April 2025

The fiber-based bottles market is experiencing rapid growth, with revenue expected to reach hundreds of millions between 2025 and 2034.

The fiber-based bottles market is expected to witness substantial growth throughout the forecast period. Fiber-based bottles are sustainable packaging options that are mostly composed of plant-based, renewable resources like recycled paper fibers or wood pulp. These lightweight, biodegradable, and often recyclable bottles have been designed to replace standard plastic or glass bottles. This movement is spreading to new sectors and industries like medicine, health, and cosmetics, where fiber-based packaging has historically been relatively uncommon. Additionally, the production method emits less CO2 than that of plastic and other traditional alternatives. Fiber bottles can be used with water, adult beverages, dairy products, non-carbonated soft drinks, detergent, and products for skin and hair care, among other uses.

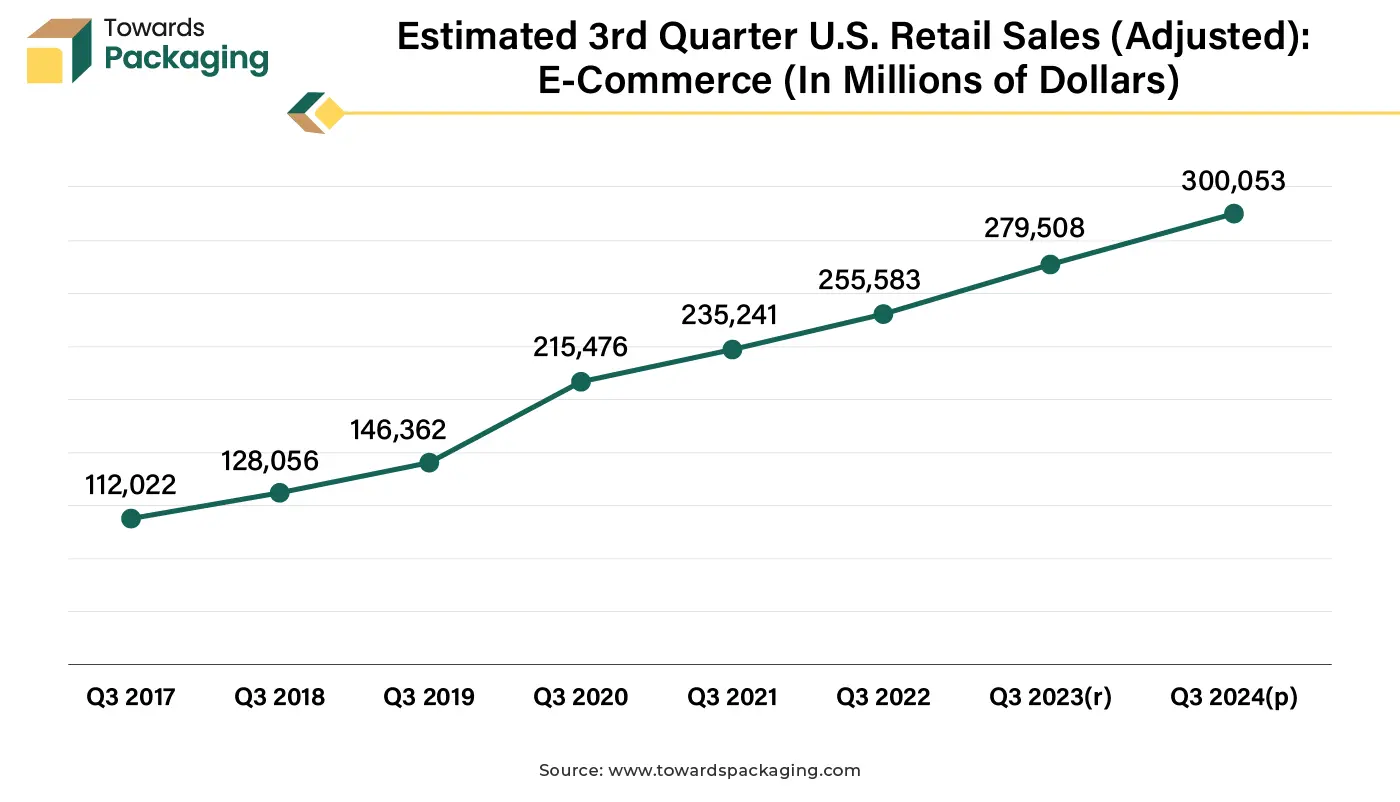

The rising environmental awareness and stringent government regulations on plastic usage along with the increasing consumer demand for eco-friendly and biodegradable packaging choices is expected to augment the growth of the fiber-based bottles market during the forecast period. Furthermore, the advancements in material science and manufacturing technologies such as dry molded fiber processes coupled with the growing focus on reducing carbon footprints across industries are also anticipated to augment the growth of the market. Additionally, growth of the e-commerce sector as well as the expanding markets in Asia-Pacific due to the increasing urbanization and a growing middle class is also projected to contribute to the growth of the market in the near future.

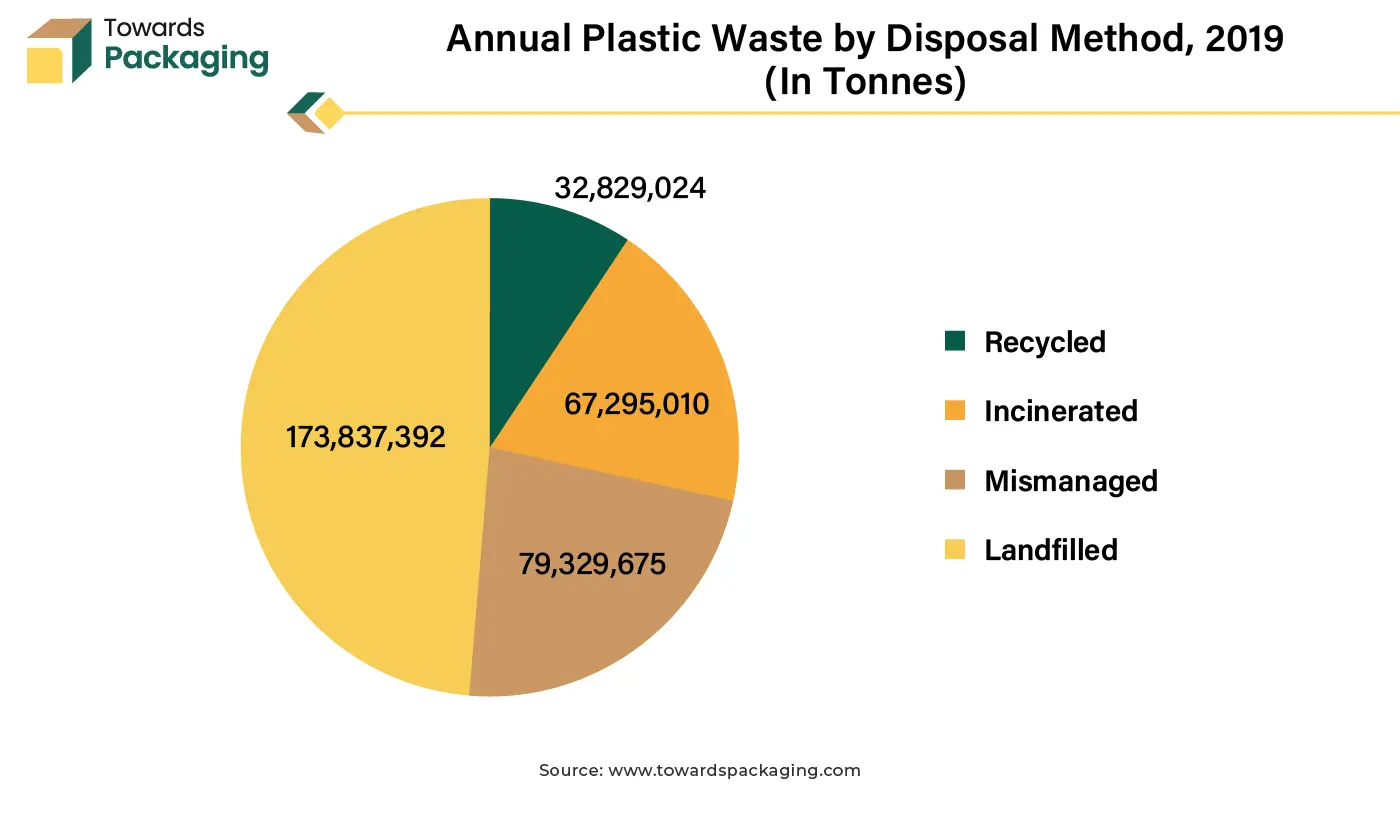

The growing environmental concerns with the traditional materials like plastic are anticipated to support the growth of the fiber-based bottles market during the estimated timeframe. As per the Organization for Economic Co-operation and Development, between 2000 and 2019, the amount of plastic waste produced worldwide has nearly doubled, from 156 million tons to 353 million tons. Packaging accounts for almost 40% of all the plastic waste, consumer goods for 12% and textiles for 11%, all of which have lifespans of less than five years. Of this waste, only 55 metric tons were collected for recycling; however, 22 metric tons were still considered recycling residual and required additional disposal. In the end, over 50% of plastic waste ended up in sanitary landfills, 19% was burned, and 9% was recycled. The other 22% was burned in open pits, spilled into the environment, or dumped in unmanaged dumpsites.

These concerns have increased consumer, industry as well as regulatory awareness, prompting them to seek alternatives that are consistent with sustainability objectives. Fiber-based bottles are an appealing option because of its recyclability and low carbon footprint. Unlike plastic, they break down naturally, reducing long-term environmental harm, and unlike glass, they need less energy for manufacturing. Customers are increasingly favoring eco-friendly companies, creating an atmosphere favorable for the adoption of fiber-based material. This shift is a broader movement towards reducing the waste, promoting circular economies and achieving the climate goals. As industries such as beverages, personal care and e-commerce are focusing on the sustainable practices, the demand for the fiber-based bottles is expected to surge as a sustainable choice.

The economic and technical barriers are anticipated to hinder the growth of the fiber-based bottles market within the estimated timeframe. The cost of raw materials, production, and transportation can make fiber-based materials more costly than plastic. Depending on the state of the market and the availability of taxes or incentives for environmentally friendly packaging, the price difference between fiber-based and plastic packaging could shift. Also, integrating the fiber-based materials into existing packaging workflows can be complex. Since fiber-based materials have different physical as well as chemical qualities compared to the plastic films such as rigidity, thickness, moisture sensitivity, and heat resistance, it may be essential to make changes to the packaging equipment as well as machinery. It could be important to completely replace certain packing technology to operate fiber-based materials correctly.

Another challenge is consumer perception and acceptance. As certain buyers might opt for plastic bottles due to their perceived quality, convenience, or familiarity, it may encounter problems with consumer adoption and perception. Certain technical obstacles can also be posed by the fiber-based bottles such as guaranteeing the products' safety, shelf life and aesthetics, specifically for sensitive products like medications. This perception is further intensified due to the concerns about how well fiber-based bottles can protect product integrity, mainly under challenging conditions such as moisture or temperature fluctuations. The unfamiliarity with fiber-based materials and the lack of widespread education on their benefits contribute to these misconceptions. Together, these factors are expected to slow down the market growth through reducing both supply and demand.

The government bans on the single-use plastics is expected to create substantial growth opportunity for the fiber-based bottles market in the near future. Bans on the single-use plastics coupled with the policies promoting eco-friendly alternatives, have created a favorable environment for the sustainable packaging alternatives. Many governments are further applying fines on the plastic use which is expected to encourage the companies to shift towards sustainable practices. For instance

The legislative frameworks that focus on the circular economy concepts strengthen the market by supporting practices like recycling and composting, which are acceptable with the properties of fiber-based materials. As regulatory pressures increase around the world, the fiber-based bottle market is set to grow substantially, providing manufacturers with an opportunity to surpass growing environmental regulations while also serving the sustainability-conscious consumers.

Artificial Intelligence (AI) is expected to positively impact the fiber-based bottles market. Paper mills can tackle the most difficult sustainability issues by combining artificial and human intelligence. More specifically, mill operators may constantly achieve sustainability targets all while improving production inputs with AI-driven autonomous control. When it comes to fiber use, operators have multiple chances to meet sustainability targets by enabling AI figure out the fiber quantity and supply selection. The auto-optimized fiber consumption only uses the minimum quantity of fiber required to achieve quality standards, while the auto-adjusted furnish mix combines recycled or substandard quality paper and chooses the most cost-effective and sustainable fiber blend.

This is achieved by developing a virtual sensor for the important quality standards using AI and machine learning, and then optimizing the furnishing by integrating an AI-driven feedback control loop. Machine learning is an essential part of this process because machine conditions and fiber quality can change minute by minute. Decisions about process adjustments can be made by the AI system more quickly and often than by operators due to the machine learning. Furthermore, AI also facilitates the detection and removal of elements that are neither recyclable nor biodegradable, opening the door for more eco-friendly packaging techniques. AI can further be utilized by companies looking to improve their supply chain operations to minimize waste and maximize productivity. With the integration of AI, the fiber-based bottles market is likely to experience greater cost-efficiency making it an important factor for market growth and competitiveness.

The wood paper segment is likely to grow at a considerable CAGR during the forecast period. Wood fiber is derived from a renewable resource and that makes it a sustainable friendly alternative to plastic, which has been a major concern for both consumers as well as government due to its non-biodegradability. Additionally, wood fiber has high strength and adaptability that helps manufacturers to produce durable lightweight bottles to withstand the challenges of the packaging and transportation. Furthermore, the technological advancements in the wood fiber processing to guaranty that it meets the hygiene and safety standards for packaging food and drinks is also likely to support the segmental growth of the market in the years to come.

The beverages segment of the market held largest share. This is owing to the increasing demand for on-the-go drink options with various flavors and premium products from the consumers. Furthermore, the growing focus on health and wellness functional beverages such as those fortified with vitamins, minerals, and natural ingredients is also expected to contribute to the segmental growth of the market. Additionally, the emerging trends like low-calorie, organic and plant-based drinks, coupled with the advancements in the packaging as well as distribution are further expected to support the segmental growth of the market in the near future.

North America held substantial market share in the year 2023. This is owing to the policies such as bans on single-use plastics and extended producer responsibility (EPR) laws in the states like California and New York. Additionally, the rising e-commerce sector as well as the growing demand for beverages is also expected to contribute to the regional growth of the market. The Census Bureau of the Department of Commerce projects that U.S. retail e-commerce sales for the third quarter of 2024 were $300.1 billion, adjusted for seasonal variation but not for hikes in prices. The third quarter of 2024 was predicted to see $1,849.9 billion in total retail sales. E-commerce accounted for 16.2 percent of total revenues in the third quarter of 2024. Furthermore, the well-established recycling systems as well as high environmental awareness are also expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at the fastest CAGR during the forecast period. This is due to the growth of urban populations and industrial sectors in economies such as like India, China and Southeast Asian nations. Also, the increase in the regional efforts to establish and promote a circular economy as well as the rising percentage of the corporate commitments towards sustainability along with the growing beverage industry comprising bottled water, soft drinks and alcoholic beverages is likely to contribute to the regional growth of the market. India's alcoholic beverage market is expected to grow to US$ 64 billion from US$ 52.4 billion in 2021, over the next five years, as per the International Spirits & Wines Association of India (ISWAI). This would guarantee India's position as the fifth-largest contributor to worldwide market revenues in the short to medium term. Furthermore, the government regulations and initiatives are also expected to contribute to the regional growth of the market.

By Material

By End-Use Applications

By Region

April 2025

April 2025

April 2025

March 2025