April 2025

.webp)

Principal Consultant

Reviewed By

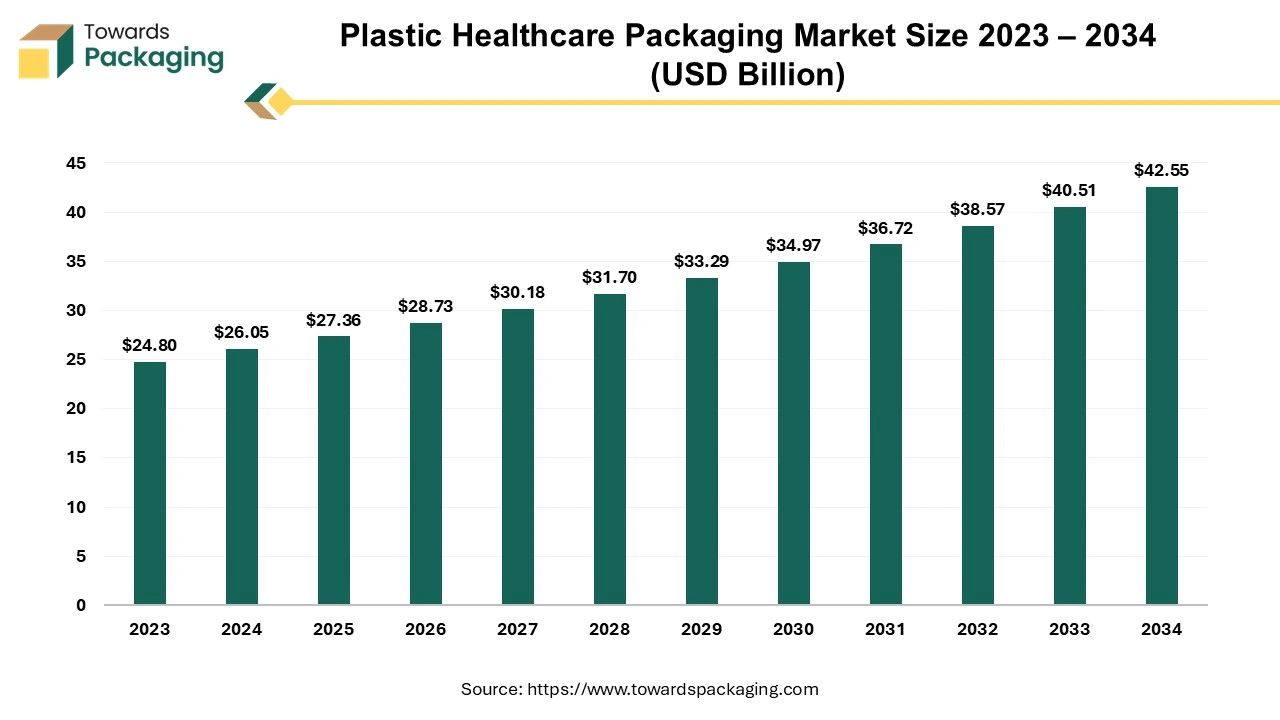

The plastic healthcare packaging market size is forecasted to expand from USD 27.36 billion in 2025 to USD 42.55 billion by 2034, growing at a CAGR of 5.03% from 2025 to 2034.

The key players operating in the healthcare sector are influenced by the benefits offered by the plastic packaging, which has risen the demand for the plastic healthcare packaging and is estimated to drive the growth of the plastic healthcare packaging market over the forecast period.

The science, art, and technology of enclosing or safeguarding goods for use, sale, distribution, and storage is known as packaging. Packaging also includes the process of creating, assessing, and designing packages. The affordable means of supplying presentation, protection, identity, information, convenience, compliance, integrity, and stability of the product is known as pharmaceutical packaging. The selection of materials used in pharmaceutical packaging is essential to ensuring the integrity, safety, and sustainability of the product for the environment.

The packaging is mainly divided into three types, primary packaging, secondary packaging and tertiary packaging. The material that first encloses and holds the product is known as primary packaging. This is typically the distribution or use unit that is the smallest; example a bottle, blister packs, and aerosol spray can. Outside of the primary packaging, secondary packaging may be used to bundle primary packages together.

Plastic bottles made of polyethylene terephthalate (PET) are becoming more and more popular as the industry's preferred packaging option. It is crucial to guarantee the safety and adherence of pharmaceutical packaging. Polyethylene Terephthalate (PET) plastic bottles adhere to the strict quality standards and legal criteria established by organizations such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA).

Artificial Intelligence (AI) is finding different uses in the packaging industry. The plastic healthcare packaging industry is embracing technological advancements. Using innovative technologies like – AI, there is an improvement in safety, accessibility and sustainability for the patients. AI integration has a lot of benefits for this industry. New tools like RFID tags, QR Codes, micro-electromechanical systems track, software for managing and maintaining patient records, medical adherence and even personalized medicine packaging are made possible with AI-based technology implementations. Counterfeiting is a serious issue in healthcare; technologies like blockchain have helped mount anti-counterfeiting efforts to ensure original and authentic medicines are reaching the consumers.

Easy-to-use package alternatives that enhance medication adherence are precisely modern patients seek. Market research indicates that single-dose packaging, child-resistant closures, and easy-to-open features are becoming more and more common. Personalized packaging that has precise directions and dosing information is also growing in popularity. This development is being driven by an increase in occurrences of chronic illnesses and an aging population. In an attempt to boost efficiency and enhance patient safety, the healthcare industry is implementing smart packaging. The latest packaging technologies include sensors and extra functionalities to oversee product quality, measure temperature and humidity, and provide instantaneous data for enhanced supply chain management.

For instance,

A recent expert survey reveals strong global support for cutting plastic production and addressing plastic pollution. Conducted across 19 countries, the survey highlights a significant public consensus on the need to tackle plastic waste and prioritize sustainable solutions.

The survey underscores a clear global demand for stronger measures to reduce plastic use and promote more sustainable packaging solutions.

Consignee: GRIFOLS THERAPEUTICS LLC

Consignee: SRC MEDICAL INC

Consignee: FARALLON BRANDS

Consignee: SIGMA ALDRICH CO LLC

Consignee: NIKON INSTRUMENTS INC

The bottles segment held the dominating share of the plastic healthcare packaging market in 2024. Pharmaceutical items are shielded from moisture, light, and oxygen by plastic bottles, which has excellent barrier qualities and keeps them stable and effective. This preserves the strength and caliber of drugs, guaranteeing that patients will benefit from them. Pharmaceutical products are shielded from moisture, light, and oxygen by plastic bottles, which has excellent barrier qualities and keeps the items stable and effective. This preserves the strength and caliber of drugs, guaranteeing that patients will get 100% drug efficacy from medicine stored in the bottle. As the plastic bottles are transparent, both patients and medical physician are able to visually examine the contents, confirm that labels are accurate, and look for any indication of contamination or tampering.

Increased safety and rise in the pharmaceutical supply chain are result of transparency provided by the plastic bottle usage. Due to their light weight, plastic bottles have a lower environmental impact and lower shipping costs. Owing to its longevity, there is less chance of harm during handling, transportation, and storage of medications. Pharmaceutical goods in a variety of forms and sizes, including liquids, powders, and solid doses, can be inserted into plastic bottles through moulding. By virtue of its adaptability, packaging solutions can be tailored to fit particular requirements and increase user convenience.

The vials & ampoules segment is estimated to grow at fastest rate over the forecast period. Plastic ampoules and vials are usually thin-walled plastic containers, which are filled and sealed using techniques like tip sealing or pull sealing. The method for opening the plastic ampoules is generally carried out by snapping off the upper neck of the container. The plastic vials and ampoules is right choice for storing unstable and chemically active elements as the seal protects the compound from degradation and contamination. Certain special grade of plastic is used for manufacturing the vials and ampoules, which is made up of low-density and high density plastic materials. Focusing on the key benefits offered by the plastic vials and ampoules the key players operating in the market are focused on developing new plastic material vials and ampoules which is estimated to fuel the growth of the segment over the forecast period.

For instance,

The blister segment is observed to be the fastest growing segment over the forecast period. Blister packs, also known as blister packaging, are pre-made materials for packaging that consist of a flexible top and a thermoformed plastic cavity. The substance is held within blister-like, deeply cut pockets or cavities in this kind of packaging. A heat seal is used to fuse the two structures together after a backing material, also known as lidding, is matched to the flat portion of the plastic cavity containing the object.

There are several forms of blister packaging, depending on the need. Blister packs are most commonly used for packing pharmaceutical items such tablets, lozenges, pills, and capsules. Owing to their inexpensive raw materials, quick operation, and low cost, they are also utilized in the packaging of consumer goods such toys, food, electronics, and equipment. The key players operating in the market are focused on launching new blister packaging which is expected to drive the growth of the segment over the forecast period.

For instance,

The Polyethylene segment held the dominating share of the plastic healthcare packaging market in 2024. The polyethylene material is mainly used in healthcare sector for packaging purpose. It is generally utilized in packaging of medical devices and pharmaceutical products, specifically for the production of bottles for liquid medicines. As the polyethylene material is precisely resistant to negative impact that the presence of oxygen could have on medicines, it is used widely for pharmaceutical products packaging. The key players operating in the market are focused on developing and launching the polyethylene material sustainable packaging for medical devices which is estimated to drive the growth of the segment over the forecast period.

For instance,

The polypropylene segment is expected to grow at fastest rate over the forecast period. Polypropylene is a multipurpose material that may be used for many different applications. It is also one of the most prevalent plastics used in packaging. Because of its strong and chemical-resistant qualities, it is particularly well-liked in the pharmaceutical sector. A form of thermoplastic utilized in many different sectors and applications is called polypropylene (PP). It is renowned for being strong, inexpensive, and versatile.

For instance,

The pharmaceutical segment held the dominating share of the plastic healthcare packaging market in 2024. The need for advanced packaging solutions is being driven by both the rapid urbanization and changing lifestyles that are leading to an increase in healthcare requirements due to the rising number of lifestyle disorders. Increasing launch of the new pharmaceutical medicines and tablets is rising the demand for the plastic packaging, as the plastic packaging is appropriate solution for restricting the reaction of product with container. The increasing need for packaging solutions, like blister packaging, for customized and precision medicine underscores the market's growth prospects over the forecast period. The key players operating in the market are focused on adopting the inorganic growth strategies like partnership to develop pharmaceutical packaging, which is estimated to drive the growth of the segment over the forecast period.

For instance,

The medical devices segment is expected to grow at fastest rate during the forecast period. The medical equipment must be packaged to reduce the chance that patients may be exposed to pollutants and residues. The package must guarantee that the contents remain sterile until they are broken. Systems for packaging non-sterile devices must preserve the product's purity and integrity. To prevent contamination of medical products and devices, the healthcare industry depends on this technology.

Medical equipment makers and institutions are guaranteed to adhere to industry norms through the use of sterile packaging. Assuring that medicinal product is safe and secure during transit and storage, as well as in pristine condition and ready to use when opened, medical device packaging is an essential step in the production process. Displaying essential product information and promoting a brand are two further uses for packaging. Product recalls, sterility loss, product damage, and reduced performance are all possible consequences of improper product packaging. Penalties, reputational harm, and expensive market delays are possible outcomes. Moreover, the key players operating in the market are focused on adopting inorganic growth strategies like collaboration for developing new packaging solution for addressing the challenges occurring while packaging the medical device, which is estimated to drive the segment over the forecast period.

For instance,

North America witnessed the highest revenue share for the year 2024 in the plastic healthcare packaging market owing to rapid technology advancements, high level of medical awareness, and a robust healthcare infrastructure. The need for sophisticated packaging solutions has been heightened by the notable rise in healthcare spending in the area. Pharma and medical device industries in North America have also made investments in creative and environmentally friendly packaging solutions due to strict regulatory requirements and a focus on sustainability.

The market will present profitable prospects for the players as long as the area prioritizes healthcare developments. The market's growth in North America is expected to be emphasized during the forecast period by the industry's increasing attention on the development and deployment of bioplastics and other sustainable packaging solutions. In addition, the presence of major important players in the region is contributing to the market's growth. One of the most advanced and contemporary industries in North America is the pharmaceutical industry. The key players operating in the market are focused on expansion of the production capacity to meet the increasing demand of packaging which is expected to drive the growth of the plastic healthcare packaging market in the North America region.

For instance,

Asia Pacific is the most fastest growing and lucrative market, significantly driven due to launch of the new product by the key players operating in market to meet high clinical needs. The region is expected to grow at the fastest rate in the market analysis due to the need for pharmaceutical and medical products in developing countries like China, India, Indonesia, and Malaysia, as well as the region's expanding middle class and discretionary money.

The increasing prevalence of kidney disease in Asia created a demand for novel treatments, including high-tech tools to improve care. Renal disease is on the rise in Asia due to rising incidence of diabetes and hypertension. Furthermore, the need for packaging film in the medical and healthcare sectors increased due to the emphasis on extending the life of medical supplies and equipment and eliminating the possibility of bacterial or viral contamination. Plastic medical packaging has grown rapidly in many developing countries, including China and India, because plastic healthcare packaging offer benefits like cost savings, sustainability, and product safety.

Furthermore, the Asia-Pacific region is expected to lead the market in terms of volume and value due to the region's strong industrial base, growing need for ecologically friendly packaging choices, and concentration of large manufacturers. Increasing initiative by the government to bring advanced technology in the Asia Pacific region for accelerating the production of the plastic medical packaging solution, which is estimated to drive the growth of the plastic healthcare packaging market in Asia Pacific region over the forecast period.

For instance,

Europe is expected to be experience a notable rate of growth during forecast period owing to increasing launch of the plastic medical packaging solution by the key players operating in the Europe region.

By Product Type

By Material Type

By Application

By Region

April 2025

March 2025

March 2025

March 2025