at the recipient's doorstep.

Pet care brands that effectively adjust their strategies to align with the evolving patterns of consumer purchasing behaviour and provide an exceptional user experience are poised to emerge as victors in eCommerce. In this competitive arena, the brands that successfully navigate these changes and prioritize the seamless satisfaction of their customers will secure a winning position and attain prominence in the e-commerce landscape.

Caring for pets has evolved into a lifestyle choice for numerous individuals in today's fast-paced world. Given the demands of busy schedules and work commitments, pet owners seek adaptable solutions for effectively preparing, feeding, and tending to their beloved animals. Flexible packaging has emerged as a highly convenient option, presenting diverse user-friendly features.

Flexible packaging excels in providing an elevated level of convenience, catering to the needs of pet owners. This convenience is achieved through various technologies that facilitate easy opening and secure resealing, ensuring freshness and minimizing waste. Moreover, these packaging solutions often incorporate handles that enhance portability and enable comfortable carrying, while their durable formats occupy minimal storage space.

Adopting flexible packaging in the pet care industry addresses the modern pet owner's demand for practicality, efficiency, and ease of use. By offering solutions that streamline pet care routines and accommodate busy lifestyles, flexible packaging has become a preferred choice for those seeking a seamless and hassle-free approach to their pets' needs.

Freshness:

Sustainability:

Convenience:

A recent survey revealed that over 60% of pet owners in Belgium, Canada, France, the U.K., and the U.S. are willing to pay more for pet food products with environmentally friendly packaging. Despite this willingness, packaging professionals face significant challenges, including quality control and increased costs associated with sustainable packaging. The conflicting data on consumer willingness to pay more and industry difficulties highlights a tension between consumer expectations and practical realities.

The report examines two key aspects of sustainable pet food packaging: consumer willingness to pay for it and the challenges faced by packaging professionals. The survey provides insight into consumer attitudes towards sustainable packaging, while the Industrial Physics survey highlights the difficulties encountered in the industry.

The data was gathered through two surveys:

The survey results indicate a significant portion of pet owners are inclined to pay a premium for sustainable packaging, especially in the U.K. and France. However, this willingness is tempered by skepticism about the authenticity of sustainability claims. Packaging professionals face obstacles such as increased costs, quality control issues, and challenges in material performance. The ongoing evolution in sustainable packaging technology suggests that while the field is growing, it remains fraught with difficulties for both consumers and suppliers.

The analysis reveals a discrepancy between consumer demand for sustainable packaging and the practical challenges faced by the industry. While a majority of pet owners are willing to pay more for environmentally friendly packaging, the high costs and complex quality control processes create barriers. The industry's ongoing efforts to innovate and address these challenges will be crucial in bridging the gap between consumer expectations and practical implementation.

The pet food packaging market is undergoing a transformative shift characterized by a comparative evolution in packaging materials, design aesthetics, and sustainability practices. Traditional plastic packaging maintains a dominant presence due to its economic feasibility, while a discernible trend toward eco-friendly alternatives, such as biodegradable and recyclable materials, is shaping the industry's trajectory. Design preferences span from vibrant and illustrative to minimalist, reflecting varying consumer tastes.

Moreover, sustainability is a pivotal driver, compelling brands to adopt greener packaging solutions like compostable materials and reduced waste packaging. Amidst robust competition, established market leaders strive to innovate and incorporate sustainability, whereas emerging players capitalize on niche offerings to secure market niches. Globally, regions respond distinctively, with developed markets emphasizing eco-consciousness and emerging markets seeking cost-effective solutions. Successful engagement in this arena necessitates a nuanced understanding of these dynamics, ensuring relevance and competitiveness.

By Material Outlook

By Product Outlook

By Animal Type Outlook

By Application Outlook

By Region

March 2025

March 2025

March 2025

March 2025