April 2025

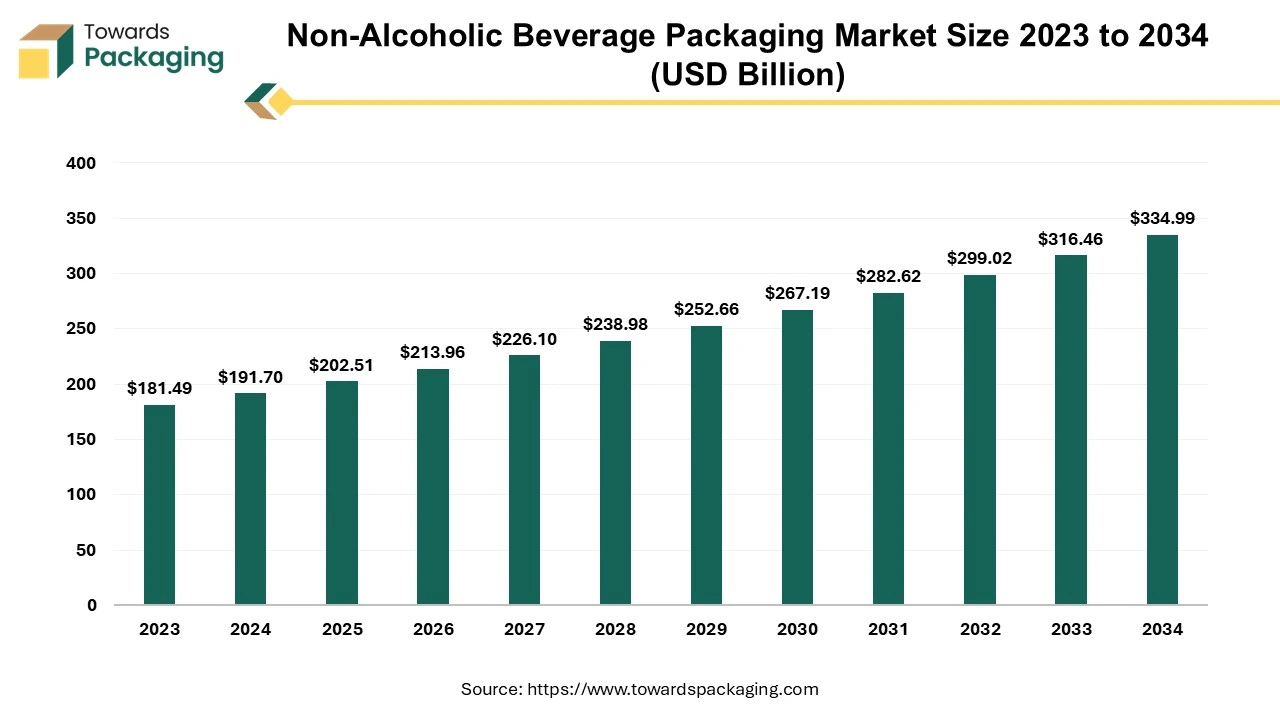

The non-alcoholic beverage packaging market size is set to grow from USD 202.51 billion in 2025 to USD 334.99 billion by 2034, with an expected CAGR of 5.9% over the forecast period from 2025 to 2034.

Drinks classified as non-alcoholic include a wide range of liquids such as fruit juices, nectars, vegetable juices, carbonated and non-carbonated flavored drinks, and water-based brewed or steeped drinks such as tea and coffee. Aptly called non-alcoholic beverage packaging, this specialty area of the packaging business handles the packaging of these drinks. This area of the packaging industry is devoted to creating, producing, and marketing materials and containers made especially for non-alcoholic beverages. Non-alcoholic beverage packaging includes various package designs that are painstakingly made to satisfy the particular needs of various beverage kinds. Throughout the whole supply chain, the primary goal of these packaging styles—including bottles, cans, cartons, pouches, and various other options—is to maintain the non-alcoholic beverages' freshness, quality, and convenience.

Ensuring product safety is a critical factor in developing and manufacturing packaging for non-alcoholic beverages. In addition to shielding the contents from outside influences and contamination, the packaging has to guarantee that the drinks arrive to customers in perfect shape. Prolonging the shelf life is essential since it enables beverages to keep their quality for longer. The market for non-alcoholic beverage packaging is shaped by environmental sustainability, which is becoming increasingly important. An increasing focus is being placed on using environmentally friendly materials and encouraging sustainable packaging methods as the industry realizes how important it is to lessen its ecological footprint. This includes looking into possibilities for recycling, cutting waste, and using environmentally friendly goods.

The market for non-alcoholic beverage packaging is closely related to various beverages' demands and distinctive qualities. It includes various packaging options with a modern focus on safety, shelf-life extension, and environmental sustainability. These options are intended to address freshness, quality, and convenience. The non-alcoholic beverage packaging industry keeps up with changing consumer tastes and industry trends by coming up with creative solutions to fulfill the market's changing demands.

Asia-Pacific area continues to lead the global in non-alcoholic beverage packaging with the most significant market share. Asia Pacific's supremacy is predicted to endure because of the region's rapidly urbanizing population, rising disposable incomes, and changing consumer lifestyles. The 'on-the-go' urban lifestyle in Asia has increased "single-serve" beverage packaging every day. The trend of functional beverage consumption in Asia as a healthier substitute for sugar-based drinks is a noteworthy cause of this shift in consumer behaviour. APAC's packaging environment uses a variety of materials, including paper, plastic, aluminium, glass, and aseptic multi-layer materials. PET packaging continues to be the most popular option despite an increasing focus on sustainability, especially in regions like China, Japan, and India.

Tetra Pak is a prominent participant in the packaging sector, holds a noteworthy position in the Asian market, with its aseptic packaging contributing roughly 35% of its worldwide earnings. The region's adoption of Tetra Pak machines prompted Tractus to assign a recent co-location plan that involved finding and vetting more than 115 organizations with Tetra Pak machines in several nations. Tetra Pak’s significant APAC revenue is mainly generated from important markets like China, Thailand, and Indonesia, highlighting the need to comprehend the particular equipment needs of co-packers in these areas.

Due to urbanization, economic expansion, and shifting consumer preferences, the Asia-Pacific area remains at the top of the non-alcoholic beverage packaging industry. The drive towards more healthful beverage options and the ease of single-serve packaging highlight how dynamic the APAC packaging market is. The substantial presence of leading market players emphasizes, even more, how crucial it is for co-packers functioning in this booming industry to consider strategic factors when determining what machinery, they need.

North America's non-alcoholic beverage packaging market is ranked second, illustrating how changing consumer tastes have generated a dynamic industrial landscape. To address consumer needs for sustainable packaging solutions and align with the growing emphasis on convenient, functional beverage formats and healthier product offerings, beverage manufacturers in the region are proactively adapting.

The United States is a country where the non-alcoholic beverage market has had significant growth in terms of sales. The total dollar sales of non-alcoholic beverages in the United States by August 2022 were $395 million. The market is dominated by non-alcoholic beer, which accounts for 85.3% of sales and $328.6 million in value. Another important player is non-alcoholic wine, which accounts for 13.4% of sales and has a market value of $52.04 million. Even though they make up only 1.3% of the total, non-alcoholic spirits have experienced a tremendous rise, with a market value of $5.03 million, indicative of the packaging sector's substantial expansion.

This increase in sales indicates the sector is flexible in shifting customer tastes and the rising need for non-alcoholic beverage options. The market's growth trajectory results from beverage producers' diverse strategies, which address sustainability issues, provide handy formats, and satisfy consumers' growing desire for healthier options. North America continues to be an essential area to monitor for new advancements and innovations in non-alcoholic beverage packaging because of its substantial market share in this dynamic sector. North America will play a significant role in determining the direction of non-alcoholic beverage packaging in the future due to the industry's dedication to sustainability, convenience, and health, which aligns with a broader trend in consumer preferences.

The market for non-alcoholic beverages is dominated by plastic packaging, which uses essential components such as glass, paper, and board, rigid metal, flexible packaging, and rigid plastics. In the non-alcoholic beverage business, rigid plastics-particularly PET containers-are preferred due to their lightweight, portable, and convenient design that supports consumption while on the go. Food and drink items stored in rigid plastics are long-term protected due to their affordability and durability. PET containers use less energy during production and transportation than aluminum cans and glass bottles. They are also more energy-efficient. PET bottles-frequently used for soft drinks-go through a hot filling for a longer shelf life. Heat-setting components improve temperature resistance during design and manufacture. These containers are specially designed with distinctive features to satisfy the needs of the beverage sector.

The consumption of virgin plastic is expected to decline significantly, according to significant beverage producers. One corporation plans to reduce 46.3 million pounds of raw plastic annually by switching to recycled PET (rPET). Simultaneously, another anticipates a 20% reduction in the use of virgin plastic by switching select products to rPET. Despite rPET's benefits, finding and using it efficiently present difficulties. This emphasizes how crucial it is to keep up the research and work with the business to address these issues and advance eco-friendly packaging options for the non-alcoholic beverage industry.

Non-alcoholic beverage packaging encompasses a range of materials, with PET bottles dominating the market due to their widespread use. Glass bottles also hold a significant share, providing a premium and sustainable alternative. Cans and paper laminates are employed, showcasing the industry's commitment to diverse packaging solutions to meet consumer demands and sustainability goals.

The bottled water segment has become a powerhouse within the beverage business, with an impressive revenue of US$342.40 billion and an anticipated 5.24% annual growth rate. This category is essential to the world's beverage consumption, with water leading the way and making up around 34% of all packaged drinks consumed globally. This emphasizes the importance of water to human health and hydration, making it a vital component of the worldwide beverage industry. An impressive surge in annual consumption characterizes the bottled water industry, with a staggering growth of nearly 40%. On an individual level, this translates to an astonishing 47 gallons per person, highlighting the widespread adoption of bottled water as a preferred choice for hydration. The upward trajectory in consumption underscores the growing demand for convenient and portable hydration solutions, reflecting consumer preferences for on-the-go lifestyles and health-conscious choices.

In the bottled water segment, companies predominantly opt for plastic or glass containers to deliver their products to consumers. Plastic containers take centre stage, comprising a 97.3% share of the bottled water packaging market. This is indicative of the industry's preference for the practicality and convenience offered by plastic, aligning with consumer preferences for lightweight, portable, and easily recyclable packaging solutions. Glass bottles while constituting a smaller share at 2.3%, still play a role, particularly in niche markets where consumers may prioritize environmental considerations or product purity. The prevalence of plastic containers is a testament to consumer preferences and reflects the industry's commitment to providing accessible and convenient hydration solutions. As the bottled water segment grows substantially, it remains a focal point in the broader beverage market, responding to evolving consumer lifestyles and preferences for healthy, on-the-go hydration.

The demand for bottled water is rising at a rate of 7%, driven by its perceived benefits. However, this surge has accompanying drawbacks, notably the annual contribution of 14 million tons of plastic pollution to the oceans. In terms of per capita consumption, Mexico, Italy, Thailand, and the United States emerge as the leading nations in bottled water consumption.

Water constitutes a significant portion of global packaged beverage consumption, comprising nearly 34% worldwide. This reflects its essential role in human hydration and health. Multiple beverage categories, such as milk, dairy, carbonated soft drinks, alcoholic drinks, and new developments, all maintain significant market shares. This highlights the ongoing change in the beverage business and reflects the wide range of consumer tastes.

The retail segment established a dominant position in the market in 2023. It is expected to grow at the fastest CAGR throughout the forecast period. Supermarkets, hypermarkets, online merchants, and other retail channels are all included in the broad category of outlets that make up the retail channel. Supermarkets and hypermarkets dominate this industry due to the enormous selection of brands and goods that are readily available under one roof. This subcategory's popularity in the market is partly attributed to the consumer appeal of one-stop shopping experiences.

Certain supermarkets are consciously increasing their product range in the non-alcoholic beverage market. Well-known retailers like Whole Foods, Target, Aldi, and Walmart are expanding their product lines to meet the growing consumer demand for alcohol-free options. This calculated move positions supermarkets and hypermarkets as significant actors in the retail landscape within this market category, in line with changing consumer tastes and the growing popularity of alcohol-free alternatives.

| Global Non-Alcoholic Drinks Ranking, 2023, $ Million | |

| Company Name | 2023 |

| Coca-Cola | 33,468 |

| Pepsi | 18,335 |

| Red Bull | 6,962 |

| Monster | 6,788 |

| Nescafe | 6,005 |

| Gatordae | 4,916 |

| Dr Pepper | 4,401 |

| Sprite | 4,166 |

| Nongfu Spring | 4,113 |

| Lipton | 3,021 |

As of 2023, the non-alcoholic beverage industry ranks Coca-Cola, Pepsi, Red Bull, Monster, Nescafe, Dr Pepper, Sprite, Lipton, Nongfu spring and Gatorade among the top players. These brands showcase consistent popularity, reflecting diverse consumer preferences and the enduring influence of established and innovative products in the non-alcoholic drinks sector.

The competitive landscape of the non-alcoholic beverage packaging market is characterized by established industry leaders such as Amcor Limited, Reynolds Group Holdings Limited, Ball Corporation, Alcoa Inc., Inc., Owens-Illinois, Crown Holdings, Inc., Rexam PLC, Compagnie de Saint-Gobain, Ardagh Group S.A., and Tetra Laval International S.A. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences.

Amcor offers various environmentally friendly packaging options, including coffee, beer, wine, spirits, soft drinks, juices, energy drinks, and aseptic dairy products. Their dedication extends across multiple beverage categories, guaranteeing responsible packaging methods across the supply chain.

Reynolds is the beverage industry's leading innovator, specializing in traceability and product decoration solutions. Reynolds provides solutions for various applications, including labeling, carton coding, printing, and pallet labeling. They cater to customers of all sizes and are committed to excellence.

Ball Corporation is a notable global pioneer in providing innovative and environmentally friendly aluminum packaging solutions, primarily for the beverage sector. Their primary focus is on providing sustainable packaging solutions that meet current environmental regulations.

By Material

By End Use

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025