March 2025

.webp)

Principal Consultant

Reviewed By

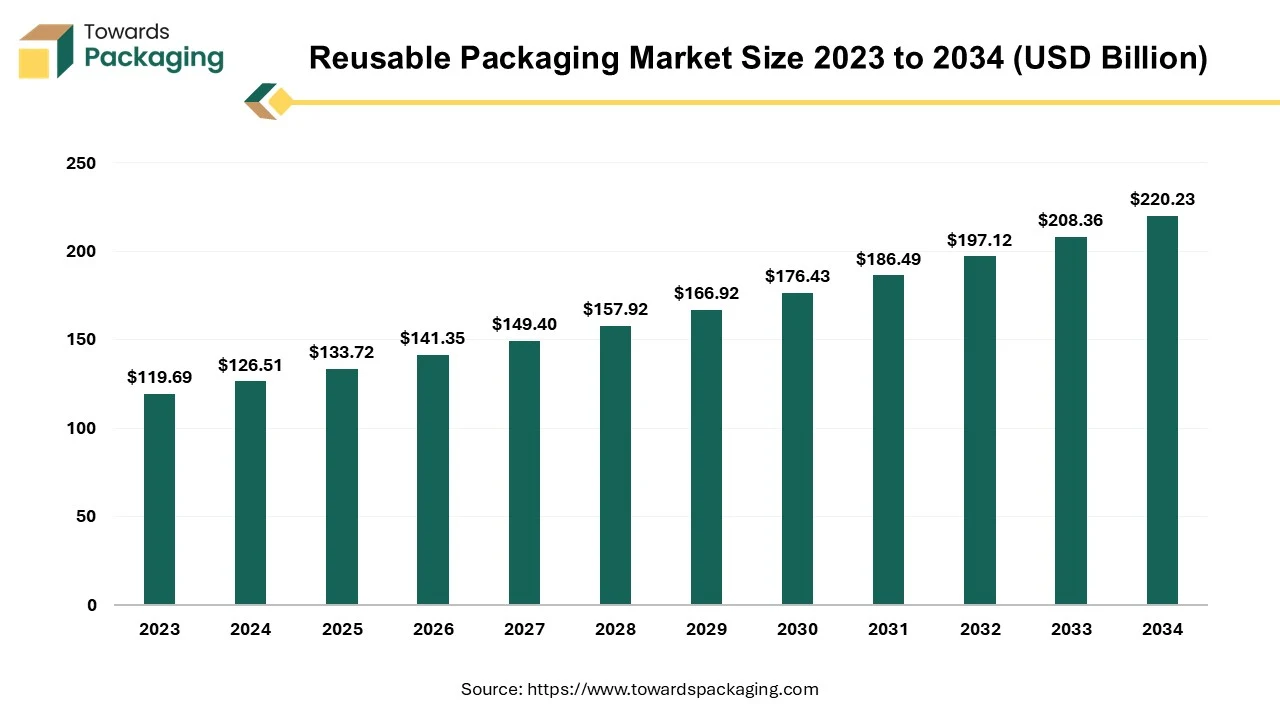

The reusable packaging market is projected to grow from USD 133.72 billion in 2024, with growth continuing from 2025 to 2034. The market is expected to reach USD 220.23 billion by 2034, expanding at a CAGR of 5.7%, driven by the adoption of circular economy principles and sustainable packaging.

Reusable packaging which can be considered one of the oldest packaging approaches still in operation, has faced significant displacement since the introduction of single-use packaging. The shift in focus toward factors like brand differentiation, convenience, and cost efficiency has contributed to its decreased prominence. Currently, reusable packaging finds its main application in specific segments within a limited number of countries, such as refillable beverage bottles.

However, mounting sustainability concerns voiced by regulatory authorities and consumers worldwide drive a renewed interest in reusable solutions across the packaging value chain. Although several startups and pilot initiatives have been launched, widespread adoption beyond specific segments or countries has yet to be achieved. Without a significant course change, our projections indicate that the global market will only achieve a penetration rate of 5% or lower by 2030. It's important to note that the actual penetration may vary across regions and end-use sectors.

It is important to note that historically, reusable containers and bottles were the prevailing packaging format. In the past century, large refill systems were commonly used for milk, wine, and beverages. However, the introduction of single-use packaging quickly became the preferred option due to its cost efficiency and brand differentiation potential. Consequently, reusable packaging experienced a decline in popularity, except in specific regions like the Nordic countries, Germany, and Latin America, where bottle deposit systems are in place.

Today, the landscape is shifting again, driven by growing consumer concerns regarding sustainability and increased regulatory pressure on single-use packaging, especially for products with low circularity and significant environmental impact. As a result, interest in reusable packaging has surged significantly. Many countries are now implementing national bans, taxes, and quotas to encourage the adoption of reusable packaging as an alternative to single-use options.

These initiatives are noteworthy examples of such efforts:

Furthermore, there has been a notable rise in the number of start-ups dedicated to developing reusable packaging solutions. These start-ups are actively piloting their innovations, primarily focusing on areas such as food and food service. However, they are also exploring new segments, such as beauty and personal care, where refill pouches are gaining traction in e-commerce. This surge in entrepreneurial activity indicates a growing interest and investment in reusable packaging across various industries, paving the way for more sustainable packaging options.

The increasing focus on packaging sustainability driven by regulatory requirements and consumer demand has sparked a renewed interest in reusability solutions throughout the packaging value chain. These solutions can reduce greenhouse gas emissions and minimize packaging waste by reducing the number of packages in circulation. This is achieved by enhancing packages' reusability and increasing the number of use cycles, often called "rotations."

However, several challenges hinder the widespread implementation of reusability within the current packaging value chain. These limitations are primarily associated with acceptance barriers, inadequate infrastructure, concerns regarding product safety, and cost considerations. To gain a comprehensive understanding of these complexities, this article examines the potential impact of reusability solutions across three key dimensions:

The global push for sustainability has increased interest in reusable packaging solutions across various industries. Reusable packaging offers a more environmentally friendly alternative to traditional single-use packaging, reducing waste generation and promoting a circular economy. This article will delve into the reusable packaging market, focusing on different materials used, their benefits, and the business implications. Plastic remains dominant in the reusable packaging market due to its durability and versatility. Reusable plastic containers and pallets are widely adopted in retail, logistics, and automotive industries. Plastic packaging can be easily cleaned, sanitized, and reused multiple times, minimizing the need for single-use options. However, it is crucial to prioritize using recyclable or biodegradable plastics to mitigate the environmental impact.

Using reusable materials to manufacture new plastic packaging results in reduced resource consumption, encompassing both energy and raw materials. As a result, there is a decrease in the emission of CO2 into the atmosphere, leading to a reduction in greenhouse gas emissions. The entire material is utilized in recycling plastics, allowing it to be repurposed and eliminating waste completely. Additionally, recyclable packaging occupies less storage and transportation space, further contributing to enhanced sustainability. The exceptional quality and properties of sustainable, flexible packaging guarantee the optimal preservation of the product, eliminating the necessity for repackaging.

Prominent corporations recognize societal expectations and concerns, and several major brands, such as Nestlé, have proactively announced initiatives to address the issue of packaging waste and its impact on the environment. These companies are dedicated to ensuring that none of their packaging finds its way into landfills or pollutes the surroundings. They have made a firm commitment to making their packaging materials completely recyclable or reusable, thereby effectively tackling the problem of plastic waste.

Europe has established itself as the frontrunner in the reusable packaging market, commanding the largest market share. This notable position can be attributed to a combination of factors:

One of the key drivers propelling market growth in Europe is the increased demand for sustainable packaging solutions. This growing preference for sustainable alternatives is driven by the desire to reduce waste generation and minimize the overall carbon footprint. As a result, the European market experiences substantial revenue growth as businesses and consumers actively seek environmentally conscious packaging options.

Each individual in Europe generates nearly 180 kg of packaging waste annually. Packaging constitutes a significant proportion of the consumption of virgin materials, with 40% of plastics and 50% of paper used in the European Union (EU) allocated for packaging purposes. Without intervention, the EU is projected to witness a further 19% increase in packaging waste by 2030, with plastic packaging waste expected to surge by 46%.

The new regulations introduced aim to reverse this trend. For consumers, these rules ensure the availability of reusable packaging alternatives, eliminate unnecessary packaging, restrict excessive packaging, and provide clear labelling to facilitate proper recycling. These regulations create fresh business opportunities for the industry, particularly for smaller companies. Additionally, they reduce reliance on virgin materials, enhance Europe's recycling capacity, and decrease dependence on primary resources and external suppliers. Ultimately, these measures propel the packaging sector towards achieving climate neutrality by 2050.

The retail landscape has a specific influence on the selection and design of packaging. The retail market is experiencing significant changes, driven by the rising popularity of e-commerce and the increasing demand for online grocery ordering and home delivery services. However, the shift to home delivery has led to concerns regarding excessive packaging material usage, prompting the development of various concepts to mitigate this issue. Despite these efforts, a comprehensive analysis of the packaging implications stemming from the transition to e-commerce still needs to be better understood.

One potential impact is the reduced significance of marketing in packaging design. With the shift to e-commerce, the traditional role of packaging as a marketing tool may diminish as consumers rely more on online descriptions and visuals rather than physical packaging. Additionally, primary packaging design may need to be optimized for e-commerce distribution, often resulting in additional packaging materials to ensure safe and secure shipping to the end consumer.

On the other hand, e-commerce presents opportunities for innovative service concepts and distribution models. Packaging can be reimagined to support these new approaches, such as exploring more sustainable packaging solutions that align with the service-based nature of e-commerce and the specific requirements of online distribution.

Overall, the implications of e-commerce on packaging design and distribution are still evolving, and further exploration is needed to fully understand the potential opportunities and challenges that arise from this shifting retail landscape.

This scenario focuses on the non-food e-commerce sectors, specifically industries such as fashion, electronics, and beauty products. Germany's e-commerce market stands as one of the largest in Europe, boasting an impressive annual delivery volume of approximately 2.3 billion shipments. However, the adoption of reusable packaging within this market segment is minimal, with only a few isolated instances and an extremely low market penetration rate.

To address this situation, we conducted an in-depth model analysis that explores the transition from conventional padded-paper mailer bags and boxes to more sustainable protective-plastic mailer bags or boxes made from recyclable polypropylene (PP) materials. In our modeling approach, we established strategically located collection points near residential areas to efficiently gather reusable items for subsequent redistribution in subsequent usage cycles without incorporating a dedicated washing stage.

Our model analysis reveals a significant increase in transportation requirements due to the necessity of returning packaging materials to reusable packaging operators, third-party logistics centers, or distribution centers. In fact, for packages that undergo 20 rotations, transportation costs are projected to account for over 75 percent of the total expenses while contributing to more than 65 percent of the overall carbon dioxide (CO2) emissions.

Based on the comprehensive e-commerce modeling conducted, it becomes evident that reusable packaging solutions exceeding 20 rotations present a competitive advantage from an environmental perspective. It is important to note, however, that additional rotations may be required if the cleaning operations associated with the reuse process result in higher emissions.

The reusable packaging market is characterized by a highly competitive landscape, with several key players vying for market share and driving innovation. Prominent companies have invested heavily in research and development to create innovative and sustainable packaging solutions that cater to diverse industries and customer demands. However, the market also presents opportunities for emerging players who offer niche reusable packaging solutions that address specific industry requirements. Additionally, collaborations and partnerships between packaging manufacturers, retailers, and logistics providers have become increasingly prevalent, fostering the development of comprehensive and efficient reusable packaging ecosystems. As sustainability continues to be a key focus for businesses and consumers alike, the reusable packaging market is expected to witness steady growth and further competition as companies strive to deliver environmentally friendly and cost-effective packaging solutions.

By Material

By Type

By End-Use

By Region

March 2025

March 2025

March 2025

March 2025