April 2025

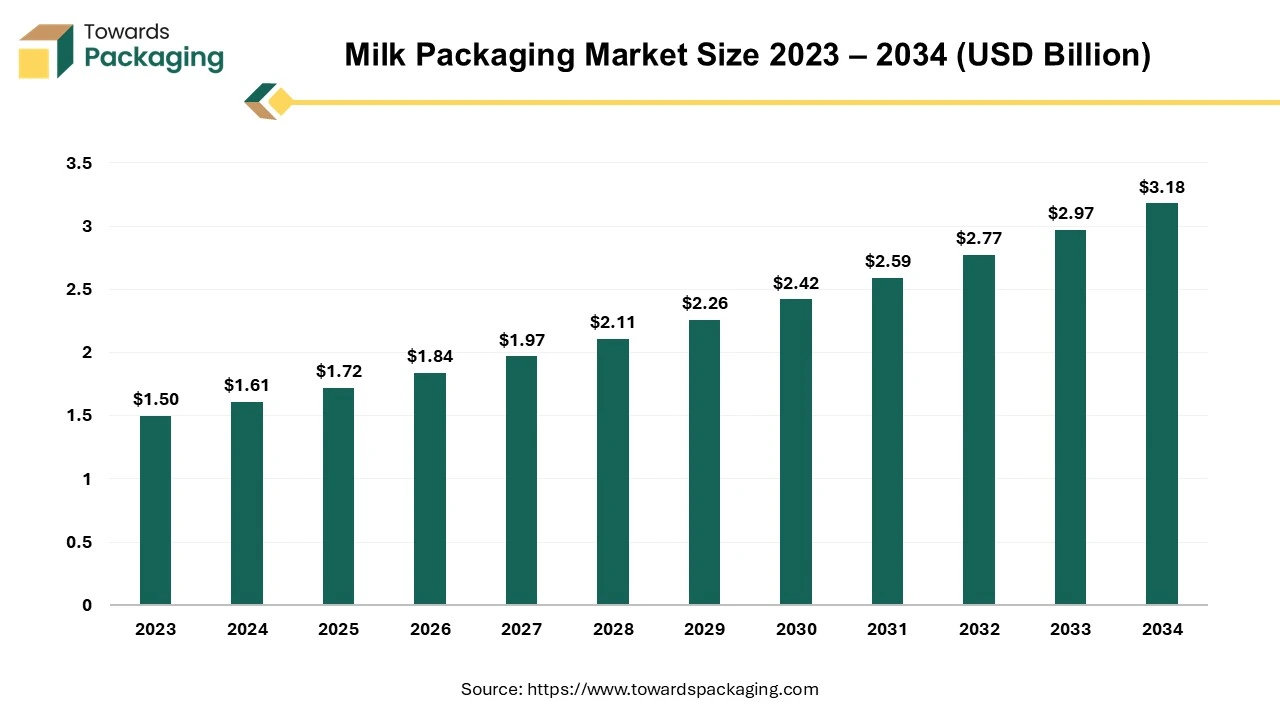

The global milk packaging market size reached US$ 51.15 billion in 2024 and is projected to hit around US$ 81.35 billion by 2034, expanding at a CAGR of 4.75% during the forecast period from 2024 to 2035. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing milk packaging which is estimated to drive the global milk packaging market over the forecast period.

The process of filling and sealing milk containers for delivery is known as milk packaging. A variety of containers, such as bottles, cartons, and pouches, are used to package milk. Milk packaging is known as the materials and methods utilized to store and transport milk while ensuring its freshness, quality, safety, and convenience for consumers. It consists of various types of containers, such as: Plastic Bottles (HDPE or PET), Cartons (Tetra Pak or Gable Top), Pouches (Plastic or Multi-layered Film), Glass Bottles and Cans.

The key players operating in the market are focused using eco-friendly material like biodegradable & compostable cartons. The compostable and biodegradable cartons are made from plant-based materials like sugarcane or cornstarch. The recyclable & reduced plastic bottles are used for packaging milk which are made up of lighter HDPE or PET bottles with less plastic use. The glass bottle return systems have been practised to maintain sustainability. More dairies are reintroducing refillable glass bottles to reduce waste.

Newly introduced aseptic & extended shelf life (ESL) cartons has improved milk’s shelf life without refrigeration (e.g., Tetra Pak with barrier layers). Smart labels & QR codes allow consumers to scan for freshness data, sourcing information, or recycling tips. Self-chilling & insulated packaging keeps milk cooler for longer periods without external refrigeration.

Some of the brands are experimenting with milk pouches made from seaweed or other edible materials. Concentrated milk pods – Pre-measured portions of concentrated milk for easy dilution, reducing transport weight and waste. Squeeze pouches & spouted pouches are being used for on-the-go dairy products like flavoured or protein-enhanced milk.

Increased Home Deliveries: There's a growing demand for home-delivered milk in reusable packaging. Companies like Milk & More in the UK are expanding services to meet this demand, reflecting a consumer shift towards sustainability and convenience.

Preference for Sustainable Options: Consumers are increasingly favoring packaging solutions that minimize environmental impact, prompting manufacturers to adopt eco-friendly materials and designs.

AI is transforming the liquid packaging industry by improving efficiency, reducing waste, and enhancing consumer experience. The artificial intelligence integration provides smart quality control & safety. Machine vision systems inspect milk packaging for leaks, deformities, or contaminants, reducing product recalls. The artificial intelligence integration automated hygiene monitoring. AI analyzes data from sensors in packaging plants to ensure compliance with sanitation standards. AI models predict spoilage rates based on temperature, humidity, and packaging material.

AI helps manufacturers choose eco-friendly packaging materials that maintain milk quality while reducing plastic use. AI predicts demand fluctuations, reducing overproduction and packaging waste. AI models analyze production data to optimize energy use and minimize emissions. AI-powered smart labels provide consumers with real-time freshness tracking, recycling tips, and farm-to-table transparency. AI analyzes consumer preferences to recommend milk products based on dietary needs (e.g., lactose-free, organic).

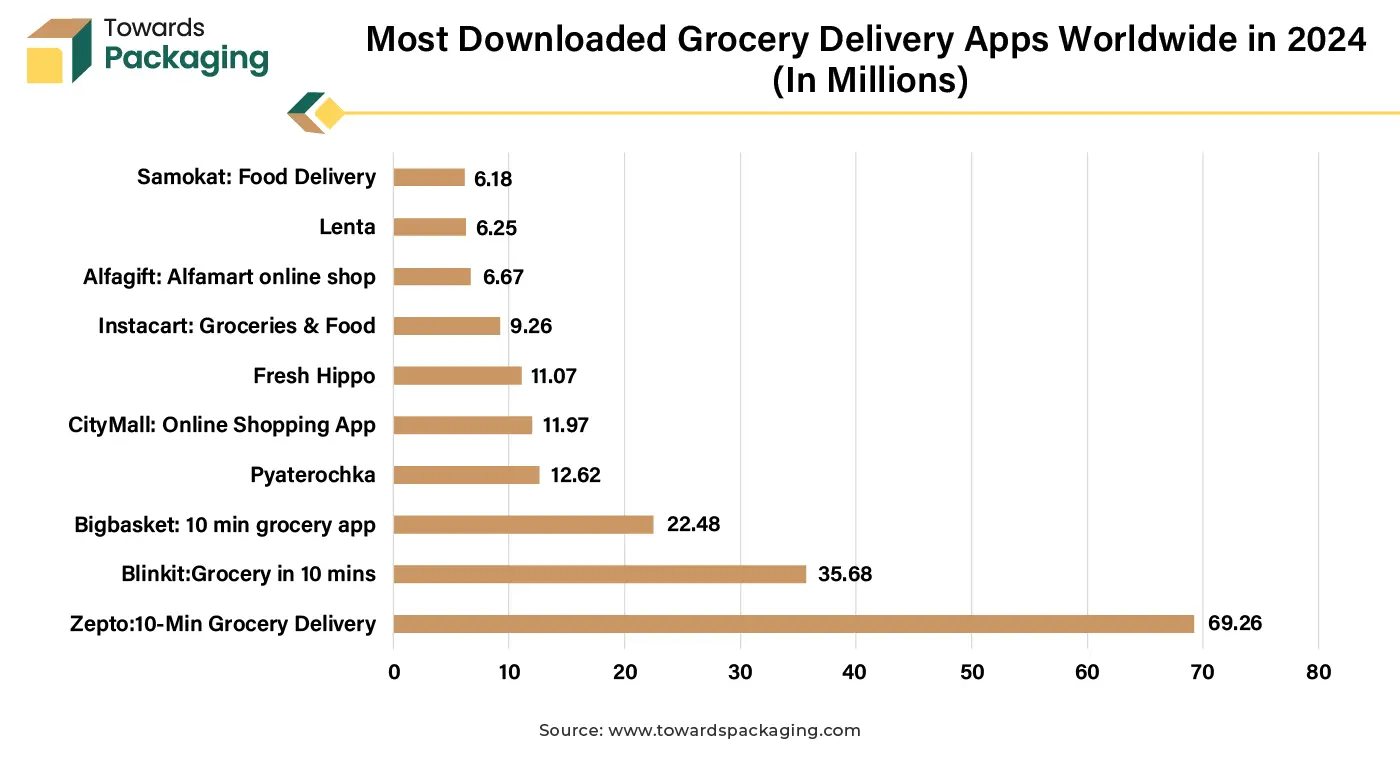

More consumers are ordering milk online through grocery delivery platforms and dairy subscription services. This drives demand for customized and reusable packaging, such as refillable glass bottles and sustainable pouches. Online milk sales require sturdy, spill-proof, and tamper-resistant packaging to withstand transportation. Packaging innovations like shock-absorbent cartons and insulated pouches help maintain milk quality during delivery. ECommerce brands are adopting eco-friendly, lightweight, and compact packaging to reduce shipping costs and environmental impact. Plant-based bioplastics, recyclable cartons, and collapsible packaging are gaining popularity.

E-commerce brands are adopting eco-friendly, lightweight, and compact packaging to reduce shipping costs and environmental impact. Plant-based bioplastics, recyclable cartons, and collapsible packaging are gaining popularity. More dairy farms and brands are bypassing retailers and selling directly to consumers online, requiring premium, brand-specific packaging. Custom branding and personalized packaging (e.g., milk cartons with customer names or farm stories) enhance brand loyalty.

The key players operating in the milk packaging market are facing issue due to fluctuating raw material prices and stringent regulations. Strict government regulations on food packaging, recycling, and sustainability standards can create challenges for manufacturers, increasing compliance costs. The cost of raw materials like plastic, glass, or paperboard, along with advanced packaging technologies, can increase overall production expenses, limiting market growth. The growing consumer shift toward plant-based milk alternatives (e.g., almond, oat, and soy milk) reduces the demand for traditional milk packaging. Milk’s perishability requires efficient cold chain logistics, and packaging innovations alone may not fully address shelf-life extension, limiting market growth.

Aseptic & Ultra-High Temperature (UHT) packaging extends shelf life and reduces refrigeration needs. Smart packaging with QR codes and sensors for freshness tracking. AI-driven quality control and automation in packaging processes. For instance, in August 2024, CCL Label has introduced EcoFloat WHITE, an upgraded version of its EcoFloat low-density polyolefin sleeve material, in order to greatly increase the recyclable nature of dairy packaging. With regard to high-density polyethylene (HDPE) bottles, which are frequently used for yogurt, probiotic drinks, and other comparable items, this innovative technology has the potential to revolutionize the dairy sector.

The pouches segment held a dominant presence in the milk packaging market in 2024. Pouches require less material compared to bottles or cartons, making them cheaper to produce and transport. Lower production costs lead to affordable pricing for both manufacturers and consumers. Milk pouches are lightweight, reducing transportation costs and making handling easier. They take up less space in storage and refrigerators compared to rigid containers. Many pouches use less plastic than rigid bottles, making them eco-friendlier. Some are recyclable or made from biodegradable materials, appealing to sustainability-conscious consumers. Pouches allow for attractive printing and branding opportunities, helping companies stand out. Countries like India, China, and parts of Africa prefer pouches due to affordability and ease of distribution.

The paperboard segment registered its dominance over the global milk packaging market in 2024. Paperboard cartons are coated with polyethylene (PE) or aluminum to create a moisture-resistant and airtight barrier, preventing spoilage and contamination. Aseptic (UHT) cartons can keep milk fresh for months without refrigeration, making them ideal for long-term storage and distribution. The surface of paperboard allows for high-quality printing, making it easier for brands to display product information and marketing messages. Paperboard cartons are space-efficient and stackable, reducing storage and logistics costs. Cartons often come with resealable spouts or easy-pour designs, enhancing user experience. Paperboard is made from renewable resources (wood pulp) and is recyclable, making it an eco-friendly choice that aligns with sustainability trends.

Asia Pacific region dominated the global milk packaging market in 2024. Increasing population, urbanization, and changing dietary habits are driving higher demand for milk and dairy products, especially in China, India, and Southeast Asia. Governments in countries like China and India are promoting packaged milk for better food safety and hygiene. Policies supporting dairy infrastructure and cold chain logistics further boost the packaging market. Major dairy companies such as Mother Dairy, Yili, Amul, Mengniu, and Vinamilk are expanding their production and distribution, rising the need for advanced milk packaging.

North America region is anticipated to grow at the fastest rate in the milk packaging market during the forecast period. Consumers are increasingly preferring eco-friendly and recyclable packaging, such as paperboard cartons (Tetra Pak, gable-top) and biodegradable pouches. Growth in demand for organic, lactose-free, and plant-based milk alternatives is driving innovations in high-quality packaging. Premium dairy brands are using resealable and portion-controlled packaging to cater to health-conscious consumers. Aseptic (UHT) packaging is growing rapidly, reducing dependency on cold chain logistics and allowing for convenient storage. Extended shelf-life (ESL) milk is gaining popularity in supermarkets, boosting demand for advanced packaging technologies. Leading dairy companies (e.g., Danone, Nestlé, Lactalis, Dean Foods) are investing in new packaging solutions to enhance efficiency and sustainability. The adoption of lightweight plastic bottles, paperboard cartons, and flexible pouches is growing.

By Packaging Type

By Material

By Region

April 2025

April 2025

April 2025

April 2025