April 2025

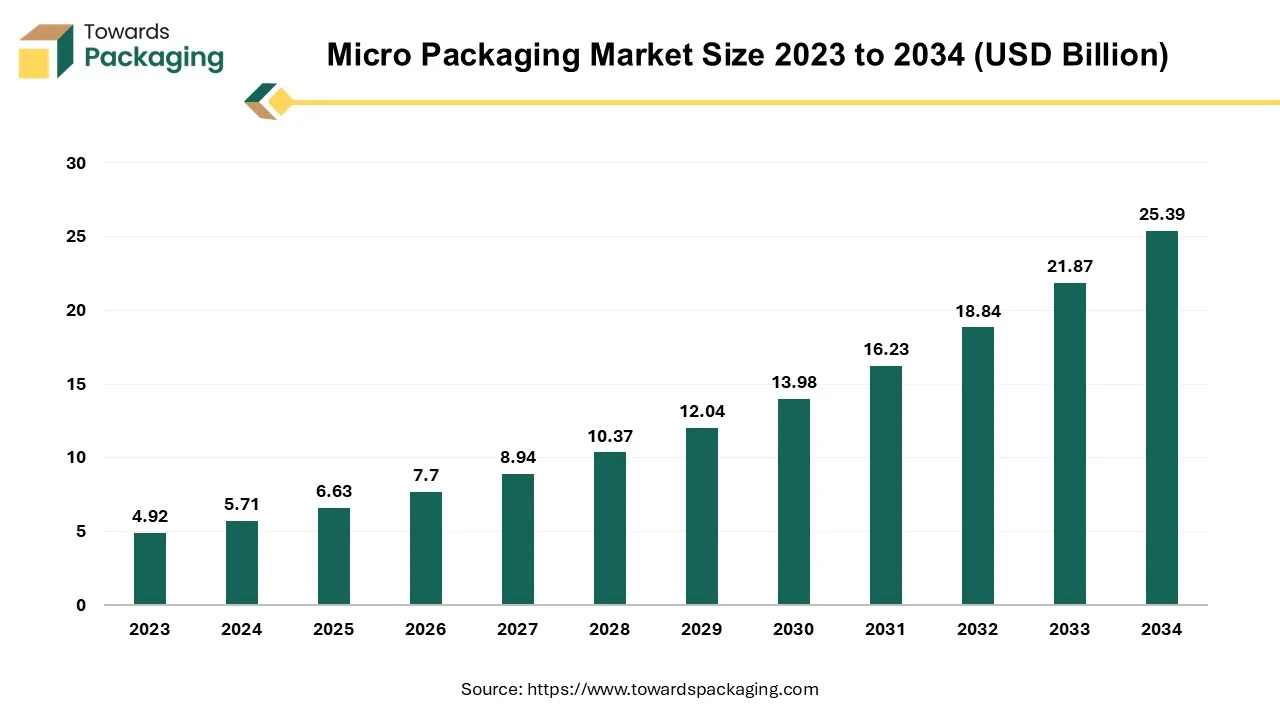

The global micro packaging market size is estimated to reach USD 25.39 billion by 2034, up from USD 5.71 billion in 2024, at a compound annual growth rate (CAGR) of 16.09% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The micro-packaging market is anticipated to augment with a considerable CAGR during the forecast period. The use of nanomaterials in combination with the various packaging techniques to provide an air, light and heat barrier is known as micro packaging. This relatively new idea offers a range of growth prospects across all the segments of the worldwide packaging market. This type of packaging is lightweight, offers excellent mechanical strength and antimicrobial properties and can provide the consumer about the product's safety condition. These characteristics contribute to the rising demand for this packaging from the various industries worldwide, which supports the growth of the market within the estimated timeframe.

The continuous technological advancements in nanotechnology and materials science coupled with the rising demand in the pharmaceutical and food industries for packaging that extends shelf life, ensures product integrity and maintains safety is anticipated to augment the growth of the micro-packaging market within the estimated timeframe. The growing increasing environmental concerns as well as the shift towards sustainable packaging solutions are also expected to support the market growth. Furthermore, the growing population in emerging economies as well as the trend towards smart packaging is also likely to contribute to the growth of the market in the years to come. The global packaging market size to grow at a 3.16% CAGR between 2025 and 2034.

The growing pharmaceutical sector due to the increasing healthcare needs, advancements in drug development along with the expanding access to the healthcare services, particularly in the emerging economies is likely to support the growth of the market during the forecast period. According to the International Federation of Pharmaceutical Manufacturers & Associations, 53 new medications were introduced in 2020, while over 9,000 compounds are presently at various phases of development worldwide. The number of medications under the development in 2021 for specific illness categories was 1,488 for infectious diseases, 1,677 for immunology, 1,668 for neurology and 3,148 for cancer. According to the estimates, a research-based biopharmaceutical industry invested USD 198 billion in biopharmaceutical research and development globally in 2020. Also, as per the report by IQVIA, without including the vaccines, the global pharmaceutical industry is estimated to reach $2,030 billion by 2027 as a result of the development of novel products

Due to this growth, there is an increasing need for the packaging technologies that can shield delicate pharmaceutical products from light, moisture, and oxygen; all of which can reduce the stability and efficacy of the drug. Vials and other micro-packaging technologies preserve sterility and protect against contamination. Vials are typically preferred over bottles for containing medications and other liquid pharmaceuticals. This is typically due to their smaller size and ease of transportation. These are mostly used to store medications in powder, liquid, or cap form. Though plastic vials are becoming increasingly common, but glass vials are also used, especially for immunizations.

The environmental impact of the packaging materials is likely to hinder the growth of the micro-packaging market within the estimated timeframe since it raises concerns over the sustainability as well as the waste management. Traditional packaging materials, particularly plastics, are derived from the fossil fuels and do not readily decompose. This leads to the long-lasting pollution in the landfills and oceans. As per the Waste and Resources Action Programme (WRAP), every year, 141 million tonnes of plastic packaging is generated worldwide. Approximately one-third of all the plastic packaging sold worldwide leaks from collecting systems, contaminating the surrounding area. The usage, production and disposal of plastics add around 1.8 billion tonnes of greenhouse gas emissions.

Also, according to the statistics by Eurostat, the predicted total amount of the packaging waste produced by the EU in 2021 was 84.3 million tonnes, that is 6.0% (or 4.8 million tonnes) of increase as compared to 2020. The production of all kinds of the packaging waste material rose between 2010 and 2021, but at varying degrees. Waste from wooden packaging showed the largest relative growth, followed by the waste from plastic, paper and cardboard. Waste from cardboard and paper packaging climbed-up the most in absolute terms. Every plastic object ever created is still in existence since plastic does not biodegrade. Marine animals consumes plastic that has been discarded or washed into the oceans, regardless of whether it converts down into the micro plastics or not. Companies are providing single-use plastic to the world's population, which is rising at a rapid rate. As the consumer awareness as well as the regulatory pressures regarding environmental sustainability increases, companies are facing more criticism along with the demand for eco-friendly packaging alternatives.

The emergence of nanotechnology in packaging is expected to create immense growth opportunities for the growth of the market in the years to come. The development of nanoparticles using the nanotechnology has generated a lot of interest in the packaging industry, particularly in the food packaging sector. Foods that are very prone to spoiling are not acceptable to the consumers. The key to handling and maintaining the food quality properly is food packaging. To provide better, smart as well as active packaging, advancements are made to the conventional food packaging. The field of nanotechnology is a nascent field that deals with the developing, modifying, identifying and manufacturing the materials at the nano-scale (1–100 nm). When it comes to preserving the food and maintaining their quality, edible coatings that contain nanomaterials and nanoparticles are better compared to conventional packaging materials. By enhancing the strength, flexibility, durability, barrier along with the reuse qualities of the packaging polymers, nanoparticles can change their mechanical and the physical characteristics.

Efficient food packaging is developed using a number of inorganic, organic and mixed nanoparticles to prevent qualitative as well as quantitative wastage of food products. They extend the shelf life of the food items and improve the structural and barrier qualities of packaging materials. An innovative method of extending the lifespan of food items is active packaging, which stops the oxidation, moisture build-up, microbial invasion and decaying. Antimicrobial substances stop microorganisms from growing by either eradicating its cellular structure or blocking their metabolic processes. Reactive oxygen species, which prevent replication of DNA and ATP synthesis and cause cell damage or death, are produced in part by nanoparticles.

Furthermore, one of the most useful applications of nanotechnology is the development of nano-sensors, which are used to track the internal and external conditions of both processed and fresh food items. Since some foods are extremely perishable and decay quickly when their storage circumstances change, a number of indicators, including pH, time-temperature, and leak indicators, have been created to track the quality of food. Time and temperature sensors show how much time has elapsed after opening by a perceptible color change and indicate the time remaining to consume the food safely. Thus, nanotechnology presents a promising opportunity to improve the quality of micro-packaging, offering significant advantages to both the producers as well as the customers.

The plastic segment captured largest market share of 48.61% in 2024. Plastic is widely used because of its inexpensive cost of production and adaptability. As it can be shaped into a wide range of shapes, even the intricate ones and it is perfect for producing a wide range of packaging products. Furthermore, plastic is lightweight and thus minimizes fuel use in the transportation. Several plastic categories are resistant to the moisture and environmental factors, such as sunlight. They are also resistant to numerous substances and are not vulnerable to corrosion processes. Given their high level of regulation, plastics are the safest packaging material to utilize. Also, plastics are ecological owing to its substantial recyclability, which helps to develop a circular economy for packaging and they additionally contribute to decreasing the carbon footprint since they are significantly lighter than other materials. These factors are expected to contribute to the segmental growth of the market.

The food and beverage segment held largest market share of 60.34% in 2024. This is owing to the increasing demand for fresh and high-quality food products from consumers across the globe. Furthermore, the food and beverage industry faces stringent safety and quality regulations, which necessitates the use of innovative packaging materials. Additionally, the high-profile food contamination incidents and increased scrutiny over foodborne illnesses is also likely to increase the demand for packaging options to guarantee the highest safety standards. With the goal of solving some of society's fears about the complicated issue of food safety, novel packaging, additives, and nutrient encapsulation have been established due to the application of nanotechnology concepts in the food sector. Therefore, a number of researches including active and intelligent packaging with nanotechnology have been initiated in to guarantee higher food quality and assist the market in creating food packaging that is resistant to deterioration.

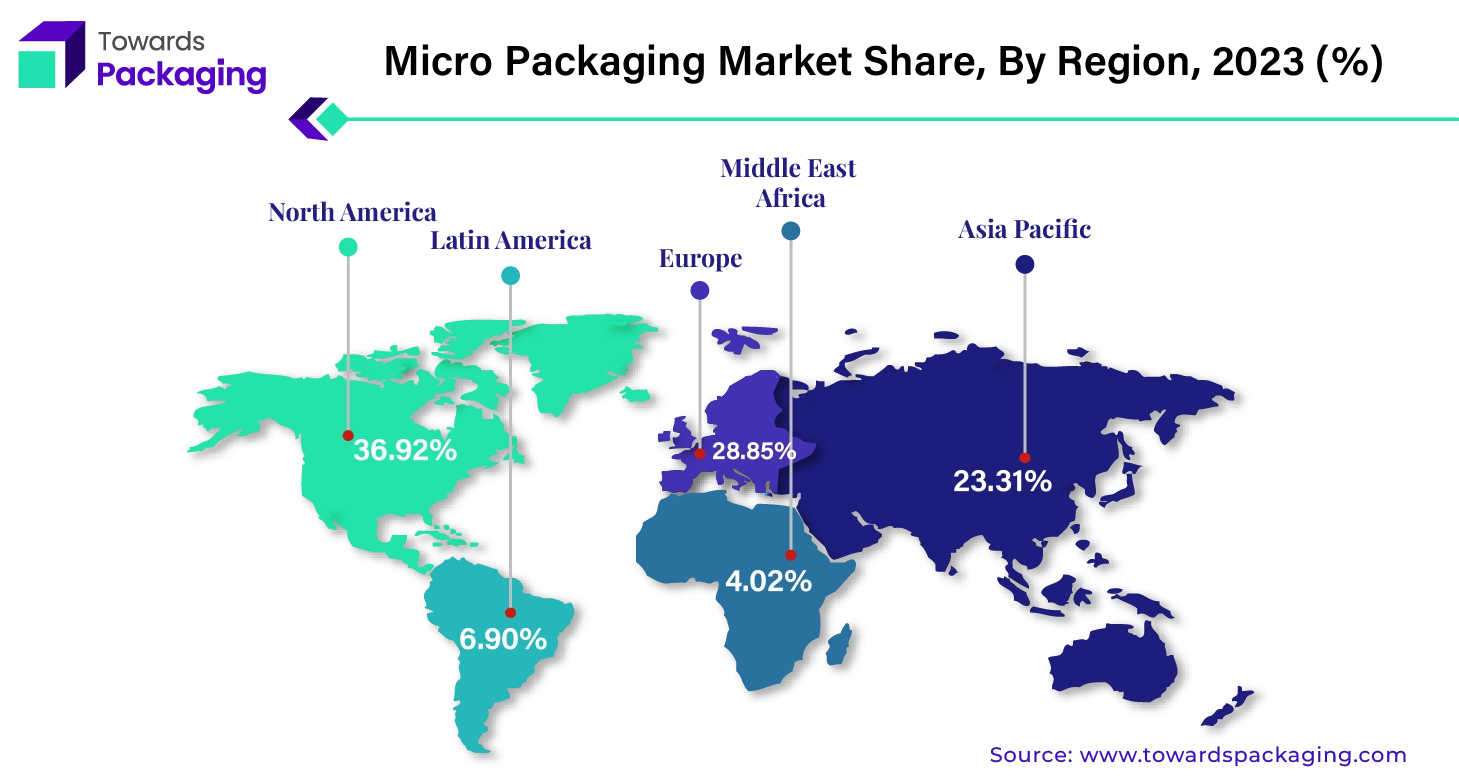

Asia Pacific is expected to grow at a fastest CAGR of 18.98% during the forecast period. This is owing to the rapid urbanization and industrialization in the economies like China and India. Furthermore, the higher disposable incomes as well as the improved living standards along with the increase in the consumer spending are also likely to support the growth of the market in the region. Additionally, the growing e-commerce market is also expected to contribute to the regional growth of the market during the forecast period. China is the world's largest e-commerce industry, accounting for over 50% of all the transactions. Also, as per the data by the International Trade Administration, in Korea, nationwide online revenue increased from $168.5 billion in 2021 to $180.4 billion in 2022. The primary driver of the market growth is the widespread use of the smartphones. This has created a substantial demand for the micro-packaging products in the region.

North America held largest market share of 36.92% in 2024. This is due to the continuous advancements particularly in the fields of nanotechnology and materials science across the region. Also, the stringent standards for food safety, pharmaceutical packaging and environmental impact are further expected to support regional growth of the market in the years to come. Furthermore, the growing pharmaceuticals industry is also expected to support the regional growth of the market in the near future. According to the data by IQVIA, the pharmaceutical market in the United States reached USD 714.3 billion with a growth rate of 12.6% over 2022. Also, as per the 2021 Patented Medicine Prices Review Board Annual Report, from 2012 to 2021, the pharmaceutical sales increased by 56.4% in Canada reaching $34.1 billion.

By Material

By Product Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025