March 2025

.webp)

Principal Consultant

Reviewed By

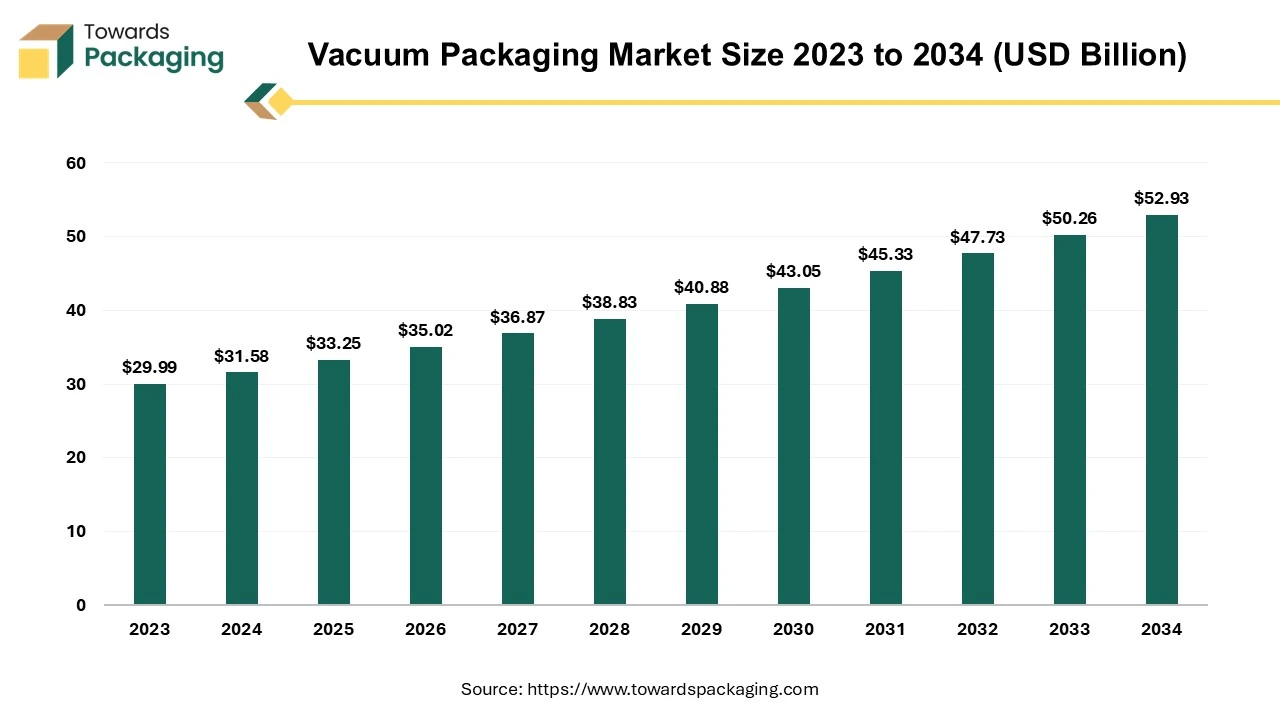

The vacuum packaging market size is forecast to grow from USD 33.25 billion in 2025 to USD 52.93 billion by 2034, driven by a CAGR of 5.3% from 2025 to 2034.

A vacuum packaging method is used to remove air from a package. The packaging may be made up of both flexural and rigid types. The intent is to prolong the shelf life of foodstuffs and, with flexibility, to remove oxygen from the container. Package forms are used to reduce the volume of contents and packages.

Vacuum packaging lowers atmosphere oxygen, which inhibits the evaporation of volatile components and limits the growth of aerobic bacteria or fungi. Long-term storage of food commodities, including cereals, cheese, almonds, cured meats, coffee, smoked salmon and crunchy potato chips. Because it prevents bacterial growth, vacuum packaging may also be used for a shorter duration to keep fresh items, including meats, vegetables, and liquids. A food preservation method that is quite useful in the contemporary retail trade is vacuum packaging.

Many microorganisms that need oxygen to develop are slowed down in size by this kind of packaging. Anaerobic bacteria can multiply in an oxygen-depleted environment, which could lead to problems with food safety. Yersinia enterocolitica, Listeria monocytogenes, and the spore-forming non-proteolytic Clostridium botulinum are a few pathogens to be concerned about in vacuum-packed foods. To stop the growth of anaerobic microbes, vacuum packing is frequently employed in conjunction with other food processing methods like retorting or chilling.

Vacuum packaging is widely used in the food sector, pharmaceuticals, and other industries. Due to the growing population, high incomes, changes in lifestyles, and an increase in media access by means of the Internet, T.V., and economic growth, demand for packaging is rising. The global packaging market is valued at 79 billion U.S. dollars and growing at a rate of between 15 and 17%.

| Trends | |

| Advancements in Packaging Technology | Ongoing advancements in packaging technology, including vacuum packaging machinery, are helping to improve the efficiency and effectiveness of the packaging process. Automation, intelligent packaging solutions, and innovations in materials are contributing to this trend. |

| E-commerce and Direct-to-Consumer (DTC) Impact | The rise of e-commerce and direct-to-consumer models has influenced packaging requirements. Vacuum packaging helps protect products during transportation and ensures they reach consumers in optimal condition, which is crucial for the e-commerce sector. |

| Increased Demand for Extended Shelf Life | One of the primary trends for vacuum packaging is the desire to extend the shelf life of products. Consumers and manufacturers alike are increasingly focused on reducing food waste, and vacuum packaging helps preserve the freshness of food for a longer duration. |

| Rising Popularity of Convenience Foods | The trend towards convenience foods, including ready-to-eat meals and snacks, has driven the demand for vacuum packaging. Consumers are looking for packaging solutions that maintain the quality and flavour of convenience foods. |

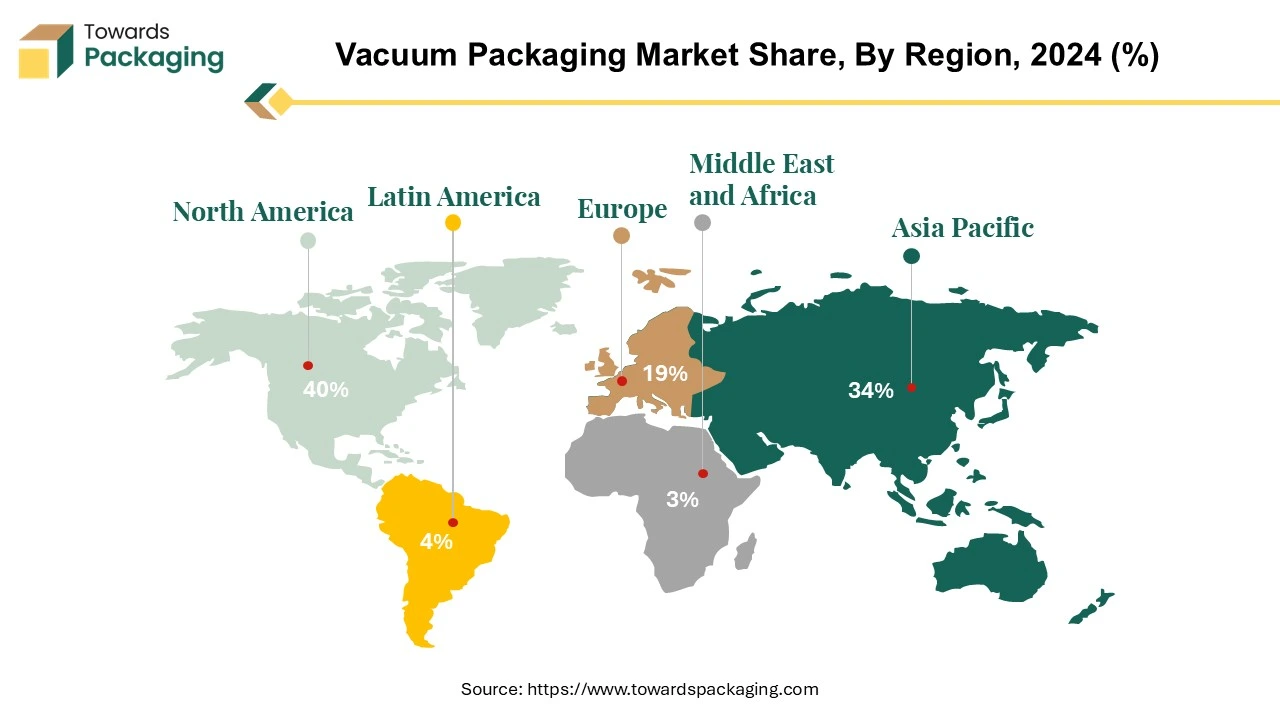

North America emerged as a dominant force, wielding significant influence, and shaping the industry's trajectory. Several factors contribute to the region's supremacy, reflecting economic strength, technological prowess, and a robust demand for advanced packaging solutions. North America, comprising the United States and Canada as primary contributors, boasts a thriving economy characterized by diverse industries and consumer markets. The region's economic prosperity has fostered a culture of innovation and investment in cutting-edge technologies, including packaging-related ones. With a discerning consumer base that values convenience and product integrity, the demand for effective vacuum packaging solutions has surged, driving the market's expansion.

North America stands at the forefront of technological advancements, particularly in the vacuum packaging sector. The region's commitment to research and development has led to the creation of state-of-the-art packaging machinery and materials. Advanced vacuum packaging technologies, such as modified atmosphere packaging (M.A.P) and vacuum skin packaging (V.S.P.), find widespread adoption in North American industries, further solidifying the region's dominance in the global market.

The vacuum packaging market in North America is subject to stringent regulatory standards that ensure the safety and quality of packaged goods. Government agencies, such as the Food and Drug Administration (F.D.A.) in the United States and the Canadian Food Inspection Agency (CFIA), set rigorous guidelines for packaging materials and processes. The adherence to these standards not only enhances the credibility of North American products but also propels the development and adoption of innovative vacuum packaging solutions.

North America's vacuum packaging dominance extends across diverse industries, including food and beverage, pharmaceuticals, and electronics. In the food sector, vacuum packaging plays a pivotal role in developing the shelf life of perishable goods, reducing food waste, and meeting the evolving needs of consumers for convenient and sustainable packaging. Similarly, in the pharmaceutical and medical industries, vacuum packaging ensures the preservation and sterility of sensitive products, contributing to healthcare solutions' overall safety and efficacy.

American companies engaged in vacuum packaging have positioned themselves as global leaders, leveraging their expertise to cater to international markets. North American manufacturers' competitiveness and ability to meet the diverse packaging requirements of a worldwide clientele have fuelled the region's export prowess in the vacuum packaging sector.

North America's dominance in the vacuum packaging market results from various factors, including economic strength, technological innovation, regulatory compliance, and versatility across multiple industries. As the region advances packaging solutions, its influence on the global vacuum packaging market is expected to endure and evolve with changing consumer preferences and industry dynamics.

The Asia Pacific region has emerged as a powerhouse in the vacuum packaging market, asserting its leadership through robust economic growth, expanding industrial sectors, and a burgeoning demand for advanced packaging solutions. This region, encompassing countries such as China, India, Japan, and others, is witnessing a transformative shift in its packaging landscape, with vacuum packaging playing a pivotal role.

The remarkable economic growth of several Asia Pacific countries has been a driving force behind the region's dominance in the vacuum packaging market. Rapid industrialization and an evolving consumer landscape have fuelled the demand for efficient and sustainable packaging solutions across various industries, including food and beverage, pharmaceuticals, and electronics. With a burgeoning middle class and changing consumer preferences, there is a heightened awareness of food safety, quality, and shelf life. This has led to increased adoption of vacuum packaging, which offers superior protection against external contaminants, extends the shelf life of products, and ensures the preservation of freshness — factors highly valued by discerning consumers in the region.

Asia Pacific is at the forefront of technological advancements, and this prowess extends to the packaging industry. The region has witnessed significant investments in research and development, leading to the implementation of cutting-edge vacuum packaging technologies. These innovations cater to the diverse needs of industries, driving efficiency and enhancing the overall quality of packaged goods. The robust growth of the food and beverage sector in Asia Pacific has been a significant catalyst for the surge in the vacuum packaging market.

As urbanization accelerates and lifestyles change, a growing demand for packaged and convenience foods is driving the need for advanced packaging solutions that ensure product freshness and integrity. To meet the escalating demand, domestic and international vacuum packaging players are strategically investing in the Asia Pacific region. Collaborations, partnerships, and mergers are becoming commonplace as companies seek to capitalize on the region's immense market potential and establish a strong presence in this rapidly growing market.

Asia Pacific's rise as the leader in the vacuum packaging market results from a confluence of factors, including economic vibrancy, technological prowess, shifting consumer preferences, and a thriving industrial landscape. As the region continues to witness sustained growth and development, it is poised to shape the future trajectory of the global vacuum packaging market.

Polyethylene is a cornerstone material in the vacuum packaging market, offering versatility and cost-effectiveness, making it a preferred choice for various applications. Today, plastic materials are used in almost 60% of packaging. In the industry, flexible plastic makes up 52.7%, P.E.T. accounts for 24.5%, and thin plastic containers make up 11.1%. Together, these three categories comprise approximately 90% of newly packaged goods. Plastics are predicted to increase by more than 228 billion new units by 2024.

Comprising both Low-Density Polyethylene (LDPE) and High-Density Polyethylene (H.D.P.E.), P.E.caters to the diverse needs of vacuum packaging. LDPE, recognized for its flexibility, is extensively utilized in producing plastic films and bags tailored for vacuum packaging. This flexibility proves invaluable, particularly when packaging irregularly shaped items, allowing the material to conform seamlessly to the product's contours. On the other hand, H.D.P.E., with its higher density, provides a sturdier structure, making it suitable for applications where rigidity is paramount.

One of the standout features of P.E. in vacuum packaging is it's transparency. LDPE films offer clarity that allows for easy visibility of the packaged product. This transparency not only enhances the visual appeal of the packaging but also provides consumers with a clear view of the contents, contributing to a positive consumer experience. Beyond its physical attributes, P.E. also serves as an effective barrier against moisture, safeguarding the integrity of the packaged items. In the competitive landscape of vacuum packaging, the cost-effectiveness of P.E. further solidifies its position, making it an attractive choice for businesses aiming to balance performance with economic considerations. Whether preserving the freshness of food products or ensuring the protection of various items, Polyethylene's adaptability continues to make it a leading player in the realm of flexible packaging solutions within the vacuum packaging market.

In the expansive realm of the food and beverage industry, the packaging sector plays a pivotal role, employing an array of materials and technologies to enhance the protection and preservation of products. A standout player in this landscape is vacuum packaging, which has become a global imperative owing to its multifaceted advantages. The demand for vacuum packaging is set to cover an estimated 73% of the projected 200 billion fresh packs by 2025, underscoring its integral role in the packaging domain. Specific segments emerge as dynamic forces driving production volumes within the food and beverage industry.

Notably, soft drinks, dairy products, and confectionery are poised to be the most significant contributors, collectively accounting for a substantial share of the 200 billion fresh packs. Among these segments, the sugar sector is anticipated to take the lead, foreseeing a significant growth of 60 billion pieces at a commendable 5.4% Compound Annual Growth Rate (CAGR). Additionally, confectionery and yoghurt segments are set to contribute significantly, projecting growth rates of +3.9% and 3.9%, respectively. Other sectors like salty snacks, rice, milk alternatives, oils, cookies, and fresh milk are also experiencing notable growth trends.

The spotlight is on natural liquid water in the beverage world, which is expected to dominate with over 57 billion new packs. While the quantity may be smaller, ready-to-drink (RTD) beverages are positioned for exceptional performance, projecting a remarkable +8% CAGR. Aromatized water, energy drinks, sports drinks, and carbonated water are also anticipated to perform well, each with its distinctive growth trajectory. The surge in the vacuum packaging market is a direct response to the escalating demand within the food and beverage industry. As consumer preferences evolve and awareness of sustainable packaging practices grows, vacuum packaging emerges as a critical solution, aligning with industry demands for extended product shelf life and preservation.

The symbiotic relationship between the food and beverage industry and the vacuum packaging market reshapes the packaging landscape. The strategic adoption of vacuum packaging technologies not only meets the demands of a dynamic market but is also poised to be a driving force in the evolution of sustainable and efficient packaging solutions for the foreseeable future.

The vacuum packaging market is characterized by intense competition because there are several key players, such as Amcor plc, Berry Global Group, Coveris Holdings S.A., Sealed Air Corporation, Schur Flexibles Holding GesmbH, the Vacuum Pouch Company Ltd., Winpak Ltd., Nemco Machinery A/S, Plastopil Hazorea Company Ltd., Allfo GmbH & Co. KG, Plastissimo Film Co., Ltd. And Klöckner Pentaplast. This market has a medium level of market concentration, and several major players are present, using tactics such as product innovation, acquisitions, and mergers to obtain a competitive edge.

The market players are significantly impacting environmental development by adopting sustainable packaging and creating awareness among consumers through innovative packaging materials. Amcor plc and Berry Global Group are lead players who have a global impact by reducing carbon through innovative packaging materials adopted by leading companies that started sustainable packaging by introducing vacuum packaging for food and beverage and several pharmaceuticals industries in their packaging and other materials.

By Material

By End Use

By Region

March 2025

March 2025

March 2025

March 2025